Investing in Qingdao, Shandong Province: China City Spotlight

Qingdao’s blue economy is rapidly modernizing creating new market-entry opportunities in its mature manufacturing and services industries. The city is known for its international seaport that supports shipping bulk resources like oil, iron ore, and coal; it is now turning its attention to the fast-growing consumer goods trade for future growth. In this city spotlight article, we break down key growth areas in Qingdao and profile its attractive development zones and industry parks for companies looking to set up here.

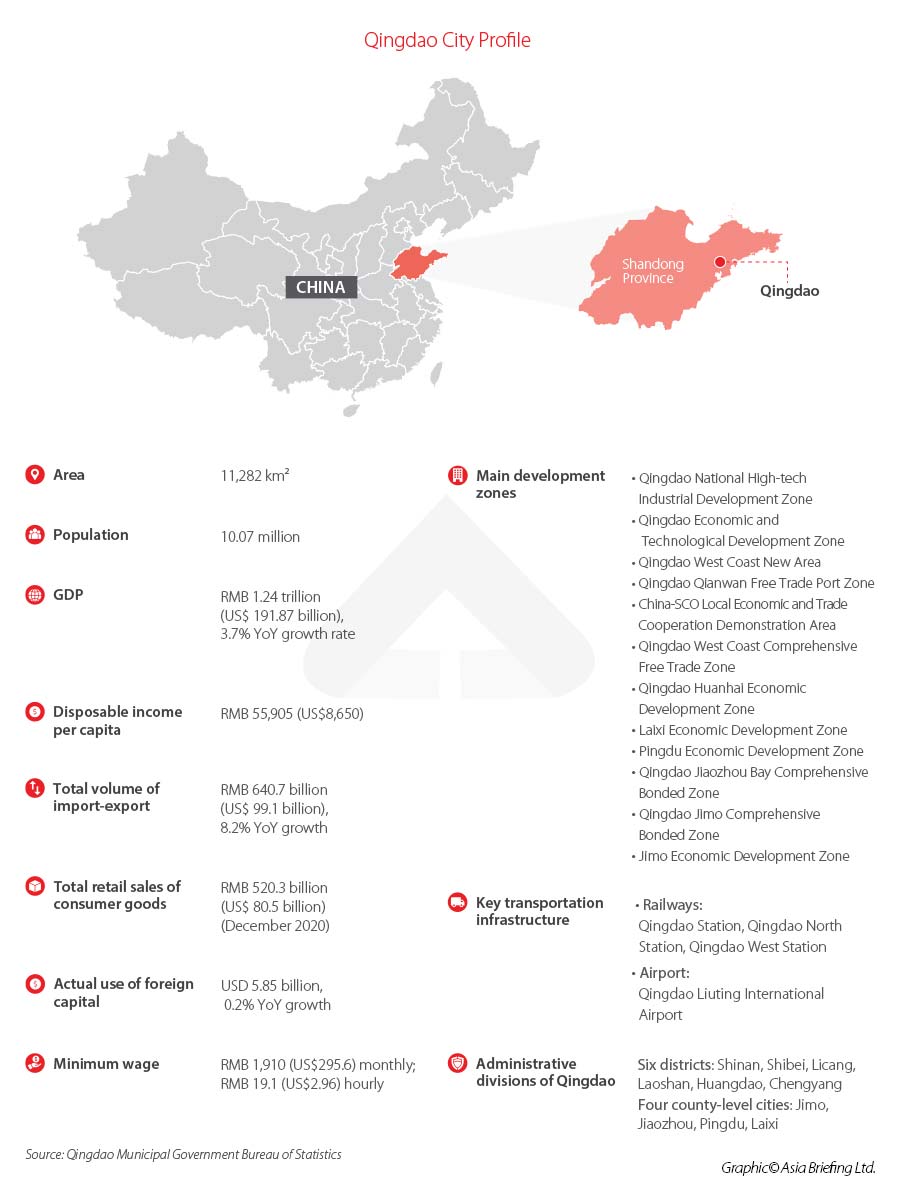

Qingdao is a major city located on the Yellow Sea coast in the eastern province of Shandong. Sprawling around Jiaozhou Bay at the tip of the Shandong peninsula, Qingdao enjoys a strategic location for international trade and is a key Belt and Road city on the ‘maritime silk road’.

Qingdao has capitalized on its historic position as an important international seaport and invested heavily in the modernization of its traditional maritime and manufacturing industries.

At the same time, a thriving tertiary sector is opening up new channels for market entry, offering an exciting landscape for investors to tap into a wide range of emerging industries.

