IIT Subsidies in China’s Greater Bay Area: You Can File Your Applications Now

- Last year, South China’s Guangdong province released measures to grant subsidies to outstanding overseas talents working in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) in a bid to lure talent from Hong Kong and Macao.

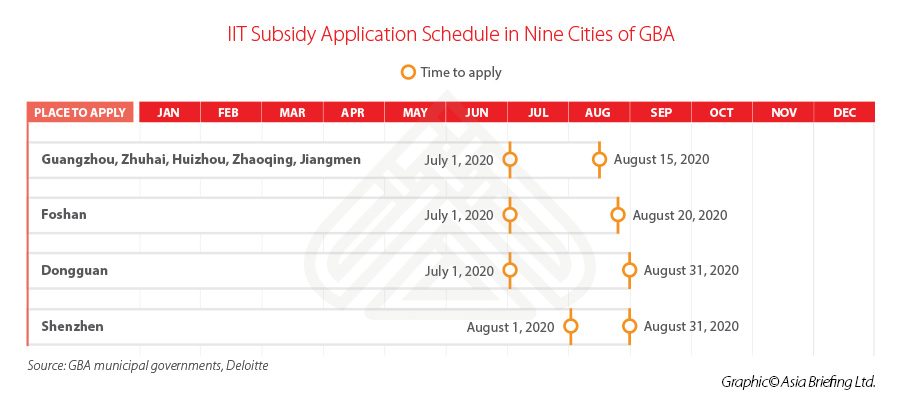

- Starting July 2020, qualified talents and their employers will be able to file applications in most of the nine target cities.

- Eligible overseas talents can receive financial subsidies equal to the portion of the individual income tax they paid in the nine cities last year that exceeds 15 percent of the taxable income.

China introduced the preferential policy on individual income tax (IIT) subsidy for overseas professionals and talents working in nine cities in Guangdong in 2019. The first round of IIT subsidy applications to access those subsidies has started this month.

So far, the cities of Guangzhou, Shenzhen, Zhuhai, Huizhou, Zhaoqing, Jiangmen, Dongguan, and Foshan have rolled out the Guidelines for Applying for Fiscal Subsidies on Individual Income Tax (High-end Foreign Talents) in the GBA. Qualified talents and/or their employers are supposed to file their applications in the following one or two months to secure the fiscal subsidies, which will be calculated based on the IIT paid in 2019.

Key background information

- In March 2019, China’s Ministry of Finance (MOF) and State Taxation Administration (STA) jointly released the Circular about the Preferential Individual Income Tax Policies in the Greater Bay Area (Cai Shui [2019] No.31). The “No.31 Circular” stipulated that during the five years from the start of 2019 to the end of 2023, eligible overseas talents working in nine cities of Guangdong province – Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen, and Zhaoqing – can be granted tax-free subsidies.

- Three months later, in June 2019, Guangdong province rolled out more detailed implementation rules – the Circular about the Implementation of individual Income Tax Preferential Policies in the Greater Bay Area (Yue Cai Shui [2019] No.2). The “No.2 Circular” regulates that eligible overseas talents working in the aforesaid nine cities can enjoy a preferential IIT rate of 15 percent. The portion of the IIT that exceeds 15 percent of the taxpayer’s taxable income will be returned by means of subsidies – once a year.

- In August 2019, Guangzhou city became the first of the nine cities to announce its relevant local measures – the Interim Measures for the Administration of Financial Subsidy for Personal Income Tax Preferential Policies in the Greater Bay Area. Since then, other cities have been following suit with similar but differentiated local measures, and establishing the calculation method of subsidy amount, conditions of eligible talents, and application procedures in the specific city.

