Fujian Pingtan Extends 15% CIT for Qualified Enterprises Until End of 2025

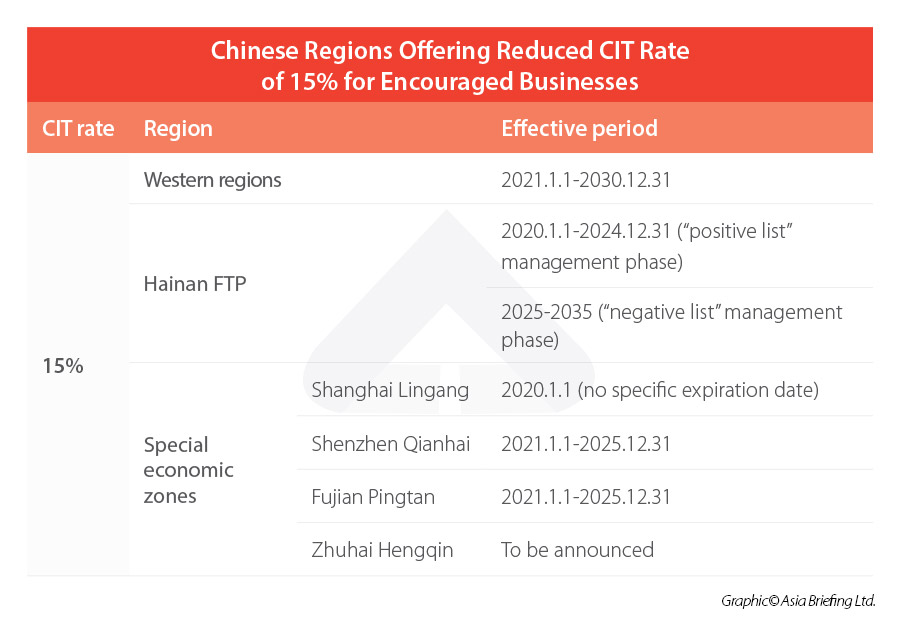

Fujian Pingtan Comprehensive Pilot Zone continues to offer a reduced corporate income tax (CIT) rate of 15 percent to eligible enterprises for five more years (until December 31, 2025). Qualified enterprises must have their main business in any of the 146 sectors encouraged by the Zone in its 2021 Edition CIT Preferential Catalogue. This tax incentive is also available in the special economic zone of Shenzhen Qianhai till 2025.

On December 8, 2021, the Ministry of Finance (MOF) and the State Taxation Administration (STA) announced the Notice on the Continuation of Corporate Income Tax Preferential Policy in the Pingtan Comprehensive Pilot Zone (Cai Shui [2021] No.29).

From January 1, 2021 to December 31, 2025, eligible enterprises in Fujian Pingtan Comprehensive Pilot Zone (hereafter “Fujian Pingtan”) are able to enjoy a reduced corporate income tax (CIT) rate of 15 percent – a significant reduction from the standard CIT rate of 25 percent.

To qualify, the enterprise must:

- have its main business in the encouraged industries stipulated in the 2021 edition of the Catalogue for Encouraged Industries Eligible for CIT Preferential Treatment (“CIT Preferential Catalogue”); and

- its income from the main business must present more than 60 percent of its total income.

Fujian Pingtan is a comprehensive pilot zone adjacent to Taiwan; together with Shenzhen Qianhai (next to Hong Kong) and Zhuhai Hengqin (near Macao), the three regions rolled out the CIT preferential policy as early as 2014.

According to the Cai Shui [2014] No.26, from January 1, 2014 to December 31, 2020, firms established in Fujian Pingtan, Shenzhen Qianhai, and Zhuhai Hengqin were eligible for a reduced CIT rate of 15 percent if they were engaged in the encouraged industries listed in the respective area’s Preferential CIT Catalogue. The revenue from the firm’s main businesses was required to make up at least 70 percent of the enterprise’s overall revenue.

As the CIT preferential policy expired at the end of 2020, this year, all of the three zones have extended the CIT policy for another five years – until the end of 2025. Fujian Pingtan and Shenzhen Qianhai have released and expanded their Preferential CIT Catalogues, as well as relaxed the requirement on the proportion of the main businesses.

Which industries are especially encouraged in Fujian Pingtan?