Qingdao’s economic profile

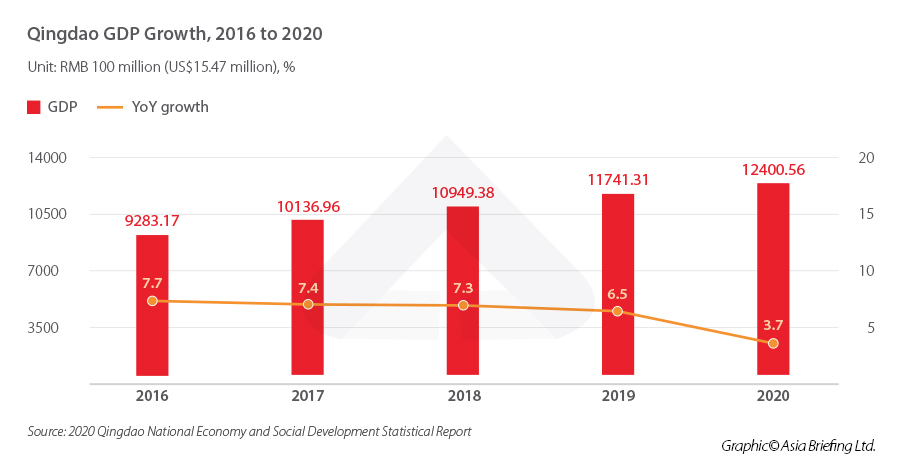

In line with China’s overall economic trend, Qingdao’s GDP growth slowed during the pandemic period, from 6.5 percent in 2019 to 3.7 percent in 2020. The city is nonetheless optimistic about its post-pandemic recovery – its GDP in the first quarter of 2021 grew 18 percent year-on-year, showing an average two-year increase of 4.7 percent.

The total volume of import-export grew to RMB 640.7 billion (US$99.1 billion), at a growth rate of 8.2 percent, though down from 11.2 percent in 2019. Of this, exports grew 13.7 percent to RMB 387.6 billion (US$59.9 billion), whereas imports grew at an incremental 0.7 percent, reaching RMB 253 billion (US$39.1 billion) in 2020.

Import-export with Belt and Road countries saw a higher increase in 2020, growing 16.3 percent and reaching RMB 181.7 billion (US$28.1 billion).

Qingdao’s actual use of foreign capital is rising steadily despite the decline in 2020, which saw just 0.2 percent growth from 2019 for a total of US$5.85 billion. 2021 is looking brighter: between January and April 2021, actual use of foreign capital totaled US$2.18 billion, a 32.4 percent year-on-year rise.

Qingdao city profile

Composition of Qingdao’s economy

Foreign trade and investment landscape

Due to its strategic location, Qingdao has long been an important seaport for international trade. Traditionally, the port mainly shipped bulk resources, such as oil, iron ore, and coal, but is now increasingly looking to the fast-growing consumer goods trade for growth.

The city is a key shipping hub for international trade partners, most notably the member countries of the Regional Comprehensive Economic Partnership (RCEP), a free trade agreement between 15 Asia-Pacific countries, and the Shanghai Cooperation Organization (SCO), an alliance between China and five central Asian nations.

Trade with RCEP member countries is booming, accounting for 37 percent of the city’s total trade volume in 2020. Earlier this year, the city opened up new shipping routes to Malaysia and Vietnam, helping to expedite the import and export of cold chain goods and other products.

Meanwhile, to foster trade and cooperation between the SCO countries, Qingdao established the China-SCO Local Economic and Trade Cooperation Demonstration Area, completed in April 2021. The area will launch 20 projects with a total investment of RMB 66.8 billion (US$ 10.3 billion), covering trade and logistics, new energy, high-end manufacturing, tourism, and biomedicine.

The city is ramping up investment incentives and mechanisms to make it more attractive to foreign investors. According to the Qingdao Bureau of Commerce, there were 13,735 foreign-invested enterprises in the city as of the first quarter of 2021, with 282 new projects added between January and April 2021.

Key growth areas in the blue economy

The Port of Qingdao is one of the 10 busiest seaports in the world. To this day the city relies heavily upon its blue economy, in particular container shipping and other traditional maritime industries, such as oil and fishing.

During the 13th Five Year Plan period (2016 to 2020), the city’s gross ocean product (GOP) grew an average of over 13 percent annually. By 2020, Qingdao reported a GOP of RMB 358 billion (US$55.4 billion), accounting for 28.9 percent of the local GDP.

Maritime industries are still a key area for growth. The city received RMB 300 million (US$46.4 million) in national funds during the 13th FYP to become one of the first maritime innovation development demonstration cities, under which 35 demonstration projects were established.

Today, industries such as shipbuilding, offshore engineering, and shipping and logistics are modernizing fast. The city has built a number of fully automated shipping terminals, powered by hydrogen energy, 5G technology, and automated guided vehicles.

