More Than a Hobby: Understanding the Esports Market in China

In a recent article, we discussed the policies and regulations in the esports industry in China. An emerging and relatively niche market, esports has gained in popularity among the younger demographic, generating millions in revenues. In this article, we explore the opportunities and risks in the industry.

Esports market in China at a glance

Esports, short for electronic sports, is a kind of competition based on video games. It has gained in popularity across the world since the 2000s as internet access has widened, turning a leisure hobby into an industry that’s worth billions. In 2022, global esports tournaments have been expected to rake in US$1.4 billion in revenue and the figure may grow to US$1.9 billion by 2025.

China is the largest single-country market in the world, fueled by the growth of Chinese consumers’ purchasing power, as well as Chinese tech giants’ investments that have spurred gaming entertainment. In 2021, China’s esports market size was about RMB 167.3 billion, according to iResearch. China also has the highest number of active esports players and tournament viewership thanks to new technologies with mobile devices and live streaming.

According to the Ministry of Human Resources and Social Security, in 2019 there were more than 5,000 esports teams and clubs in China, with about 100,000 professional esports players and a total of 500,000 people employed in the industry. China Audio-video and Digital Publishing Association (CADPA) reported a total of 62 esports competitions held in the first half of the year, a slight increase from last year.

Both PC games, such as League of Legends, and mobile games, including Wild Rift, Honor of Kings, and Peacekeeper Elite, are very popular in China.

Business scope in China’s esports market

The esports market profits in multiple ways, including by selling gaming accessories, running tournaments, streaming live events, advertising, merchandise sales, and media rights.

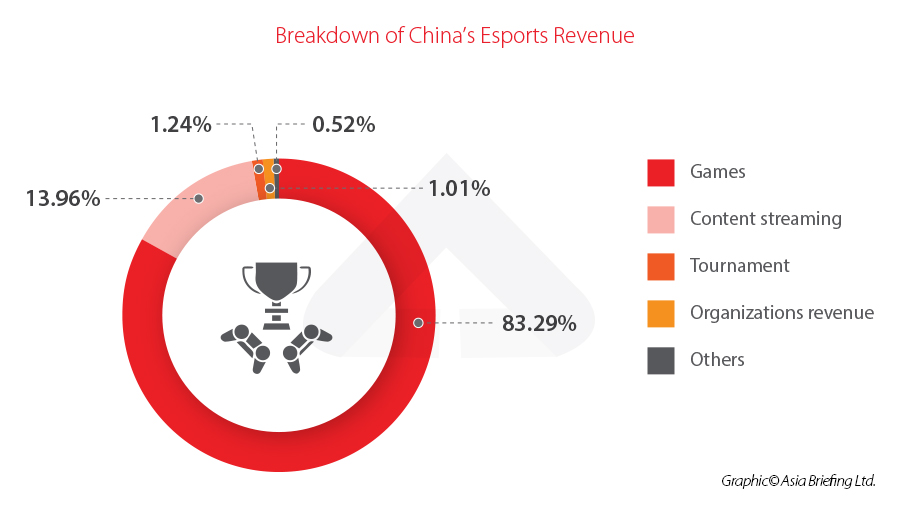

In recent years, businesses in the gaming industry have boosted their revenues by running tournaments and establishing professional teams. Based on a report from CADPA, China’s esports revenue streams break down as: games (83.29%), content streaming (13.96%), tournament (1.24%), organizations revenue (1.01%), and others (0.52%).

Esports tournaments have turned gaming into a social event that involves professional players and spectators. During these events, the public can watch multiplayer video game competitions with professional players playing as individuals or as a team. Some companies have also included observing features for further broadcasting.

While video games are designed for all kinds of players, many esports games are specially designed to be played professionally. The esports industry is not only lucrative for big companies, but also for professional players, thanks to some tournaments that offer a prize pool of over a dozen million U.S. dollars. Some of these players become celebrities in the industry, with thousands of fans. Their gaming practice set examples for the fans, who then look to emulate their esport idols by purchasing similar equipment and accessories.

Government recognition of esports

China is one of the earliest adopters of esports on an official, government level. China’s General Administration of Sports recognized esports as an official sport category in 2003.

The esports sector, however, has both a sporting and cultural dimension, linking sports, technological, social, and psychological considerations. Recognizing their significance for China’s economy, the Ministry of Education added the esports management major in 2016, with more than 50 universities offering related programs. Students study courses on game development, esports events and services, esports media, and esports training. The first batch of esports management students graduated in 2021, eyeing future opportunities in the industry.

In early 2019, the Ministry of Human Resources and Social Security also recognized esports operators and esports player as two new official professions.

