More Advanced Manufacturing Taxpayers in China to Benefit from Expedited Refund of Uncredited VAT

China is allowing more taxpayers to be eligible for full value-added tax (VAT) credit refund in the advanced manufacturing industry. Since June 2019, China has been granting full refund of incremental uncredited VAT to general taxpayers in four advanced manufacturing sectors. The new policy, effective April 2021, brings another five sectors, including pharmaceuticals, under the current tax policy support. The move has been seen as a bid to boost China’s advanced manufacturing industry.

On April 28, 2021, China’s Ministry of Finance (MOF) and State Taxation Administration (STA) released the Announcement on Clarifying Policies on the Refund of Period-End Uncredited Value-Added Tax in Advanced Manufacturing Industries (MOF STA Announcement [2021] No.15), which took effect retroactively from April 1, 2021.

According to the Announcement, qualified taxpayers engaged in nine sectors of the advanced manufacturing industry are entitled to apply to the tax authority for a refund of the incremental uncredited value-added tax (VAT) in May 2021 and the subsequent tax declaration periods. Here, the “incremental uncredited VAT” means the increased period-end uncredited VAT compared with March 31, 2019.

Previously, the period-end uncredited VAT (the overpaid input VAT at the end of each taxable period) was not refundable in the current taxable period but could be carried forward to and be deducted in the next taxable period. Since the deepened VAT reform in China from April 2019, qualified taxpayers in all industries were allowed to apply for uncredited VAT refund in the current taxable period. Starting June 2019, qualified taxpayers in the advanced manufacturing industry started to enjoy a similar but more relaxed policy.

This year, the country expanded the scope of advanced manufacturing taxpayers eligible for the VAT refund policy, benefiting another five sectors, including pharmaceuticals, chemical fiber, railway, vessel, aerospace and other transport equipment, electrical machinery and equipment, and instruments and meters.

Who are the advanced manufacturing taxpayers?

Who are the advanced manufacturing taxpayers?

An eligible advanced manufacturing taxpayer, referred to in the Announcement [2021] No.15, shall be a general taxpayer producing and selling the following nine categories of products, as defined in China’s Industrial Classification for National Economic Activities:

- Non-metallic mineral products

- General equipment

- Special equipment

- Computer, communication, and other electric devices

- Pharmaceuticals

- Chemical fiber

- Railway, vessel, aerospace, and other transport equipment

- Electrical machinery and equipment

- Instruments and meters

Besides, the sales revenue for the above products must account for more than 50 percent of the total sales revenue of the manufacturing taxpayer.

Before April 2021, only producers and sellers of non-metallic mineral products, general equipment, special equipment, and computer, communication, and other electric devices are able to enjoy full VAT credit refund. Now, the new policy – the MOF STA Announcement [2021] No.15 – has incorporated the latter five types of products in the list.

How to be eligible for the VAT credit refund?

