Hong Kong Budget 2021-22: Blueprint for Economic Recovery

Financial Secretary Paul Chan unveiled Hong Kong’s 2021-22 budget last month, which included a series of ‘counter-cyclical measures’ aimed at reducing the burden of individuals and enterprises in the city.

The HK$120 billion budget introduces policies designed to speed up the market recovery process, bolster digitalization efforts, and strengthen Hong Kong’s competitiveness in the Greater Bay Area (GBA).

In light of these government measures, Financial Secretary Chan forecast 3.5 to 5.5 percent growth for Hong Kong in the upcoming year, with the upper-end estimates mirroring the IMF forecast for the global economy in January 2021.

This paints a hopeful future for Hong Kong in the coming months. But while the budget presents a blueprint for economic recovery, much of its implementation still needs to be worked out.

Ultimately, this hinges on the course of the pandemic, the vaccine rollout, and the management of various geopolitical factors. Currently, the HK government has earmarked over HK$8.4 billion for the procurement and administration of COVID-19 vaccines, with five groups of citizens prioritized for the first round of vaccines.

Reviving the economy

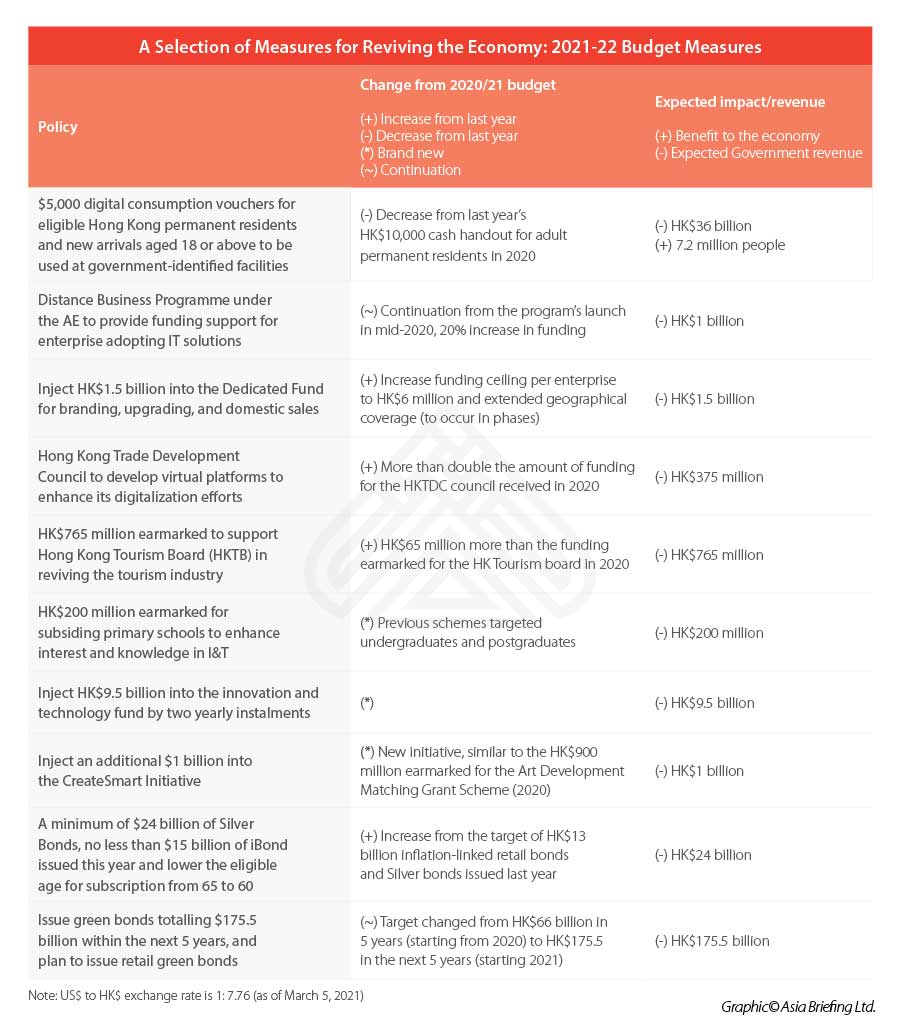

Stimulating the economy is the major theme of the budget, as the city enters its second year of recession and unemployment is at an all-time high. Though many of the economic measures are similar to those announced in 2020, there is a subtle shift away from immediate lump sum relief measures to more long-term strategies.