And in 2021, esports was included in the 14th Five-Year Plan, and national standards for esports players were released.

Moreover, esports will make its official debut as one of the official sports to be played at the next Asian Games to be held in Hangzhou, China (postponed from 2022 to 2023). This newly emerged industry is now on its way to be a discipline at the Olympic Games.

Business opportunities for foreign players in China’s esports market

The demand for games in China is enormous as is the growth potential of gaming companies. With the rapidly expanding influence of esports events and content, the commercialization of elements such as copyright, event sponsorship, and streaming production still maintains a high growth rate. The esports industry provides opportunities for foreign brands that are ready to enter China’s market.

Future growth drivers of the market will be a combination of esports and emerging formats, including back-end infrastructure, such as cloud computing and IoT; front-end devices, such as augmented reality (AR), virtual reality (VR), and mixed reality (MR); and underlying technologies, such as blockchain and NFT. Existing business models in the esports industry are thus expected to change in response to evolving technologies and technological applications.

China also needs additional talents in the sector. One executive of Tencent Holdings estimated that at least two million talents over the next three to four years will be needed to keep China competitive in the esports industry. Personnel will include event organizers, esports club managers, livestreamers, broadcast presenters, media workers, and people developing linked products.

Further, esports should not be considered as a ‘lone’ business. Its popularity among young people has created a new type of ‘fandom’ economy that spurs consumption. New business opportunities emerge constantly; below are some examples:

- In April 2022, Tencent and Beijing Universal Resort announced their partnership for the 2022 seasonal event. Tencent’s Honor of Kings, Peacekeeper Elite, QQ Speed, card game Doudizhu, as well as several other games, will be officially added to the Beijing Universal Resort parade.

- In August 2022, Tencent and Ouyu Technology launched the first esports-themed hotel in Hangzhou, China. The hotel caters to the gaming community, featuring top-of-the-line hardware, comfortable setups, bootcamps, access to professional live-streaming, and even incubation training areas.

Risks and uncertainties

Despite the promising numbers, the industry also faces severe challenges, as the Chinese government tries to balance burgeoning business opportunities and public concerns, especially for minors. Per rules introduced in August 2021, those aged under 18 are limited to only three hours of gaming per week (Fridays, weekends, and holidays only). All games have also required real name verification to restrict minor’s access. Many analyze that this regulation may have a knock-on effect on the country’s esports scene, restricting the talent pipeline and causing a drop in esports consumption by minors.

Additionally, the government has frozen approvals of new games. From June 2021 to April 2022, China did not issue a single new license for monetizable games. On July 18, 2022, the Ministry of Commerce issued new guidelines to simplify and expand the approval process for online games, lifting previous restrictions. Game license approvals have also begun to favor games that are educational in nature. Leading gaming companies, such as Tencent and NetEase, after receiving few approvals, are looking to expand overseas instead of overleveraging on the Chinese market.

Businesses also need to consider the government’s ongoing squeeze on the “platform economy” that has resulted in hefty fines for Tencent, Alibaba, and various other tech companies. These regulations may reduce incentives for new product development and marketing efforts in gaming.

Concerns also arise that the esports market might have begun reaching the industry ceiling, after years of rapid growth and expansion. In the first half of 2022, total revenue of the gaming industry declined 1.8 percent year-on-year. Despite the large market, the growth of esports games and esports livestreaming revenues has slowed down. While the pandemic-induced supply chain disruption may have contributed to the decrease, above-mentioned policy restrictions also make the sector’s prospect murkier.

Looking ahead

Businesses eyeing opportunities in China’s esports industry should have flexible plans that can suit both the short-term and long-term development of esports in the country. Soon, with esports making its debut in international games in 2023, China will be expected to hasten its investment in the sector to retain competitiveness. In fact, during the Asia Games in Hangzhou next year, it can be expected that campaigns related to esports will catch public attention.

Finally, the esports market is not limited to gaming alone but includes other sectors, ranging from livestreaming, event sponsorship, entertainment, and lifestyle. It is these additional commercial avenues that will open more doors to foreign investment. Therefore, having business capacity that can be transferred to these linked sectors may enhance benefits for esports firms.

To be competitive in the long-term, investors should closely monitor China’s regulatory environment. State policies could push the esports and gaming sector to produce more content that is socially responsible and educational, particularly when targeted at minors. It is important that your business strategy plans for such contingencies as well as catering to Chinese consumer preferences.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China’s Q3 2022 Economic and Trade Roundup: Recovery Better Than Expected

- Next Article 20th Party Congress Report: What it Means for Business, the Economy, and Social Development