Funding and Subscribed Capital When Opening a Company in China and the UK

This series concentrates on the UK-China business angle. Every week, we will add a new video that answers some of the most frequently asked questions about setting up a company in China and the UK. Each video answers the same issues from both the China and UK perspectives.

Key insights will be provided by Maria Kotova, Head of UK Business Development and China market entry director at Dezan Shira & Associates, and Lisa Gui, Assistant Manager at HW Fisher.

If you have any questions about doing business in China or the UK, reach us at UK.Ireland@dezshira.com.

Episode 8: Funding and subscribed capital when opening a company in China and the UK

Funding and subscribed capital when opening a company in China

Registered capital is the fund all shareholders contribute or promise to contribute to the company when they apply to the local administration of Market Regulation (AMR) for incorporation of the company. The amount of the registered capital depends on a range of factors, which include the region, the sector, the company’s business scope, the planned scale of operations, etc. It will show in the company’s business license, this information is available to the public to show the fund strength or capacity of a company to some extent.

The registered capital does not need to be paid completely up front. The previous system of paid-up capital has been replaced by a subscribed capital model, under which a schedule of contributions must be declared in the Article of Association and be registered with the local AMR in charge. The government will check whether the investors follow the capital injection plan.

There is no minimum registered capital requirement for corporate establishment except few industries, such as banking, financing, insurance, etc. Despite this, in practice, the governing authorities will ensure that a company’s registered capital is sufficient to support its business operations for at least one year, including its rent, labor costs, and office expenses.

UK investors need to strike a balance between the amount of capital and estimated business expenses. If you subscribe too low of an amount and your company is not generating enough profit to cover expenses, your company may run out of cash. It may take months to apply for the increase.

On the other side, if your subscribed capital is too high and your company in China starts to generate profit very fast, it will be difficult to reduce this amount. You will need to submit an application with strong evidence and while authorities are generally supportive of increasing the capital amount, they are often reluctant to reduce it and it may take some time to be approved.

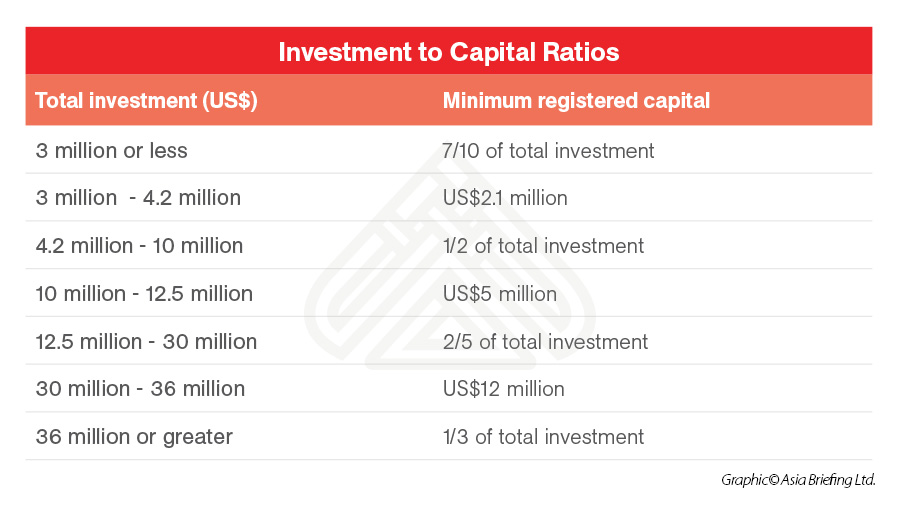

Moreover, the registered capital can affect the amount of offshore debt the FIE can borrow from other investors or foreign banks if the FIE chooses to follow the ratio between registered capital and total investment as shown in the following chart. The upper limit of offshore debt is the gap between the total investment and the registered capital.

Funding and subscribed capital when opening a company in the UK

When setting up a limited company in the UK only a de-minimis amount of capital needs to be subscribed for, and you can form a company with as little as £1 of share capital.

There is no limit to the number of shares you can issue and it is up to the company to issue either paid or unpaid shares, which means you don’t have to pay your shares in full at once (although tax and other commercial consequences can arise from this).

It’s important to understand the Articles because the share right details are usually contained therein.

See more from the series

Episode 7

Episode 6

Episode 5

Episode 4

Episode 3

Episode 2

Episode 1

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at uk.ireland@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article The 2022 CPC Congress: Impact On Foreign Trade & Investment

- Next Article China’s Cybersecurity Industry: A Market Analysis