Planning Your 2021 Investment Budget: Opportunities in China

As businesses prepare their 2021 investment budgets, investing in China is still the top choice for foreign firms.

Having suffered through the worst of the outbreak in the initial months of 2020, China emerged stronger and more resilient, reflected in its disease control strategies, policy priorities, and support for the private sector.

After businesses and factories reopened and internal movement relaxed following the successful implementation of COVID-19 control measures, China proved itself to be a reliable investment destination.

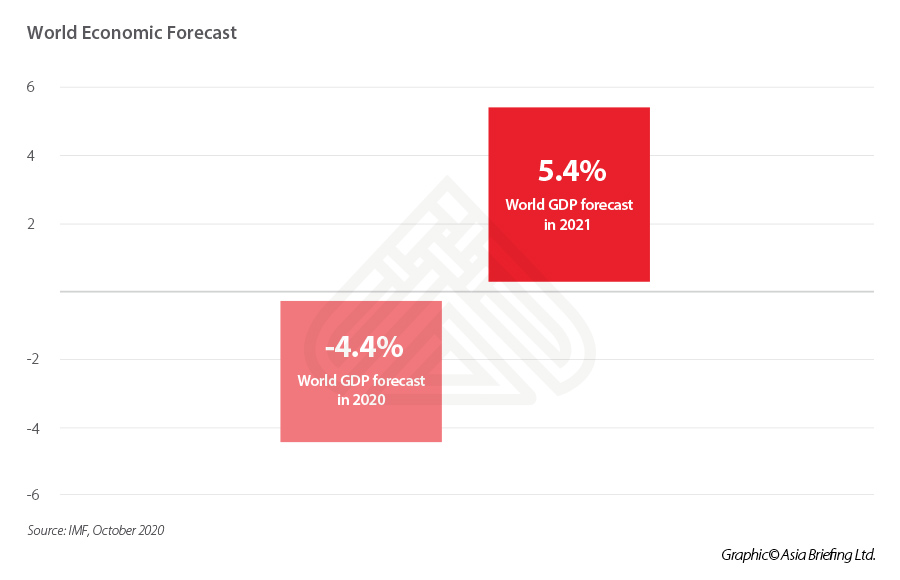

China’s economic outlook

According to official data released by China’s Ministry of Commerce, foreign direct investment (FDI) into China rose by 5.2 percent year-on-year to RMB 718.81 billion (US$107.2 billion) in the first nine months of 2020, with 22,602 foreign-invested enterprises (FIE) having newly established by the end of August. In September alone, FDI inflows into China reached RMB 99.03 billion (US$14.25 billion), up by 25.1 percent, as compared to the same period last year. Leading multinational companies, such as ExxoMobil, BMW, Toyota, and Invista, increased their investment into China.

This is in great contrast to the estimated 40 percent plunge in global FDI inflows in 2020. According to the World Investment Report 2020, released by the United Nations Conference on Trade and Development (UNCTAD) in June 2020, global FDI inflows are expected to drop below the trough reached during the 2008 global financial crisis. Among the major economies affected, FDI inflows into the US declined 64.5 percent in the first half of 2020, while Germany suffered a 23.5 percent FDI decline in the same period. Even Vietnam, the new favorite destination for foreign investors, saw its FDI inflow fall by 5.1 percent in the first eight months of 2020.

The most straightforward reason behind this is China’s relatively quick recovery from the COVID-19 outbreak. China’s COVID-19 spread was overwhelmingly brought into control in February, around two months after the virus was first recognized.

In April, Wuhan – the epicenter of the pandemic – lifted its 2.5 months-long lockdown. Despite new clusters emerging in Dalian, Beijing, Urumqi, and recently in Qingdao and Kashgar, China has shown its capability in the rapid containment and control of the infectious outbreaks.

Most remarkably, it has been able to implement massive test and trace operations wherever the clusters emerged, to expose any asymptomatic cases and expel chances of a wider spread of the virus. In Qingdao, for example, local health authorities tested 10 million inhabitants, discovered the origin of the cluster, and confirmed that there were no community spread risks within five days. Such effectiveness in controlling the spread of the virus provides security and confidence to the people living in China, as well as businesses and foreign investors.

By April 2020, 99 percent of large-scale industrial enterprises and 84 percent of small- and medium- sized enterprises had restored their production nationwide. The rate of personnel returning to work was 94 percent by this time. The general public also gradually returned to their pre-epidemic lifestyle, with 637 million people hitting the road for domestic trips during the National Day Golden Week in early October, 79 percent of the traffic recorded in 2019.

