China Plus One Series: Understanding Malaysia’s Appeal to Foreign Investors

In recent years, many foreign companies based in China have started planning to move investment to alternative locations in Asia to supplement their operational capacity.

In this series, we profile potential destinations for foreign investors looking to strategically diversify their presence in the Asian market.

A “China plus one” strategy is one where investors complement their core China operations with investment in another country to lower costs, diversify risks, and access new markets.

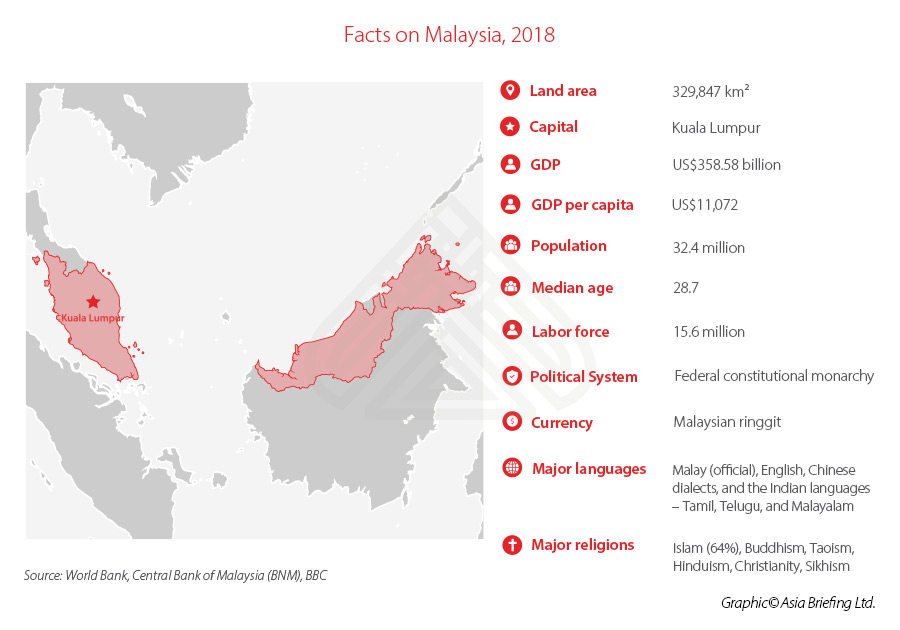

Located in the heart of Southeast Asia along the Straits of Malacca, Malaysia is well internationalized and boasts one of the most advanced economies of Southeast Asia. The development of the country benefits from decades of industrial growth and political stability.

Economy and industry

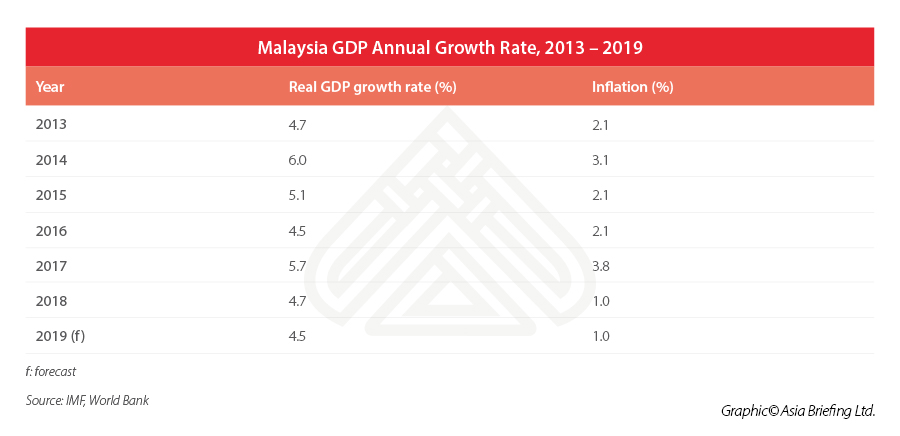

Malaysia’s economy is well diversified and resilient. It continues to grow at a sustained pace despite the impact of external shocks. Its economy has been on an upward trajectory, with an average growth rate of 5.4 percent since 2010.

