How Should Companies Prepare for the Special VAT E-Fapiao?

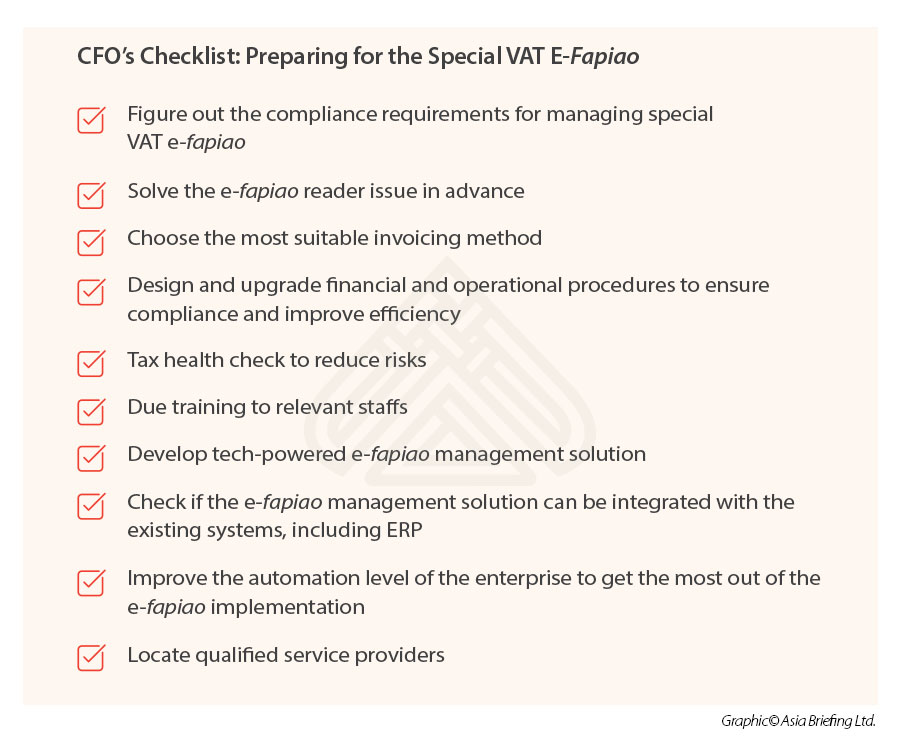

With the implementation of special VAT e-fapiao becoming more prevalent through 2021, it has been a top priority for CFOs and finance managers with responsibility for China operations to prepare for e-fapiao’s impacts on their existing procedures and systems as well as to comprehend the benefits rooted in the digitalization management of VAT invoice.

In this article, we offer some tips from a practical perspective.

Figuring out the compliance requirements

Before developing any new accounting and financial processes and building sophisticated automation solutions, the first thing the CFO should do to prepare for the special VAT e-fapiao implementation is to let the financial team have a good understanding of the relevant compliance requirements. This is the basis of everything.

As introduced in the previous articles, China has been developing relevant laws and regulations to facilitate the implementation of e-fapiao, which put forward specific requirements on the authenticity, non- repeatability, and archiving / retention of electronic invoices.

Failing to comply with such requirements may cause monetary penalties and worsening tax credits. What’s worse, the enterprise may not be able to deduct the corresponding expenses from taxable income when calculating corporate income tax, or not be able to offset the output VAT from the input VAT when calculating the VAT liability.

Companies are suggested to keep abreast of the regulatory updates by regularly checking the official website of the STA as well as professional analysis written by tax and financial experts. When necessary, companies are also suggested to arrange training sessions for financial staff to help them grasp the key compliance points.

Solving the software issue in advance: E-fapiao reader

The special VAT e-fapiao is in OFD format, which requires enterprises to install a special software developed by the STA to open and read. That is to say, without the special software, the enterprise will not be able to properly process special VAT e-fapiao.

This creates problems for many companies whose overseas headquarters implement strict IT restrictions on the Chinese subsidiaries for data security reasons.

For such companies, it may take months for their headquarters to evaluate the software before approving the installment. Although special VAT e-fapiao are not mandatory and companies can choose to receive e-fapiao or paper fapiao at the current stage, this might not be the case when special VAT e-fapiao is more aggressively promoted by the STA. Besides, it might be not easy for a company to refuse to receive e-fapiao if the company is not in an advantageous position in the supply chain.

