Trading Opportunities Available Under the RCEP

This article was originally published on May 26, 2021, and updated on November 5, 2021.

- Update: The Regional Comprehensive Economic Partnership (RCEP) agreement will come into force from January 1, 2022, according to the Australian Government’s Department of Foreign Affairs and Trade. It comes as Australia and New Zealand become the latest member countries to ratify the agreement. Other countries that have ratified RCEP include Brunei, Cambodia, Laos, Singapore, Thailand, Vietnam, China, and Japan.

The RCEP agreement creates a free trade arrangement between ASEAN and Asia-Pacific nations, providing new trading opportunities through tariff reduction, new rules of origin, and trade-facilitation measures.

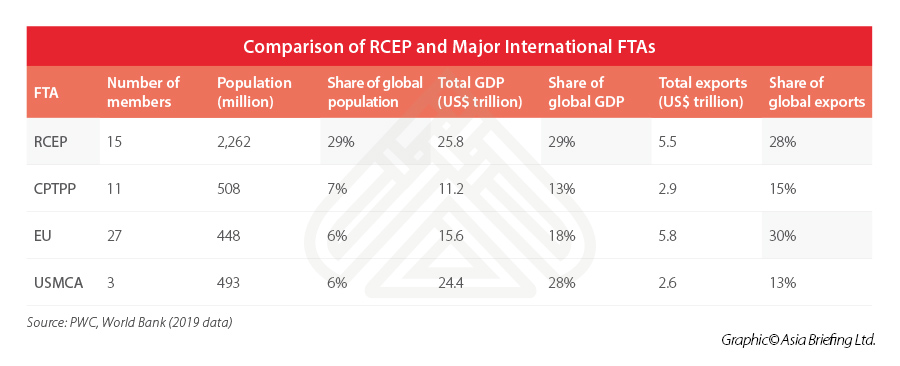

In November 2020, after eight years of negotiation, the Regional Comprehensive Economic Partnership (RCEP) Agreement was finally inked by 15 Asia-Pacific nations, by far becoming the largest plurilateral free trade agreement (FTA) in the world.

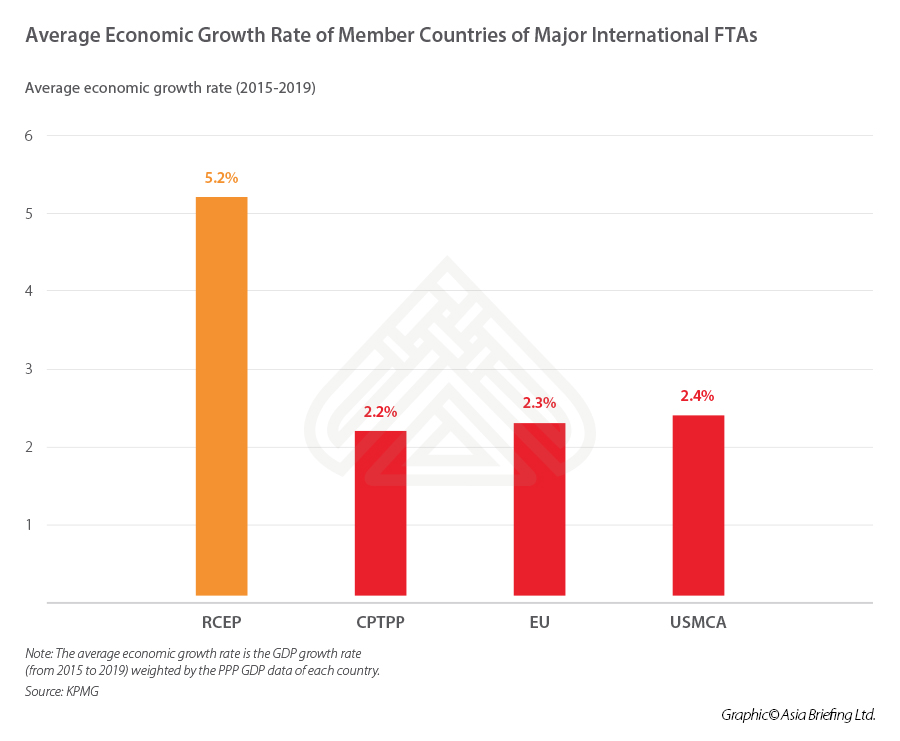

The signatory countries to the RCEP – 10 ASEAN countries as well as five non-ASEAN countries, China, Australia, New Zealand, Japan, and South Korea – cover nearly one third of the world’s population, one third of the global GDP, and one third of the world’s total exports. The bloc is also the fastest growing and most promising investment region in the world.

Once ratified by at least six ASEAN countries and three non-ASEAN countries, equivalently three fifths of all the signatories, the RCEP agreement will enter into force in 60 days. Analysts expect that could happen in the second half of 2021 or early 2022.

