Hong Kong Budget 2023-24: Speedy Recovery and the Path to Normalcy

On February 22, 2023, Hong Kong’s Financial Secretary Paul Chan announced the Hong Kong 2023-24 Budget that revealed his blueprint to boost the city’s recovery momentum in the post-COVID era.

This is the first budget of the current-term government and also the first presented since Hong Kong’s emergence from the COVID-19 pandemic and resumption of quarantine-free travel with the Chinese Mainland and the world.

Chan’s budget introduced multiple measures and schemes to encourage consumption, support enterprises, and attract investment. More than 80 percent of the government’s resources will be allocated to the development of small and medium sized enterprises (SMEs). On the other hand, the vouchers issuance and profits tax and salaries tax reduction will be on a smaller scale, as the city plans to dial down fiscal spending.

In this article, we discuss Hong Kong’s economic situation in 2023 and summarize key points for businesses from Budget 2023-24.

Hong Kong economic situation in 2022 and outlook for 2023

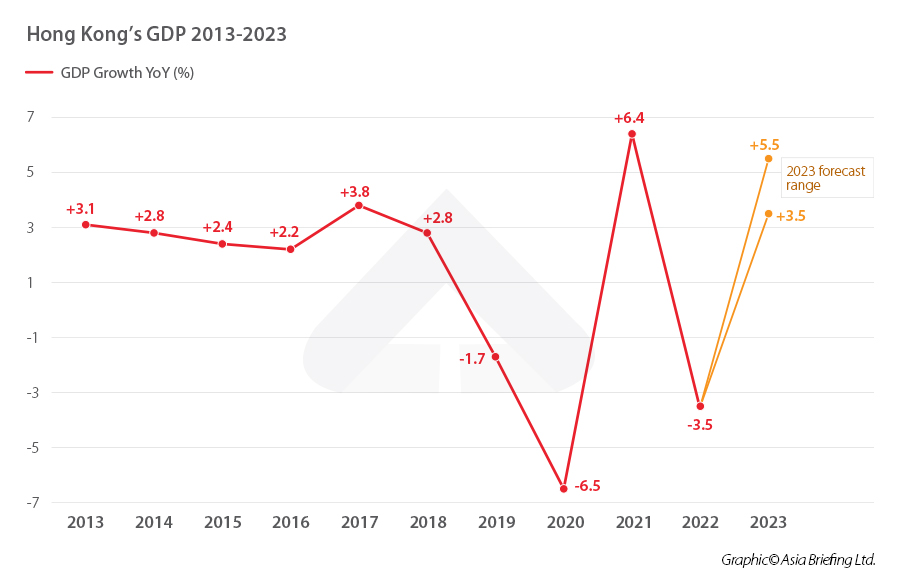

Hong Kong’s economy was faced with strong headwinds in 2022. The external environment deteriorated markedly with advanced economies dragged by surging energy and commodity prices and rampant global inflation. The Chinese mainland’s economic growth also slowed due to sluggish overseas demand and recurring COVID-19 outbreaks. Regionally, the fifth wave of the COVID in early 2022 and tightened financial conditions heavily dampened Hong Kong’s market consumption. With both external facing and domestic segments of the economy hit hard, Hong Kong’s overall GDP contracted by 3.5 percent in 2022.

Among others, Hong Kong’s total goods exports posted a notable decline of 13.9 percent in real terms in 2022. As for trade in services, Hong Kong’s total service exports declined by 0.9 percent, despite exports of travel services recording a surge with Hong Kong gradually relaxing its quarantine requirement for visitors. Moreover, the overall investment expenditure fell by 8.5 percent due to a subdued economic outlook and rising borrowing costs.

In 2023, the further weakening of growth momentum in advanced economies caused by tightening monetary policies and heightened geopolitical tensions will continue to challenge Hong Kong’s goods exports. But the accelerated growth of the Chinese mainland is expected to alleviate part of the pressure. Moreover, Hong Kong expects visitors and private consumption to rebound in tandem with improvements in overall economic sentiment, which will be conducive to fixed asset investment.

Taking these factors into account, it is forecast that Hong Kong’s economy will achieve growth of 3.5 to 5.5 percent in 2023. It is also forecast that Hong Kong’s economy will grow by an average of 3.7 percent per annum in real terms from 2024 to 2027, higher than the growth trend of 2.8 percent during the decade before the pandemic.

