Investing in Guangdong – Preferential Tax Policies in Hengqin New Area, Zhuhai

The Hengqin New Area of Zhuhai city in Guangdong is striving to develop high-tech and modern services industries and deepen integration with neighboring Macao. To achieve this, the local government has rolled out a range of preferential tax policies to attract companies and highly skilled talent to the area. We discuss the preferential tax policies available and which companies and individuals are eligible to enjoy them.

Hengqin New Area is a small island to the west of Macao and a district of Zhuhai City in Guangdong. The 106-square-kilometer island was incorporated into the Zhuhai Special Economic Zone in 2009, in order to develop the island’s economy through targeted growth policies.

The island has since become a key area for the development of strategic and emerging industries, such as high-tech, finance, and advanced manufacturing, among others. It is also an important testing ground for cooperation between Macao and Guangdong province.

In 2021, the government released a development plan for the Guangdong-Macao In-Depth Cooperation Zone in Hengqin (the “Hengqin Cooperation Zone”), an area covering the entirety of the island, which seeks to deepen ties between Macao and Guangdong and develop key industries in the region.

As part of this plan, the local government has implemented a series of preferential tax policies for companies and talent in the area. These include reductions to corporate income tax (CIT) for companies in 150 industries and individual income tax (IIT) reductions and waivers for skilled, in-demand talent, and Macao residents.

In this article, we provide an overview of the Hengqin Cooperation Zone and discuss the preferential tax policies available to companies and individuals.

Overview of Hengqin New Area

Hengqin New Area is connected to Macao through a series of bridges and ferry links, and to the mainland portion of Zhuhai by bridge and the Zhuhai metro. The Hengqin extension line of the Macao Light Rapid Transit, which will connect Macao and Hengqin, is currently under construction and is set to open in 2025. Transport from Macao to Hengqin takes approximately 30 minutes, and many people commute on a daily basis for work in Hengqin.

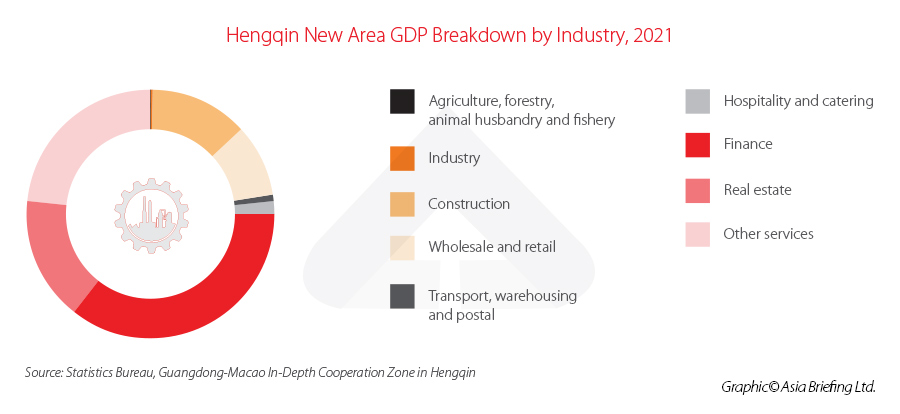

Hengqin New Area’s GDP grew 8.5 percent in 2021, reaching RMB 45.463 billion (US$6.8 billion), accounting for 11.7 percent of the entire GDP of Zhuhai. The local economy of Hengqin is dominated by the services sector, which accounted for 86.7 percent of local GDP in 2021. This is substantially higher than the contribution of the services sector to Zhuhai’s overall economy, which stood at 56.7 percent of GDP in 2021. The single largest industry by economic contribution in Hengqin is finance, which accounted for 35.6 percent of local GDP in 2021, followed by real estate, which accounted for 15.9 percent of GDP.

Development of Hengqin Cooperation Zone

The Hengqin Cooperation Zone, which was first announced in 2019, aims to create a synergistic relationship between Macao and Hengqin by facilitating business, trade, and the movement of people across the borders. The zone will also serve as a test zone for the integration of the two regions under the “One Country, Two Systems” policy.

The Masterplan for the Construction of the Hengqin Guangdong-Macao Deep Cooperation Zone (the “Construction Plan”), released in September 2021, is currently the main blueprint in place for the development of the area. It outlines various targets and preferential policies for incentivizing businesses to set up in the Hengqin Cooperation Zone and for attracting talent.

The Hengqin Cooperation Zone also acts as a means for diversifying Macao’s economy, which is still highly reliant on gaming and tourism and is therefore vulnerable to external disruption. The Construction Plan aims to develop a broad range of service industries, including science and technology R&D, high-end manufacturing, and high-tech as well as emerging industries, such as integrated circuits (IC), electronic components, new materials, new energy, big data, artificial intelligence (AI), Internet of Things (IoT), and biomedicine. Other key industries for development are traditional Chinese medicine, tourism, sports, exhibitions, leisure, and modern finance.

The government hopes to better leverage Hengqin’s strong services industries and position the zone as a strategic bridge between Macao and the Chinese mainland to develop Macao’s economy and further open Hengqin to the outside world.

Preferential tax policies in the Hengqin Cooperation Zone

Reduced 15 percent CIT

Qualified industrial companies located in the Hengqin Cooperation Zone can enjoy a reduced 15 percent CIT rate (the standard CIT rate in China is 25 percent).

