China 2022 FDI Roundup: Stronger Policies Aim to Maintain Growth Momentum

Foreign investment in China saw rapid growth in the first eight months of 2022, particularly in sectors such as high-tech and manufacturing. However, foreign direct investment from the European Union became more concentrated – among certain sectors and countries – and hedge funds experienced the highest net outflows in 15 years. Meanwhile, Chinese officials are attempting to address foreign investor concerns surrounding COVID-19 control measures and market reforms by rolling out relevant policies. In this article we round up the data and discuss the latest news on the status of foreign investment in China.

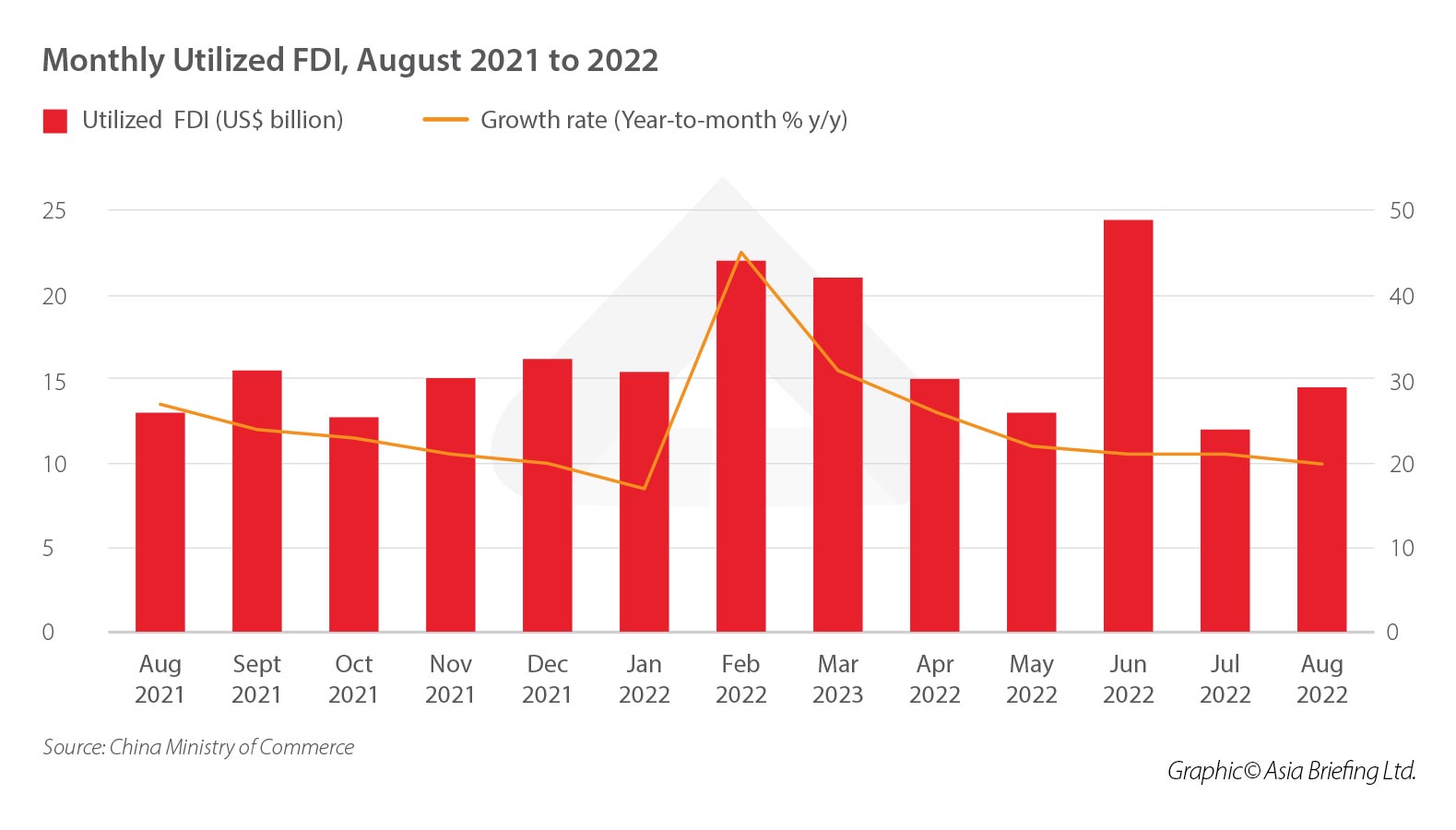

China’s Ministry of Commerce recently released the latest utilized foreign capital data for the period between January and August 2022. The data paints a positive picture overall. However, looking at the data month by month, the growth shows a less steady trajectory as the impact of the pandemic, global economic slowdown, and external geopolitical factors shake confidence among investors.