Tax measures proposed to support and attract individuals and enterprises

To relieve people’s hardship and ease operating pressures on businesses, the Hong Kong Budget 2023-24 proposes to continue to reduce profits tax, salaries tax, and tax under personal assessment for the year of assessment 2022-23, but with a lower cap as compared to last year’s Budget. Meanwhile, Budget 2023-24 proposes that profits tax and salaries tax rates should remain unchanged this year.

Besides, to address Hong Kong’s demographic challenges of low birth rate and aging workforce, Budget 2023-24 proposes to increase child allowance and increase tax deduction for voluntary contributions made by employers to the Mandatory Provident Fund (MPF) for employees aged 65 or above.

Moreover, some other tax related measures are proposed, such as providing tax deduction for spectrum utilization fees to encourage investment in telecommunication infrastructure; adjusting the value bands of ad valorem stamp duty at Scale 2 rates to ease burden on families of purchasing their first residential properties; and imposing special football betting duty to increase government revenue. The Budget 2023-24 also promises to provide clearer guidelines on whether onshore gains on disposal of equity interests are subject to tax.

Profits tax

The Financial Secretary has proposed a one-off reduction of profits tax for the year of assessment 2022-23 by 100 percent, subject to a ceiling of HK$6,000 per case, which is lower than the cap (HK$10,000) set for the previous Budget. This measure will benefit 134,000 businesses and reduce government revenue by HK$720 million.

| Effect of the Proposed One-off Profits Tax Reduction | |||

| Assessable profits | No. of businesses* | Average amount of tax reduction | Average % of tax reduced |

| HK$100,000 and below | 43,100 | HK$4,060 | 100% |

| HK$100,001 to HK$200,000 | 17,200 | HK$6,000 | 37% |

| HK$200,001 to HK$300,000 | 10,100 | HK$6,000 | 22% |

| HK$300,001 to HK$400,000 | 7,000 | HK$6,000 | 16% |

| HK$400,001 to HK$600,000 | 9,800 | HK$6,000 | 11% |

| HK$600,001 to HK$900,000 | 8,800 | HK$6,000 | 8% |

| Above HK$900,000 | 37,500 | HK$10,000 | 0.2% |

| Total | 133,500 | — | — |

| Source: Hong Kong’s 2023-24 Budget Plan

* Note: As of December 31, 2022, there were about 1.27 million corporations and 295,000 unincorporated businesses in Hong Kong. No. of Business here include 100,300 corporations and 33,200 unincorporated businesses.

|

|||

The Inland Revenue Department (IRD) of the HKSAR further supplemented the budget announcement with the following points of information:

- The tax reduction ceiling will be applied to each business.

- The proposed reduction will be reflected in the final tax payable for the year of assessment 2022-23, but not to the provisional tax of the same year. Therefore, taxpayers are still required to pay their provisional tax on time despite the proposed reduction measure.

- Before the enactment of the relevant legislation, relevant taxpayers should file their profits tax returns for the year of assessment 2022-23 as usual. Upon enactment of the relevant legislation, the IRD will calculate the reduction in the final assessment. For any final assessment for 2022-23 issued before the enactment of the law, the IRD will make a reassessment after the enactment. Taxpayers are not required to make any applications or enquiries to the IRD.

In addition to the above proposed reduction of profits tax, the 2023-24 Budget mentions that Hong Kong introduced legislative amendments into LegCo in December 2022 to provide profits tax exemption for qualifying transactions of family-owned investment holding vehicles managed by single family offices in Hong Kong. Upon LegCo’s passage of the proposal, the tax concession arrangements will be applicable to any years of assessment on or after April 1, 2022.

