E-Invoice Management in China: How Companies Can Stay Compliant

E-invoice management in China is not as simple as it seems. The bookkeeping and archiving of e-fapiao for reimbursement purpose must comply with relevant regulations to avoid additional tax costs or administrative penalties by finance authorities and the National Archives Administration.

With China hastening the roll-out of the electronic special value-added tax (VAT) fapiao (hereafter “special VAT e–fapiao“), starting December 21, 2020, taxpayers across the country are entitled to accept VAT special e-fapiao issued in the pilot places.

The nationwide implementation of special VAT e-fapiao has ushered in the era of comprehensive digital invoice management in China, but also triggered challenges in terms of maintaining clear records and transparency in the taxpayers’ financial management system. False e-fapiao, duplicated entry of the same e-fapiao, and the online management and archiving of e-fapiao can cause headaches to companies’ traditional finance teams.

On December 20, 2020, the State Taxation Administration (STA) put forward requirements on the bookkeeping and archiving of VAT e-fapiao for reimbursement purposes. It stated that taxpayers must comply with the Notice on Regulating Bookkeeping and Archiving of Electronic Accounting Vouchers for Reimbursement Purposes (Cai Kuai [2020] No.6) when managing e-fapiao.  Cai Kuai (2020) No.6 does not apply to VAT e-fapiao alone – it also applies to the management of all electronic accounting vouchers, including:

Cai Kuai (2020) No.6 does not apply to VAT e-fapiao alone – it also applies to the management of all electronic accounting vouchers, including:

- Electronic invoice (e-fapiao);

- Financial electronic receipt;

- Electronic ticket;

- Electronic itinerary;

- Electronic payment certificate specialized for Customs;

- Bank electronic receipt; and

- Other electronic accounting vouchers.

According to the Regulation, valid and authentic electronic accounting vouchers have the same legal validity as hard copy accounting vouchers. Taxpayers may choose to only use the electronic accounting voucher like e-fapiao for bookkeeping and archiving for reimbursement purpose if they satisfy all the criteria or choose to use the hard copy of the electronic voucher.

In either consideration, taxpayers must abide by the corresponding regulations on the management of electronic accounting vouchers. In addition to the existing difficulties in e-fapiao management, Cai Kuai [2020] No.6 also brings more challenges to enterprises in the compliance aspect of e-fapiao management requirements.

Using electronic accounting vouchers for bookkeeping and archiving

According to Cai Kuai [2020] No.6, a taxpayer can opt for the electronic accounting voucher for bookkeeping and archiving for reimbursement purpose – if they satisfy all the following four criteria at all times (which can be demanding for small enterprises that have not set up intelligent invoice and expense management systems):

- The electronic accounting vouchers received are verified as lawful and authentic.

- The transmission and storage of electronic accounting documents are secure and reliable and any tampering with electronic accounting documents can be discovered in time.

- The expense and accounting system used is capable of the following: receiving and reading electronic accounting vouchers and their metadata in an accurate, complete, and effective manner; completing financial accounting business under the uniform accounting system of the state; and outputting electronic accounting vouchers and their metadata in the formats specified by the National Archives Administration. The accounting system must set up necessary audit and signing procedures, such as handling, review, and approval so that it can effectively prevent the duplicated entry of electronic accounting vouchers.

- Archiving and management of electronic accounting vouchers meet the requirements set forth in the Administrative Measures on Accounting Archives (Decree No.79 of the MOF and National Archives Administration).

Using hard copies of electronic accounting vouchers for bookkeeping and archiving

If a taxpayer cannot meet the above conditions, they can use printed copies of electronic accounting vouchers as the basis for bookkeeping and archiving for reimbursement purpose, but the original electronic accounting voucher should be saved simultaneously, based on the regulation.

