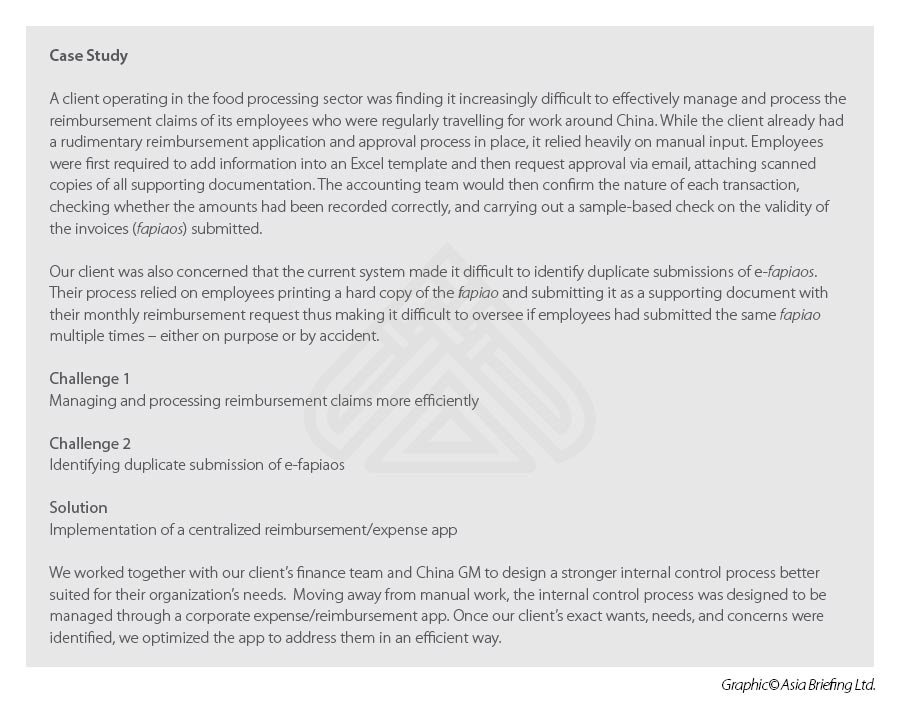

Digital Expense Management in China: How Big of a Deal is it?

We analyze why transitioning to a digital expense management system can be cost effective for your business in China and assess the best options available.

The gathering pace of the ‘shift to digital’ is clearly apparent to everyone, and it has only been accelerated further by COVID-19. There are so many areas of business in which this transition is happening, some at a faster rate than others. The shift from the traditional bricks and mortar retail model to e-commerce has been the most prominent.

In China, the companies adding the most market capitalization over the past six months have been e-commerce leaders like JD.com, and the logistics companies that connect sellers to their consumers. Online education has been another boom area.

A quieter revolution also seems to be happening in the area of corporate expense management in China, which is an area of the organization where companies can incur significant costs. One particular driver of this change that is peculiar to China (and a few other countries which operate on similar lines, like Vietnam) is the central role played by the “fapiao” within commercial transactions.

Drivers of digitalized expense management

The need for a consistent format for every fapiao provided by each company across China paves the way for digital expense management. The fapiao is an official invoice in China, which is issued not by a company independently based on its own format or style but is issued in a very specific format stipulated by the Chinese government. Companies are required to access a government system to record the details that will be represented on their fapiao. They can then either print out the fapiao on a special government-issued printer (still the main method in many industries in China), or issue e-fapiaos, which represent the same information in purely digital form.

What makes this methodology different from most other countries is that the consistent format of every fapiao provided by every company across China upon provision of taxable services makes it possible for digital expense management tools to ‘read’ the data on paper fapiaos very accurately and quickly – using optical character recognition (OCR) technology.

The increasing popularity of e-fapiaos also empowers these localized expense management apps. These days, information on fapiaos sitting in an employee’s WeChat virtual wallet can be seamlessly transferred into an expense management app, and from there, utilized to claim a reimbursement for whatever the employee happened to purchase for business purposes.

As a result of this peculiarity of the Chinese system, the perceived benefit of such expense management tools is higher than in certain other economies that are technically more advanced.

Take Singapore for example. It is not uncommon in Singapore to receive an invoice from a vendor, which is handwritten on a small piece of paper with no fixed format. The receiver of the invoice may be able to easily read the information there and summarize it for their reimbursement report, but ultimately the invoice format represents ‘unstructured data’ from a digital perspective. It is hard for a system to identify which information on such a document is the key information, and which is supplementary information. Therefore, digitization can only partially eliminate the workload for employees during their reimbursement process. A digital expense management app operating in such an environment would likely eliminate 60 percent of the overall workload for the employee. But in China, because of the structured data that exists on every fapiao, as much as 90 percent of the overall workload can be eliminated.

