Joint Ventures the Only Way Ahead in China’s Media Market

Op-ed Commentary: Chris Devonshire-Ellis and Richard Hoffmann

Aug. 16 – With the news that Rupert Murdoch’s News Corp. is selling its stakes in Chinese TV stations, the focus of attention for investing in China’s massive media market again concentrates on the joint venture as the only permissible route into the market. With a total readership of 1.4 billion, the stakes are high in China in terms of potential advertising revenues, yet the Chinese government is wary of letting foreign investors gain too much of an upper hand in terms of content. That conflict will always be won by the state, which has long erected barriers to foreign investment in the media industry.

In terms of domestic TV, foreign owned channels have only been permitted in Guangdong Province, and even there, players such as News Corp., Viacom and Time Warner have been restricted to market access – News Corp.’s revenues from China in total averaged about US$50 million per annum, against global revenues of US$32 billion – rather small return for such a major investor. Despite News Corp. wooing Beijing through political savvy (Murdoch infamously took the BBC off the China footprint after complaints from Beijing over content, and even married a Chinese national) such “patriotic” stances didn’t ultimately provide the business with the expected returns. Indeed, News Corp. return from China has been 1 percent of their total revenues, a damaging figure when compared to the senior executive time and effort spent on developing the China market, while their TV ratings in Guangdong only amounted to a 4 percent share.

It’s a similar story in publishing, where Haymarket of London, another politically well connected company owned by pro-China ex British cabinet Minister Michael Heseltine, effectively decamped to Mumbai from Shanghai after finding routes in China blocked for the publishing and distribution of titles such as “Auto Car,” “Finance Asia” and about 100 other consumer titles. With Mainland China off limits, the company has made inroads into the Indian market and now successfully produces its titles – some specific to the country – in another market of over a billion consumers.

However, the main stumbling block we have seen in China is that many media companies prefer to keep their entire title and content to themselves. Millions of dollars in wasted legal fees have been spent on trying to get around this regulatory problem, so much so that several years ago we stopped advising clients on publishing or media in China if they were not prepared to negotiate terms with a Chinese publisher or related business. Here, Dezan Shira & Associates has an advantage as we set up our own publishing subsidiary, China Briefing, back in 1999. Now morphed into a fully independent company, Asia Briefing Ltd., we know firsthand what it takes to publish in China and what avenues are open, real and what are dangerous. We’ve explored them all over the past 11 years. Suffice to say we continue to retain control, and our own model works, although our particular business model does not rely on Mainland China advertising revenues to do so. However, that has been a considered strategic decision– and doesn’t mean that if we wanted to generate additional revenues from China the situation needs to remain that way. There is indeed a choice.

For those media players that do want a slice of the China market, there is however only really one option: the China joint venture, with a maximum of 49 percent foreign ownership, and final say over content being provided under Chinese editorial control. In China, that’s as good as it gets. However, editorial content should not be an issue in the real advertising market, which is consumer driven, and 49 percent of the China market is better than none at all. Consequently, getting into China as a media player is a strategic rather than a legal issue. The doors are open, but only to those prepared to meet the Chinese government halfway. For those that are, the route in media is to choose your China partner carefully. They will almost certainly be a state-owned enterprise, with links directly to the General Administration of Press and Publication. However, these companies can vary in size and capabilities; what is required is a partner who can simultaneously generate advertising revenues, produce and distribute. Such businesses may be regional, or they may be national. Their capabilities need to be fully understood; otherwise you end up with one deal only to find the need to make another with a separate SOE for a different service. Due diligence, certainly in terms of deliverables, is a requirement here.

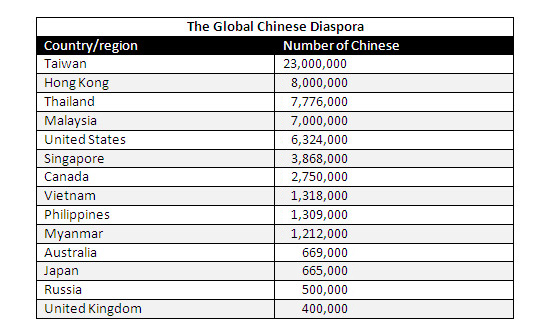

From then on, the media JV is a series of negotiated issues such as brand ownership (trademark), copyright ownership, licensing agreements and the division of profitability or losses. As mentioned, it’s the only possible route into China, but getting somewhere with the mainland market is better than getting nowhere. Chinese SOEs also have long arms into the Chinese diaspora globally – an additional factor that may be of interest to some, and an area in which China’s SOEs can assist develop. In total, the global Chinese diaspora is estimated to be some 70 million, including Chinese territories such as Taiwan and Hong Kong, where publishing laws are more relaxed than on the mainland.

While it is true that not all the above will speak or read Chinese, it does represent a significant potential bonus that conducting a media partnership with the right Chinese SOE could provide. The opportunities for media development, not just on the mainland but also overseas certainly exist. Developing a media business in China then is not off the radar; it is achievable, albeit under some caveats. Finding the right partner, being prepared to give up the final say over content and editorial, and structuring the venture properly are all issues to consider. It has certainly proved to be the case for Hong Kong’s Tom Group, who recently announced a joint venture with China Post. It can be done.

While the legal aspects of the JV structuring are a regulatory issue followed by negotiable points on the business operations and management, China as a media play can be made to work. For those who are unwilling to invest under such circumstances, the other media market of over a billion potential readers is India. And for some international media, that has also proven lucrative. Investing in China’s media is a viable option, and if unpalatable to your business model or political stance, other Asian markets, especially India, are also open and accessible.

Chris Devonshire-Ellis is the principal and founding partner of Dezan Shira & Associates, and has been involved in structuring joint ventures in China and India for over 18 years. He also established the Asia Briefing media brand in 1999 and successfully publishes titles, including magazines and books in both the China and India markets. Richard Hoffman is the senior legal associate for Dezan Shira & Associates in Beijing and has particular experience in China’s media industry. For advice and assistance over legal and regulatory aspects of publishing and media in China and India, please contact the firm at info@dezshira.com.

Chris also contributes to India Briefing , Vietnam Briefing , Asia Briefing and 2point6billion

Related Reading

China Briefing

India Briefing

Want China National Coverage? The JV Route Provides

China JV Success “A Mindset” Rather Than A Legal Structure

The 50-50 Sino-Foreign Joint Venture As A Success Story

China Briefing Guide to Setting Up Joint Ventures in China

India Briefing Guide to Doing Business in India

- Previous Article The Tax Liabilities of China Business Trips

- Next Article Customs Regulations Eased for Cross-Border Transportation in Jilin Province