Consequently, China has taken the lead, globally, in achieving an economic rebound, having benefited from the restart of production activity, and reopening of logistic links. In the second quarter of 2020, China’s economy bottomed out and rose by 3.2 percent, making it the only G20 country showing positive growth indicators. In the third quarter, China achieved a 4.9 percent year-on-year growth, in line with market projections. According to the economic outlook forecast endorsed by reputed international financial institutions, China will register positive growth in 2020, even if it is by one to two percent, and will experience a seven to eight percent rebound in 2021.

In comparison, most other countries are still struggling to contain the spread of COVID-19 and are experimenting with extended home quarantines, social distancing in public spaces, travel curbs, and constant monitoring of public health. This has naturally resulted in social push-back due to public anxiety over jobs and livelihoods and increasing risks of deeper recession. This has put China at a uniquely advantageous position.

With a new wave of the pandemic expected to hit several countries, beginning from mid-October, the proven capability of China’s central and provincial governments to manage repercussions from unforeseen events and ability to adapt to fast-changing scenarios is appealing to foreign investors. China is therefore projected to play a bigger role in facilitating the survival of businesses in the global market as well as the rise of new and innovative ventures.

Foreign investors who had seriously considered moving out of the country due to the US-China trade war, rising labor and compliance costs, and domestic market competition, are now back to the drawing table to reassess their China strategy.

Key growth drivers

Beyond the swift measures taken to contain the economic fallout of COVID-19, China has other accumulated advantages to back up its outstanding position in the global market and maintain investor confidence.

Supply chain

China’s sophisticated manufacturing and logistics infrastructure ensures it will not get replaced in the global supply chain easily. According to Xinhua, the state-run press agency, China is the only country that possesses all the industrial categories in the United Nations industrial classification, which allows firms to source goods easily. China also boasts of the largest network of high-speed rail and expressways in terms of mileage, which allows products to be transported efficiently.

The importance of these transport advantages has become fully clear right from the start of the pandemic when global supply chains were seriously disrupted due to the aggressive implementation of infection control measures. From the production and supply of masks, protective suits, and medical equipment in the early stage of the outbreak, to consumer electronics, household goods, and festival products during later months, China’s exports have made up for overseas shortages in all kinds of goods segments.

Domestic market

Being the world’s second largest economy, China’s rising purchasing power, expanding middle class, and a population approaching 1.4 billion, touts it to become the largest retail market in the near future. In 2019, for example, total retail sales of consumer goods hit RMB 41.17 trillion (US$5.97 trillion), according to the National Bureau of Statistics. This trend has remained in the wake of COVID-19.

Due to vigorous employment support measures, the per capital disposable income in the first three quarters rose by 0.6 percent, as compared to the same period last year, reaching RMB 23,781 (US$3,548). Combined with other consumption promotion measures launched by the government, the total retail sales of consumer goods have experienced growth for two consecutive months in August and September. In September alone, the total retail sales of consumer goods reached RMB 3,529.5 billion (US$526.6 billion), rising 2.4 percent over last month.

The strong domestic market performance will benefit from China’s dual circulation strategy, which intends to spur China’s domestic demand, on one hand, and simultaneously create conditions to increase foreign investment and boost production for exports, on the other. The focus on tapping into China’s internal consumption patterns and domestic markets will also buffer the impact of global economic headwinds on the country’s economic and financial stability. This is why China’s government – at the central and provincial levels – have sped up market opening reforms to make it easier for businesses to scale up, innovate, and boost economic activity, and as a result, fuel consumption growth.

Bearing this in mind, it is not hard to understand why foreign investors are once again betting big on China.

Many foreign companies have started to produce goods specifically for local consumption in China, rather than use the country as a production base for export-led manufacturing as in the past. For many companies, China is now their largest market for growth.

China’s market reforms and opening

China has endeavored to attract greater foreign investment by relaxing more market access restrictions and continuously introducing improvements to the business and regulatory environment.

Key among its reform actions, are changes to the negative lists. These lists indicate which industries are subject to special administrative measures for foreign investors, or in other words, supervised by authorities when determining market entry, scope of operation, and access to local market. The negative lists were shortened again this year.