In 2018, Malaysia recorded a GDP of US$358.58 billion, outranked only by Indonesia, Thailand, and Singapore among the Association of Southeast Asian Nations (ASEAN) countries. Its GDP per capita was US$11,072 and it maintained a low and stable inflation rate of 0.97.

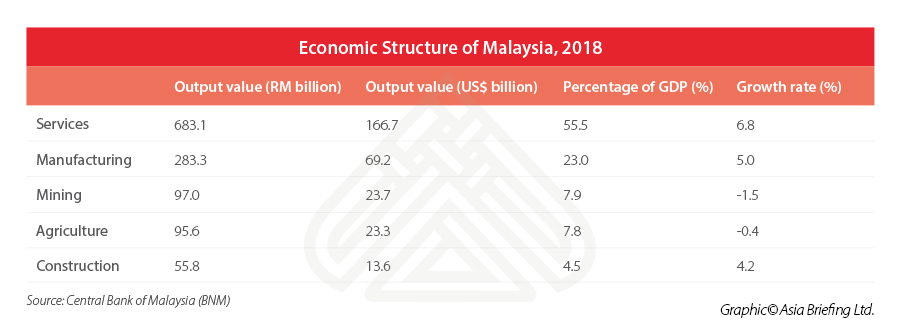

Since gaining independence in 1957, Malaysia has shifted from being an economy based on agriculture and commodities to one driven by manufacturing and services. In 2018, the manufacturing and services sectors accounted for 23 percent and 55.5 percent of Malaysia’s GDP, respectively.

Now, the insatiable global demand for electronics, commodities like oil and gas, as well as rising domestic consumption, are fueling Malaysia’s economic growth.

Categorized as an upper-middle-income economy, Malaysia is on its way to achieving high-income status by 2024. The government’s 11th Malaysia Plan aims to boost productivity, encourage innovation, and increase labor’s share of income to attain this goal.

Trade, investment, and business

Trade

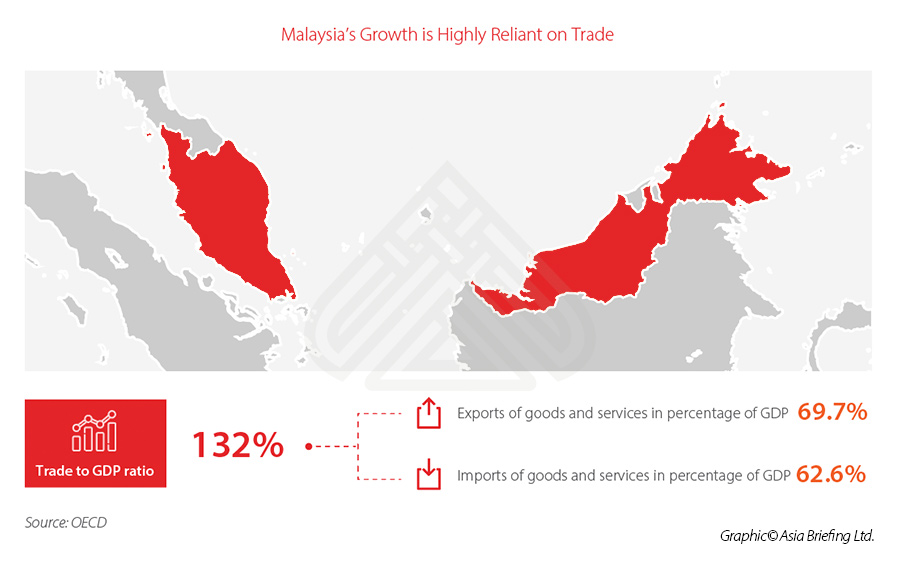

Located on a major shipping channel connecting the Indian Ocean to the west and the Pacific Ocean to the east, Malaysia recognizes the importance of international trade. Its growth is highly reliant on trade, with a trade to GDP ratio averaging over 130 percent since 2010. In 2018, Malaysia shipped US$ 247.3 billion worth of goods around the world, reflecting a 5.6 percent gain since 2014.

