2021 Data Shows Hong Kong Stands Firm as Vibrant Business and Financial Hub

Despite recent challenges, Hong Kong’s economic performance in 2021 has shown cause for optimism. The city’s economy is on track for recovery alongside a stabilized social environment and receding local epidemic breakouts.

Many new start-ups have been established in Hong Kong in 2021 – spanning industries like financial technology, e-commerce, supply chain management, logistics technology, and professional services. And many international financial institutions, including insurance companies, banks, and wealth management companies, have opted to expand their business in Hong Kong.

In this article, we walk you through Hong Kong’s latest economic and foreign direct investment data, and analyze the emerging investment opportunities in the region.

Hong Kong’s economic performance in 2021

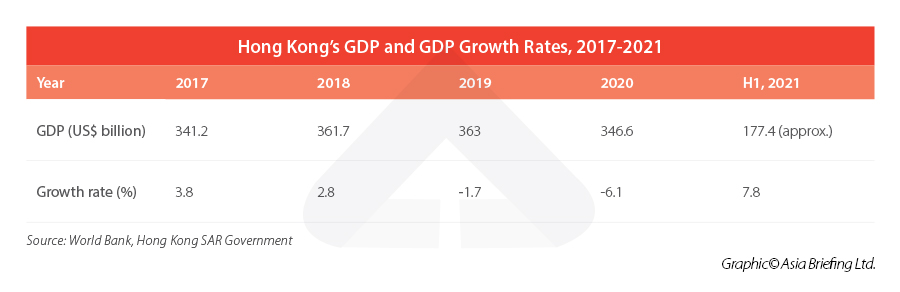

Hong Kong’s economy continued to recover in Q2 2021 (see PDF), with real GDP growing notably by 7.6 percent over 2020, slowing slightly from an upwardly revised 8.0 percent jump in Q1.

This makes Hong Kong’s overall GDP growth in the first half of 2021 a record 7.8 percent, and the GDP growth forecast for the year 2021 is expected to be around 5.5 to 6.5 percent.

The city’s unemployment rate retreated from the peak of 7.2 percent to 4.7 percent (June to August 2021). Retail sales grew by 7.4 percent year-on-year (January to July 2021). The property market has become active again, although tourism is still in the doldrums.

Despite the social and economic challenges of the past two years, businesses are still setting up or remain invested in Hong Kong. According to the latest survey of the local government, the number of business operations in Hong Kong with parent companies overseas or mainland China rose by 10 percent from 8225 in 2017 to 9049 in 2021.

The number of start-ups in Hong Kong soared by 68.5 percent from 2017 to reach 3755 in 2021. The start-up entities are spread across multiple industries, especially in the financial technology, e-commerce, supply chain management, logistics technology, as well as professional and consultancy industries.