How significant is the RCEP agreement?

Despite the RCEP’s sheer size, opinions vary as to how significant it truly is. In fact, prior to the RCEP, most of its member countries have already existing bilateral FTAs – according to The Economist, of the 2.3 trillion in goods flowing between RCEP signatories in 2019, 83 percent passed between those that already have a trade deal.

Nevertheless, the RCEP agreement is the first FTA between China and Japan, Japan and South Korea, and Japan and Australia. This agreement is expected to lead to the long-awaited trilateral FTA among these countries; the China-Japan-South Korea FTA has been under negotiation for as long as the RCEP.

In terms of its content, the RCEP agreement combines various FTAs between ASEAN nations and other Asia-Pacific countries into one overarching compact framework.

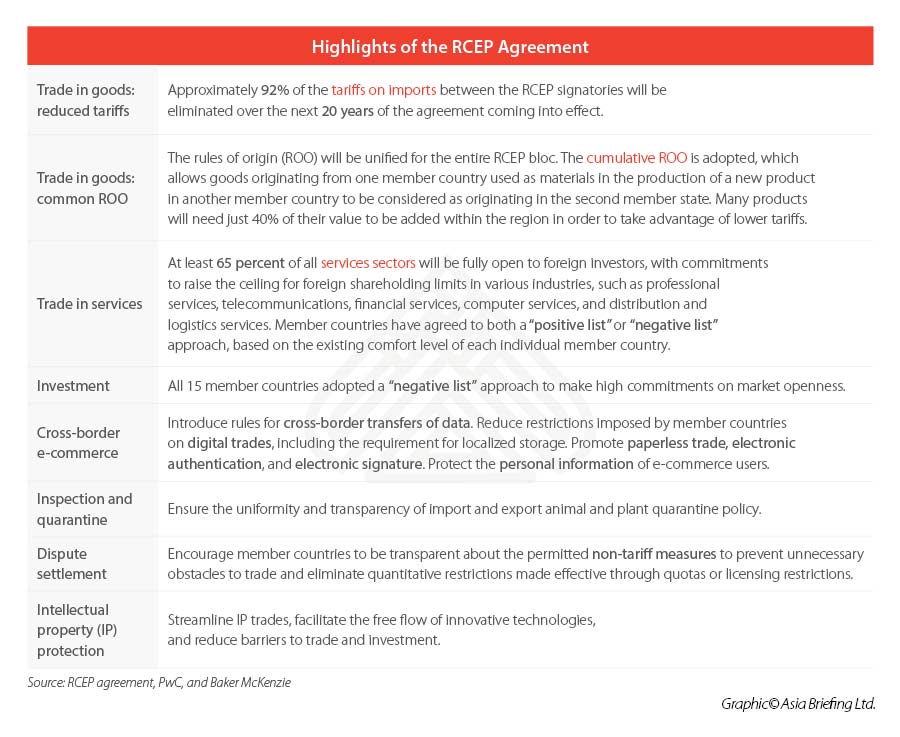

Consisting of 20 chapters and four market access schedules, the RCEP agreement covers typical provisions on trade in goods, trade in services, rule of origins (ROO), and customs procedures and trade facilitation. Beyond that, it also contains provisions that are less common in FTAs, such as provisions on small and medium-sized enterprises (SMEs), e-commerce, competition policy, and government procurement.

However, the RCEP is considered less revolutionary than the Comprehensive Progressive Trans-Pacific Partnership (CPTPP) agreement, since it lacks provisions on environment and labor standards and rules for state-owned enterprises (SOEs). Rather, the RCEP focuses more on tariff reduction and trade-facilitation measures.

What are the highlights of the RCEP agreement?

Summary of major provisions

Tariff elimination and reduction

The RCEP agreement is estimated to ultimately eliminate tariffs on over 90 percent of goods trading within the bloc over the next two decades.