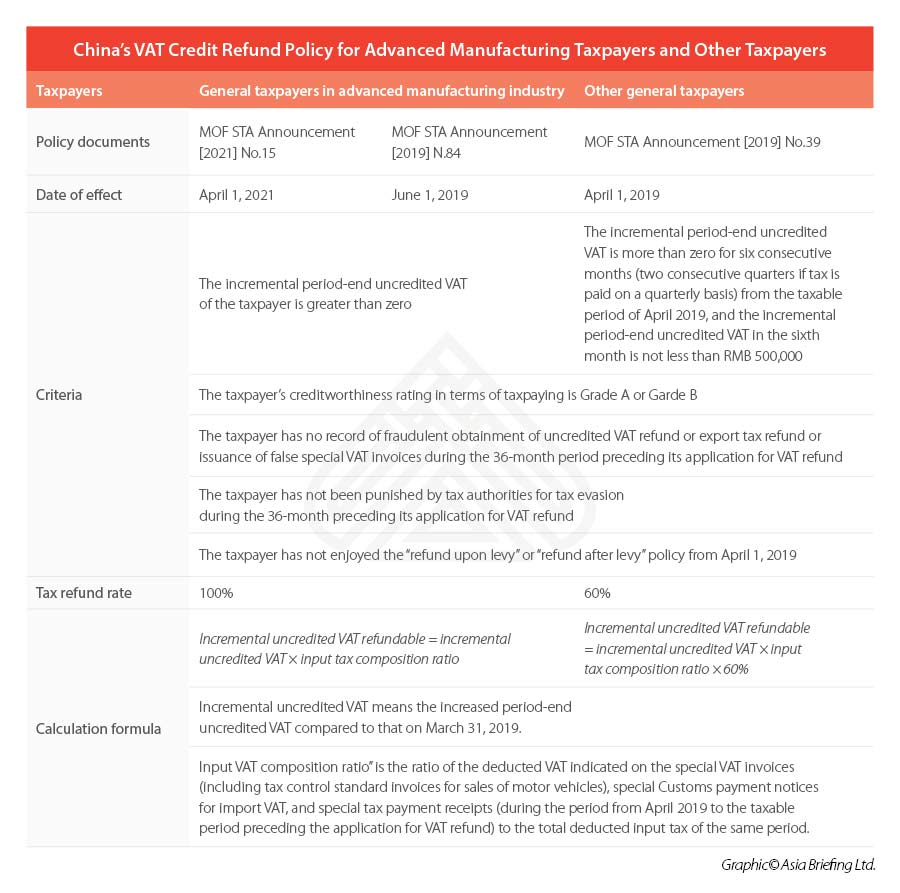

Same as before, the qualified advanced manufacturing taxpayer should satisfy all the following five conditions to enjoy the VAT refund policy:

- The incremental uncredited VAT of the taxpayer is greater than zero.

- The taxpayer’s creditworthiness rating in terms of taxpaying is Grade A or Garde B.

- The taxpayer has no record of fraudulent obtaining of uncredited VAT refund or export tax refund or issuance of false special VAT invoices during the 36-month period preceding its application for VAT refund.

- The taxpayer has not been punished by tax authorities for tax evasion during the 36-month preceding its application for VAT refund.

- The taxpayer has not enjoyed the “refund upon levy” or “refund after levy” policy from April 1, 2019.

China’s period-end uncredited VAT refund policy

Unlike the majority of countries, which allow companies to claim refund for uncredited VAT during the current taxable period, China used to generally only allow such uncredited VAT to be carried forward to the next taxable period. This led to cash flow issues for companies, particularly those with large input VAT credits.

Since 2018, China started to allow qualified taxpayers in 18 industries to apply for VAT credit refund during the current period. And this policy was expanded to all industries since April 2019 when the MOF the MOF and STA released the Announcement on Relevant Policies for Deepening VAT Reform (MOF STA Announcement [2019] No.39).

The Announcement [2019] No.39 requires that the incremental VAT credit of general taxpayers has to be more than zero for six consecutive months (two consecutive quarters if tax is paid on a quarterly basis) from the taxable period of April 2019, and the incremental VAT credit in the sixth month is not less than RMB 500,000 (US$70,500). As a result, a company in general industries can only apply twice a year for a VAT refund on the period-end uncredited VAT. The first month that qualified companies could begin applying for refunds for uncredited VAT was October 2019, six months after April 2019.

On September 4, the MOF and STA rolled out the Announcement on the Policy for the Refund of Period-End Uncredited VAT for Some Advanced Manufacturing Taxpayers (MOF STA Announcement [2019] No.84), which specified a similar but more relaxed tax refund policy for taxpayers in four advanced manufacturing sectors.

Unlike other taxpayers, eligible advanced manufacturing taxpayers don’t need to meet the six-month and RMB 500,000 requirements, so long as their incremental VAT credit is more than zero. Moreover, according to the formula in Announcement [2019] No.84, the proportion of tax refunds for eligible advanced manufacturers has been increased to 100 percent instead of 60 percent for other taxpayers.

These relaxed policies are undoubtedly a great benefit for qualified advanced manufacturing taxpayers, which will ease cash flow pressure and reduce the financial cost of taxpayers.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Beijing’s Investment Opportunities for Foreign-Owned Investors

- Next Article China and Central Asia: Bilateral Trade Relationships and Future Outlook