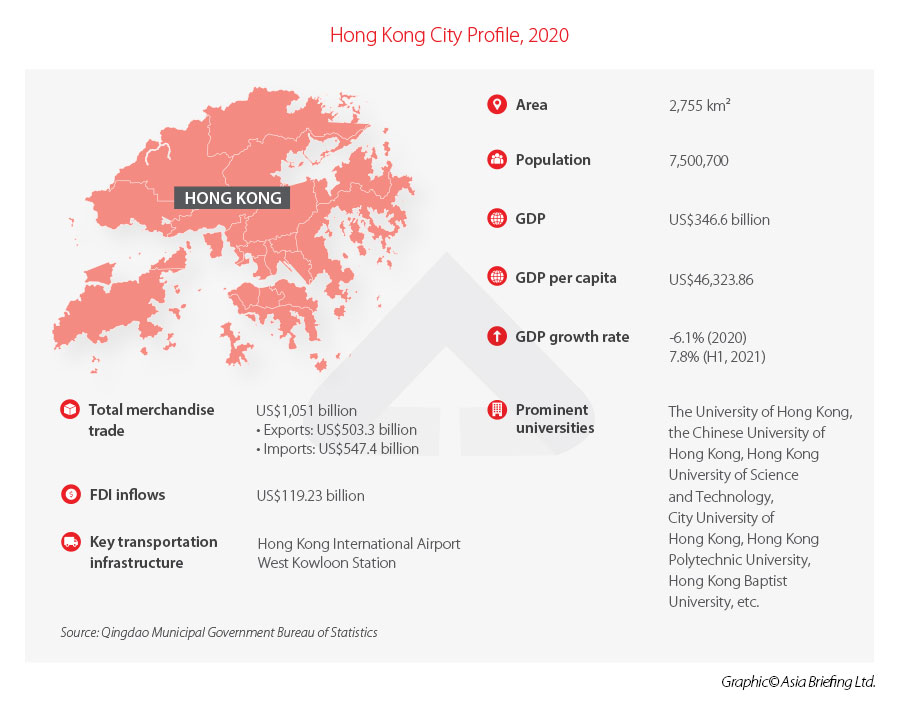

While Hong Kong’s total merchandize trade decreased in 2019 and 2020 – total merchandize trade decreased 2.5 percent to US$1,051 billion in 2020 after dropping 5.4 percent in 2019 – the figure has picked up in 2021. For the first nine months of 2021, the value of total exports of goods from Hong Kong increased by 27.3 percent over the same period in 2020, year-on-year, while the value of imports of goods rose by 26.5 percent.

Foreign direct investment in Hong Kong

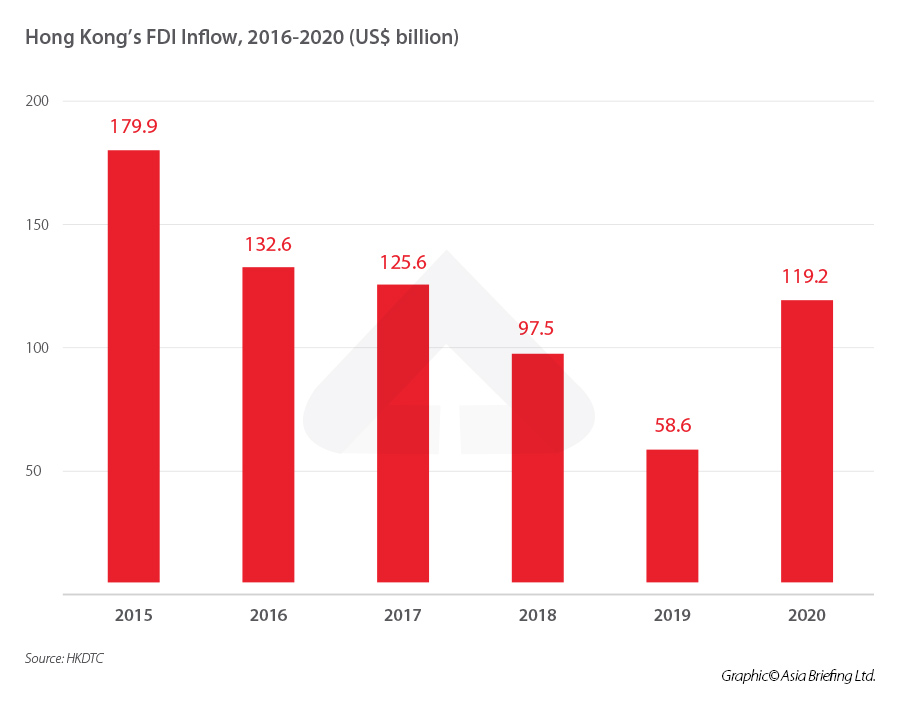

Although foreign direct investment (FDI) inflows to Hong Kong were suppressed in 2019 due to social protests, in 2020, Hong Kong’s FDI inflows rebounded sharply by 61.7 percent to US$119.2 billion, according to the World Investment Report 2021 (see PDF) published by the United Nations Conference on Trade and Development (UNCTAD) this June.