A much talked about relief measure, however, is the HK$5,000 digital consumption voucher. This will be released to HK permanent residents in multiple rounds to be used online at government-approved vendors. The consumption voucher is hoped to encourage immediate spending among consumers, trial new payment channels for spending, and induce direct benefits to the local economy.

Boost to pillar industries

Hong Kong’s traditional pillar industries – tourism, trade, finance, and technology – all received a boost in the 2021-22 budget.

Tourism, for example, which fell by 90.5 percent in 2020, will undergo a comprehensive review to assess the long-term strategies to spur the industry’s recovery. This includes the possibility of setting up air travel bubble arrangement where suitable, and the revival of local tour groups where public health can be safeguarded.

Meanwhile, technology, which is important pillar industry driving Hong Kong’s competitiveness and key bridge to integration in the GBA, also received a hefty focus. The government announced HK$9.5 billion to be injected into the innovation and technology fund by two yearly instalments, and HK$200 million has been earmarked for subsiding primary schools to enhance interest and knowledge in information and technology.

Enterprises and individuals have also had to adjust to social distancing rules – leading the ascent of new technologies and digital processes. For example, iAM Smart, which is a one-stop personalized digital service platform, launched at the end of last year, is now currently being expanded to enterprises. Once it takes effect, enterprises can authenticate through an electronic channel.

In addition, Hong Kong Trade Development Council (HKTDC), was awarded HK$375 million to develop its virtual platforms and digitalization efforts. HKTDC will continue to drive opportunities for small and medium sized Hong Kong enterprises, and will focus on developing healthcare products and services in the GBA and explore new ways to integrate physical and online businesses.

