Comparison: Prime ‘Grade A’ Office Rental Prices in China

By Collin Baffa

Jul. 5 – Prime “Grade A” office space in China typically consists of modern complexes offering state-of-the-art infrastructure and locations in the heart of each city’s central business district.

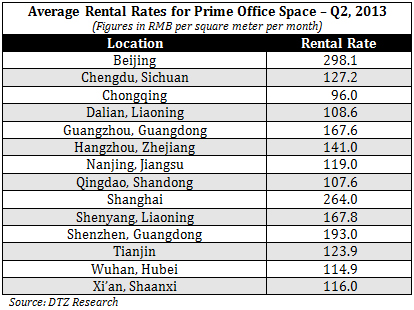

China’s first tier cities remain the most expensive markets for prime office rentals, with Beijing, Shanghai and Shenzhen topping the list, according to a survey conducted by DTZ, a global property services provider. However, despite their position atop the list of most expensive prime office rentals in China, these cities came under pressure during the first quarter of 2013.

“In Q2 2013, rentals in Beijing declined by 0.1 percent quarter-on-quarter, as the moderation in the slowing trend in the rapid rise in office rents, which first emerged in 2012, reached the point where the city’s prime office rental market has clearly begun to flatten,” said Andrew Ness, Head of North Asia Research at DTZ. “In Shanghai, by contrast, prime office rentals witnessed a stronger downward dip, declining by 0.7 percent q-o-q, this being a function of a number of factors including the relatively larger percentage of the city’s total prime office floor area occupied by MNCs, many of which have adopted a cautious attitude with respect to implementing China business expansion plans amidst the current sluggish conditions in the Mainland economy.”

Meanwhile, prime rental prices in China’s second and third-tier cities remain susceptible to local and national economic pressures. The slowdown in China’s manufacturing sector and implementation of stricter credit policies has constrained the price of some cities, while economic growth and demand for office space has led to a rise in prime office rental prices in others.

“The pattern of change in prime office rentals among the second-tier cities covered in the Q2 2013 DTZ survey was quite varied overall,” added Ness. “To cite just a few examples, while Hangzhou witnessed a 0.3 percent decline in prime office rental, q-o-q, Chengdu recorded a much more substantial 2.5 percent decline in quarterly office rent and Wuhan saw its rental rise by 2.8 percent within the same time frame.”

Average rental prices for prime office spaces during the second quarter of 2013 can be found below:

You can stay up to date with the latest business and investment trends across China by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Cities Across China Tighten Control Over Real Estate Market

Taxation on Real Estate Rental Income in China

The Disproportionate Rise of China’s Real Estate Market

Report: Mumbai Tops Shanghai as Least Affordable City

- Previous Article New Issue of China Briefing: E-Commerce in China

- Next Article China Officially Launches ‘Double Anti’ Probes on EU Wine Imports