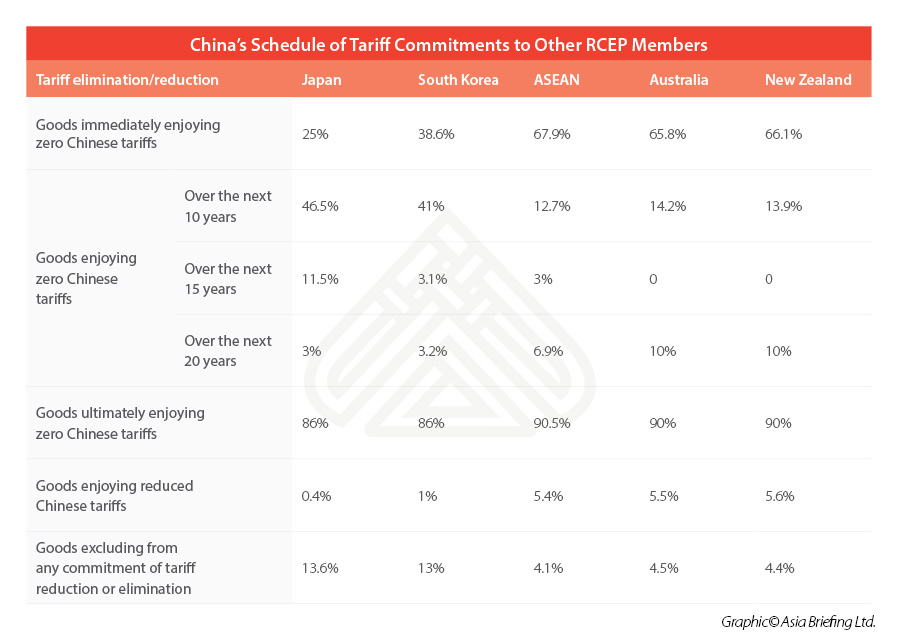

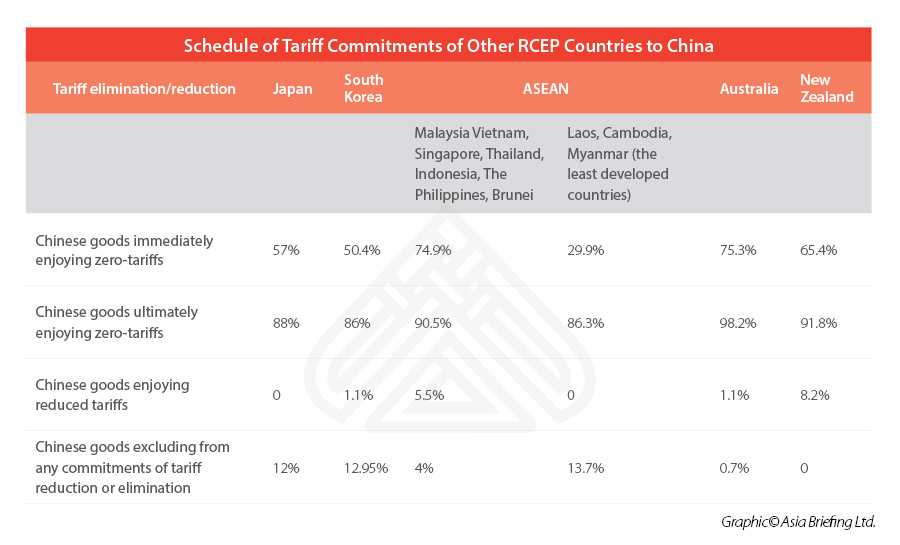

Under the framework of the RCEP, each member country sets out their Schedule of Tariff Commitments. Based on the Schedule, tariffs on specific products imported from other RCEP members can be abolished immediately once the deal enters into effect or be phased out over a transition period of about 20 years.

For example, under China’s Schedule of Tariff Commitments, China will ultimately cut tariffs to zero on 86 percent of Japanese and South Korean products, and 90.5 percent, 90 percent, and 90 percent of ASEAN, Australia and New Zealand, respectively.

In addition to the goods that already enjoy lower tariff under various FTAs, China will further cut tariffs on imports from ASEAN (such as adhesive papers, lighting and acoustic signaling devices for motor vehicles, car window lifters, unground pepper, canned pineapple, pineapple Juice, coconut Juice, nonene, diesel, etc.), imports from Australia or New Zealand (such as shark fin products, coconut oil, fiber board, etc.), and imports from South Korea (such as solar water heater, textile products and articles for specialized technical use, shark fin products, clutches and parts thereof for motor vehicles, etc.).

In return, over 85 percent of Chinese products can enjoy zero tariffs granted by other RCEP parties, among which 98.2 percent of Chinese products will enjoy zero Australian tariffs at length.

China-processed aquatic products exported to Indonesia and Malaysia, medicine products exported from China to the Philippines, household appliances exported to Brunei, paper products exported to Thailand, China-made deer antler, dextrin, scallop, and ceramic tiles exported to South Korea, and Chinese textiles, plastic products, and luggage and boxes exported to Japan will be entitled for tariff reduction or elimination thanks to the RCEP.

As the first FTA between China and Japan, the RCEP will immediately cut Chinese tariffs on 25 percent of Japanese imports (a big increase from the current eight percent) and cut Japanese tariffs on 57 percent of Chinese imports once taking effect.

Accumulative rules of origin

Another provision that is widely hailed as the most striking achievement of the RCEP is in the area of trade in goods – its rules of origin (ROO). The RCEP’s ROO will harmonize the disparate ROO provisions in ASEAN’s various FTAs and set regional-content rules.