The possibility of receiving fake fapiao is another driver pushing companies to transfer to digitalized expense management systems.

An additional factor also at work is that China has always had a problem with companies receiving fake fapiaos from employees or vendors. Vendors can deliberately falsify fapiaos to pretend they had paid tax but not actually paid.

Companies that receive fapiaos are supposed to verify whether each fapiao is indeed genuine, but without a digital expense management tool, this process is far too slow to be practical.

What it entails is the company’s accountant going to the Golden Tax System’s online portal and checking one-by-one whether each fapiao received from each employee is in compliance or not by typing in the fapiao number and comparing the details in the government system with the details on the fapiao itself.

In the event that fake fapiaos are identified (which commonly happens during an annual audit procedure because auditors are obligated to do random checks), the company faces additional costs because these expenses cannot be deducted for tax purposes, besides triggering punitive consequences.

Moreover, this problem is exacerbated, not eliminated, by the introduction of e-fapiaos. The reason is easy to understand.

An individual receives an e-fapiao for a business expense, such as a lunch with a client. If their company is using a traditional accounting process to manage expenses, they will have to print out this e-fapiao and attach it to their expense report, then submit to their manager before the reimbursement application is forwarded to the finance team for processing.

But unlike a paper fapiao, which only exists as a single original document and cannot be duplicated, an e-fapiao can potentially be printed out many times. By accident or by design, the employee may request reimbursement for a particular e-fapiao on multiple occasions. This is very difficult for the line manager or the accountant to identify – much harder than is the case for a paper fapiao.

For all these reasons, expense management app adoption has flourished in China since last year. The ability for employees to capture structured data as information within these expense management apps, and supplement it with explanations about why the expense was incurred, saves them a lot of time when they put together their reimbursement reports every month.

The advantage of digitalized expense management

For managers – review and approve easily, from anywhere

From the perspective of the line manager, to receive and be able to approve a reimbursement report immediately via mobile phone, including scans of the fapiao and other supporting documentation, provides complete transparency. There are cases where a manager having to make decisions based on incomplete, unstructured information may accept a certain expense even though they have some doubts about it, simply because the process for refusing and returning to the applicant for further justification is too time-consuming or embarrassing.

These situations can be avoided by using expense management apps because internal controls can be set up to ensure employees provide comprehensive enough information at the point of application.

The ease with which managers can reject specific items submitted through these apps also empowers them. The cost savings that can be achieved through empowering managers in this way should not be underestimated.

For the accountant – quicker and more accurate processing But the biggest advantage of these apps over the traditional method of expense management comes at the level of the company’s accountant, in its automated processing and verification of expense data.

Instead of reviewing piles of paper-based reimbursement reports and trying to identify problems manually, the accountant can simply review the digital data.

Some apps also include fapiao validity verification. Erroneous or fake fapiaos will not be able to be successfully uploaded because the application would immediately reject such an employee request. Further, the accountant may be interested to know which employees attempted to submit a fake fapiao. Similarly, did any employees attempt to submit the same e-fapiao on multiple occasions?

Again, the expense management app will automatically identify such attempts at the point of application and block them, but it might still be interesting to note how often an employee makes such attempts; if they happen to be a poorly performing employee, maybe the accountant might even consider checking historical reimbursement records to see if any such problems happened at that time but were not picked up.

In short, a process that may have taken several days for an accountant can be completed in a matter of hours. Reimbursements can be made more promptly to employees, keeping them happier. Internal controls can be managed more tightly. Problems and trends can be identified more easily. 99 percent of manual errors can be eliminated.

In the experience of the Dezan Shira team, having used one of the leading expense management apps for the first seven months of 2020, the most significant remaining problem is the limitation of the OCR technology to perfectly read figures directly from fapiaos issued by taxi drivers. In 98 percent of cases the technology works perfectly, but just occasionally the fapiao will be printed so poorly that it is difficult even for the human eye to read properly.

In these cases, an adjustment does need to be made by the applicant, and a random check is recommended from the accounting team. But this work always needed to be completed anyway via the traditional method of expense management.