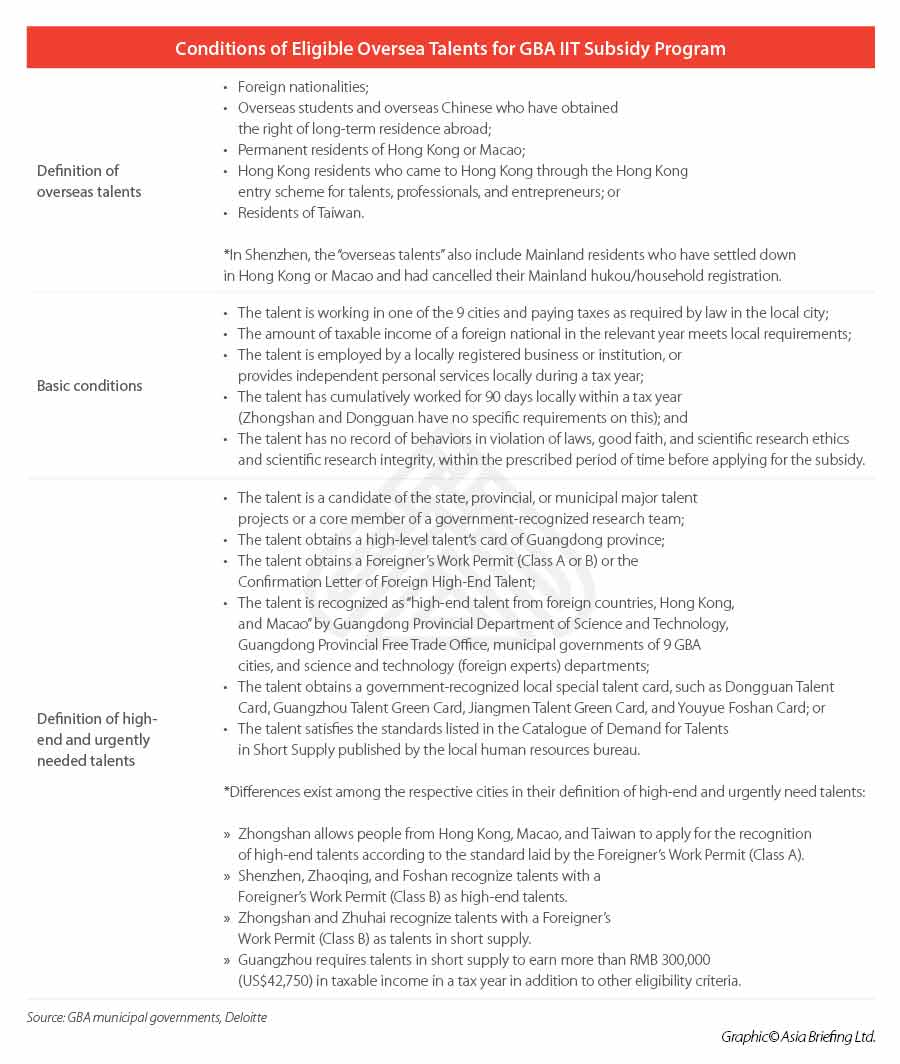

As each city formulates the implementation rules based on local conditions – the rules may vary slightly from city to city in aspect of the identification of ‘high-end’ talents and of talents in ‘short supply’ and the application procedure. Here, we summarize key information for your reference.

Calculation of subsidy amount

Generally, to calculate the amount of subsidy, the formula is: The subsidy amount = the amount of IIT paid in nine cities in 2019 – taxable income × 15% Specifically, under the IIT subsidy policy, the taxable income includes the following sub-items:

- Comprehensive income, including: – Income from wages and salaries; – Income from labor compensation; – Remuneration income; and – Income from royalties;

- Operating income; and

- Subsidized income from selected talent programs or talent projects.

The subsidies will be calculated based on the above taxable individual income sub-items separately and will then be distributed on a lump-sum basis next year. Thus, the calculation formula of subsidy amount can be extended as:

The subsidy amount =∑ [(the amount of IIT paid in sub-items in nine cities in 2019 – taxable income in sub-items × 15%)]

To clarify the IIT payment of overseas talents (including “HKMT residents”), you can refer to our guide on China’s IIT rules to understand rules on foreign workers’ tax residency in China and the IIT calculation methods, or refer to the government’s original documents – the Announcement on the Criteria for Determining the Residence Time of Individuals without Domicile in China (MOF STA Announcement [2019] No.34) and the Announcement on Individual Income Tax Policies for Non-resident Individuals and Non-domiciled Resident Individuals (MOF STA Announcement [2019] No.35).

Scope of eligible overseas talents

To apply for the subsidies, eligible talents must fall under the following scope:

Who can apply?

Individuals or the employer of the talents can both file the application to relevant government departments. Where the IIT of the overseas talent is withheld and paid by a withholding agent, the withholding agent can apply for subsidies on behalf of the overseas talent. If the individual income tax is declared by the taxpayer himself or herself, the application can be filed by the taxpayer.

In Shenzhen, the subsidy application can be submitted by individuals after being examined and approved by the enterprises where the individual works for. Application from individuals providing independent personal services will not need to be approved by the employer.

Remittance of the subsidies

The subsidies will be directly allocated to the domestic personal bank account designated by the eligible talent. To ensure timely access to the subsidies, it is recommended that enterprises and eligible individuals make appropriate preparations and file applications as soon as possible according to the implementation measures and actual conditions issued by their cities. Employers can evaluate the feasibility of applying for the subsidy for their employees and start planning their staff assignment in the GBA cities for the future.

You are welcome to contact our GBA-based professionals for assistance in foreigners’ IIT calculation, subsidy application, and derive practical solutions on human resource arrangement in GBA. Please email us at China@dezshira.com.

About Us China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Planning for Uncertainty: Global Staffing Solutions to Facilitate Your China Market Entry

- Next Article How to Close a Representative Office in China: Step-by-Step Process