If the company has no established solution before receiving large amounts of special VAT e-fapiao, the corresponding accounting, tax calculation and filing, and archiving process will unavoidably be delayed and affected.

Companies are suggested to deal with this issue as early as possible, to give the overseas headquarters enough time to evaluate the software and try to get approval for installment in time. This is the most straightforward solution.

Alternatively, companies can use third-party professional services firms to help them process the special VAT e-fapiao received. Such professional firms usually have complete and up-to-date e-fapiao solutions, which are more convenient to use for companies. However, as it also takes time for both parties to reach consensuses on the terms, such as price and service scope, companies are also suggested to start the process sooner than later.

Choose the most suitable invoicing method

As the special VAT e-fapiao is expected to be rolled out to all existing companies in the near future, another item on the CFO’s checklist should be choosing the most suitable invoicing method to issue special VAT e-fapiao. This will depend on the specific situation and demands of the enterprise.

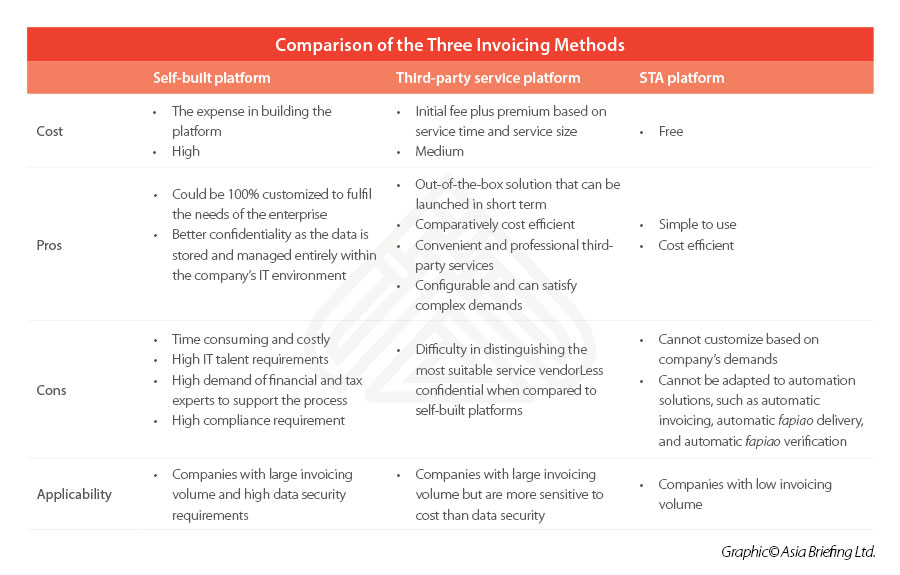

Currently, there are three main invoicing methods being discussed:

- Issuing special VAT e-fapiao through the STA e-fapiao service platform: Companies can apply a free USB“key” from the local tax bureau and use it to access the public e-fapiao service platform developed by the STA to obtain and issue special VAT e-fapiao. This method is simple to use and free of charge. But it’s not suitable to deal with a large volume of e-fapiao requests as it still involves quite a lot of manual work. Moreover, this STA platform is not open to customization and thus cannot satisfy the special demands of enterprises, such as automated e-fapiao processing and smart reporting.

- Issuing special VAT e-fapiao through third-party e-fapiao service platforms: Companies can issue special VAT e-fapiao through a third-party e-fapiao platform, which is usually an out-of-the-box solution and can be customized to a certain extent to fit a company’s special However, as the third-party platform must access certain transaction data in the invoicing process, and cloud technology is commonly adopted in this method for storage and delivery, some companies may have data security concerns and the service procurement may be subject to strict scrutiny of the overseas headquarters. Besides, there are around 100 third-party e-fapiao service platforms on the market and it’s a tough task for companies to distinguish the capable and most suitable ones. Companies are suggested to seek professional assistance in selecting platforms, to evaluate the capability and stability of services.

