EU Chamber Business Confidence Survey for Foreign Companies in China: Key Observations

Recently on June 20, 2022, the European Chamber of Commerce in China (EU Chamber) released its European Business in China Business Confidence Survey 2022, based on insights from 620 European companies doing business in China, 79 percent of which have been doing so for over 10 years.

Following the recent lockdowns in multiple cities of China, with the strictest implementation in Shanghai, the country seems to be going through something unprecedented and both local and foreign companies are facing challenges of a very complex nature.

While much of the world is moving beyond the COVID-19 pandemic, China is still sticking to its “zero-COVID” policy, making it extremely hard and unpredictable for companies doing business here.

“The only thing predictable about China today is its unpredictability, and that is poisonous for the business environment,” said Bettina Schoen-Behanzin, vice president of the European Union Chamber of Commerce in China.

What was stated by Ms. Behanzin comes as no surprise to those who live and work in China: “Increasing numbers of European businesses are putting China investments on hold and re-evaluating their positions in the market as they wait to see how long this uncertainty will continue, and many are looking towards other destinations for future projects”.

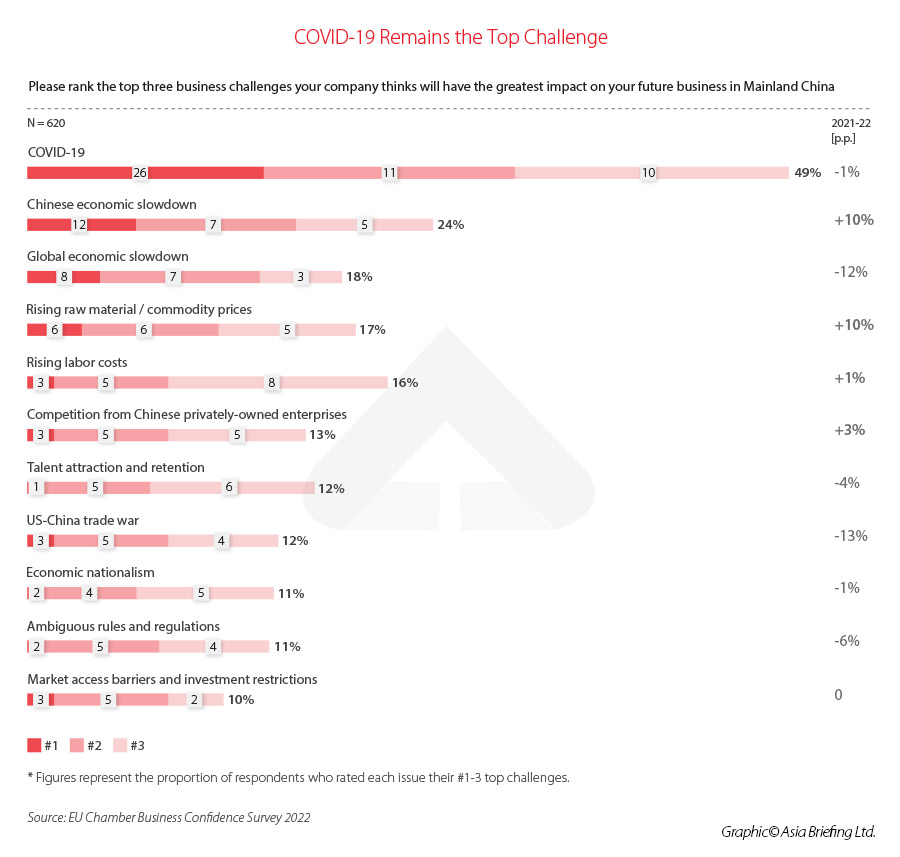

As revealed in the EU Chamber survey report, 60 percent of European companies said that doing business is to some extent becoming “more difficult” in 2022, compared with 47 percent in 2021. In addition to COVID-19 prevention and control measures, the impact of the Russian-Ukraine conflict has been felt all over the world. This, among other concerns, are the top challenges to European companies in China.