Meanwhile, taxpayers should also establish a retrieval system between the electronic accounting voucher and the hard copy bookkeeping vouchers. An ideal retrieval system should be able to store accounting vouchers and other business documents electronically, build the business logic relationship between files, establish the reference relationship between electronic accounting vouchers and paper accounting vouchers, and provide multi-dimensional retrieval conditions for quick access to the original accounting documents. In this way, the system can save search time and manpower and improve internal and external audits.Retention periods of accounting records

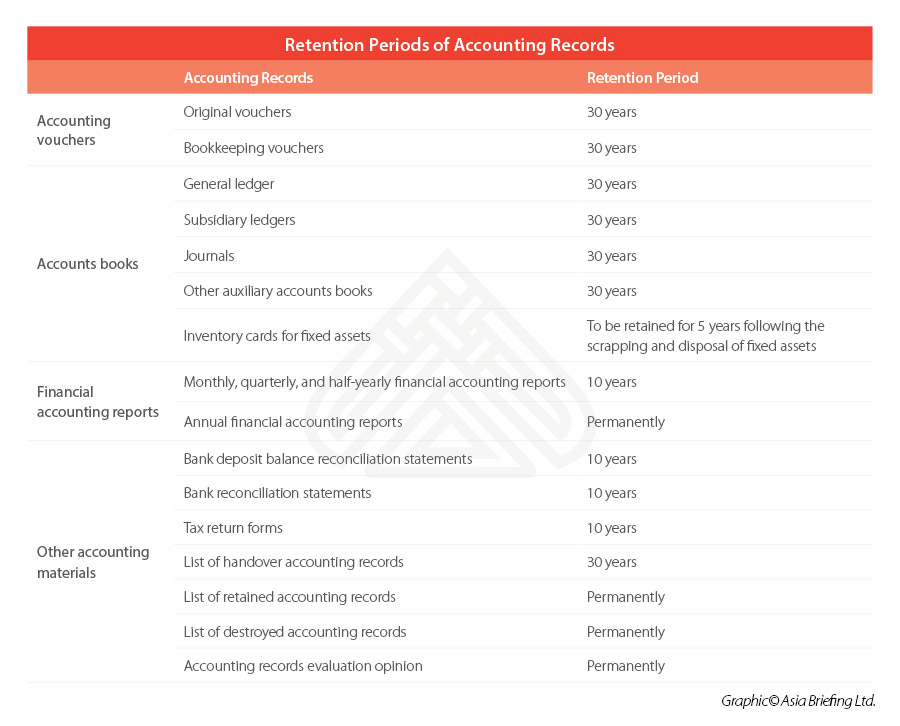

Companies should also notice that the minimum retention periods for some accounting records – either in paper or the electronic version – have been changed from 10 or 30 years, instead of the original three, five, 10, 15, or 25 years, according to the Administrative Measures on Accounting Archives (Decree No.79 of the MOF and National Archives Administration), which came into effect from January 1, 2016. This requires companies to optimize cloud storage systems and archive management solutions.

E-invoice management in China: Solutions to stay compliant

To stay compliant with the above regulations, it is strongly advisable that companies build up or update their information technology solutions, such as the expense system, accounting system, and cloud storage solution, to manage and archive e-fapiao and other accounting vouchers and ensure their accuracy, reliability, security, and completeness. An ideal IT solution for e-invoice management should achieve the following functions:

- Automatically verify the validity of VAT e-fapiao;

- Automatically read electronic accounting vouchers accurately, completely, and effectively;

- Reject duplicated entry of the electronic accounting voucher that has been submitted;

- Set up necessary audit and signing procedures, such as handling, review, and approval;

- Prevent electronic accounting records from being tampered with;

- Link electronic invoices with other vouchers and store the documents in a systematic way;

- Enable a backup system, which can effectively protect data against accidents, vandalism, and natural disasters; and

- Ensure that the local system or cloud storage solution can satisfy the long-term retention requirements of electronic accounting vouchers.

Dezan Shira & Associates offer digital expense management solutions and comprehensive corporate accounting service solutions that incorporate the above features and enable our clients to stay in full compliance with China’s regulations on electronic invoice management. As the issuance of e-fapiao becomes more prevalent through 2021, the topic will soon become a top priority for CFOs and finance managers with responsibility for China operations. For more information or help on accounting voucher management solutions, please contact IT@dezshira.com.

About Us China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Investment Opportunities in Shenzhen and the Greater Bay Area

- Next Article China Promulgates New Extraterritorial Jurisdiction Measures