E-Fapiao Compliance Management in China and Regulatory Requirements

The increased adoption of e-fapiao (e-invoice) and the digital transformation of China’s tax system have made it possible for companies to genuinely consider creating a paperless working environment and achieve accounting and tax automation in the future. However, in the early stages of this digital revolution, businesses can face a number of challenges if they are not adequately prepared.

For one thing, in the coming few years we can expect that more regulatory measures will be rolled out to ensure a seamless transition from the paper to the digital invoicing system, which may pose compliance risks to the company.

For another, based on the digitalized accounting data contained in e-fapiao, tax regulators will be empowered to leverage technologies like big data and cloud computing to strengthen tax collection and administration, which may expose the company to increased tax risks.

Organizations and businesses in China that purchase, obtain, transfer, and keep e-fapiao should consciously stay abreast of the latest regulatory and technological changes, to avoid any additional operating costs or tax burdens, or even being penalized by the government.

Why e-fapiao compliance is essential?

Avoiding government penalties

Improper handling of e-fapiao may subject a company to penalties by the government.

According to the Accounting Law of People’s Republic of China (PRC), the Chinese government can impose a fine on an organization or an individual that fails to comply with the requirements on the management of accounting vouchers.

For example, if they fail to obtain and fill in the original fapiao, or the original fapiao obtained or filled-in does not comply with relevant provisions, or if they fail to make records in account books based on verified fapiao, or if they fail to safekeep fapiao as per the provisions, which results in damage or loss of accounting materials.

An organization can be fined between RMB 3,000 (US$466) and RMB 50,000 (US$7,770) and an individual who is directly accountable for the accident can be fined between RMB2,000 (US$311) and RMB20,000 (US$3,110).

Criminal liability could also be pursued, if the organization or the individual(s) involved are deemed to have committed a criminal offence due to aggravating circumstances.

Avoiding additional operating costs

What is more, as China begins rolling out special value-added tax (VAT) e-fapiao from 2020, general corporate taxpayers may also face risks of not being allowed to deduct input VAT if they improperly handle the special VAT e-fapiao, which could cause very large operating losses for certain companies.

This will also have a knock-on effect on the ultimate liability for corporate income tax (CIT). In China, before taxing the income of enterprise, reasonable expenditures and other certain expenses within certain limits are allowed to be deducted.

However, those expenses need the corresponding evidencing fapiao to prove that they have actually been incurred. Improper handling of e-fapiao could cause some expenses to become ineligible for deduction, thus obligating the enterprise to pay more CIT.

Avoiding low tax credit ratings

China applies tax credit ratings to corporate taxpayers – A-level taxpayers have the best credibility, while D-level taxpayers have the worst. Tax authorities review and adjust companies’ tax credit ratings each year, based on indicator information related to tax declaration, tax payment, fapiao and tax control equipment management, and account books management.

Under the tax credit evaluation system, which adopts a demerit method, an organization will face the risk of losing points and demotion, if it fails to obtain, issue, use, and keep fapiao as per the regulations.

According to the Administrative Measures on Taxpayers Creditworthiness (Trial Implementation), a taxpayer can be directly graded as D-level if it violates the provisions on fapiao management, which results in non-payment, under-payment of tax, or tax fraud by other organizations or individuals, or if it issues special VAT fapiao fraudulently, which constitutes a tax-related criminal offense.

Contrary to A-level taxpayers who will be entitled to favorable treatment like streamlined administrative procedures and fast-tracked approvals, D-level taxpayers will face increased frequency of supervision and inspection and stricter scrutiny in a wide range of tax-related matters, such as application for fapiao issuance and VAT refunds on exported goods. They may also be restricted or prohibited in terms of financing, public procurement, access to land supplied by the government, etc. if tax authorities share information with other relevant authorities.

Compliance requirements on e-fapiao management

China implemented general VAT e-fapiao since 2015 and started deploying special VAT e-fapiao since 2020. In a bid to better regulate the conduct of enterprises in managing electronic accounting vouchers, in March 2020, the State Tax Administration (STA) released the Notice on Regulating the Reimbursement, Bookkeeping, and Archiving of Electronic Accounting Vouchers (Cai Kuai [2020] No.6).

Fake and falsified e-fapiao

According to the Cai Kuai [2020] No.6, all electronic accounting vouchers received by enterprises must be verified as lawful and authentic before being applied for reimbursement, then subsequently bookkeeping and archiving.