At the same time, China-focused hedge funds saw some of the highest net outflows in 2022, according to media reports, although analysts say investors still want exposure to China due to its strong growth potential. Meanwhile, a new report from the EU Chamber of Commerce addresses the concerns of European businesses, calling for more reforms to improve the market opportunities, even as European companies reaffirm their desire to operate in the China market.

Addressing these issues, Chinese officials have expressed an eagerness to roll out measures to encourage more foreign investment in China, which may bring about more favorable conditions for foreign investors and businesses.

In this article, we summarize and analyze the latest foreign capital and investment data and discuss how the government will seek to boost foreign investment.

China FDI up 20.2 percent year-to-date in 2022

In the period from January to August 2022, actual use of foreign capital reached RMB 892.7 billion, an increase of 16.4 percent from the same period the previous year. In dollar terms, that is US$138.4 billion, an increase of 20.2 percent from the same period in 2021.

The services sector absorbed the lion’s share of this amount, accounting for RMB 662.1 billion, a year-on-year growth rate of 8.7 percent. Meanwhile, utilized foreign capital in the high-tech sector grew 33.6 percent year-on-year, with high-tech manufacturing and high-tech services growing 43.1 percent and 31 percent, respectively.

Utilized foreign capital originating from South Korea saw the fastest growth rate, up 58.9 percent from the same period the previous year. This was followed by Germany (30.3 percent year-on-year), Japan (26.8 percent year-on-year), and the UK (17.2 percent year-on-year). Meanwhile, the regions with the highest growth rate of utilized foreign capital were western China, growing 43 percent year-on-year, followed by central China (27.6 percent year-on-year), and eastern China (14.3 percent year-on-year).

The strong FDI growth has come despite the impact of continued COVID-19 containment measures, in particular the strict lockdowns imposed on major cities in April and May. Looking at the utilized FDI numbers on a monthly basis, however, the trend looks a little less certain. The fastest growth of 2022 thus far happened in January and February, with utilized FDI growing a whopping 45.2 percent year-on-year in February. This was before the significant spread of the Omicron variant of COVID-19, which led to stricter control measures imposed in cities across China.

April and May saw an expected slump as the impact of lockdowns took its toll, while the spike in June – which recorded US$24.6 billion in utilized FDI, above just US$13.3 billion in May – is likely a result of businesses returning to normal operations following the lifting of restrictions.

July saw the smallest figure in the year, with utilized FDI reaching just US$11.6 billion. August appears to show improving figures – up to US$14.5 billion – but it may be too soon to say whether this trend will continue.

