How Long Does it Take to Register a Company in China and the UK?

We discuss the timeline and key considerations of setting up a company in China and the UK.

This series concentrates on the UK-China business angle. Every week, we will add a new video that answers some of the most frequently asked questions about setting up a company in China and the UK. Each video answers the same issues from both the China and UK perspectives.

Key insights will be provided by, Maria Kotova, Head of UK and Ireland Business Development and China market entry director at Dezan Shira & Associates, and Lisa Gui, Assistant Manager at HW Fisher.

If you have any questions about doing business in China or the UK, reach us at UK.Ireland@dezshira.com.

Episode 10: How long does it take to register a company in China and the UK?

How long does it take to register a company in China?

Foreign investment into the People’s Republic of China (hereafter “China”) can be made via one of several types of investment vehicles. Choosing the appropriate investment structure for your business depends on a number of factors, including its planned activities, industry, and investment size.

Whilst there are different investment options and entities available, we will focus on a Wholly foreign-owned enterprise (WFOE).

A WFOE is a limited liability company wholly owned by one or more foreign investor(s), which offers a very straightforward management structure.

Unlike an RO, a WFOE can make profits and issue local invoices in RMB to its suppliers. A WFOE can employ local staff directly, without any obligations to employ the services of an employment agency. A WFOE can also expand to create subsidiaries in China.

And compared to a JV, a WFOE has better autonomy and flexibility to execute the company policies intended by the investors without considering the Chinese partner. It is also believed to be better at protecting the company’s intellectual property and technology.

However, the setup procedure of a WFOE is more complicated. And WFOE is not feasible if the targeted sector is listed as “restrictive” in the Special Administrative Measures on Access to Foreign Investment (“National Negative List”) or the Special Administrative Measures (Negative List) for Foreign Investment Access in Pilot Free Trade Zones (“FTZ Negative list”), where foreign investors need to have a Chinese equity partner to form the business. In other words, incorporating a WFOE to engage in these sectors would not be permitted. Investors that try to do so will see their application denied. WFOEs that engage in these activities illegally after being incorporated face fines or even the cancellation of their business license.

There are three distinct WFOE setups available:

- Service (or consulting) WFOE;

- Trading WFOE (or foreign-invested commercial enterprise [FICE]); and

- Manufacturing WFOE.

While all three structures share the same legal identity, they differ significantly in terms of their setup procedures, costs, and the range of commercial activities in which they are allowed to engage. Trading WFOEs and manufacturing WFOEs must derive the majority of their revenue from their namesake business, but can also provide associated services. Service WFOEs are additionally permitted to conduct trading activities related to their services.

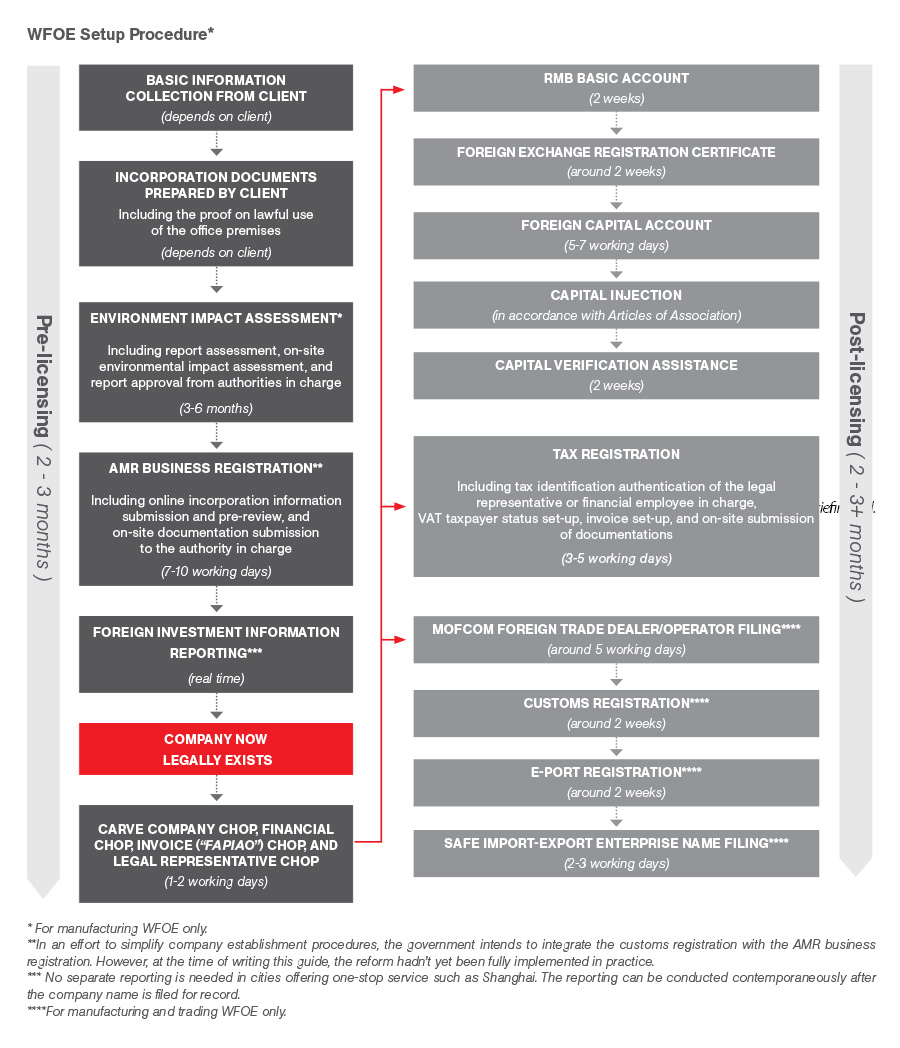

Timeline and setup procedure when establishing a foreign investment structure in China:

Establishing a foreign investment structure in China generally takes between three and six months and involves the following government authorities:

- Ministry of Commerce (MOFCOM) and its local branches;

- State Administration for Market Regulation (SAMR) and its local branches;

- State Administration of Foreign Exchange (SAFE) and its local branches;

- State Taxation Administration (STA) and its local branches;

- General Administration of Customs (GAC) and its local branches; and

- National Bureau of Statistics (NBS) and its local branches.

The establishment process varies based on one’s chosen investment structure and planned business scope. For example, manufacturing WFOEs require an environmental evaluation report to be completed, while trading WFOEs need to comply with the customs/commodity inspection requirements.

Below we take WFOE as an example to demonstrate the setup procedure:

How long does it take to register a company in the UK?

Once you have chosen the company’s name and have the relevant information ready, the timeline for setting up a UK Company is short, a company can be formed and registered within 24 to 48 hours once the application is made. However, opening a business bank account, registering a trademark, etc. can prolong the process. It is important to mention that once the company is registered, you will be able to operate your business whilst other components are not fully finalized.

Experts at HW Fisher mentioned, “it is important that you register for corporation tax within 3 months of starting to trade. Furthermore, you may need to register as an employer and pay payroll taxes if you employ UK-based staff, as well as considering your VAT position as highlighted above.”

See more from the series

Episode 9

Episode 8

Episode 7

Episode 6

Episode 5

Episode 4

Episode 3

Episode 2

Episode 1

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at uk.ireland@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China-Cuba: Bilateral Trade and Investment Prospects

- Next Article Maternity Leave and Payment: A Comparison of Relevant Rules in Mainland China and Hong Kong