Lower Corporate Tax Rate in Lingang New Area of Shanghai FTZ: Eligibility Criteria

On July 31, 2020, the Shanghai Municipal Finance Bureau released the Circular about Corporate Income Tax Policies for Key Industries at Lingang New Area of China (Shanghai) Pilot Free Trade Zone, which will be implemented retrospectively from January 1, 2020.

The Circular clarifies a preferential corporate tax policy that was first made known at the unveiling of the overall plan of Lingang New Area Free Trade Zone (FTZ) back in August 2019.

According to the Circular, eligible enterprises engaged in the production, development, or research and development (R&D) of products within four key industries – integrated circuits (IC), artificial intelligence (AI) biomedicine, and civil aviation will be eligible for a lower corporate income tax (CIT) rate of 15 percent in the first five years since its date of establishment.

We break down key points of the new preferential policy below.

Which enterprises can qualify for the preferential tax policy?

Under the new preferential policy, eligible enterprises will be subject to a CIT rate of 15 percent, reduced from the usual 25 percent that applies to businesses in China.

To be eligible, enterprises must meet the following conditions listed in the Circular:

- The enterprise must be a legal entity, and registered in the Lingang New Area from January 1, 2020;

- The enterprise’ main business is in the IC, AI, biomedicine, or civil aviation industries; and

- The enterprise must engage in substantive production and R&D activities in the ‘Catalog of Key Fields and Core Links’ (see table below).

In the last of these requirements, authorities define ‘substantive’ activities as the fixed and continual business engagement in one of the eligible key sectors – demonstrated either by fixed premises, staff, or supporting software and hardware that matches the production, research, or development activities.

In addition, the company’s main R&D or sales products must include one key technology product that plays an important or indispensable role within the industrial chain of key fields for IC, AI, biomedicine, and/or civil aviation as listed in the Catalog below.

Activities covered by this Catalog generally include areas that are upstream or downstream of the key industry – for example, manufacturing of core components, parts and equipment, development of software, or any research and development adjunct to the development of new products.