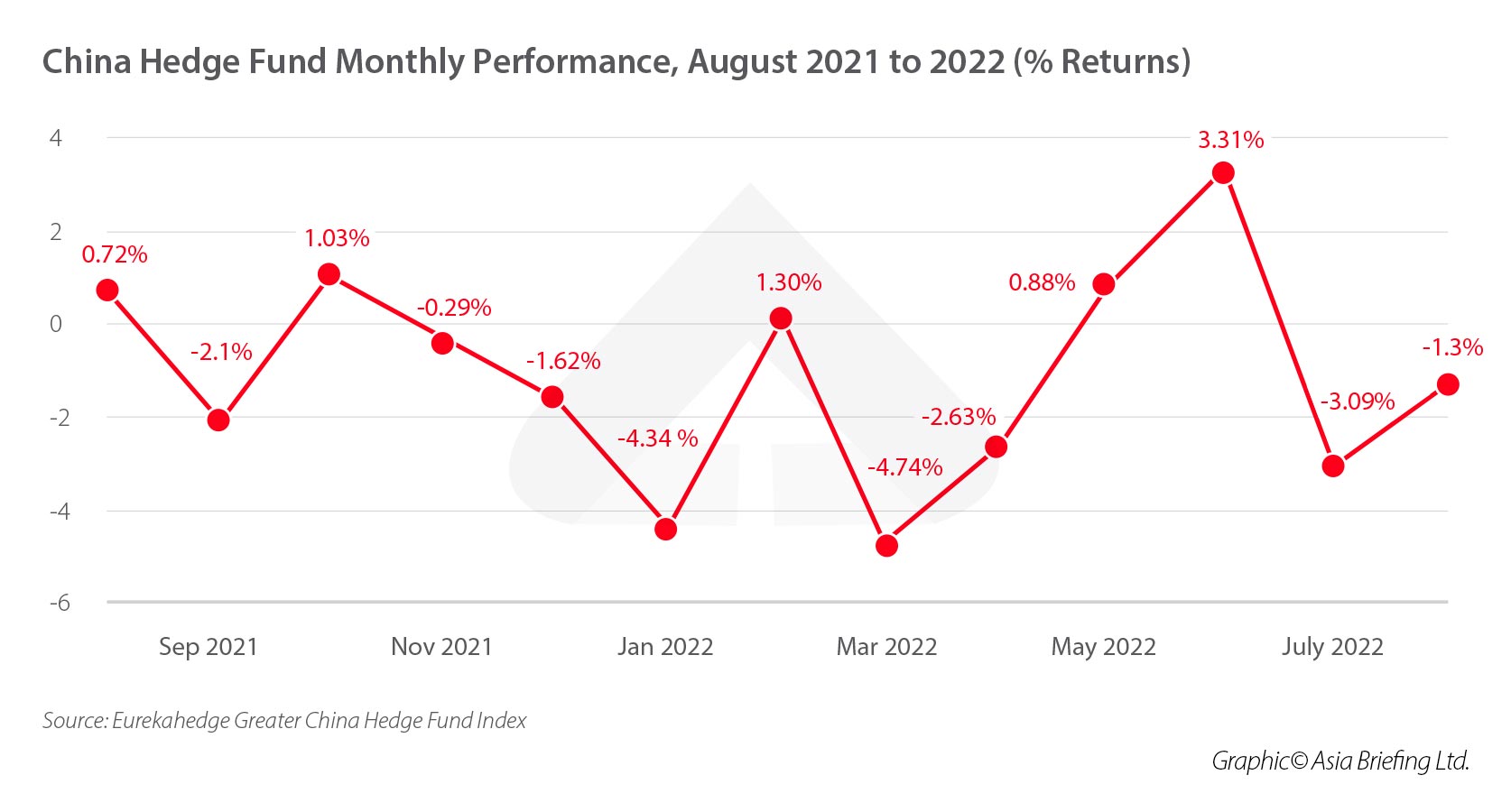

China-focused hedge funds see record net outflows in 2022

Figures from data provider Eurekahedge showed that hedge funds with a focus on the Greater China region experienced the highest net outflows in 2022 since the index began recording the data 15 years ago. Net outflows reached US$3.6 billion in the first seven months of 2022, according to Reuters, as hedge funds sought to reduce their exposure to China. Meanwhile the average returns on investments in the first eight months of 2022 reached -11.54 percent.

The net outflows mark a reversal of the US$1.8 billion net inflows recorded in 2021, and US$8.7 billion in net inflows in 2020. According to analysts cited by Reuters, investors are still keen on maintaining exposure to the China market as the country remains a prominent growth market. Moreover, net outflows seen this year are likely due to factors such as the fallout from the Russia-Ukraine conflict, COVID-19 lockdowns, and the sell-off of US-listed Chinese stocks due to their potential delisting from US stock markets. The impact of these factors may ease as time goes by, and further policy clarity on matters such as COVID-19 following the 20th Party Congress – held from October 16 onward – may help to assuage investors’ concerns and reverse the current course of investment outflows.

European investment in China becomes increasingly consolidated as EU Chamber calls for more reforms

According to a new report from data and analytics firm Rhodium Group, FDI from European firms into China has become increasingly consolidated among a few investors, sectors, and origin countries over the past four years. According to the report, in the period from 2018 to 2020, over 80 percent of FDI came from just 10 investors, although this proportion dropped to 71 percent in 2021.