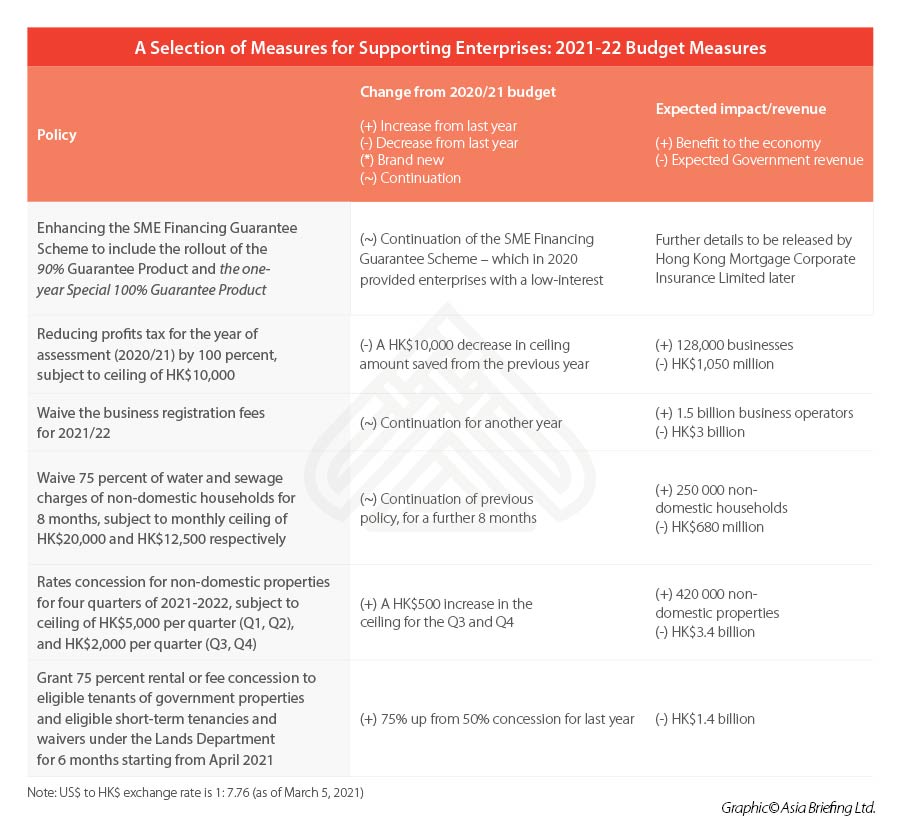

Support for businesses

The 2021 Budget announced measures allocating HK$9.5 billion to supporting businesses amid the economic downturn. Many measures, such as the business registration and utility fee waivers, are a continuation of measures announced in last year’s budget, with some slight adjustments.

Most notably, the SME Financing Guarantee Scheme has been expanded to include two new guarantee products to provide enterprises with better access to low-interest loans and interest subsidies.

This round of extension will be available until the end of 2021 and will serve to:

- increase the maximum loan per enterprise from the total amount of employee wages and rent from 12 months to that for 18 months;

- raise the loan ceiling from HK$5 million to HK$6 million;

- extend the maximum repayment period from five years to eight years; and

- extend the maximum duration of principal moratorium from 12 months to 18 months.

Further, the reduction of profit tax will be extended to the 2020-21 year of assessment, meaning that enterprises can be entitled to a 100 percent reduction subject to a ceiling of HK$10,000 (half of the eligible 2019-20 reduction amount).

However, in exchange, the government plans to raise the stamp duty on equity transactions by 30 percent to boost its revenue. This will mean, starting August 1, duty on stocks will rise from 0.1 percent to 0.13 percent.

Relief for individuals

The prolonged economic downturn has plunged some people into financial difficulties, with the latest figures showing the unemployment rate in Hong Kong peaking at seven percent.

Consequently, many Hongkongers have demanded temporary unemployment assistance.

The budget thereby allocates HK$6.6 billion to create around 30,000 time-limited jobs and announced the launch of the fourth tranche of the Love Upgrading Special Scheme, which will provide more training options and online course for trainees starting from July this year.

Further, the government has announced that it will set up a Special 100% Loan Guarantee for Individuals Scheme for unemployed persons, which will offer them a maximum loan of an amount six times their average monthly income during employment (subject to a ceiling of HK$80,000) with a fixed interest rate of one percent per annum up to five years.

Applicants will be offered a principal moratorium (no obligation payment period) of 12 months, once the amount has been paid in full, the interest rate will be refunded to the applicant in full. Importantly, freelancers will be able to benefit from this loan, if they provide proof of loss of income.

Reduction of salaries tax will also be extended another year for the personal assessment by 100 percent; however, the ceiling has been reduced from HK$20,000 to HK$10,000 for the 2020/21 financial year.

In addition, rates concession for domestic properties in 2021-22 have also been extended, subject to a ceiling of HK$1,500 per quarter in first two quarters and HK$1,000 per quarter in remaining two quarters.

Building back the economy and preparing for long-term recovery

The HK Budget offers a hopeful way forward for key industries, such as financial services, tourism, innovation, technology, and the digital economy. The HKSAR Government also strives to support individuals financially, overcome talent constraints, promote innovation and technology development, invest in education and nurture talent, and strengthen connection with the world.

The city has suffered multiple blows in the past two years – the economic fallout arising from the unrest in 2019-20, which was then superseded by the fallout from COVID-19 that surfaced in Hong Kong as early as January 23. The Budget thus showcases Hong Kong’s resilience in the face of adversity and provides a blueprint for how the city plans to rebuild itself from the ground up while looking at creating long-term growth.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article The China Firewall Test: Which Websites are Blocked, and Does it Matter?

- Next Article Norway and China Strive to Complete Free Trade Agreement Negotiations