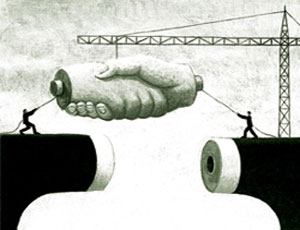

Co-Investing in China with Chinese Partners

An introduction to foreign-invested partnerships and foreign-invested joint stock companies

By Chet Scheltema and Frank Yang

Jul. 5 – Foreign investors and domestic Chinese investors have traditionally been unable to co-invest in mainland business ventures, except by means of the joint venture or unofficially sanctioned structures. With the introduction of several new legal entities, this restriction has been lifted and foreign and domestic investors may now freely co-mingle their resources in one enterprise. These structures are the foreign-invested partnership and the foreign-invested joint stock company, both of which are bound to become ever more important instruments in the foreign investors’ chest of tools for doing business in China.

Jul. 5 – Foreign investors and domestic Chinese investors have traditionally been unable to co-invest in mainland business ventures, except by means of the joint venture or unofficially sanctioned structures. With the introduction of several new legal entities, this restriction has been lifted and foreign and domestic investors may now freely co-mingle their resources in one enterprise. These structures are the foreign-invested partnership and the foreign-invested joint stock company, both of which are bound to become ever more important instruments in the foreign investors’ chest of tools for doing business in China.

The traditional foreign invested enterprises introduced in the 1980s are the representative office (RO), joint venture (JV), and wholly foreign-owned enterprise (WFOE). Note that although JVs allow co-investing, it is on highly restrictive terms and excludes individual investors. Meanwhile, unofficially sanctioned structures range from:

- Offshore holding companies that control WFOEs and are held in the name of foreign persons for the benefit of domestic Chinese;

- Domestic corporations held on behalf of foreign investors by local Chinese; and

- Variable interest entities, which are domestic companies with Chinese ownership, but controlled by foreign interests through a series of contractual relationships.

These structures reflect the fact that Chinese regulators have been mistrustful and resistant towards foreign investment and that Chinese markets have remained connected to the global economy primarily as a manufacturing base for export abroad. Accessing domestic markets by means of these structures has been slow, difficult, and costly.

Chinese legislators have introduced these new investment structures as China’s markets have matured and strengthened and the need and desire for greater openness has become apparent (e.g. accession to the WTO). This was first seen in the foreign-invested joint stock company in 1995 (Revised in the 2000s) and then the foreign-invested partnership in the 2000s. They are a far cry from the traditional foreign invested enterprises and offer the promise of tremendous flexibility and structuring versatility.

Foreign-invested partnerships

The foreign-invested partnerships (FIPs) of most relevance here are the foreign-invested general partnership (FIGP) and the foreign-invested limited partnership (FILP). Unlike the restrictions on co-investing found in the traditional structures, the FIPs allow domestic and foreign partners, whether corporate or individual, to participate as investors in just about any combination desired. The partnership agreement created by the partners is the defining document for determining ownership percentages, decision-making, and the distribution of profits. The partners are free to negotiate and agree upon mutually acceptable terms subject only to final approval by the Administration of Industry and Commerce.

FIPs also offer the advantage of speed. Regulations governing FIPs require the Administration of Industry and Commerce to approve or reject a partnership business license application within 20 days, and the need for MOFCOM review is eliminated. The traditional RO usually requires two months to establish, while WFOEs and JVs may require four months or longer.

Besides offering the possibility of co-investing with Chinese partners, FIPs also offer the benefit of “pass thru” taxation, which means profits will not be taxed until received by the individual or corporate parent. The 25 percent corporate income tax is theoretically eliminated, therefore offering the prospect of substantial tax savings.

FIPs also allow the partners to freely allocate profits and losses without reference to their original capital contribution (in contrast to a WFOE or JV; RO’s may not issue invoices and make profits). This is particularly attractive for project financing where a limited partnership interest could be structured as debt or with other special financing characteristics.

The difficulties presented by FIPs are:

- The general partner has unlimited liability and may be required to disclose its major assets to persuade regulators and business partners of its creditworthiness (limited partner liability is limited to the extent of its investment); and

- The newness and novelty of the structure may arouse the concern of business partners and even local regulators.

The problem of unlimited liability can be handled through the use of a limited liability corporate parent to act as general partner, but the problem of unfamiliarity will only be overcome with time and the patience to educate partners and local regulators.

Foreign-invested joint stock companies (aka, companies limited by shares)

The foreign-invested joint stock company (FIJSC), otherwise known as a company limited by shares, is a limited liability company that also permits the relatively free co-mingling of foreign and domestic investments. The FIJSC is particularly attractive because it allows for broad participation in the equity of the company, whether Chinese or foreign, and whether public or private. The company can offer its executives and employees stock incentive plans and eventually even offer its shares to the public on a public stock exchange (e.g. Shanghai Stock Exchange). Furthermore, it may use its stock as assets/currency in debt and equity offerings and mergers and acquisitions. In these ways, the FIJSC is most like its corporate counterparts in America and Europe.

As with the FIJSC’s foreign counterparts, greater freedom to enlist broad participation in its equity comes along with higher and more demanding standards of corporate governance. Not surprisingly, the minimum capital requirement is also substantially higher at RMB30 million.

Because the FIJSC is a more complex organization, it also requires more time, energy, and expense to establish. However, for foreign-invested enterprises in China that would like to conduct the full range of corporate activities normally associated with a growing and ambitious western company or a multinational corporation, the FIJSC offers the most desirable structure.

Other recently introduced foreign investment structures also provide the opportunity to co-mingle assets with Chinese partners, but these enterprises are purposely designed for investing, not business operations, and reach beyond the means of most small and medium-sized enterprises. They include the foreign-invested holding company and foreign-invested venture capital investment enterprise. The minimum cumulative capital requirement is US$30 million for the former and the requirements for the latter are that each investor contributes at least US$1 million.

Because of certain limitations to the traditional business structures, including the inability to co-invest with Chinese partners, the more flexible and versatile FIPs and FIJSC present investors with some tantalizing new options. The complexity of the FIJSC and the novelty and lack of familiarity of the partnership may lead some to turn back to the WFOE, but it is likely only a matter of time until the FIPs and FIJSC become a more common choice for foreign and domestic investors in China.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to The China Advantage, our complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

An Introduction to Doing Business in China

An Introduction to Doing Business in China

Asia Briefing, in cooperation with its parent firm Dezan Shira & Associates, has just released this 40-page report introducing everything that a foreign investor should be familiar with when establishing and operating a business in China. This guide is immediately available as a complimentary PDF download on the Asia Briefing Bookstore.

Administration Rules for Foreign-Invested Partnerships Released

Foreign-Invested Partnerships: The Third Road in China

Creating a Web Startup in China – The Yunio Way

- Previous Article New Issue of China Briefing: Value-Added Tax Reform

- Next Article China Releases 12th Five-Year Plan for Energy Saving and Environmental Protection Industry