Moreover, in the period from 2018 to 2021, almost 70 percent of FDI from Europe went to just five sectors – autos, food processing, pharmaceuticals and biotech, chemicals, and consumer products manufacturing. Of this, 31 percent went to automotive equipment and components. Finally, in the period from 2018 to 2021, just four European countries – Germany, the UK, France, and the Netherlands – accounted for 87 percent of total FDI on average. Of this, four German firms – Volkswagen, BMW and Daimler, and BASF – accounted for 34 percent of the total European FDI by value during this period.

Meanwhile, a position paper released by the European Union Chamber of Commerce (“EU Chamber”), discusses various factors why China may become less attractive as an investment destination for European companies. These include stalling SOE reform and increasingly ad-hoc policymaking, inflexible COVID-19 policy, fewer opportunities for knowledge exchange, and shifting supply chain strategies.

The EU Chamber advocates focusing on reform efforts to assuage investors’ concerns, which include accelerated opening of market segments and avoiding decoupling with other markets.

The report also mentioned that China remains an important market for European businesses due to its significant growth potential, manufacturing strength, and industrial clusters that are “hard, if not impossible, to replicate elsewhere”.

Chinese officials seek to boost foreign investment

In the wake of the economic slowdown and uncertainty created by the pandemic, the Chinese government has taken steps to boost spending and investment and get the economy back on track to faster growth. This includes taking steps to encourage foreign investment.

In recent weeks and months, top Chinese government officials have repeatedly called for policies and measures to boost foreign investment. At a weekly State Council meeting chaired by Premier Li Keqiang on September 13, the Premier called for stabilizing foreign investment and trade. The measures proposed to achieve this include:

- Strengthening the guarantee of essential factors (such as energy, oil, gas, and transport) and promoting the implementation of a number of key foreign-funded projects as soon as possible.

- Further facilitating the entry and exit of foreign business, technical personnel, and their families.

- Consolidating the responsibilities of major foreign trade and investment provinces to better play a leading role and require relevant departments to improve coordination and services.

In a press briefing on September 16, Spokesperson of the National Development and Reform Commission (NDRC) Meng Wei extrapolated on these proposals from the State Council, saying that the NDRC would work with relevant departments to issue specific measures to promote foreign investment soon, with a focus on manufacturing industries. The NDRC will seek to promote foreign investment from three key aspects:

- Solve the current problems faced by foreign-invested enterprises (FIEs): While continuing to implement COVID-19 prevention and control measures, facilitate the exchange of business personnel of FIEs, improve active connection with FIEs and their upstream and downstream enterprises, adhere to the “one-by-one coordination” of matters, and ensure smooth logistics.

- Increase investment in the manufacturing industry: Roll out the Catalogue of Industries Encouraged for Foreign Investment (2022 Edition), which currently has been released in its draft form, to guide foreign investment in advanced manufacturing, high-tech, modern services, and other fields, and promote investment in central, western, and northeastern China; support the import and export of FIEs in the manufacturing industry, and guide foreign-invested enterprises in the manufacturing industry to relocate to less developed regions.

- Improve foreign investment promotion and services: Organize and implement a series of international industrial investment and cooperation activities to build a platform for multinational companies to invest and attract investment from various localities, implement streamlined administrative mechanisms for major foreign-funded projects, and accelerate the signing and implementation of projects.

The proposals by the NDRC signal one more step by government departments to implement concrete measures to assist foreign businesses and boost foreign investment in China. As investment, in particular in major infrastructure and manufacturing projects, are one of the Chinese government’s main tools for spurring economic growth, we expect various central government departments and local governments will seek to roll out preferential measures to boost foreign investment, facilitate business for foreign companies, and guarantee equitable and fair treatment.

The question remains whether such measures will be sufficient to counteract the impact of the pandemic and geopolitical uncertainties that are leaving foreign investors and businesses apprehensive, and will likely have to come in tandem with relaxed COVID-19 prevention measures – in particular quarantine times for international arrivals – as well as guarantees that businesses will receive support in the event of lockdowns and business closures.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China Launches Digital Yuan App – All You Need to Know

- Next Article China’s Hukou Reform: Zhengzhou Could Become First Megacity to Relax Hukou Restrictions