No changes are proposed to tax rates of the profits tax in the 2023-24 Budget. That is to say, the standard profits tax rates for the year of assessment 2022-23 will still be at 16.5 percent for corporations and 15 percent for incorporated businesses. And the two-tiered profits tax rates will still be as shown in the below table:

| Two-Tiered Profits Tax Rates in Hong Kong | ||

| Assessable profits | Corporations | Unincorporated businesses |

| First HK$2 million | 8.25% | 7.5% |

| Over HK$2 million | 16.5% | 15% |

Salaries tax and tax under personal assessment

To provide support for individuals who have been affected by the epidemic, the 2023-24 Budget proposes a one-off reduction of salaries tax and tax under personal assessment for the year of assessment 2022-23 by 100 percent, subject to a ceiling of HK$6,000, which is lower than the cap (HK$10,000) set in the previous Budget. This measure will benefit 1.9 million taxpayers and reduce government revenue by HK$8.5 billion.

| Effect of the Proposed One-off Reduction of Salaries Tax and Tax under Personal Assessment | |||

| Assessable income | No. of taxpayers | Average amount of tax reduction | Average % of tax reduced |

| HK$200,000 and below | 181,000 | HK$850 | 100% |

| HK$200,001 to HK$300,000 | 391,000 | HK$3,380 | 99% |

| HK$300,001 to HK$400,000 | 346,000 | HK$4,490 | 66% |

| HK$400,001 to HK$600,000 | 417,000 | HK$5,280 | 39% |

| HK$600,001 to HK$900,000 | 298,000 | HK$5,680 | 19% |

| Above HK$900,000 | 267,000 | HK$5,880 | 4% |

| Total | 1,900,000 | — | — |

| Source: Hong Kong’s 2023-24 Budget Plan

Note: As of December 31, 2022, Hong Kong had a working population of 3.67 million. |

|||

Similar to the proposed profits tax reduction measures, the IRD further supplemented that:

- For salaries tax, the ceiling is applied to each individual taxpayer. For married couples who are jointly assessed, the ceiling is applied to each married couple (that is, capped at HK$6,000 in total). For personal assessment, the ceiling is applied to each single taxpayer or married person who elects for personal assessment separately from his/her spouse. If a taxpayer elects for personal assessment jointly with his/her spouse, the tax reduction is capped at HK$6,000 for the married couple.

- The proposed tax reduction is not applicable to property tax. Individuals with rental income, if eligible for personal assessment, may be able to enjoy such reduction under personal assessment.

- A taxpayer who is separately chargeable to salaries tax and profits tax can enjoy tax reduction under each of the tax types.

- Taxpayers should file their profits tax returns and tax returns for individuals for the year of assessment 2022-23 as usual.

- The proposed tax reduction will only be applicable to the final tax for the year of assessment 2022-23 and the provisional tax for the year of assessment 2023-24, but not to the provisional tax of the same year. Therefore, taxpayers are still required to pay their provisional tax on time despite the proposed reduction measure.

Increasing child allowance and tax deduction for voluntary MPF contributions made by employer to aging employees

To encourage birth giving, the Budget 2023-24 proposes to increase the basic child allowance and the additional child allowance for each child born during the year of assessment from the current HK$120,000 to HK$130,000 starting from the year of assessment 2023-24. After the increase, the total allowance for a child born during the year of assessment will be $260,000, and the allowance for each subsequent year will be HK$130,000.

Moreover, to deal with a shrinking workforce, the Budget 2023-24 encourages employers to continue to hire mature employees by increasing the tax deduction for the MPF voluntary contributions made by employers for their employees aged 65 or above, from the current 100 percent to 200 percent in respect of such expenditure. At the time of writing, there was no further details regarding the progress of this proposal.

Tax issues regarding disposal of equity interests

The Budget 2023-24 mentions that the Hong Kong Government will put forward an enhancement proposal in mid-March 2023 to provide clearer guidelines on whether onshore gains on disposal of equity interests are subject to tax.

The initiative will not only facilitate business expansion and restructuring through disposal of equity interests, but also enhance tax transparency, lower the compliance cost of businesses, increase the competitiveness of Hong Kong’s tax regime, and enhance the attractiveness of Hong Kong as an international investment and business hub.

Other business support policies

Attracting foreign companies to re-domicile in Hong Kong

Hong Kong is renowned for being a highly competitive destination for multinational enterprises (MNEs) and headquarters. To expand market opportunities and attract foreign companies, the government plans to introduce a facilitation mechanism aimed at encouraging companies with a focus on the Asia-Pacific region to re-domicile in Hong Kong.