However, in reality, an electronic version of a fapiao is more likely to be maliciously forged or falsified using photoshop or other editing technologies. False e-fapiao may not be based on a real business transaction; and a falsified e-fapiao may lack genuine accounting data like sales amount, date of issue, and buyer’s and seller’s tax code. These e-fapiao are not allowed to be used by law.

Therefore, to stay compliant, e-fapiao receiver must verify each e-fapiao before processing them. This includes verifying the validity and authenticity of the information on e-fapiao as well as the electronic seal and e-signature.

Entities and individuals can verify the information on a VAT e-fapiao via the National VAT Invoice Verification Platform (https://inv- veri.chinatax.gov.cn/).

At present, China’s official e-fapiao are available in two formats – PDF (usually general VAT e-fapiao) and OFD (usually special VAT e-fapiao), and they must be archived in such original formats, rather than in PNG, JPG, or other digital formats.

For ODF-format special VAT e-fapiao, entities and individuals can download the OFD reader through the National VAT Invoice Verification Platform to verify the validity and authenticity of the electronic seal and electronic signature. For PDF-format general VAT e-fapiao, entities and individuals can use PDF reader to check if the e-fapiao has been tampered with.

This process could require a lot of manpower, especially if the e-fapiao need to be opened one by one manually. For businesses that receive large amounts of electronic accounting vouchers, it would be more efficient if they can install a smart expense management application that can automatically verify an array of e-fapiao or can immediately verify the e-fapiao when it is first scanned and uploaded to the system.

Duplicated entry of the same e-fapiao

In addition, Cai Kuai [2020] No.6 also requires enterprises to set up necessary review and signature procedures for effectively preventing electronic accounting vouchers from being repeatedly entered into accounts.

The reason is that unlike paper fapiao, which requires a fresh company stamp, an electronic version of a fapiao with electronic signatures can be easily reprinted, and all printed copies look the same. When using printed e-fapiao for reimbursement and bookkeeping, accounting personnel may repetitively enter the same fapiao that has been used. This will lead to duplicated reimbursement of the same expense and fraudulent bookkeeping.

To avoid this situation, enterprises should better optimize their internal control system. For those without an intelligent fapiao management system, accounting personnel will need to manually check the fapiao code and fapiao number when processing claims to eliminate duplicated input. However, this can be time-consuming and error-prone when there are piles of fapiao to confirm.

As an alternative, an enterprise may want to consider installing a smart, efficient fapiao management system that can identify and reject a previously submitted fapiao when it is uploaded to the system.

Archiving e-fapiao properly

It must also be noted that, according to Cai Kuai [2020] No.6, companies shall not merely use the printed hard-copy of e-fapiao for reimbursement, bookkeeping, and archiving.

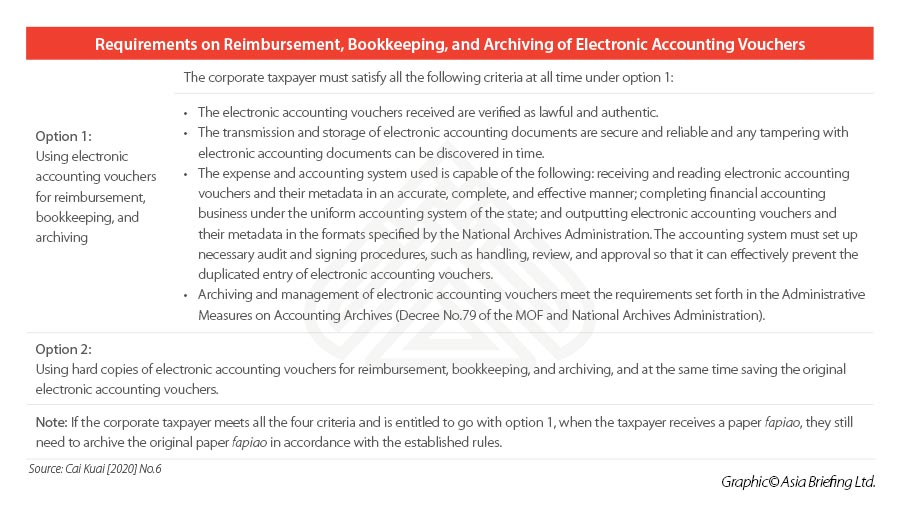

Instead, corporate taxpayers have two options:

- Only using e-fapiao for reimbursement, bookkeeping, and archiving, if they establish a digital system that satisfies all the criteria set out in the Cai Kuai [2020] No.6; and

- Using the hard copy of e-fapiao for reimbursement, bookkeeping, and archiving, and at the same time saving the original file of the e-fapiao.