Lingang New Area: New hub for high-tech R&D and manufacturing

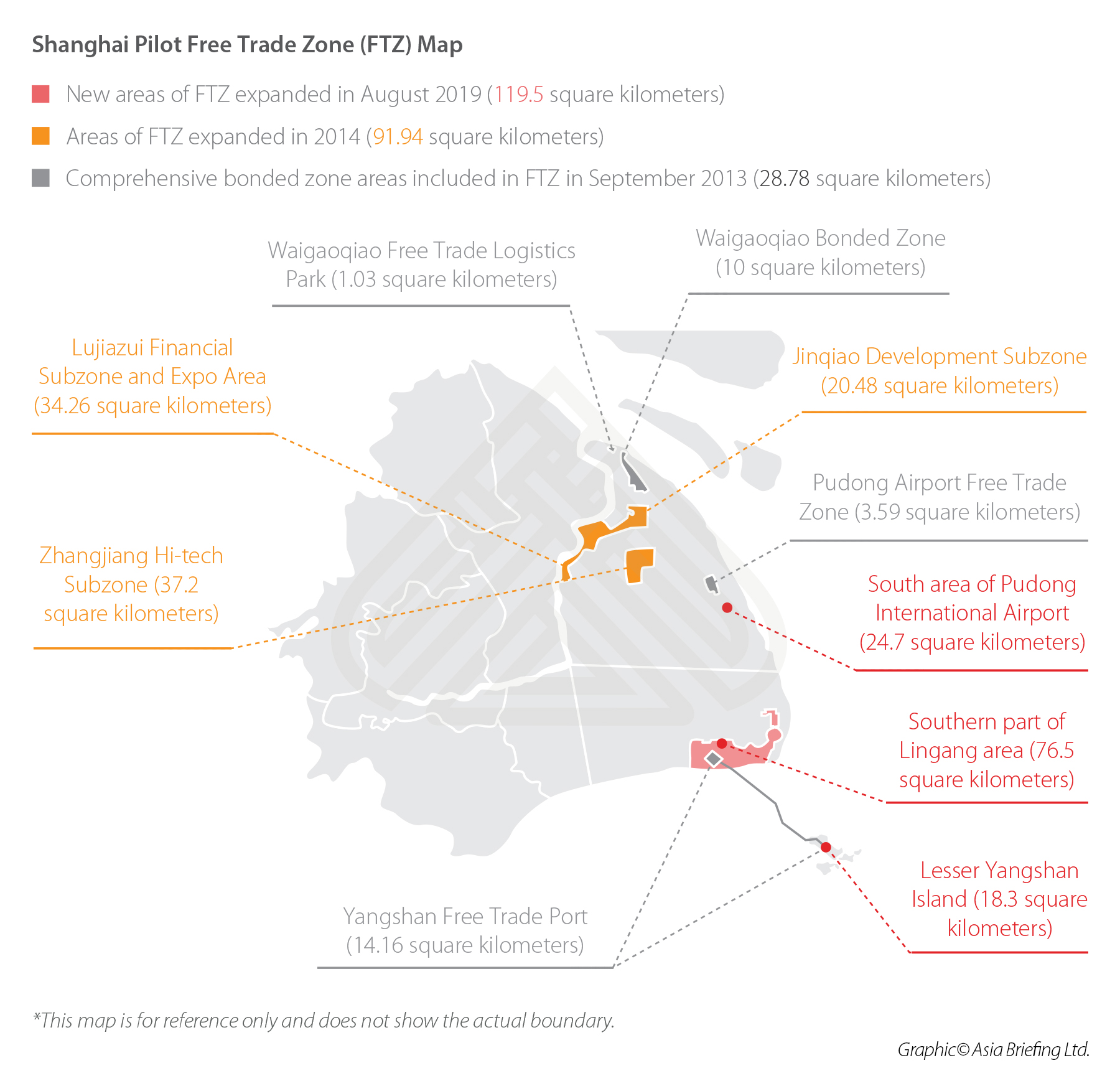

Lingang New Area is a newly carved out area of Shanghai’s Pilot Free Trade Zone (FTZ), that was established just one year ago on August 6, 2019. On paper, and in practice, the plans are part of broader measures to improve the business climate for foreign investors in China.

As described by the overview plan, one of the key priorities of the FTZ is to establish a frontier of industrial clusters with key core technologies and capabilities – using preferential tax rates, customs supervision, and enhanced cross-border financial management to attract businesses in key industries within the zone.

Already, the Lingang New Area is home to some of the world’s leading and innovative foreign companies operating within the FTZ – examples include Tesla, BMW, General Electric (GE), and Siemens AG.

This recent announcement confirming the reduced CIT rate aims to attract even more innovative and high-tech enterprises to the FTZ – with a special focus on IC, AI, civil aviation, and biomedicine – which were areas already prioritized for rapid growth and development before COVID-19 broke out.

Since the outbreak, however, the need to enhance China’s domestic capacity within these industries has also become of vital national importance, as COVID-19 effectively exposed the discrepancies between market needs and current capacity for quality supply and healthcare services.

Of the four key industries – integrated circuits has recently become the recipient of a slew of new government preferential policies in efforts to spur local production to support the fast-growing technology sector in China.

Major FTZ developments in China

The Shanghai FTZ expansion to Lingang New Area marks one of many significant FTZ developments rolled out by the Chinese government since the last year.

Spanning 119.5 square kilometers, along the southeastern tip of Shanghai, the Lingang New Area aims to facilitate free activities in trade, investment, finance, talents, and information – with a special focus on stimulating new high-tech innovation and cross-border exchange of financial and legal services.

The goal is to establish a relatively mature system of investment and trade and more open functional platforms by 2025 and become a special economic function zone with strong global market influence and competitiveness by 2035 – expanding to new areas, such as Shanghai Dazhi river, Jinhui Port, Xiaoyangshan Island, and the southern part of Pudong International Airport.

Meanwhile, China expanded its current network of FTZs to six new provinces, mainly around the central regions of the country, namely Shaanxi, Henan, Hubei, Chongqing, Sichuan, Zhejiang, and Liaoning provinces. More recently, Chinese authorities released the much-anticipated blueprint for the Hainan Free Trade Port – putting forward concrete plans to implement the largest special economic zone in China.

These recent moves by the Chinese government signal a general trend towards market liberalization and promotion of high-tech innovation deemed critical to the country’s next stage of development.

Foreign investors operating in the IC, AI, biomedicine, and/or civil aviation industries should reach out to their local professional services advisor to see whether and how they can avail these preferential CIT policies announced within the Lingang New Area FTZ. For more information and assistance on the ground, please email us at China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article China’s Incentives for Integrated Circuit, Software Enterprises

- Next Article Profit Repatriation from China: Compliance Procedures for Outbound Payments