It makes Hong Kong the third hottest economy in the world by FDI inflows in 2020, up from ranking seventh in 2019. In Asia, Hong Kong overtook Singapore to become the second-largest recipient of FDI, only after the Chinese Mainland.

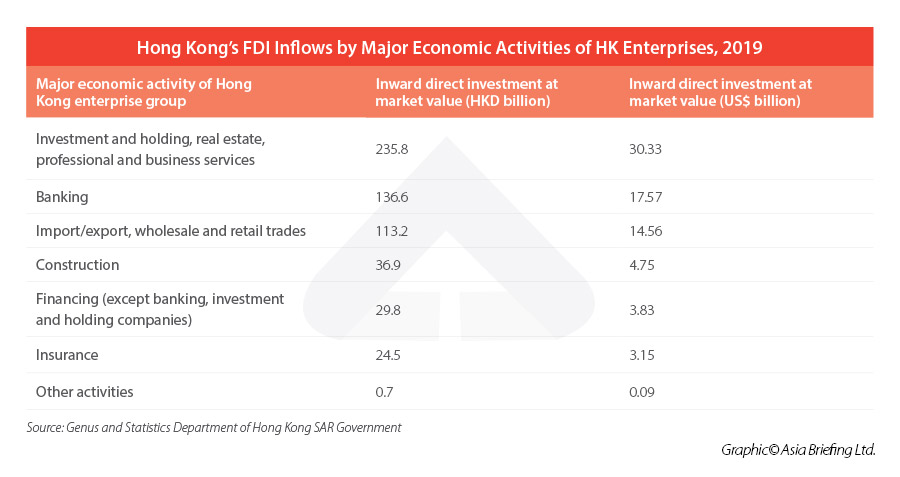

Hong Kong’s 2020 FDI surge was mainly driven by an increase in intracompany loans and reinvested earnings – dominant components of FDI for the economy. UNCTAD’s report said the surge mainly reflects corporate restructuring, particularly by Chinese multinational enterprises (MNEs), more than new investment. The rebound in cross-border M&A sales also contributed to this rise, due to many instances of Chinese MNEs consolidating affiliates in Hong Kong.

However, corporate reconfigurations and transactions by MNEs headquartered in Hong Kong have largely contributed to the growth of FDI inflows in Asia. FDI inflows to Asia grew by four percent to US$535 billion in 2020. But excluding Hong Kong, FDI to Asia was down by six percent in 2020.

The UNCTAD has commented, “Hong Kong will remain an important financial hub in Asia and a gateway to investing in China, because of its favorable tax regime, easy listing process, absence of capital controls and good regulatory framework,” even though in the short-term, the stabilization of FDI will rest on “the resolution of conflicts arising from the implementation of the National Security Law (NSL), and the normalization of tensions between China and the United States.”

Exploring investment opportunities in Hong Kong

Financial service industry

Hong Kong has remained a vibrant financial center with its financial market performing noticeably well over the last two years.

According to government data, in the 12-month period ending June 2021:

- funds raised through initial public offerings (IPOs) in Hong Kong jumped by more than 50 percent;

- the turnover of the Hong Kong stock market soared by nearly 70 percent;

- the assets under management (AUM) of the asset and wealth management business increased by 20 percent; and

- the amount of international bond issuance in the bond market ranked the first in Asia.

The city’s role as Asia’s top financial hub is expected to be further enhanced with the implementation of the Bond Connect, Stock Connect, and Cross-Border Wealth Management Connect programs, as well as the robust economic development of the Guangdong-Hong Kong-Macao Greater Bay Area (GBA).

Under the cross-border mutual access mechanism, currently, around 60 percent of international investors are trading Mainland China bonds through the Bond Connect; around two-thirds of international investors are trading Mainland China stocks through the Stock Connect.

In the Bond Connect program, it is reported that 2,733 global institutional investors have been approved to use the Northbound Bond Connect to access China’s US$17.5 trillion bond market. The Southbound Bond Connect also took off from September 24, 2021 and is expected to further expand Hong Kong’s bond market with funds from the vast GBA.