The country exports a large number of electronics, petroleum products, chemicals, machinery, and natural gas around the world. It is also one of the major producers of oil and rubber.

Overall, Malaysia posted a US$29.8 billion surplus on goods traded in 2018, up 32.2 percent from US$22.6 billion a year earlier. It has a large surplus in international electronics trade, including as a net exporter of consumer electronic gadgets.

The most in-demand goods shipped from Malaysia include electronic integrated circuits and its related parts, refined petroleum oil, petroleum gas, computers, optical readers, solar power components, and palm oil.

According to Nomura, the Asia-based financial services group, Malaysia has been one of the top five beneficiaries of the US-China trade war, especially in its exports of electronic integrated circuits and semiconductor devices.

Singapore, China, the US, Hong Kong, and Japan are the top five export destinations of Malaysia’s products. Continent-wise, in 2018, 72.2 percent of Malaysian exports by value were delivered to Asian countries, while 10.6 percent to Europe and 10.3 percent to North America.

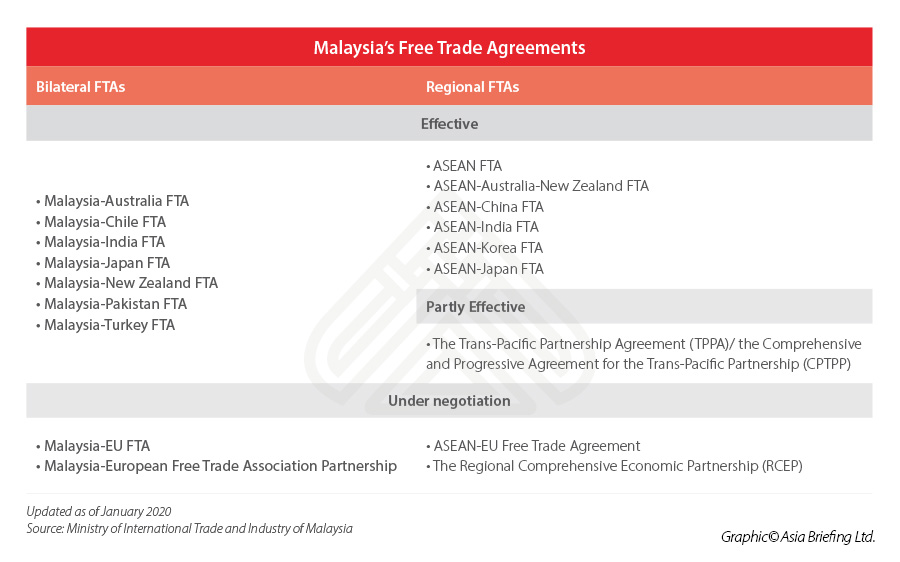

Malaysia highly values regional and bilateral trade agreements. It joined the General Agreement on Trade and Tariff (GATT) in 1957, which was replaced by the World Trade Organization (WTO). The country is thus a founding member of the WTO.

Malaysia is one of the ten ASEAN member countries and is a member of the Regional Comprehensive Economic Partnership (RCEP) negotiations – an international free trade agreement (FTA) between the ten ASEAN countries and six countries that have signed FTAs with ASEAN, namely Australia, China, India, Japan, New Zealand, and South Korea.

Malaysia is also a member of the Comprehensive and Progressive Agreement for the Trans-Pacific Partnership (CPTPP) – which used to be the Trans-Pacific Partnership Agreement (TPPA), a trade agreement between the 12 Pacific Rim countries, and was renamed as CPTPP after the US withdrawal under President Donald Trump.