That being said, despite the current predicament and the challenges imposed by the COVID-19 curbs, two-thirds of European businesses operating in China saw their revenues grow 24 percent in 2021, compared with the previous year.

To be precise, as per the survey’s findings, most European companies in China declared positive revenues and 79 percent of them reported growing profits in 2021 – higher than the 73 percent reporting the same in the previous year’s report.

However, more companies are considering shifting their current or planned investments out of China to other countries – 86 of the 372 respondents confirmed this during the survey, twice the number of respondents compared to the survey report released in February 2022.

South China business environment

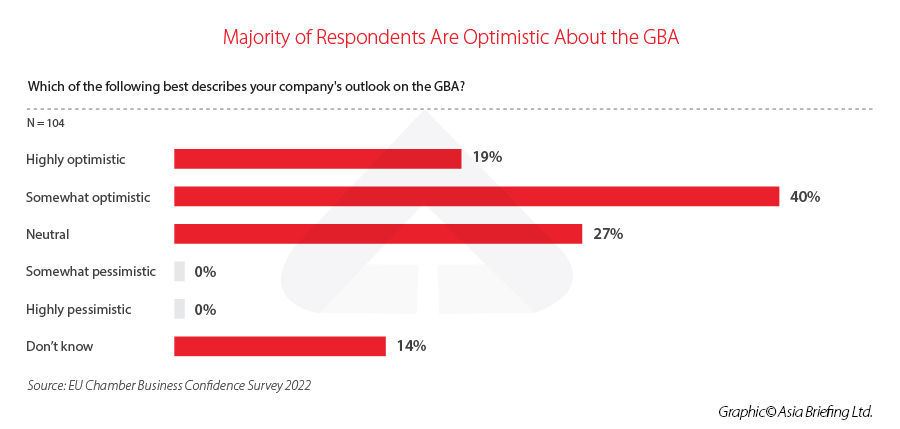

In what concerns numbers specific to South China and the Greater Bay Area (GBA), in the eyes of foreign companies, the GBA remains an attractive business destination, with most respondents being optimistic about its future and more than half of the EU Chamber members benefitting directly or indirectly from the development of the GBA plan.

Of the 106 South China-based member companies of the EU Chamber in China, 94 percent of the respondents stated they have no plans to move out of South China and 75 percent said they would like to expand in South China.

Still, some respondents noted that Guangdong’s coordination among different departments, effective implementation of local policies, and access to English-language information requires improvement.

A lot of EU companies also mentioned the problems of talent retention in the region, which most companies address through salary increases and engagement of staff through trainings and internal communication.

Finally, the top concerns that EU companies in South China would like to address and resolve is the simplification of the visa process for foreign talent, which thus far remains complex, as well as the improvement of government transparency and the creation of a level playing field for European companies.

Conclusion

Despite the relatively mixed results of the survey on European companies doing business in China as a whole, the South China results offer positive takeaways.

Should we do a similar survey in other parts of the country, I assume the results will be similar – foreign businesses are still committing to invest and operate in China. The main reason can be attributed to the fact that the Chinese market is simply too important to lose, and so far, worth the challenges posed by this troubling time.

As I write this article, the government has loosened the travel restrictions: China has waived the PU letter requirement for some Z-visa and M-visa applicants in multiple countries, the quarantine time for close contacts and inbound international travelers has been shortened to a 7+3 model (7 days of centralized quarantine and 3 days of home quarantine) from the previous 14+7 model, and China has ceased marking cities with COVID-positive cases in the travel code.

These small steps, which have already boosted the stock exchange market and the demand of flights into China, shows that Beijing is slowly but surely steering the country onto a path to normalcy.

All this will undoubtedly have positive consequences for local and foreign companies and hopefully when we analyze the next year’s business confidence survey, the picture will be much more positive than the current one.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Belt and Road Weekly Investor Intelligence #88

- Next Article China Insurance Premium Deferral: What Businesses Need to Know