The mainstay industry of aquaculture is also becoming smarter. To feed China’s appetite for seafood, Qingdao is shifting focus to experimental fishing and farming technologies. These include new mechanisms such as deep-sea fish farming, as well as the application of the Internet of Things (IoT) and other new technologies to enhance farming efficiency.

Other emerging sectors include seawater desalination, an important industry for a country likely to face critical water shortages in the coming decades. Qingdao was responsible for one seventh of the seawater desalinated in China in 2020 and has the capacity to process approximately 224,000 cubic meters of water per day.

Marine biomedicine has received a significant amount of attention in recent years, and a ‘Blue Drug Bank’ development plan for marine biomedicine received RMB 5 billion (US$773.2 million) in investment through the ‘Blue Drug Bank development fund’ during the 13th FYP period.

The government has set out several development goals for different marine industries, pending revisions based on public opinion. These include maintaining the annual growth rate of the GOP at eight percent and for it to make up 33 percent of the local GDP by 2025.

Other specific goals include increasing desalination output to 500,000 cubic meters per day and for port cargo throughput to reach 680 million tons, all of which will require significant investment and technological advancement.

Service industry growth

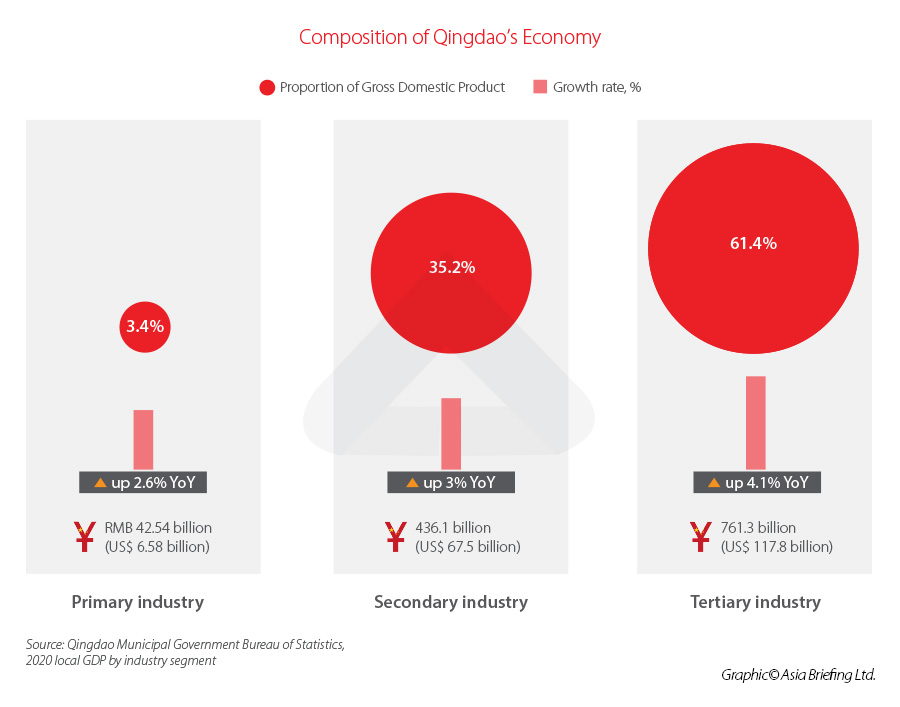

As Qingdao’s economy continues to modernize and mature, tertiary sectors are playing an increasingly important role in the city’s growth. The service industry surpassed 60 percent of the local GDP for the first time in 2019 and climbed further to 61.4 percent by the end of 2020. The local government is keen to keep this momentum going and has highlighted a number of sectors for development.

Focus is now on developing two main areas of the tertiary industry: modern services, such as finance, logistics, boutique tourism, business services, and manufacturing-related producer services.

To boost the producer service sector, Qingdao recently approved the creation of the first pilot zone for “integrating the two industries” and designated Haier Group among the project’s pilot companies.

In the coming years, the Qingdao government seeks to expand industry clusters for key sectors, which are located in a number of different dedicated development zones and parks across the city. These cover finance, logistics, culture and creativity, and digital information, as well as emerging sectors, such as healthcare, technology services, e-commerce, business services, and energy conservation and environmental protection.

Key development zones

Qingdao West Coast New Area

Located on the west coast of Jiaozhuo Bay between the Beijing-Tianjin-Hebei and Yangtze Delta regions, the Qingdao West Coast New Area (hereinafter referred to as the ‘New Area’) covers 2,096 sq km of land and enjoys 282 km of coastline, beyond which it has administration over 5,000 sq km of sea.

Home to around 2 million people, this dynamic coastal area prides itself in both its economic strength and cultural clout. It is a hub for marine engineering, shipping, electronics, petrochemicals, and other key industries, while also the host of numerous music festivals and the famous annual Qingdao Beer Festival. This area alone accounts for about one third of the city’s GDP.