By far, Malaysia has seven bilateral FTAs with Australia, Chile, India, Japan, New Zealand, Pakistan, and Turkey. Through ASEAN, Malaysia has regional FTAs with China, Japan, Korea, India, Australia, New Zealand, and Hong Kong. It also participates in the ASEAN Trade in Goods Agreement (ATIGA).

Investment

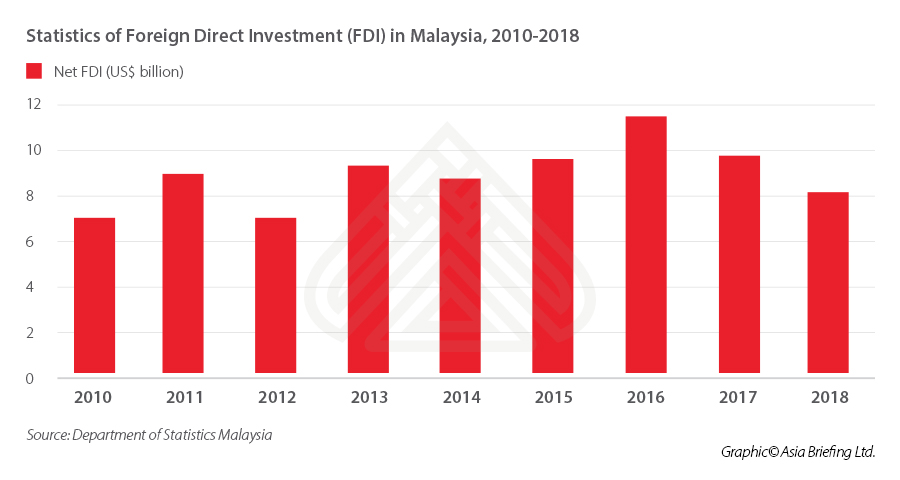

In 2018, FDI in Malaysia recorded a lower net inflow of RM32.6 billion (US$7.42 billion) as against RM40.4 billion (US$9.13 billion) in 2017. The FDI flows were in a downward trend since 2017 due to lower investment in the mining and quarrying sector.

More than 50 percent of FDI inflow went into the services sector and 47 percent into the manufacturing sector. The US, China, the UK, Hong Kong, Singapore, and Japan contributed the most FDI in Malaysia in 2018. Continent-wise, Asia (44.9 percent) remained the highest region of FDI flows, followed by Europe (33.7 percent).

The Malaysian government allows 100 percent foreign ownership in healthcare, retail, education, as well as professional, environmental, and courier services sectors. Export-dependent Malaysia is keen to attract FDI and promote high-value manufacturing. Investment incentives like corporate income tax exemption and tax allowance are provided in industries, such as advanced electronics, medical devices, biotechnologies, and green technologies.

However, there are restrictions on foreign investment remain in fisheries, energy, telecommunications, finance, and transport services. Further, foreign investment in public-private-partnership (PPP) projects is capped at 25 percent of equity.

According to the Malaysian Investment Development Authority (MIDA) – a government body that promotes local and foreign investment and approves manufacturing investments, in 2018, Malaysia had approved a total of investments worth RM87.4 billion (US$19.9 billion), including foreign investment and domestic investment, 37.2 percent higher than the previous year.

The top-performing industries included petroleum products (37 percent), basic metal products (15 percent), electronic products (13 percent), paper, printing, and publishing (six percent), chemicals (six percent), and rubber products (five percent).

Malaysia encourages enterprises to invest in products and business practices promoted by the government in the manufacturing sector – such as medical equipment, electronic products and components, halal food, etc. Tax incentives include corporate income tax exemption for a period of five to ten years for companies granted “Pioneer Status“, which will be taxed at 30 percent of their statutory income.