The Cross-Border Wealth Management Connect just kicked off in October 2021 with reportedly over 20 banks in Hong Kong having applied for selling 100 investment funds to mainland investors.

Hong Kong is already the second-largest IPO fundraising market, the largest offshore RMB clearing center, and the fifth largest in terms of market capitalization in the world, as well as the third-largest stock market in Asia in 2020. With closer financial links with the GBA, Hong Kong’s status as the world’s leading financial hub is expected to stay the course, and this in turn brings huge opportunities for Chinese and Hong Kong banking, securities, wealth management, and insurance industries.

International legal and dispute resolution services

Hong Kong is home to some 850 local solicitor firms and more than 70 global law firms. Legal advisors based in Hong Kong are familiar with the legal and regulatory landscape of different countries around the world. Benefiting from a sound and independent legal system, Hong Kong has long been a regional hub for dispute resolution, with the Hong Kong International Arbitration Center rated the most preferred seat of arbitration outside Europe.

Recently, China has rolled out policies to enhance Hong Kong’s position as the center for international legal and dispute resolution services in the Asia-Pacific Region. China’s pilot measures permit qualified Hong Kong and Macao legal practitioners to obtain the qualification to practice Mainland laws in the nine Chinese mainland cities in the GBA. Hong Kong-, Macao-, Taiwan- and foreign-invested enterprises registered in specific areas of the Mainland (like Qianhai) are allowed to choose Hong Kong laws or use Hong Kong as the seat of arbitration to resolve disputes. This is expected to boost cross-border legal services (see PDF) and encourage more enterprises to use the laws of Hong Kong and its dispute resolution services.

In addition, the Department of Justice (DOJ) of Hong Kong and the Supreme People’s Court of Mainland China have signed a number of mutual legal assistance arrangements on reciprocal recognition and enforcement of judgments, interim measures in arbitral proceedings, etc. These arrangements have made Hong Kong the only jurisdiction outside the Mainland where mutual recognition of and assistance in insolvency proceedings are allowed, and the only seat of arbitration outside the Mainland where parties are able to apply to Mainland courts for interim measures.

International trade, aviation, and transportation industries

As China implements the Dual Circulation Strategy (DST), Hong Kong’s role as a bridge connecting the Mainland and the rest of world can be further enhanced. Under the GBA integration plan, Hong Kong is expected to play a key role in accelerating business cooperation and trade with Guangdong province, including via e-commerce. This will create huge opportunities for Hong Kong’s trade, aviation and transport industries.

In 2020, Hong Kong was the world’s sixth-largest trading entity in goods – eighth largest importer and sixth largest exporter. As the government’s latest business environment report said, “the city can leverage its status as a trade center to strengthen connections of the Mainland’s industrial chain with that of the world (especially Southeast Asia) through supply chain management.”

In terms of trade in services, as the upgrading of China’s economy generates new demands for professional services like finance, consulting, and accounting, and legal services, Hong Kong – with its pool of high-quality talents and services at international standards – stands very much to gain.

Meanwhile, the development of cross-border e-commerce and the construction of the GBA port cluster (consisting of ports in Hong Kong, Shenzhen, and Guangzhou Nansha) will continue benefiting Hong Kong’s aviation, maritime, and logistics industries.

Hong Kong is a highly free-market economy with strengths in many areas – level playing ground for international investors, a low and simple tax regime, world-class infrastructure, highly skilled and multinational talent pool, a fair society under the rules of law, etc., and will stand firm as a vibrant business, trade, and financial hub in China.

For more information on business opportunities in Hong Kong financial, trade, logistics, professional services, technology and innovation, and other sectors, you are welcome to contact us at China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Wie kann man einen Lieferanten dazu bringen, zu einer Null-Fehler-Denkweise zu wechseln und Maßnahmen zu ergreifen?

- Next Article Trading Opportunities Available Under the RCEP