The RCEP’s cumulative ROO allows goods originating from one RCEP member country used as materials in the production of a new product in another RCEP member country to be considered as originating in the second member country. Many products will need to have just 40 percent of their value to be added within the RCEP region to take advantage of lower tariffs.

Investors, especially multinational corporations, can expect lower costs and increased flexibility in regional supply chains layout once the RCEP is implemented.

Regional trading opportunities under RCEP

The RCEP’s members are at vastly different levels of economic development, ranging from the very developed countries, such as Japan and Singapore, to the very underdeveloped, such as Laos and Myanmar.

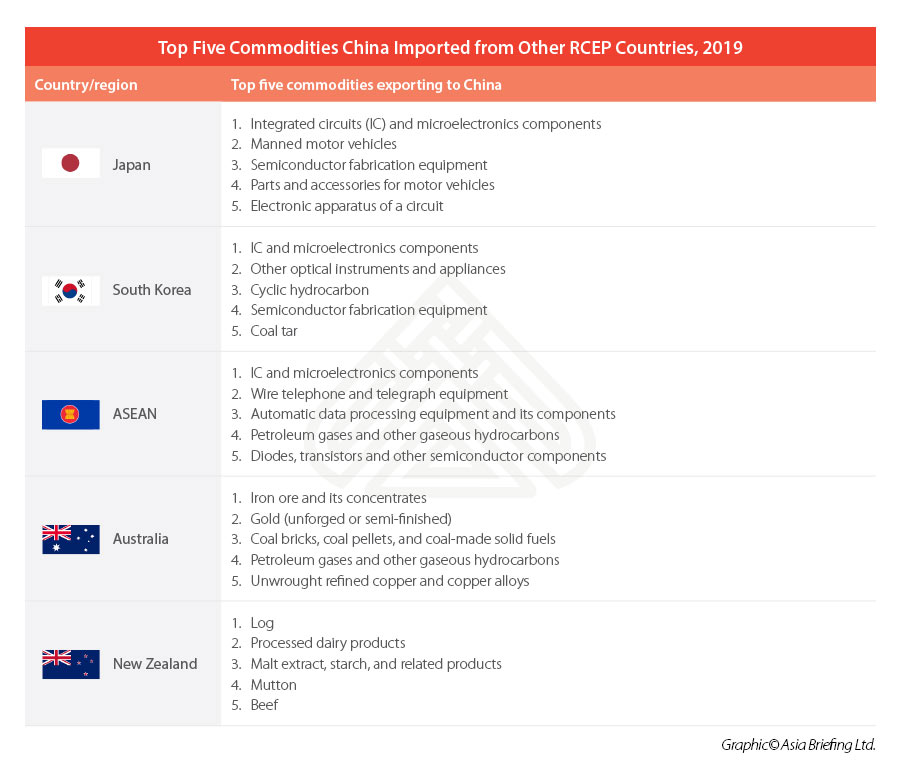

To better understand this economic map, the members might be grouped into four types of economies: exporters of high-tech or high-end products (Japan and South Korea), exporters of industrial raw materials and consumer goods (Australia and New Zealand), processing and entreport-oriented economies (the major ASEAN countries like Singapore and Malaysia), and manufacturing and consumer economy (China).

Due to the diverse economic and industrial structures of the RCEP economies, the deal is expected to have significant implications for expanding and deepening the intraregional supply and value chains.

As the first FTA involving Japan, China, and South Korea, the RCEP will enable extensive supply chain interaction between the three countries, especially in electronics industry, where Japan and South Korea occupy the high-end technology links of some electronics industry chains. For example, in the advanced display technology and industry, precision manufacturing equipment “evaporator” and its key raw materials are almost monopolized by Japanese companies, while South Korea holds many patents related to OLED (Organic Light Emitting Diode) screen manufacturing. China, while it has ramped up its R&D efforts, still relies on imports from Japan and South Korea. As China is growing as a major consumer economy in the Asian region, Japan’s automotive industry is also expected to benefit from Chinese households’ demand for vehicles.

At the same time, Australia and New Zealand, rich in natural resources, are likely to further develop the supply of industrial raw materials and final consumer goods to China’s maturing economy and tap into its consumption markets – Australia mainly exports iron ore, unforged gold, coal, and dairy products to China, while New Zealand mainly exports forestry products, dairy products, and meat.

ASEAN economies will be in a unique position to service China’s growing domestic economy with value-added consumer and intermediate products. Singapore will stand to gain mainly from growth in supplying China with chemical and petroleum products. Vietnam will develop a greater focus on electronics and machinery. The lower-income RCEP economies will also benefit from the significant shift of textile and apparel industries out of China to their lower cost bases.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article 2021 Data Shows Hong Kong Stands Firm as Vibrant Business and Financial Hub

- Next Article Companies with Equity-Based Compensation Plans are Subject to More Reporting Obligations in China