Business environment and cost

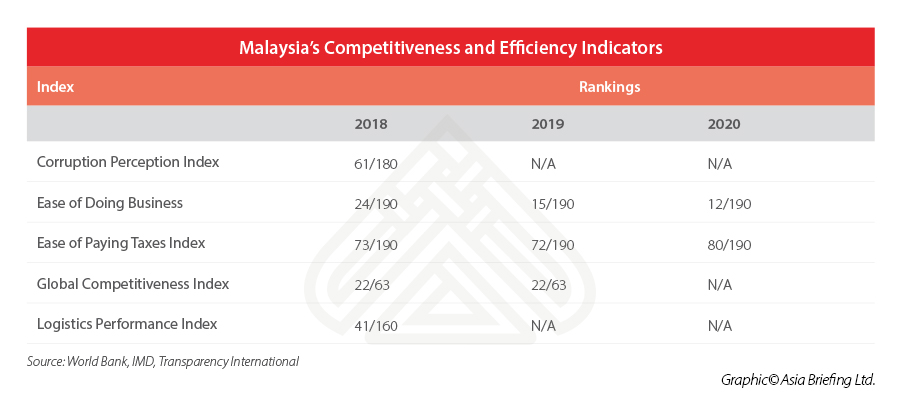

In 2020, Malaysia ranked 12th among 190 economies in terms of ease of doing business (World Bank Doing Business Report 2020).

The country continues to be attractive to foreign investors due to its broadly liberal and transparent investment policy, a developed infrastructure, attractive incentives, and high cost-competitiveness.

MIDA’s website details the costs of starting a business in different regions of Malaysia as well as taxation, human resource, unitalities, transportation cost, and living costs (check out here).

We present some of the key data below.

Malaysia’s tariffs

- Import duties – zero to 50 percent; and

- Export duties – five to 30 percent, applying to 217 tariff lines (the export of products, such as rubber, timber, palm oil, and tin requires special permission from the relevant Malaysian government agencies and may be subjected to higher taxation).

Malaysia’s business taxes

- Corporate income tax – 24 percent on non-resident companies;

- Sales and service tax (SST) – five percent or 10 percent of standard sales tax rates, six percent of service tax rate; and

- Branch tax rate – 24 percent, no tax is withheld on transfer of profits to a foreign head office.

Malaysia’s labor cost

- Minimum wage – RM1,200/month (US$295/month).

- Social security contributions – 12 percent of employer’s contribution if the employee’s monthly wages are above RM5,000 (US$1,138.6) per month or 13 percent if the employee’s monthly wages are below RM5,000 per month. Employees’ contribution rate is fixed at 11 percent of monthly wages – regardless of income level.

Where to invest in Malaysia

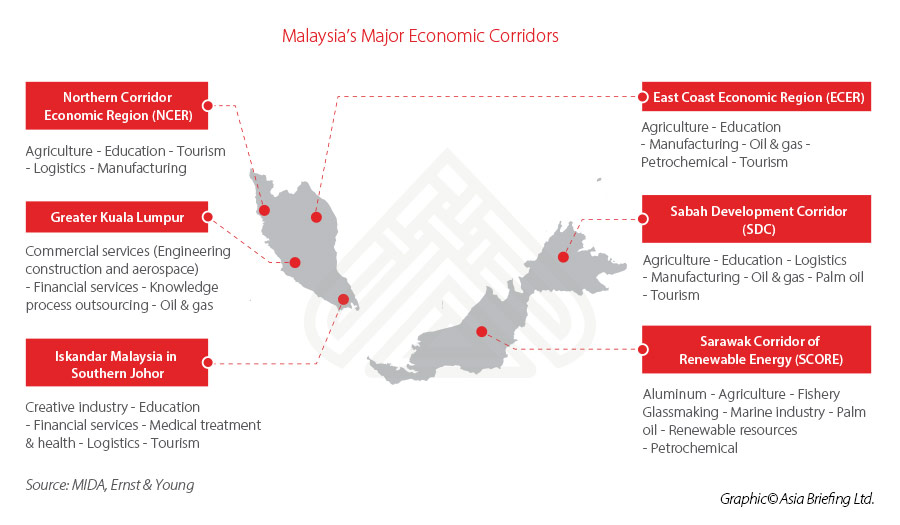

Malaysia’s six major economic corridors provide a wide range of investment opportunities