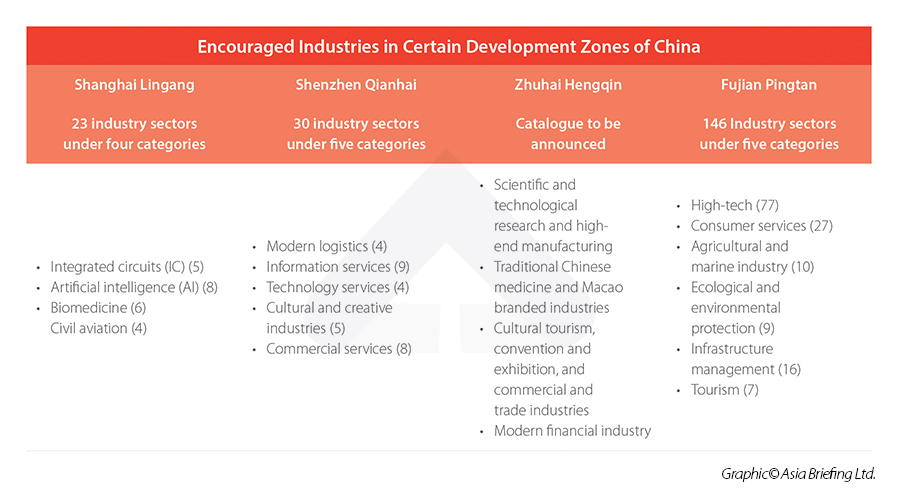

In the 2021 edition of the CIT Preferential Catalogue, Fujian Pingtan encourages 146 industries under six broader categories – high-tech, services, agricultural and marine industry, ecological and environmental protection, infrastructure management, and tourism.

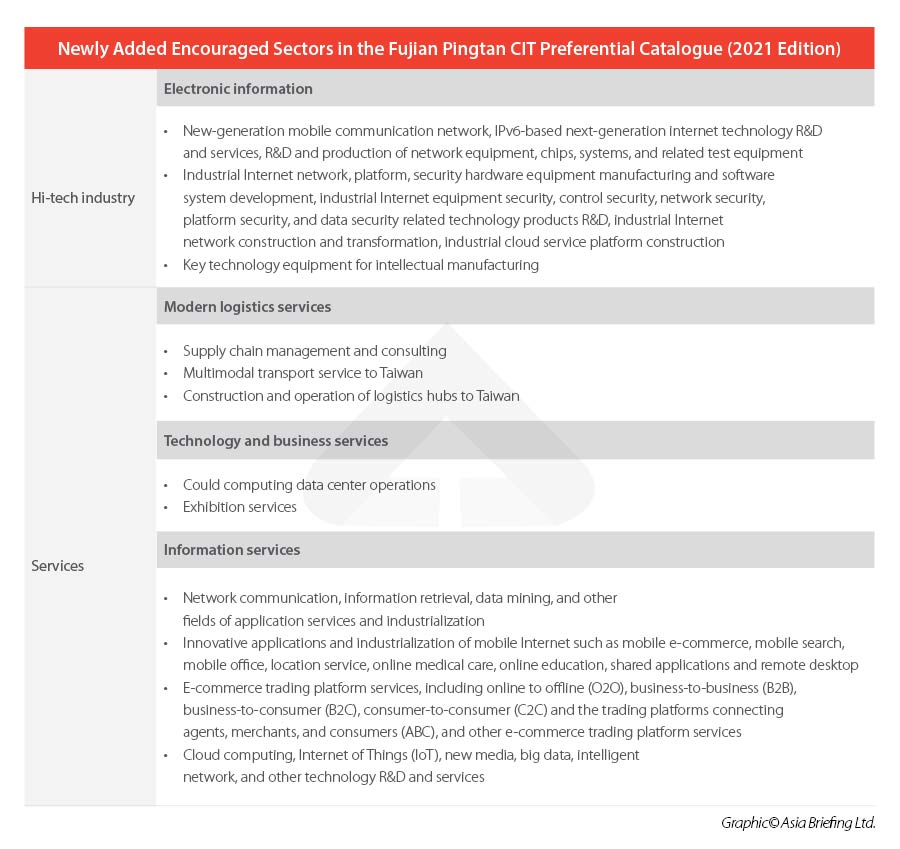

The 2021 edition has added 12 items in four industries – electronic information, modern logistics, technology and business service, and information service – to the previous 2017 edition.

Notably, Pingtan’s Catalogue has added cloud computing data center operation as well as R&D and services of cloud computing technology and Internet of Things (IoTs) technology – to promote the development of the emerging industries. Besides, Pingtan’s Catalogues also includes two unique items related to Taiwan – namely, multimodal transport services to Taiwan and construction and operation of logistics hub to Taiwan.

Leveraging CIT incentives to establish your China business operations

China has introduced similar CIT preferential policies in many other regions, such as Shanghai Lingang New Area, Hainan Free Trade Port (FTP), and China’s western regions, besides in Fujian Pingtan, Shenzhen Qianhai, and Zhuhai Hengqin.

Basically, all these regions require the enterprise’s main business to fall under its encouraged catalogue and the revenue of the enterprise’s main business to account for more than 60 percent of its total revenue. The major difference is that each region formulates and frequently updates their own encouraged catalogues.

Although these catalogs generally cover mainstream high-tech and advanced manufacturing industries, some regions may encourage some other specific industries based on their characteristic development orientations.

Thus, before establishing their operations in China, enterprises are suggested to conduct a self-assessment to determine whether its main businesses fall under the Catalogue of a specific region and can leverage the tax incentives. If it is hard to define the industry or sector category, they are advised to consult local professionals or the relevant administrative departments of the local government.

China Briefing has been tracking the latest news on CIT incentives in China. Our parent company, Dezan Shira & Associates, has an experienced team of business intelligence consultants, tax accountants, and lawyers across the country and can advise on options for investing in Fujian as well as emerging and attractive sector-based opportunities. Please contact us at China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China Lowers Tariffs on 954 Products from January 1, 2022

- Next Article 2022 Import-Export Taxes and Duties in China