- Issuing special VAT e-fapiao through a self-built e-fapiao platform: Companies can also build their own e-fapiao platform for e-fapiao As the data is all retained locally in the self-built platform, this method is suitable for companies having a high data security requirement. Besides, as the self-built platform can be deeply customized to satisfy the special demands of the enterprises, such as batch processing, this method is suitable for those with large invoicing volumes. However, on the other hand, building one’s own platform requires highly capable IT developers and highly cooperative financial and tax experts to support the process. Besides the self-built e-fapiao platform must satisfy the requirements stipulated in the STA Specifications for the Standards of Self-built and Third-party Electronic Invoice Service Platforms, and a filing made to the local tax bureaus is required. The whole process could be time-consuming and costly. Companies are suggested to plan for the budget and the development as early as possible.

A comparison of the three methods is summarized in the following table. Companies are recommended to carefully understand their own demands and study the pros and cons of each method to make the best choice.

Design corresponding financial and operational procedures

As the laws and regulations impose new requirements on the authenticity, non-repeatability, and archiving of the e-fapiao, companies will need to redesign corresponding financial procedures to maintain compliance.

For example, companies can solely use the e-fapiao as the voucher for reimbursement, bookkeeping, and archiving, only if they can satisfy all the below conditions:

- The electronic accounting vouchers received are verified as lawful and

- The transmission and storage of electronic accounting documents are secure and reliable and any tampering with electronic accounting documents can be discovered in

- The expense and accounting system used is capable of the following: receiving and reading electronic accounting vouchers and their metadata in an accurate, complete, and effective manner; completing financial accounting business under the uniform accounting system of the state; and outputting electronic accounting vouchers and their metadata in the formats specified by the National Archives The accounting system must set up necessary audit and signing procedures, such as handling, review, and approval, so that it can effectively prevent the duplicated entry of electronic accounting vouchers.

- Archiving and management of electronic accounting vouchers meet the requirements set forth in the Administrative Measures on Accounting Archives (Decree 79 of the MOF and National Archives Administration).

But if a taxpayer cannot meet the above conditions, they can use printed copies of electronic accounting vouchers as the basis for reimbursement, bookkeeping, and archiving, however, the original electronic accounting voucher should be saved simultaneously.

Thus, companies have to develop due procedures to distinguish whether the e-fapiao they have received can satisfy the conditions of solely using e-fapiao for reimbursement, bookkeeping, and archiving, and then take the right actions in dealing with the reimbursement, bookkeeping, and archiving.

Besides, companies will also need to make relevant changes to their other operations with the e-fapiao rolling out and automation upgrade. For example, companies will have to upgrade their payment cycle as the “delivery upon issuing” of e-fapiao will make the process much faster.

Companies are suggested to carefully comb their financial and operational scenarios to check if any of them need to be redesigned to fit the e-fapiao implementation and integrate internal and external resources to standardize the upgraded processes.

Tax health check

As the real-time monitoring and the traceability of e-fapiao improve the tax bureau’s capability in discovering tax-related violations, companies are suggested to taking measures in advance to find and resolve any risky areas before being caught by the authority in charge.

This can include arranging a regular tax health check and improving the firm’s internal control system.

Internal control is important in ensuring the smooth application of e-fapiao and avoiding unnecessary risks. In practice, a company’s internal control system might be deficient either because of cost efficiency considerations or because the significance of the internal control system is underestimated by its management. Loopholes in the company’s internal control system could cause unnecessary lapses or losses to the business in terms of whether a company can efficiently manage the compliance risks associated with e-fapiao.

A regular tax health check, either conducted internally or by a professional third party, will help identify the weak points in the business’s daily operations and reduce the risk of triggering worse tax investigations from the tax bureau. Considering third-party service firms are usually more professional on relevant matters and more confidential when reviewing financial and operational documents, it is highly recommended if the company’s budget allows.

E-fapiao and automation

The added value of e-fapiao, including higher productivity, improved transparency and accuracy, human resource cost-saving, and better risk control, are deeply associated with the automation level of the relevant processes. To ensure compliance and get the most out of the e-fapiao implementation, companies are suggested to consider adopting technologies to facilitate their e-fapiao management, reimbursement management, accounting, tax, and supply chain management processes, step by step.

Tech powered e-fapiao management

The digital nature of e-fapiao enables it to be powered by automation technologies, which is essential in ensuring the accuracy, reliability, security, efficiency, and completeness of the e-fapiao management.