The following is a summary of the economic corridors:

Northern Corridor Economic Region (NCER)

The NCER covers the Perlis, Kedah, and Penang state and Northern Perak in the northern part of the Malay peninsula, with an area of about 18,000 square kilometers, focusing on encouraging investment in sectors like agriculture, manufacturing, tourism, education, and logistics.

East Coast Economic Region (ECER)

The ECER covers areas on the east coast including the states of Kelantan, Terengganu, Pahang, and Mersing Jetty port in Johor, with an area of about 67,000 square kilometers across 51 percent of Peninsular Malaysia, focusing primarily on the country’s traditional strengths in manufacturing, agribusiness, oil and gas, petrochemical, and tourism.

As inward investment focused almost exclusively on Kuala Lumpur and the southern states of Selangor and Johor, NCER and ECER became key projects to promote investors’ interest in the country’s northern regions.

Sabah Development Corridor (SDC)

The SDC covers a large part of Sabah state in East Malaysia, with an area of about 74,000 square kilometers, focusing on encouraging investment in tourism, logistics, agriculture, and manufacturing.

Greater Kuala Lumpur (Greater KL)

The Greater Kuala Lumpur area comprises 10 municipalities of Kuala Lumpur and its surrounding areas in Selangor. The government plans to build Greater Kuala Lumpur area as an international metropolitan as a foothold for Malaysia to progress towards becoming a high-income nation. Commercial services, financial services, and knowledge process outsourcing are encouraged there.

Iskandar Malaysia in Southern Johor (IRDA)

The IRDA is located in Johor state at the southern tip of the Malay peninsula, with an area of about 2,200 square kilometers and focusing on promoting the services sector as a key driver of economic development, such as tourism, education, health care, logistics, creative industries, and financial services. Established in 2006, it was envisaged as a world-class business, residential, and entertainment hub. Investors here are keen to capitalize its proximity to Singapore.

Sarawak Corridor of Renewable Energy (SCORE)

The SCORE is located in the northwest of Sarawak state in east Malaysia, with an area of about 71,000 square kilometers. Sarawak state is rich in energy resources. Major industries here are oil and gas, aluminum, glass, palm oil, timber, animal husbandry, aquaculture, marine engineering, and other renewable resources.

With its superior business infrastructure, position as a gateway to regional and global markets, abundant natural resources, and multilingual talent pool – Malaysia is rapidly becoming a major global investment destination. Foreign entities should consider some key points in order to develop an enduring and long-term strategy and successful business action plan for investment in Malaysia. They are advised to seek professional service agencies and match with relevant business partners where applicable so that they have a grasp of Malaysia’s company laws, taxation schemes and area-wise incentives, understand regional cost comparisons, and can combine international best practices with local norms in the target area.

Read Our China Plus One Series

China Plus One Series: Understanding Vietnam’s Appeal to Investors in Asia

China Plus One Series: Understanding Vietnam’s Appeal to Investors in Asia

China Plus One Series: Indonesia’s Appeal to Foreign Investors in Asia

China Plus One Series: Indonesia’s Appeal to Foreign Investors in Asia

China Plus One Series: Cambodia’s Appeal to Foreign Investors

China Plus One Series: Cambodia’s Appeal to Foreign Investors

China Plus One Series: Investment Opportunities in Thailand

China Plus One Series: Investment Opportunities in Thailand

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, and Thailand in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article How to Use China’s Preferential Policies Rolled Out amid COVID-19

- Next Article Hong Kong’s New SME Financing Guarantee Scheme: An Explainer