Incentives for establishing headquarters in the New Area

The New Area provides financial incentives for foreign-funded companies to set up headquarters. To qualify, a company must receive US$10 million or more in actual foreign investment, for which it can receive rewards of two percent of the actual foreign capital invested that year, capped at RMB 100 million (US$15.5 million).

Companies that have already established headquarters within the area and increase registered foreign capital are also eligible for rewards. In this case, the New Area offers one percent of the increase in registered foreign capital in a given year, capped at RMB 20 million (US$3.1 million).

Financial companies setting up headquarters in the New Area can also enjoy a 20 percent subsidy for land purchased for office buildings, with a maximum subsidy of RMB 10 million (US$1.5 million). To be eligible, at least 60 percent of the land must be used for the company’s own buildings.

Financial companies that purchase office buildings within three years of registering in the New Area are also eligible for a 20 percent subsidy of the cost, with a maximum amount of RMB 10 million (US$1.5 million).

Incentives for industry projects

Beyond headquarters, the New Area provides fiscal incentives for projects in key industries. These include:

- A reward of one percent of actual funds received for shipping and logistics projects worth RMB 50 million (US$7.7 million) or more, capped at RMB 5 million (US$773,156).

- A reward of three percent of actual funds received for new financial institutes, capped at RMB 150 million (US$23.2 million), and a reward of 1 percent of additional funds received in a given year for existing financial institutions.

- A reward of up to RMB 30 million (US$4.6 million) for science and technology research projects set up by leading international universities and research institutes, and a subsidy of RMB 20 million (US$3.1 million) for projects engaged in emerging information technology such as 5G, artificial intelligence, and big data.

- A reward of two percent of the actual funds received for new foreign-invested projects in key industries with US$50 million or more in foreign capital (excluding loans from foreign shareholders) or foreign-invested projects with a capital increase of US$30 million or more in a given year, capped at RMB 100 million (US$15.5 million).

Qingdao Economic and Technological Development Zone

Established in 1984, the Qingdao Economic and Technological Development Zones (QETDZ) is one of the oldest development zones in the city.

The QETDZ has built clusters for mainstay industries, such as electronics, petrochemicals, automobile, and shipping and maritime engineering, and also has areas dedicated to high-end equipment manufacturing, IT, and cross-border e-commerce, and other emerging industries.

The zone is home to eight university campuses and 59 research institutes. Alibaba and Haier Group are among companies that have established projects in the zone.

Qingdao High-Tech Industrial Development Zone

Located on the north side of Jiaozhou Bay, the Qingdao High-Tech Industrial Development Zone (QHIDZ) covers 327.8 sq km of land split into a number of smaller parks, including the Qingdao High Science and Technology Industrial Park, the Qingdao Marine High-Tech Zone, Shinan Software Park, and the Blue Silicon Valley Core Area.

The QHIDZ focuses on six core areas, namely software and information, medical and pharmaceuticals, smart manufacturing and new materials, internet, finance, and high-end services. Major telecom companies, such as Huawei and ZTE, as well as electronics manufacturer Haier and German robotics brand Kuka, all have projects within the QHIDZ. It is also home to eight commercial bank branches and 115 venture capital institutes.

Blue Valley Marine Economic Development Zone

The Blue Valley Marine Economic Development Zone, known colloquially as the ‘Blue Silicon Valley’ and alternatively ‘Oceantek Valley’ in English, is primarily focused on marine research. It is currently home to 26 major laboratories, deep-sea bases, and other research centers, as well as 24 university campuses, research institutes, and innovation parks.

Qingdao Qianwan Free Trade Port Zone

The Qingdao Qianwan Free Trade Port Zone (hereinafter referred to as the Port) is the Qingdao section of the wider China (Shandong) Pilot Free Trade Zone. Located within the West Coast New Area and covering 52 sq km, the Port is a hub for international trade and shipping, including cross-border e-commerce and vehicle imports, and focuses on maritime industries, advanced manufacturing, maritime, and modern finance, among other industries. It is also home to Asia’s first fully automated container terminal.

Qingdao is a magnet for foreign investment and trade

Building upon its legacy of maritime trade and industries, Qingdao is striving to turn itself into a modern, high-tech city and cement its position as a key artery through which to tap into China’s consumer markets and emerging sectors.

With a vibrant business landscape, strong ties to countries in the Asia Pacific, and preferential investment policies, Qingdao will continue to be an attractive destination for foreign investors and is likely to make the city a formidable player in high-tech marine industries and strategic global trading hub.

Foreign investors wishing to learn more about Qingdao’s preferential policies can submit inquiries by emailing qingdao@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article How to Properly Conclude an Electronic Labor Contract in China: Clarifications Issued in New Guideline

- Next Article L’economia circolare cinese: Capire il nuovo Piano Quinquennale