To be eligible for this policy, companies must meet the below criteria:

- The main business must be in one of the industries in the Hengqin Guangdong-Macao Deep Cooperation Zone Corporate Income Tax Preferential Catalogue (2021 Edition) (the “catalogue”) and derive at least 60 percent of income from this main business. The catalogue includes 150 sectors across high-tech, science and education R&D, traditional Chinese medicine, tourism, modern services, finance, and more.

- Carry out a “substantive operation”, which means that the actual management organization of the enterprise is located in the Hengqin Cooperation Zone, and implements substantive and comprehensive management and control over the production and operation, personnel, accounting, property, and other aspects of the company.

For companies that are headquartered in the Hengqin Cooperation Zone, the 15 percent preferential CIT policy only applies to the income derived by the headquarters and any eligible subsidiaries that are also located within the zone. For companies that are headquartered elsewhere, the preferential CIT policy only applies to the eligible subsidiaries that are located within the zone.

The above preferential tax policy is implemented retroactively from January 1, 2021, and no expiry date is provided. Analysts believe this is a sign that these incentives will be in place for a long time.

Waiver for CIT on new ODI income in tourism, modern services, and high-tech

The income derived from new overseas direct investment (ODI) from companies established in the Hengqin Cooperation Zone in the tourism industry, modern services industry, and the high-tech industry can be exempted from CIT. To be eligible, the income from new ODI must meet the following criteria:

- It is made up of operating profits derived from newly established overseas branches, or dividend income corresponding to the newly increased ODI in the case of repatriation from overseas subsidiaries with a shareholding ratio of 20 percent or above.

- The statutory CIT rate of the country or region in which the overseas subsidiaries are located is no less than 5 percent.

- Preferential tax treatment for the purchase of fixed and intangible assets.

Newly purchased fixed assets (other than houses and buildings) or intangible assets with a unit value of up to RMB 5 million (US$743,516) can be deducted from the taxable income on a one-off basis.

In addition, depreciation and amortization are no longer calculated annually. Companies can shorten the depreciation and amortization period for newly purchased fixed or intangible assets with a unit value of over RMB 5 million, or adopt an accelerated depreciation and amortization method.

Preferential IIT policies

In January 2022, the MOF and STA released Preferential Individual Income Tax Policies for the Hengqin Guangdong-Macao Deep Cooperation Zone, detailing the implementation of IIT policies for talent in the Hengqin Cooperation Zone first introduced in the Construction Plan.

Both domestic and foreign high-end talent that is in demand in the Hengqin Cooperation Zone is eligible for an IIT waiver for the portion of the tax burden on over 15 percent of their income.

On April 3, 2023, the National Development and Reform Commission (NDRC), China’s macro planner, released the Catalogue of Encouraged Industries in the Hengqin Guangdong-Macao In-Depth Cooperation Zone (the “Encouraged Industries Catalogue”), a list of industries that are encouraged for investment and whose workers are eligible for the above-mentioned IIT waiver.

The Encouraged Industries Catalogue includes 185 different sectors organized into the following five categories:

- Technology R&D and high-end manufacturing (70 sectors, including integrated circuits, internet and software services, and new polymer functional materials);

- Macanese industries such as Chinese traditional medicine (24 sectors, including Chinese medicine and new drug development and production);

- Culture, tourism, exhibition, and business and trade (59 sectors, including R&D of digital cultural products, commodity trading, and cross-border e-commerce);

- Modern finance (16 sectors, including securities and futures brokerage, asset management, investment (trading) consulting, investment banking, and other securities and futures service system construction); and

- Other (16 sectors, including higher education, international education, vocational skills training, and sports schools).

Meanwhile, for residents of Macao that work in Hengqin, the portion of their tax burden in the Hengqin Cooperation Zone that is in excess of Macao standards is exempt from IIT.

The income that is eligible for these two preferential policies includes comprehensive income from the cooperation zone (including wages and salaries, labor remuneration, author’s remuneration, and royalties), business income, and subsidized income for talents recognized by the local government.

Residents working in the cooperation zone can enjoy the above preferential policies when handling the annual IIT settlement.

These policies will be implemented from January 1, 2021 to December 31, 2025.

Applying for preferential tax policies

Drawing from the experience of other regions with preferential tax policies, such as the Hainan Free Trade Port, authorities are relatively strict when it comes to evaluating whether a company has a substantial presence in the region in order to be eligible for the benefits. Companies are therefore advised to begin documenting the requisite information on operations, personnel, accounting, property, and other factors that may help to prove their presence in the zone at the earliest time possible.

The application period for the 2021 preferential IIT policies was February 2022, and the application period for 2022 – expected to open in early 2023 – is yet to be announced. For the talent eligibility requirements, see our article here. The updated requirements for the 2022 application are yet to be released.

For more information on the preferential policies available to companies and individuals in Hengqin, you can contact our on-the-ground tax experts by emailing china@dezshira.com.

This article was originally published on July 13, 2022, and last updated on April 17, 2023.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article The Recipe to Win China’s Fast-Food Market

- Next Article Hengqin Cooperation Zone in Zhuhai, Guangdong Releases Rules for Preferential Income Tax Policy