Developing Your China Trade with Japan and South Korea Under RCEP

The article was originally published on June 28, 2021, and last updated on November 5, 2021.

- Update: The Regional Comprehensive Economic Partnership (RCEP) agreement will come into force from January 1, 2022, according to the Australian Government’s Department of Foreign Affairs and Trade. It comes as Australia and New Zealand become the latest member states to ratify the agreement. Other countries that have ratified RCEP include Brunei, Cambodia, Laos, Singapore, Thailand, Vietnam, China, and Japan.

China’s tariff commitments to Japan and South Korea under RCEP is expected to boost their bilateral trade flows and create multilateral trade opportunities.

In November 2020, China, the 10 ASEAN members, Japan, South Korea, New Zealand, and Australia signed the long-awaited Regional Comprehensive Economic Partnership (RCEP) Agreement.

While most signatory countries have existing free trade agreements (FTAs) with each other – even prior – the RCEP’s multilateral agreement is the first ever FTA between China and Japan as well as between Japan and South Korea. Thus, the conclusion of the RCEP agreement also raises hopes for a trilateral free trade deal between these three East Asian economies, which has been under negotiation for as long as the RCEP.

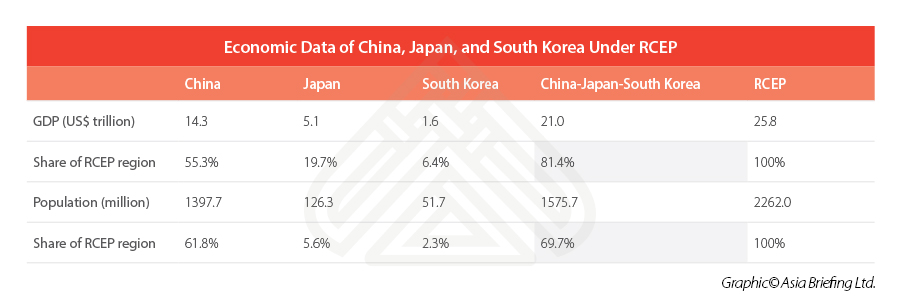

China, Japan, and South Korea, as the world’s second, third, and 12th largest economies, respectively. Together, they account for more than 80 percent of the total GDP of the RCEP region and nearly 70 percent of the total population of the RCEP signatory countries.

However, the trio’s trade within the RCEP region accounted for only 19.8 percent of their total global trade in 2018; in comparison, this is lower than the 45.2 percent share for other RCEP countries within the region out of their global trade and the 60.7 percent for the EU within the EU region out of the EU countries’ global trade.

Market analysts expect there will be great potential for economic and trade cooperation opportunities among China, Japan, and S. Korea as well as between the trio and other RCEP members with the effectiveness of the Agreement.

Existing trade flow between China, Japan, and South Korea

China has long been the largest trading partner of Japan and South Korea.

Chinese products made up more than 23 percent of the total imports of Japan and South Korea in 2020. And over 22 percent of Japanese exports and 25 percent of South Korean exports flowed into the Chinese market last year.

Japan and South Korea also feature on China’s top five trading partners’ list.

In 2020, Japan and South Korea were the second- and third- largest exporters to Chinese markets, respectively. They were also the third- and fifth-largest export destinations for Chinese goods.

China-Japan trade data and tariff commitments

China-Japan trade data

In 2019, Japanese exports to China were worth US$128 billion. The top five categories of Japanese goods exported to China were machines (US$52.6 billion), chemical products (US$17 billion), vehicles and their parts (US$14.2 billion), instruments and apparatus (US$14.1 billion), and plastics and rubbers (US$9.02 billion).

The most popular Japanese goods for Chinese markets included machinery having individual functions (US$8.5 billion), cars (US$7.51 billion), and integrated circuits (US$7.24 billion).

In turn, China sold goods worth US$152 billion to Japan the year in 2019. The top five categories of Chinese exports to Japan were machines (US$66.6 billion), textiles (US$19.4 billion), chemical products (US$8.76 billion), metals (US$9.32 billion), and foodstuff (US$5.42 billion).

Main Chinese export products to Japan were broadcasting equipment (US$11.5 billion), computers (US$10.1 billion), and office machine parts (US$4.32 billion).

