Hong Kong’s Tax, Investment, and Trade Agreements with Countries in the Middle East

Hong Kong has signed several double tax avoidance and bilateral investment treaties with countries in the Middle East, helping to facilitate trade and investment and boost cooperation between the two regions. We provide an overview of the current HK investment treaties in place with countries in the Middle East and discuss how they help protect investments and facilitate business exchange.

Hong Kong is deepening trade and investment cooperation with countries in the Middle East, opening new opportunities for companies and investors in the region to gain a foothold in the vibrant city.

This cooperation is underpinned by a series of bilateral investment, trade, and tax treaties with countries in the region that guarantee fair taxation and protection of investments. In addition, several countries in the Middle East are members of the WTO, and trade and investment between the two regions are in some instances covered by multilateral treaties.

Below we provide an overview of the active bilateral and multilateral agreements between Hong Kong and Middle Eastern countries.

Hong Kong DTAs with Middle Eastern countries

Hong Kong has active double taxation agreements (DTAs) with four countries in the Middle East, namely, Kuwait, Qatar, Saudi Arabia, and the United Arab Emirates (UAE). It is also in the process of negotiating DTAs with Bahrain and Israel.

| DTAs with Countries in the Middle East | ||

| Country | Status | Effective Date |

| Kuwait | In force | July 2013 |

| Qatar | In force | December 2013 |

| Saudi Arabia | In force | September 2018 |

| United Arab Emirates | In force | December 2015 |

| Bahrain | Under negotiation | – |

| Israel | Under negotiation | – |

In all four of the DTAs, the taxes covered in Hong Kong are:

- Profits tax

- Salaries tax

- Property tax

Hong Kong implements a two-tiered profits tax system:

- For the first HK$2 million (US$254,833), the tax rate is 8.25 percent for corporations and 7.5 percent for unincorporated businesses

- For over HK$2 million, the tax rate is 16.5 percent for corporations and 15 percent for unincorporated businesses

However, for two or more connected entities, only one may elect the two-tiered profits tax rates. The rest of the entities shall still be taxed at 16.5 percent for corporations and 15 percent for incorporated businesses. Enterprises that already benefit from preferential tax regimes, such as the corporate treasury center regime, aircraft leasing regime, and others, are also excluded from the two-tiered profits tax regime.

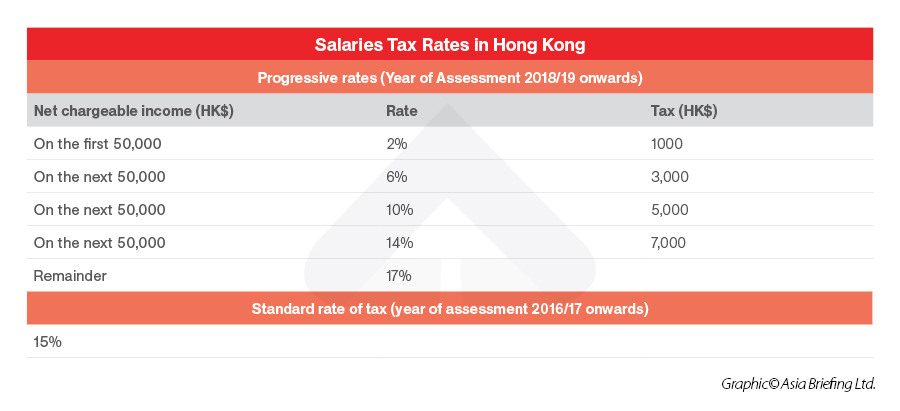

Hong Kong implements a progressive salaries tax rate on “net chargeable income” or a standard salaries tax rate on “net income”.

Net chargeable income = total income – deductions – allowances

Net income = total income – deductions

Hong Kong’s property tax rate is 15 percent of the net assessable value of income arising from the letting of immovable property in Hong Kong.

| Taxes Covered by Hong Kong’s DTAs | |

| Hong Kong |

|

| Kuwait |

|

| Qatar |

|

| Saudi Arabia |

|

| United Arab Emirates |

|

Residency is defined slightly differently in the various DTAs. In the Kuwait, Qatar, and UAE DTAs, a Hong Kong resident is defined as:

- Any individual who ordinarily resides in Hong Kong

- Any individual who stays in Hong Kong for more than 180 days during a year of assessment or for more than 300 days in two consecutive years of assessment, one of which is the relevant year of assessment

- A company incorporated in Hong Kong or, if incorporated outside of Hong Kong, that is normally managed or controlled in Hong Kong

- Any other person constituted under the laws of Hong Kong or, if constituted outside Hong Kong, that is normally managed or controlled in Hong Kong

- The Government of Hong Kong

In the Saudi DTA, the term “resident of a Contracting Party” is defined more broadly as “any person who, under the laws of that Contracting Party, is liable to tax therein by reason of his domicile, residence, place of incorporation, place of management or any other criterion of a similar nature”.