Reporting, analysis, and compliance – digital data

Under the traditional method of accounting for these expenses, after verification of the completeness and accuracy of each report, the accountant has to manually enter a summary of that information into the financial reporting package. This is extra work, and it is prone to error. The more expense reports there are, the larger the workload. Upon entry, the accountant must choose the correct accounting category – again time consuming.

Because of time constraints and volume of work, most accountants will choose to enter only a very limited amount of information. Not many companies will scan all the paper documents (including fapiaos) and attach them to the information stored within their financial management system.

Because of this, such data on expenses, which could be used by the company for all sorts of useful analytical purposes, becomes obsolete. It sits on pieces of paper, in an unstructured manner, and will probably only ever be seen by an auditor before being consigned to a dusty file room somewhere. The value in that information has been, literally, locked up.

In contrast, by utilizing an appropriate expense management app and linking it seamlessly with a well-designed tech-powered accounting software system, a large amount of relevant information can be automatically transferred into the accounting software. This information can include the scans of the fapiaos (and the e-fapiaos), as well as other supporting documentation. All of this information can be organized in a way so that it can be subsequently analyzed. Auditors can rely on this digital information to do their audits remotely. Financial controllers can incorporate the data into wider analyses to spot important business trends. Fraud can be identified. The information becomes alive again.

So, to answer the question posed at the head of this article, digital expense management is a big deal, and it is particularly significant in China because of the centralized fapiao management methodology utilized here.

Approaches to achieve digitalized expense management

Having grasped the potential value of such apps, companies should also give some thought to which ones might be the most effective. In general, there are three approaches that companies can take:

Approach 1

Develop something for themselves via tools, such as MS PowerApps, which can integrate into whichever tech-powered accounting software environment they are using.

Approach 2

Utilize globally recognized expense management platforms. One particularly well-known platform is Concur, which is owned by System Applications and Products (SAP).

Approach 3

Look to the local Chinese market, which has many companies delivering localized apps. There are pros and cons to each of these approaches.

Assessment of each approach

The first approach is probably only viable for quite large companies with substantial presence in China. Even for such companies, it is quite a big task to not only gather all the requirements and create a good enough user experience, but also to integrate such apps with the many third parties that form a core part of the business landscape in China. These include the tax bureau, the various ride-hailing apps, hotel, and flight booking apps, banks, and even Chinese character OCR technology providers. The main advantage to this approach would be to maintain all data within one integrated environment, and to have 100 percent control over that environment. However, the cost is high.

The second approach has been chosen by quite a number of companies already, as part of their global digital expense management strategy. Naturally, using one tool across multiple geographies has benefits, especially from the IT perspective. But these platforms are generally not optimized for the Chinese environment to an adequate degree. They may not link with all the important third-party apps to facilitate seamless transfer of data. Or their OCR technology partner may not be one that focuses on Chinese language character recognition, which is important when dealing with fapiaos. As a result, user experience and user adoption tend to be negatively impacted. These apps also tend to be more expensive on a per-user basis.

The third approach is the cheapest way forward. The cost of one license for some of these apps can be as little as RMB 300 /year(appox.US$40). Some of them are bilingual and they have a lot of flexibility in terms of their configuration. Naturally these companies have concentrated on integrating their products with the Chinese business landscape, so the experience for users is relatively seamless and intuitive. The main problem for foreign investors is how to identify the most appropriate providers and how to configure the apps appropriately. There are legitimate concerns about data security, as certain data concerning their employees and expenses may pass through third-party servers. There is also the risk that because many of these Chinese providers are effectively start-ups, the reliability of their service provisions or even the robustness of their platform may be deficient.

Summary

To summarize, during this period of extreme pressure on corporate profitability, control over expenses becomes imperative. Especially for companies headquartered a long distance from China, getting full transparency on what is being spent and why – can help eliminate unnecessary expenditure and improve the bottom line. It can also reduce tax risk. Expense management apps can play an important role here. Not only that, but they can also improve employee efficiency in both the front office and the back office. Therefore, serious thought should be given by companies on how to effectively utilize this technology. Now is an ideal time to persuade employees to change ingrained habits, empower managers, and streamline this aspect of your internal operations.

We help organizations in China optimize their employees’ and internal expense management with digital tools that speed up business administration, simplify remote submissions and approvals, and minimize expense and approval errors. For more information about our services, and how we can help solve challenges for your organization, please email us at china@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China and Central Asia: Bilateral Trade Relationships and Future Outlook

- Next Article Chongqing – The New Frontier for Foreign Investment in Southwest China