China-Japan tariff commitments

Because Japan and China had never signed an FTA, trade tariffs between China and Japan adopt the most favored nation treatment (MFN) standard stipulated by the World Trade Organization (WTO).

According to data from the World Integrated Trade Solution (WITS) in 2018, among China’s imports from Japan, 7.79 percent of the number of tariff items are duty-free; on the contrary, 59.98 percent of the number of Chinese tariff items are free from Japanese tariffs.

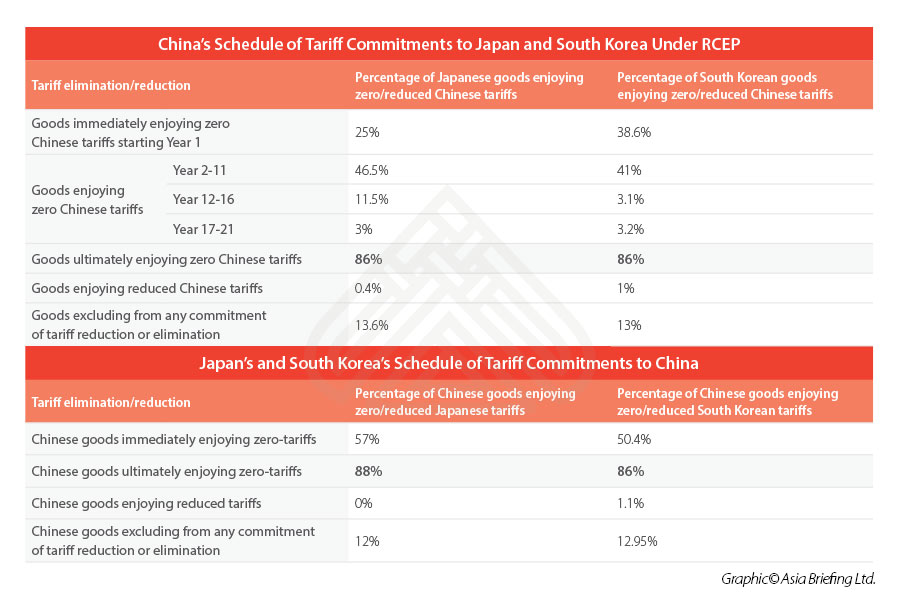

After the RCEP comes into effect, under China’s Schedule of Tariff Commitments, China will ultimately cut tariffs to zero on 86 percent of Japanese goods (a big increase from around eight percent, which is the case currently). Under Japan’s Schedule of Tariff Commitments, Japan will eventually cut tariffs to zero on 88 percent of Chinese goods (a fair increase from the current around 60 percent).

Under the framework of the RCEP, each member country, based on their Schedules, will abolish tariffs on specific products imported from other RCEP members, in phases, over a transition period of about 20 years.

According to the Schedules of China and Japan, soon after the RCEP agreement takes effect – a) minerals, textiles and clothing, chemicals, and metals exported from Japan to China and plastics and b) rubbers, textiles and clothing, and chemicals exported from China to Japan – are expected to enjoy zero or reduced tariffs.

China promised to gradually reduce tariffs on imports of Japanese products to zero in the first, the 11th, the 16th, and the 21st year upon the effectiveness of the RCEP agreement.

In the first year, Chinese will further impose zero tariff on 68.7 percent of the number of tariff line items of Japanese minerals, 38.1 percent of the chemical products, 32.8 percent of fuels, and 30.8 percent of metals.

In the first 11 years, 83.3 percent of the number of tariff line items of textile and clothing, 82.6 percent of chemical products, 75.4 percent of mineral products, 74.8 percent of base metals and their products, and 72.6 percent of leather goods, will be gradually subject to zero tariff.

Eventually, after 21 years’ effectiveness of the RCEP, the percentage of newly added duty-free items in all categories of Japanese products, except wood products and transport products, will be above 65 percent.