The definitions of “resident” in the four Middle Eastern countries are as below.

| Definitions of “Resident” in Hong Kong’s DTAs | |

| Kuwait |

|

| Qatar | Any individual who has a permanent home, his center of vital interests, or habitual abode in Qatar, and a company incorporated or has its place of effective management in Qatar. The term also includes the State of Qatar and any political subdivision, local authority, or statutory body thereof. |

| Saudi Arabia | Any person who, under the laws of that Contracting Party, is liable to tax therein by reason of his domicile, residence, place of incorporation, place of management, or any other criterion of a similar nature. |

| United Arab Emirates |

|

Hong Kong’s BITs with Middle Eastern countries

Hong Kong has currently signed bilateral investment treaties (BITs) with two countries in the Middle East: UAE and Kuwait.

Both BITs guarantee treatment to investors from the other party that is equal to that afforded to investors in their own country or region.

This treatment includes compensation for losses as a result of:

- War or other armed conflict, revolution, a state of national emergency, revolt, insurrection, or riot in the area of a given party’s jurisdiction

- Requisitioning of an investor’s property or destruction of an investor’s property by a contracting party’s forces or authorities that was not caused in combat action or was not required by the necessity of the situation

Under the BITs, investors are also guaranteed unrestricted rights to transfer their investments and returns abroad. These assets include:

- Payments from compensation for losses and expropriation

- Payments by one contracting party to an investor under an indemnity

- Payments arising out of the settlement of disputes

The scope of investments that are guaranteed the right to transfer abroad is broader in the UAE BIT, with the explicit addition of:

- Initial capital and additional amounts to maintain or increase an investment

- Returns

- Payments made under a contract, including repayments pursuant to a loan agreement

- Proceeds from the sale or liquidation of all or any part of an investment

- Earnings and other remuneration of personnel engaged from abroad in connection with an investment

- Profits and returns of airlines

All payments are also freely convertible under the BITs.

The BITs also outline dispute resolution mechanisms, which include submission of the dispute to a neutral international arbitration tribunal.

For more information on how investors can benefit from China’s BITs, see our article here.

WTO agreements

In addition to the bilateral agreements discussed above, several Middle Eastern countries are members of the WTO. This, by extension, means that Hong Kong and these countries are party to several multilateral trade and investment agreements, which provide additional protection for trade and investment between the regions.

Middle Eastern countries that are WTO members include:

- Bahrain

- Egypt

- Israel

- Jordan

- Kuwait

- Oman

- Qatar

- Saudi Arabia

- UAE

- Yemen

Multilateral treaties under the WTO include:

- The Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), which requires WTO members to extend intellectual property (IP) rights to the IP owners in any member state or region. It includes a most-favored-nation (MFN) clause, guaranteeing equal treatment for IP rights protection for all member countries and regions, and offers dispute resolution and compensation mechanisms.

- Agreement on Trade-Related Investment Measures (TRIMs), which prohibits members from implementing investment measures that have the effect of restricting trade with other members, such as local content requirements (requirements for a company to use locally-produced goods or local services in order to operate in the market).

- General Agreement on Trade in Services (GATS), which guarantees MFN status to service providers of any WTO member (except governmental services such as social security schemes, public health, education, and services related to air transport).

Hong Kong economic and trade office in Dubai

Hong Kong has recently taken steps to deepen trade and investment cooperation with the UAE by setting up its first economic and trade office (ETO) in Dubai in October 2021. The ETO will seek to promote trade and investment cooperation between Hong Kong and the Middle East, in particular the Gulf Cooperation Council (GCC) member countries (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and UAE).

According to the ETO, key sectors for cooperation include new and traditional energy, smart cities, transportation, logistics, fintech, biotech, and jewelry, among others. The ETO has also invited governments and companies in the GCC to “make use of the logistical, architectural, financial, legal, accounting, management, and other professional services available by Hong Kong enterprises to reap the social and economic benefits from this unique regional cooperation initiative”.

Dezan Shira & Associate’s Dubai Office opens in September 2022. We will assist investors throughout the Middle East in understanding and investing in markets in China, ASEAN, and India. For information on investment opportunities for Middle Eastern companies in Hong Kong and help with market entry, you can contact us at dubai@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China-United Arab Emirates (UAE): Bilateral Trade and Investment Outlook

- Next Article 10 Things Businesses Need to Know When Setting Up a Company in China and the UK: Episode 4