The 2020 National Negative List cut the number of restrictive measures by 17.5 percent, from 40 to 33, and the 2020 FTZ Negative List cut the restrictive measures by 18.9 percent, from 37 to 30. Taking auto manufacturing as an example, the restrictions on the share ratio of foreign investment in commercial vehicle manufacturing has been liberalized. Before, the Chinese party shareholding percentage in commercial automobile manufacturing was to be no less than 50 percent.

Besides, with the Foreign Investment Law and supporting regulations coming into effect this year, together with other reforms in the areas of company establishment, tax, finance, reporting and compliance management – foreign investors in China are playing on a more even ground with domestic competitors.

China has also publicly stated its intentions to accelerate market opening reforms.

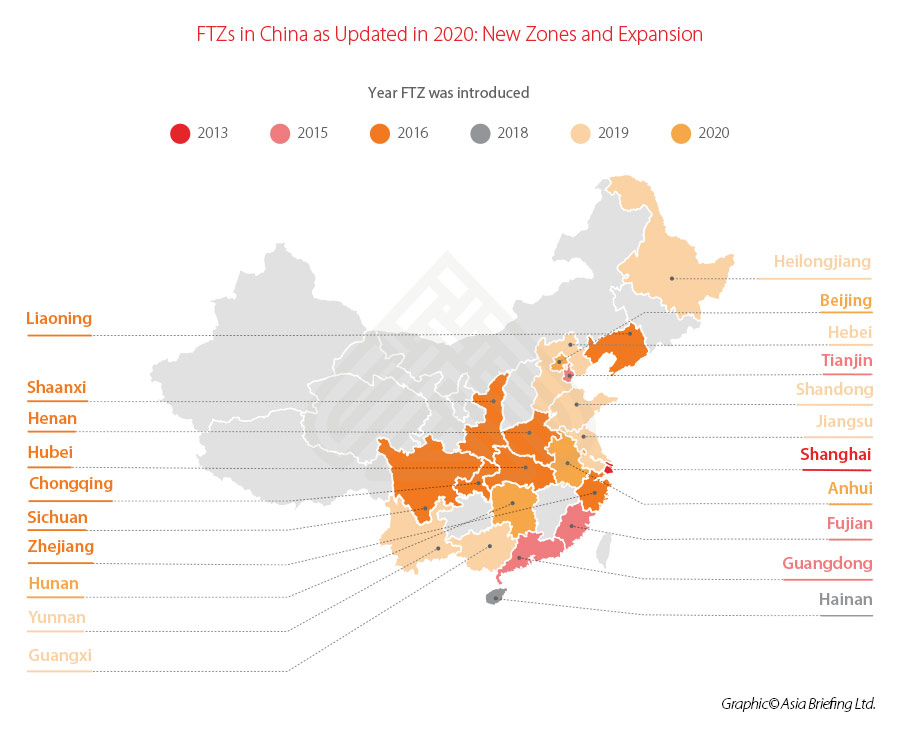

More free trade zones (FTZs) were announced to diversify scope and access to preferential incentives as well as pilot sector- and region-based relaxation of entry norms.

Most recently, on September 21, 2020, China announced it would establish pilot FTZs in Beijing, Tianjin, and Anhui, raising the country’s FTZ tally to 21. This also constitutes part of China’s efforts to transform into a more innovative, service, and consumption-driven economy and the creation of sustainable and high-end manufacturing capacity to attract international businesses.

Such policy orientation towards high-tech innovation and market opening – that was initially an outcome of US-China trade tensions – will pave the ground for future and sustainable patterns of growth and investment in China.

Which sectors in China show the greatest potential for foreign investors?

Service sectors

China’s service sector is the main driver of the country’s economic growth and the basis for the next stage of its development. With China transitioning to a more sustainable post-industrial service and consumption-driven economy, the service sector is growing at a faster pace – by 2019, it was responsible for 59.4 percent of total GDP growth.

Impacted by COVID-19 in the first few months, some service industries may see permanent disruptions as consumption habits change and the push towards digitization accelerates. Opportunities in the retail and e-commerce, living streaming, online education, healthcare service industry, etc. are increasingly becoming evident.

Take the online education segment as an example, which has steadily expanded in the last five years. Prior to the outbreak, market researchers projected China’s online education and educational technology market would grow by 12.3 percent to reach RMB 435.8 billion (US$61.5 billion) in 2020. Much of this market consisted of supplementary education, such as exam preparation, tutoring, and foreign language instruction. The forced closure of schools and universities due to COVID-19, however, led to rapid growth in the online education market and put renewed emphasis on educational technology designed for institutional use.