As shown in the table on the next page, under the first option (only using the electronic version of fapiao for bookkeeping and archiving), the corporate taxpayers must satisfy four specific criteria at all times.

This includes the requirements that the corporation’s financial system must ensure secure and reliable transmission and storage of e-fapiao and can track and discover any tampering with e-fapiao in time.

The expense and accounting system must be able to receive and read e-fapiao and its metadata accurately, completely, and effectively. The accounting system must also set up audit and signing procedures to prevent the duplicate entry of e-fapiao.

These criteria can be demanding for many small enterprises that have not set up intelligent invoice and expense management systems.

For companies that cannot meet the four criteria, they will need to use the printed copies of e-fapiao as the basis for reimbursement, bookkeeping, and archiving, and simultaneously safe keep the original e-fapiao based on the regulation – paper copies should also be archived in accordance with the established rules. This transitional approach may increase the administrative costs of the enterprise.

As currently both paper fapiao and e-fapiao are being used in China, if the corporate taxpayer meets all the criteria and is entitled to only use e-fapiao for reimbursement, bookkeeping, and archiving, when the taxpayer received a paper fapiao from supplier or employer, it still needs to archive the original physical paper fapiao in accordance with the established rules.

To be noted, as of the date of issue of this magazine, the Cai Kuai [2020] No.6 has been implemented for more than one year. Businesses that haven’t updated the way of managing e-fapiao could face compliance risks or pay significant costs in correcting previous malpractice.

Retaining e-fapiao for a sufficient period of time

Companies should also be aware that the minimum retention periods for some accounting records – either in paper or the electronic version – have been changed to 10 or 30 years, instead of the original 3, 5, 10, 15, or 25 years, according to the Administrative Measures on Accounting Archives (Decree No.79 of the MOF and National Archives Administration).

E-fapiao, as one kind of original accounting voucher, are required to be retained for 30 years. This can be challenging for businesses. Paper fapiao need physical space to be stored and are easily damaged or lost, while e-fapiao and other electronic accounting documents require a powerful and secure cloud or localized storage system and an intelligent archive management solution to manage them.

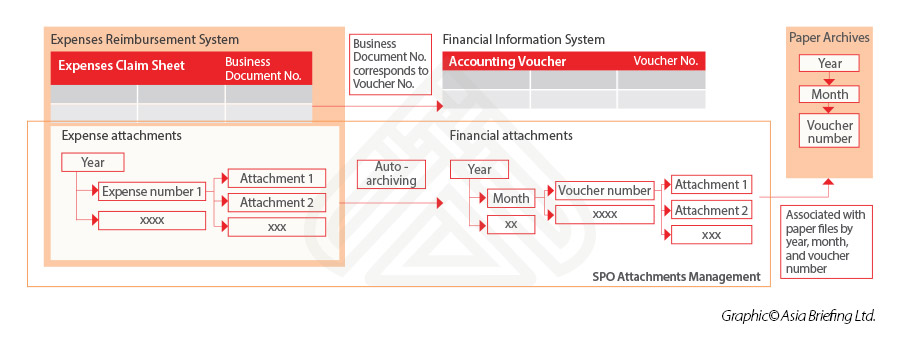

For taxpayers that need to keep both the paper and electronic accounting vouchers, it is highly recommended to establish a retrieval system between the physical and digital documents.

An ideal intelligent archive management system should be able to store e-fapiao, accounting vouchers, and other business documents in a digital format, build the business logic and reference relationship between the files, and provide multi-dimensional retrieval conditions for quick access to the original accounting documents. In this way, the system will not only save time and manpower when looking to retrieve information, but also improve the efficiency of internal and external audits.

Case study

Case I: Tampering with invoice contents

Company A receives as reimbursements a large number of entertainment expenses each month as it needs to carry out extensive market development work. Entertainment expenses are relatively hard to monitor by the company and thus more open to abuse by employees than many other types of expenses.