This initiative is intended to allow these companies to capitalize on the favorable business environment and professional services that Hong Kong has to offer. The government will hold consultations and submit legislative proposals in 2023-24 to support this measure.

In addition, the government will allocate HK$100 million to InvestHK over the next three years for attracting more family offices to Hong Kong.

Giving Hong Kong Investment Corporation Limited a more active role

During the 2022 Policy Address, the Chief Executive proposed the creation of the Hong Kong Investment Corporation Limited (HKIC). The HKIC will use fiscal reserves to promote economic and industrial growth, attracting investment and companies, while also promoting cooperation between Hong Kong and sister cities in the GBA.

The HKIC is already operational and is currently identifying high-quality partners for strategic investments that can be made in a timely manner. A board of new directors was just announced on February 15, 2023.

Supporting SMEs and Start-ups

The Budget 2023-24 proposes to extend the application period of all guarantee products under SME Financing Guarantee Scheme (SFGS) from end-June 2023 to end-March 2024, to give SMEs more room to adjust and secure a firm footing.

Under the SFGS, individuals or organizations seeking loans, including existing borrowers submitting top-up applications, must contact the lenders directly to apply for a loan or credit facility. The lenders will utilize their professional expertise, judgment, and diligence to evaluate each application and verify the eligibility of each loan applicant before submitting the guarantee applications and supporting documents to the HKMCI for assessment and approval.

Interested individuals and businesses can access the full list of lenders here.

In addition to this, the Hong Kong Trade Development Council (HKTDC) will continue to offer assistance through various initiatives, including:

- The Transformation Sandbox (T-box), a program designed to provide Hong Kong-based SMEs with support in areas such as branding, e-commerce, manufacturing and supply chain solutions, and new markets.

- The Guangdong-Hong Kong-Macao Greater Bay Area (GoGBA), a one-stop platform, which helps investors navigate business opportunities between the SAR and the GBA.

- Start-up Express, the HKTDC’s start-up development program, which targets tech-oriented start-ups, as well as those willing to expand in international markets.

Finally, the Hong Kong Science and Technology Parks Corporation (HKSTPC) plans to:

- Add HK$400 million to its Corporate Venture Fund; and

- Merge its current Acceleration Program with an additional investment of HK$110 million to create the Co-acceleration Program, in order to help high-potential technology start-ups grow into regional or global businesses.

Improving IP protection

To align with Hong Kong’s innovation and technology (I&T) development, the government will continue to invest resources in promoting and developing the “original grant patent” system.

To achieve this, the Intellectual Property Department will receive an additional funding of HK$10 million in the next two years to recruit and train patent examiners, build a talent pool, and achieve institutional autonomy in conducting substantive patent examination by 2030.

Moreover, Budget 2023-24 mentions that Hong Kong will introduce a “patent box” tax incentive to provide tax concessions for profits sourced in Hong Kong from qualifying patents generated through R&D activities. The legislative amendments are expected to be subjected to the LegCo in the first half of 2024

Issuing consumption vouchers

To boost the market sentiment, stimulate local consumption, and speed up economic recovery, the 2023-24 Budget proposes a new round of consumption voucher scheme, under which eligible Hong Kong permanent residents and new arrivals who are 18 years old or above will receive a total of HK$5,000 in two separate installments.

To expedite the disbursement of the consumption vouchers, the government will first distribute vouchers valued at HK$3,000 in April of this year using registration data from last year’s program. The remaining vouchers will be distributed together with the vouchers for new eligible persons in the middle of the year.

This is half the amount issued in 2022 (HK$10,000) as Hong Kong is no longer shackled by stringent COVID measures and the Financial Secretary attempts to dial down fiscal spending of the city.

Boosting trade

Hong Kong will continue to capitalize on its position as a major regional trading port to drive its economy in the coming years. To expand its trading industry, the Budget 2023-24 offers several strategies for developing trade with overseas markets, in particular emerging markets.

One such strategy is to further expand its network of free trade agreements (FTAs) and investment agreements (IAs) to encompass more emerging markets. In his speech, the financial secretary also said that Hong Kong will actively work to join the Regional Comprehensive Economic Partnership (RCEP), a trade pact of 15 Asia-Pacific countries, including the 10 ASEAN member countries.

