The Competitive Advantages of Manufacturing in Vietnam

SHANGHAI — The state of manufacturing in Vietnam today so closely parallels that of China ten or more years ago—when low-wage, low-tech, low-added value manufacturing acted as a magnet for FDI into the country—that many foreign investors with existing China operations are actively inquiring about the payoffs of moving to Vietnam. As China moves further up the value chain in manufacturing, Vietnam has been well-poised to pick up the slack. As a result, Vietnam’s manufacturing sector grew at a compound annual growth rate of more than 9 percent between 2005 and 2010 and today accounts for 25 percent of GDP.

Since Vietnam’s accession to the World Trade Organization in 2007, foreign investment into the country has exceeded investment into Indonesia, the Philippines, and Thailand combined. According to Deloitte’s Manufacturing Competitiveness Index, Vietnam is on track to jump eight ranks among global manufacturers over the next four years, to tenth overall. Growth in the industry has accelerated in the lead up to 2015, when the ASEAN Economic Community will come into effect, transforming the ten-country bloc (Vietnam included) into a single market and production base.

Why ASEAN Overtook China’s Foreign Investment Last Year

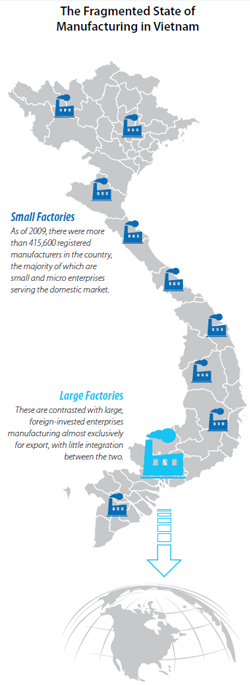

On the whole, the manufacturing industry in Vietnam is distinguished by a high degree of fragmentation and polarization. As of 2009, there were more than 415,600 registered manufacturers in the country, the majority of which are small and micro enterprises serving the domestic market. These are contrasted with large, foreign-invested enterprises manufacturing almost exclusively for export, with little integration between the two. The backbone of manufacturing is composed of five industries—agribusiness, leather, wood processing and products, metal products, and apparel—which together account for 40 percent of commodity exports.

The Vietnamese government encourages manufacturing through special zones featuring lower corporate income tax rates and limited-duration tax exemptions. Foreign investors in Vietnam also benefit from favorable tax rates on corporate income (22 percent) and dividends (0 percent), with plans stated to lower the former to 20 percent by 2016. Wages are at the lower end of the spectrum across Asia’s manufacturing hubs, at nearly half those of China (and less than half when adjusted for mandatory social insurance contributions).

China-ASEAN Wage Comparisons and the 70 Percent Production Capacity Benchmark

Infrastructure in Vietnam, while surpassing that of the Philippines and Thailand in terms of coverage, still has room for improvement. A lack of unifying standards between Vietnam’s private and public education systems has resulted in a shortage of skilled workers in the country (nearly 87 percent of the workforce is unskilled). Going forward, Vietnam faces challenges of curbing the role of state owned enterprises (SOEs) in the economy and avoiding the trap of low value-added manufacturing. Recent government reports have emphasized the development of technology, mechanics, information and communications technology, and pharmaceuticals.

These factors and more combine to make Vietnam the ideal manufacturing export hub for pursuing a China + 1 strategy. In Dezan Shira’s Vietnam offices, we have witnessed this trend firsthand as a number of our clients have sought our assistance in transferring their manufacturing and sourcing operations to Vietnam in search of lower operational and labor costs in addition to a more investor-friendly regulatory environment. For more information on the advantages of Vietnam’s manufacturing industry for your business, please see our related publications below or contact vietnam@dezshira.com.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Manufacturing Hubs Across Emerging Asia

Manufacturing Hubs Across Emerging Asia

In this issue of Asia Briefing Magazine, we explore several of the region’s most competitive and promising manufacturing locales including India, Indonesia, Malaysia, Singapore, Thailand and Vietnam. Exploring a wide variety of factors such as key industries, investment regulations, and labor, shipping, and operational costs, we delineate the cost competitiveness and ease of investment in each while highlighting Indonesia, Vietnam and India’s exceptional potential as the manufacturing leaders of the future.

Developing Your Sourcing Strategy for Vietnam

Developing Your Sourcing Strategy for Vietnam

In this issue of Vietnam Briefing Magazine, we outline the various sourcing models available for foreign investors – representative offices, service companies and trading companies – and discuss how to decide which structure best suits the sourcing needs of your business.

- Previous Article Haikou: An Emerging Industrial City

- Next Article China Extends Export Tax Rebate Scheme