Since Company A has not fully digitalized its fapiao and expense management process, it still needs to preserve both the original e-fapiao (the original digital file received by the employee and submitted for reimbursement) and the printed copy of the e-fapiao. In daily practice, the company’s financial department just roughly checks the information on the printed copy of the e-fapiao and may often fail to verify the original e-fapiao as required.

Some employees have taken advantage of this loophole, using tampered e-fapiao to claim additional amounts as entertainment expenses. In one case, an employee tampered with the description of “goods or taxable services”, the amount on the e-fapiao, and even hid a part of the invoice verification code on the printed copy of the e-fapiao and successfully got expensed. He did this by printing out the original pdf of the e-fapiao, tampering with it manually, and re-saving as a pdf.

Such misconduct was only noticed by the company in an internal audit conducted long after the incidents. The company was ultimately unable to deduct these entertainment expenses from its taxable income.

Analysis:

Fapiao used for reimbursement must be genuine and not tampered with, as stipulated in the tax laws and regulations. In situations where a company has not achieved 100 percent digitalization in its e-fapiao management, the company must preserve a printed copy of the e-fapiao in addition to the original copy.

This exposes the company to higher risks of receiving maliciously forged or falsified fapiao. Although the original copy of an e-fapiao is hard to be tampered with as it is encrypted, loopholes exist at the current stage. For example, a general VAT e-fapiao can be saved as an image before printing, which can be modified by photoshop or other editing technologies.

If the company doesn’t have due procedure to collect and verify the original e-fapiao, it is very likely that such misconduct will trigger tax losses for the company upon exposure of such behavior. In the worst-case scenario, if such misconduct was discovered by the tax authority, the company’s tax credit might be negatively affected and potential tax investigations might be initiated.

Companies are suggested to verify the validity and authenticity of the information on e-fapiao as well as the electronic seal and e-signature. In the long run, companies are also suggested to utilize digitalized e-fapiao and expense management solutions to improve internal control and reduce the tax risks caused by fapiao incompliance.

Case II: Invoice based on no real transaction

Company B’s main business is to provide support services for some on-site projects, which is why many of its employees get dispatched to various project locations. According to Company B’s internal reimbursement policies, the company allocates a reimbursement limit to each employee every month. Within the reimbursement limit, the employee can claim expenses by providing the corresponding VAT invoices.

Given this background, some employees have asked vendors to issue invoices with higher transaction amounts than the actual amount incurred or even purchased fapiao from a third-party agency despite the lack of real transactions, in order to make maximum use of the reimbursement limits.

One employee rented a house from an individual but dishonestly acquired fapiao issued by a hotel management company. Obviously, such fapiao were not based on real transactions, which is against the tax law and deemed as illegally collected. What’s worse, it overstated the transaction amount (monthly rental fee), which was much higher than the market price.

Such misconduct of the hotel management company was finally noted by the authority when the company failed to pay the due taxes and went missing. The tax authority then issued tax inspection notices to all companies who purchased fapiao from this company.

Company B was therefore subject to a special tax audit from the tax authority for two years because of the receipt and use of fapiao with non-real transactions. After a thorough investigation conducted by the tax bureau, the illegal conduct w exposed. Company B was asked to do the correction on its CIT declaration. In the meantime, such violations led to a demotion of Company B’s tax credit rating.

Analysis:

Corporate fapiao receivers need to keep in mind that all fapiao should be issued based on a real business transaction. If companies fail to comply with such compliance requirements, tax losses and monetary penalties might be triggered, in addition to the potential restrictions to participate in certain businesses. What’s worse, more misconduct might be found in the tax authority’s special audit and investigation, which could seriously affect the enterprise’s tax credit or its capability of applying for VAT rebates.

In the context of e-fapiao implementation, such misconducts are more easily discovered by the tax authority as the traceability of e-fapiao and the application of data technologies empowers tax officials to be more capable and efficient in discovering violations. Without a well-established internal control system, businesses like Company B could easily be implicated in tax risks by other related parties.

Companies are suggested to pay enough attention to the issue and establish due internal control and e-fapiao and expense management solutions to avoid the occurrence of such incidents. At the same time, companies should consider utilizing internal and external resources to enhance the training of employees on compliance, fapiao management, and professional ethics.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Guangzhou’s Next Round of GBA IIT Subsidy Applications: July 1 to August 31, 2021

- Next Article China City Spotlight: Investing in Foshan, Guangdong Province