Regardless of being self-built or procured from an external source, an ideal tech-powered e-fapiao management should achieve the following functions:

- Automatically verify the validity of electronic accounting vouchers;

- Automatically read electronic accounting vouchers accurately, completely, and effectively;

- Reject duplicated entry of the electronic accounting voucher that has been submitted;

- Set up necessary audit and signing procedures, such as handling, review, and approval;

- Prevent electronic accounting records from being tampered with;

- Link electronic invoices with other vouchers and store the documents in a systematic way;

- Enable a backup system, which can effectively protect data against accidents, vandalism, and natural disasters; and

- Ensure that the local system or cloud storage solution can satisfy the long-term retention requirements of electronic accounting

Companies can use these as the starting points to plan their own solutions or to negotiate with third-party service providers for out-of-the-box solutions.

Digitalized expenses management

Expense management digitalization has been explored for a while under the trend of “shift to digital” and the implementation of e-fapiao makes the process even easier as the e-fapiao data is natively machine-readable.

In general, there are three approaches that companies can take:

- Approach 1: Develop something for themselves via tools, such as MS PowerApps, which can integrate into whichever tech-powered accounting software environment they are

- Approach 2: Utilize globally recognized expense management platforms. One particularly well-known platform is Concur, currently owned by

- Approach 3: Look to the local Chinese market, which has many companies delivering localized

There are pros and cons to each of these approaches. The first approach is probably only viable for quite large companies with a substantial presence in China. The main advantage of this approach would be to maintain all data within one integrated environment and to have 100 percent control over that environment. However, the cost is relatively high and development can be expected to take several months to complete.

The second approach has been chosen by quite a number of companies already, as part of their global digital expense management strategy. But these platforms are generally not optimized for the Chinese environment to an adequate degree and tend not to link with all the important third-party apps to facilitate seamless transfer of data during the overall process. They can also be very expensive in terms of a monthly per-employee subscription.

The third approach is the cheapest way forward. The cost of one license for some of these apps can be as little as RMB 300 /year (approx.US$40). Some of them are bilingual and they have a lot of flexibility in terms of their configuration. The main problem for foreign investors is how to identify the most appropriate providers and how to configure the apps in the most suitable manner.

Accounting and tax automation

Starting from the implementation of tech-powered e-fapiao management solutions, companies can explore the possibility of accounting and tax automation as both areas are highly rules-based.

Once an e-fapiao management system can be made compatible with the company’s existing ERP system, information about both income and expenses can be extracted from the ERP system and be automatically linked with relevant accounting vouchers (e-fapiao) processed by the e-fapiao management system, before attributing to pre-established accounting subjects. A general ledger record can be generated and archived automatically, which is one major component within accounting automation. Via this process, tax automation can also be achieved by automatically recognizing, calculating, entering, and reporting the input VAT and export VAT data obtained from the procurement and sale processes.

Locating a qualified service provider

In situations where the company does not have the budget or time to develop its own internal team to handle the myriad challenges imposed by the implementation of e-fapiao and at the same time doesn’t want to miss the automation trend to improve their business operations, one practical option is to cooperate with a third-party service provider.

A qualified service provider usually has rich knowledge and experience in both financial management and technology applications. They hold the following advantages:

- They can easily grasp the needs of the client company, and integrate the service demands with the appropriate technologies.

- They can customize the system to meet particular

- They can provide training to the company’s in-house finance and other departments to ensure the smooth implementation of the

- They are also responsible for the maintenance of the portal and are dedicated to timely system updates for the purpose of full compliance with laws and local

The last point is a value-added service, considering the potential frequent changes in the process of e-fapiao management before the structure reaches full maturity.

As to how to find a qualified third-party service provider, service providers that are able to deliver tech-powered e-fapiao solutions and other advanced automation services should, of course, be tech-enabled themselves and have an internal team of specialists available to deploy solutions for clients at short notice. Ideally, they should have a strong track record of having already delivered a wide range of services to companies at a similar stage of development to your own. They should not only be able to provide a solution, but also train your team on how to use it effectively. And critically, the service provider needs to demonstrate that the case manager for your account is able to work closely with your team and technology professionals on an ongoing basis so that improvements are continuous.

A version of this article was originally published in our June 2021 China Briefing Magazine, Preparing for the Coming E-Fapiao Era.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article GBA’s Shenzhen Qianhai Extends 15% CIT for Qualified Enterprises Until End of 2025

- Next Article A Close Reading of China’s Data Security Law, in Effect Sept. 1, 2021