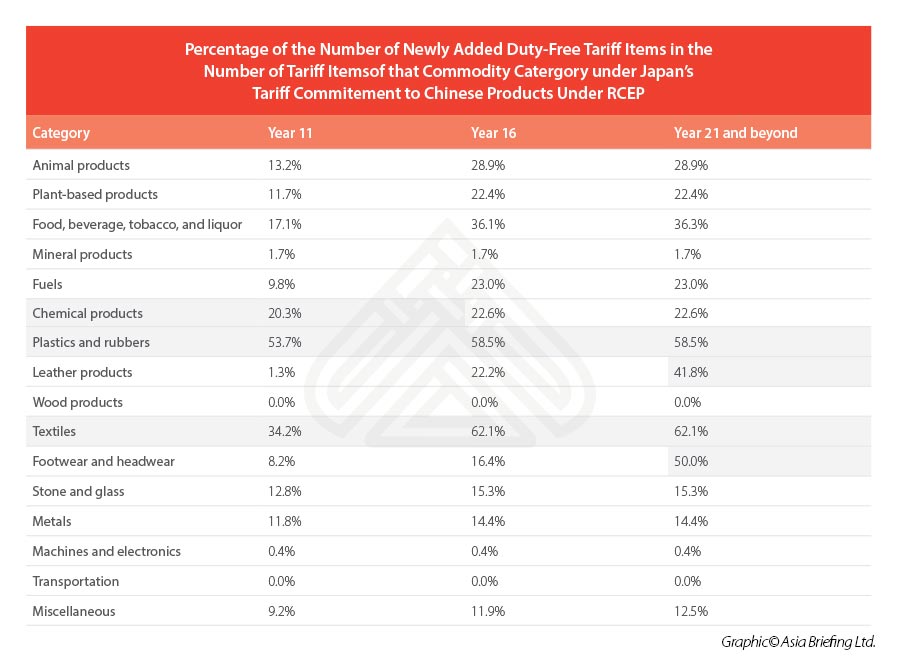

In return, Japan has also pledged to gradually reduce tariffs on most Chinese imports to zero over a period of more than 20 years.

In fact, so far, most of Chinese machinery, electronics, and transport products have already enjoyed zero MFN tariff rates when exporting to Japan. In the first year after the RCEP enters into force, 99.57 percent of Chinese machinery products and 100 percent of Chinese transport products will receive zero-tariff treatment from Japan, as well as 97.4 percent of the number of tariff line items of mineral products and 85.02 percent of stone and glass products.

In the first 11 years, Japanese tariffs on 53.7 percent of plastic and rubber products, 34.2 percent of textile and clothing products, and 20.3 percent of chemical products will be gradually reduced to zero.

Eventually, within 21 years, 62.1 percent of Chinese textiles, 58.5 percent of plastics and rubbers, 50.0 percent of footwear products, and 41.8 percent of leather products will enjoy zero Japanese tariff. The percentage of the number of duty-free items of the five categories – food, beverage, tobacco, and liquor, animal products, fuels, chemicals, and plant-based products – will reach more than 20 percent.

China, South Korea trade data and tariff commitment

China-South Korea trade data

In 2019, South Korea exported worth US$136 billion to China. The five big categories of South Korean products exported to China are machines (US$70.5 billion), chemical products (US$18.7 billion), instruments (US$11.4 billion), plastics and rubbers (US$10.5 billion), and mineral products (US$8.56 billion).

The main products exported to China are integrated circuits (US$33.8 billion), refined petroleum (US$6.5 billion), cyclic hydrocarbons (US$6.36 billion), machinery having individual functions (US$6.1 billion), and LCDs (US$5.27 billion).

China exported worth US$108 billion to South Korea, including machines (US$52.3 billion), metals (US$11.4 billion), chemical products (US$9.54 billion), textiles (US$7.07 billion), and instruments (US$3.72 billion).

Similar to what are exported to Japan, the main products that China exported to South Korea were integrated circuits (US$15.1 billion), broadcasting equipment (US$4.85 billion), and office machine parts (US$3.69B).

China-South Korea tariff commitment

China and South Korea already have an existing bilateral FTA – the China-South Korea FTA, which came into effect on December 20, 2015. So, there is limited space for the two sides to expand their zero-tariff products or increase tariff cuts under the RCEP.

Nevertheless, South Korea will further cut tariffs on Chinese deer antler, dextrin, and scallop to zero, and reduce tariff on Chinese products, such as clothing and ceramic tiles. China will impose zero tariff on textiles and stainless steel from South Korea, while some tariffs have been reduced on South Korean generators and auto parts.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Заявление на постоянный вид на жительство в Китае: процесс подачи в Шанхае

- Next Article Belt and Road Weekly Investor Intelligence, #35