With, both, educators and students growing familiar with online education tools during the pandemic, the use of educational technology (EduTech) will likely become widespread going forward. Increasingly, EduTech will not just be used for distance learning and emergencies but will get integrated with traditional offline classrooms. Faced with the threat of another wave of the outbreak, educational institutions at all levels must now stay nimble and be prepared to pivot to online classes with little to no notice.

Food and beverage sector

In the wake of COVID-19, consumers are now more conscious of food hygiene and safety than before and growing more accustomed to online services. This means that the current state of China’s complex and fragmented food supply chains, which can produce inferior products, are expected to be the target of major reforms.

Stricter food safety regulations and innovative technologies will accelerate the integration, industrialization, and standardization of China’s food supply chains, thereby also enabling food safety traceability. China’s relatively less-developed cold-chain logistics system might also witness a shift toward how Europe has developed its cold-chain model.

In the upstream segment of the food supply chain, leading companies engaged in breeding, slaughtering, and processing livestock are being encouraged by the government to extend the industry chain at provincial markets. F&B enterprises should fully understand, plan, and prepare for these changes in China’s food supply chain. And, as the industry reforms, innovates, and upgrades, investors may find it more convenient to stabilize their market presence or navigate entry through merger and acquisitions (M&A).

Besides, the intermittent break out of zoonotic diseases like bird flu, swine flu, SARS, and now COVID-19, is pushing consumers to rethink their diet structures. Consequently, plant-based meat producers and retailers are seeing bigger opportunities emerge over a relatively short period of time. The demand for dietary supplements, immune-boosting foods, and energy drinks are also expected to climb. Health concerns, an aging population, and the expanding Chinese middle class cohort will continue to drive the future growth of the health foods market.

High-tech manufacturing

As China transitions from being a low-tech producer to a high-tech manufacturing hub, value-added manufacturing segments are set to be among those that benefit the most from the government’s preferential policies. Recent tensions with the US has impacted a wide range of segments, from China’s access to chips, to building 5G networks, operating social media applications, and determining how the internet is regulated. Consequently, China is doubling down on its efforts to boost domestic high-tech manufacturing industries, among which the integrated circuit (IC) and software industries are especially emphasized. Beijing views the technology sector as a strategic one and government support is expected to increase in the years to come.

In 2020, China further upgraded its supporting policies for the IC and software sector, which cover tax breaks, favorable financing, IP protection, and support for R&D, import and export, and talent development etc. In terms of tax concessions, IC producing enterprises will enjoy the most substantial corporate tax preferential policies, while IC design, equipment, materials, packaging, testing enterprises and well as software enterprises will also benefit from tax exemptions and cuts.

Considering the ambitious goal set by Chinese leaders – to produce 70 percent of all semiconductors used by China by 2025 (the percentage is only about 15 percent currently) – the IC and software sector remains appealing for foreign investors with China as the world’s largest market for semiconductor equipment. What is also noteworthy is that Chinese companies are encouraged to cooperate with overseas research institutes and foreign companies are welcome to build R&D centers in China.

What to expect in 2021

China’s successful containment of the coronavirus outbreak within its borders enabled the quick recovery of its economy. This was helped by China’s stable social environment, integrated industrial system, efficient and advanced service and logistic networks, well-educated human resources, as well as a sizeable domestic market.

Cumulatively, these factors and outcomes have helped the country avoid large-scale relocation of foreign and local companies, so far.

Given that COVID-19 is ongoing as the world awaits a vaccine, and disease prevention will remain the new normal in 2021, China’s resilience will continue to attract foreign investor participation. Businesses should prepare to take advantage of this and plan to exploit new opportunities and market openings, which will likely be supported by policy and tax incentives. Infrastructure projects along the Belt and Road will also be reaching completion in the next year, opening newer routes to facilitate regional investments and boost trade.

At the same time, it is advisable to consult with local professional service providers to accurately assess the significance of new growth areas, structure of incentives offered by local authorities, eligibility criteria and compliance obligations, as well as preferential policies available to foreign investors. For more information and advice on doing business in China, please feel free to contact us at china@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Erschließung neuer Wachstumschancen auf Chinas F&B-Markt

- Next Article China Signals More Reforms, Support for Private Businesses