The budget also pledged the following to help boost trade in 2023 and 2024:

- Providing an additional funding of HK$550 million to the Hong Kong Trade Development Council to assist enterprises in opening up markets;

- Injecting HK$500 million into the Dedicated Fund on Branding, Upgrading and Domestic Sales (BUD Fund) and expediting the application process; and

- Allocating HK$100 million to the Hong Kong Productivity Council to strengthen assistance for SMEs in applying for government subsidies.

Pooling talents

The Hong Kong government has already implemented several policies aimed at attracting and retaining talented individuals. One such initiative is the Top Talent Pass Scheme (TTPS), which aims to recruit exceptional individuals from around the world to live and work in Hong Kong. Additionally, the government has established the Hong Kong Talent Engage program, which aims to attract and retain top talent by creating a supportive environment and providing a range of resources to facilitate their growth and development in the city.

To meet the demands of the SAR’s growing economy, the Labour and Welfare Bureau (LWB) will conduct a new round of manpower projections in the middle of 2023. These projections will help the government identify areas where there may be labor shortages or surpluses, allowing them to formulate appropriate strategies to address overall manpower demand.

In addition to these initiatives, the government plans to introduce a new Capital Investment Entrant Scheme. This scheme will allow applicants to make a certain level of investment in the local asset market, excluding property, and upon approval, they will be granted the right to reside and pursue development in Hong Kong. The scheme is aimed at attracting high-net-worth individuals and encouraging them to invest in Hong Kong’s economy, further promoting the city as a hub for business and investment.

The government has also taken decisive action to promote skills development and employment opportunities for talents in various fields, including:

- Fintech internship scheme for post-secondary students: A scheme to provide subsidies to students in Hong Kong and the GBA who participate in Fintech internships in the region. This initiative is aimed at helping students gain practical work experience in Fintech companies and enhance their employability in this growing sector.

- Pilot Program to Enhance Talent Training for the Insurance Sector and Asset and Wealth Management Sector: The program provides training opportunities for insurance and asset management professionals and aims to attract more talent to these sectors. The government is now extending it for three more years, with the goal to nurture the talent and competency in the sector.

- Maritime and Aviation Training Fund (MATF): The government is injecting HK$200 million into the MATF to support manpower training of the logistics industry, promote the development of high-end, high value-added and smart logistics, and encourage collaboration between the industry and tertiary institutions and professional organizations, attracting more young professionals in the business.

- GBA Youth Aviation Industry Internship Program: The government is increasing the first-year training places of this program from 300 to 450.

- First-hire-then-train subsidy scheme: The government is earmarking US$7 million to partner with the Hong Kong Institute of Construction to launch a two-year subsidy scheme to provide on-the-job training allowance to trainees who have chosen to enroll in Construction Safety Officer courses. This initiative seeks to promote the development of professional skills in the construction industry and provide employment opportunities for trainees.

New international tax standards

In 2021, Hong Kong, together with more than 130 jurisdictions across the globe, pledged to implement the international tax reform proposals drawn up by the Organization for Economic Cooperation and Development (OECD) to address base erosion and profit shifting (abbreviated as BEPS 2.0). In the Budget Plan speech, the Financial Secretary said that the Hong Kong will implement the global minimum effective tax rate in accordance with international consensus so as to safeguard the Hong Kong’s taxing rights and maintain the competitiveness of the city’s tax regime.

As to the new tax rules for the adoption of the BEPS 2.0, the Financial Secretary mentioned that Hong Kong plans to apply the global minimum effective tax rate on these large MNE groups and implement the domestic minimum top-up tax starting from 2025 onwards. He also promised that Hong Kong will launch a consultation exercise to allow MNE groups to make early preparation.

Developing key and emerging industries

Technology and digital industries

Two areas of focus in the Budget 2023-24 are the digital economy and infrastructure. In his speech, Chan stated that the digital economy “plays a crucial role in the course of achieving high-quality development”, and the government is thus launching projects and funds to explore and develop key digital industries.

The government has also announced specific projects and allocated funds for the digital economy in 2023 and 2024, such as earmarking HK$500 million to launch a Digital Transformation Support Pilot Programme to assist small and medium-sized enterprises (SMEs) in applying ready-to-use basic digital solutions.

In addition, to capitalize on the “huge potential” of Web3 (the third-generation internet), the government will allocate HK$50 million to expedite development of the Web3 ecosystem through measures, such as organizing major international seminars, promoting cross-sectoral business cooperation, and arranging workshops for young people.

In his speech, Chan also stressed the importance of building Hong Kong’s capabilities as an international innovation and technology center, drawing upon its strategic position in the Greater Bay Area (GBA) as well as strengths in academia, research, industry, and talent.

Moreover, the Budget 2023-24 pledges to establish a Microelectronics Research and Development Institute to enhance collaboration among universities, R&D centers, and industry players, and conduct a feasibility study on setting up a second Advanced Manufacturing Centre (AMC), the first of which was unveiled in April 2022.

Green economy and technology

The Budget 2023-24 sets out ways in which Hong Kong can capitalize on China’s “dual carbon” goals (reaching peak carbon emissions by 2030 and carbon neutrality by 2060), by turning the city into “an international center for green technology and finance”. The budget does not outline specific policy measures to achieve this but does propose to build a green technology ecosystem to attract enterprises or start-ups to set up their operations and facilitate green projects to obtain capital more conveniently and flexibly through financial innovations apart from traditional financing channels.

Financial industry

The Budget 2023-24 outlines a number of ways to capitalize on Hong Kong’s position as a regional financial hub and leading offshore RMB hub to attract investment and develop core industries. These range from expanding the issuance of bonds to develop green infrastructure, allocating more funds to attract investment, and expanding mutual market access with the mainland.

Specific plans and funds include:

- Allocating at least HK$50 billion in Silver Bonds (three-year bonds with interest payments linked to average annual inflation rate) and HK$15 billion in retail green bonds in the next financial year;

- Providing HK$100 million to InvestHK to attract more family offices to Hong Kong;

- Earmarking a certain proportion of the future issuances of government green bonds and infrastructure bonds for priority investment by Mandatory Provident Fund (MPF) funds;

- Extending the Pilot Insurance-linked Securities Grant Scheme for two more years; and

- Introducing a listing regime for advanced technology companies in the first quarter of 2023.

The Hong Kong Stock Exchange (HKEX) has also pledged to provide specific reform recommendations by the end of the year for the Growth Enterprise Market (GEM), a board that caters to SMEs, which will consider the financing needs of SMEs.

Tourism industry

The lifting of COVID-19 restrictions in Hong Kong and mainland China will see the return of international tourists to the city. Tourism remains an important industry for Hong Kong’s economy, and the Budget 2023-24 reflects the importance of the sector by setting out policies to help it recover and rebound in the next two years.

The government will:

- Extend the Travel Agents Incentive Scheme by three months, which was due to expire by end‑March 2023; and

- Inject HK$30 million into the Information Technology Development Matching Fund Scheme for Travel Agents, with the aim of encouraging the industry to undergo upgrade and transformation by making use of technology.

In addition, Budget 2023-24 proposes to offer support for key subsectors within the tourism sector, such as passenger transport. This includes launching a new scheme to offer fully guaranteed loans worth a total of around HK$2.7 billion for passenger transport operators and travel agencies. This scheme is expected to be launched in April of this year.

Creative industries

Following the success of the CreateSmart Initiative (CSI), an initiative first launched in 2009 to sponsor the creative sector, the Budget 2023-24 pledges to allocate an additional HK$500 million to boost the sector.

In addition, the government will allocate more than HK$150 million to support Hong Kong artists in taking part in performances and productions in the GBA, and to organize the GBA Culture and Arts Festival in 2024.

What next?

The proposed actions outlined in the Budget 2023-24 cannot be put into effect until the necessary legislative processes are completed, typically in April. The Budget’s proposed expenses, which are consolidated in the Estimates of Expenditure, will undergo a thorough examination by the Finance Committee of the Legislative Council after being referred by the LegCo President, and finally be approved after a third round of revisions.

Hence, it is advisable that interested individuals and businesses follow up closely developments in the coming months.

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Is China’s ‘Tech Crackdown’ Over? Our 2023 Regulatory Outlook for the Sector

- Next Article New Rules to Facilitate Overseas IPOs for Chinese Companies