Shanghai’s Financial Industry – Policy Measures for Developing a Global Financial Center

In August 2021, Shanghai released several policy documents outlining its vision for developing the city into an international financial center. The documents include city-wide strategies for further liberalization and opening up of Shanghai’s financial industry during the 14th five-year plan period (2021 to 2025). At around the same time, the Lingang New Area of the Shanghai Free Trade Zone released its own set of policy measures to incentivize the growth of the local financial industry.

On August 24, 2021, the Shanghai Municipal Government released the 14th Five-Year Plan for Developing an International Financial Center (‘the 14th FYP’). The 14th FYP contains 44 policy measures aimed at turning Shanghai into an international finance center. It outlines the city’s ambitions for leveling up the influence of Shanghai’s capital markets on the global stage with measures such as the further liberalization of the renminbi (RMB) and the opening up of the industry to outside investors.

The release of this document came the day after the release of the Measures to Support the Innovative Development of the Financial Industry in the Lingang New Area of the China (Shanghai) Pilot Free Trade Zone (the ‘Lingang measures’). This document outlines specific incentives for foreign and domestic financial institutes to set up in the Lingang New Area, a key development area of the Shanghai Free Trade Zone (FTZ) in the city’s Pudong district.

In this article, we look at the development goals outlined in the 14th FYP that may impact foreign investors, and provide an overview of the incentive policies for financial institutions to set up in the Lingang New Area.

The 14th FYP for developing Shanghai’s financial industry

Shanghai is already home to a highly developed financial sector. In 2020, Shanghai’s financial industry added RMB 716.6 billion (US$111.4 billion) in value, accounting for 18.52 percent of the city’s entire GDP that year (RMB 3.87 trillion (US$601.5 billion)). The industry is now seen as a key driver of economic growth in the region, in particular the strategically important Yangtze River Delta (YRD) region.

The goals outlined in the 14th FYP aim to grow the scale of Shanghai’s financial industry, further liberalize the sector, open it up to foreign investment, and better utilize financial tools to fuel high-tech and innovative industries.

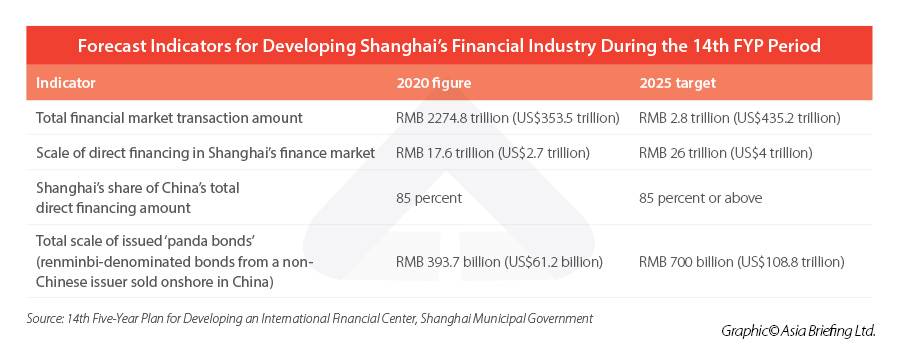

The measures outline specific targets for Shanghai’s financial industry in the 14th FYP period (2021 to 2025).

In addition to the above indicators, the document outlined the city’s aim to drive a higher level of recognition and influence of the ‘Shanghai price index’ for commodities in the international market and to attract or cultivate about 50 leading fintech companies by 2025.

The 14th FYP outlines eight key ‘tasks’ for reaching these goals. The task of highest interest to foreign investors is the measures to further liberalize Shanghai’s financial industry and open the industry up to overseas investors, as well as creating the infrastructure to better facilitate international trade.

One such measure is to further drive the internationalization of the RMB by turning Shanghai into an RMB-denominated asset allocation center. Plans to strengthen have been in the works for some time, with the city announcing goals for developing the asset allocation industry in guidelines for the development of the Pudong New Area released at the beginning of July.

Specific measures include:

- Facilitating global investors to carry out cross-border investment and financing activities in Shanghai.

- Promoting the establishment of an international financial asset trading platform.

- Accelerating the opening of China’s bond market, including the interbank and exchange bond markets, to further facilitate qualified foreign investors to participate in the Chinese bond market.

- Promoting the expansion of the futures market and providing more convenient risk hedging support for foreign investors holding domestic RMB assets.

- Increasing the number of ‘panda bonds’ issued.

- Supporting domestic players to directly issue ‘Yulan bonds’ to the international market. Yulan bonds are Chinese corporate bonds denominated in foreign currencies issued through the Shanghai Clearing House.

- Promoting the recognition of RMB-denominated bonds as qualified collateral in the international market and building channels for cross-border mutual recognition of RMB-denominated bonds and other collateral.

The measures also call for a higher level of participation of foreign investors that meet certain criteria in financial activity. This includes participating in securities, funds, and futures, or establishing financial institutions, such as life insurance companies, wealth management subsidiaries of commercial banks, insurance asset management companies, pension management companies, and credit rating agencies.

Specifically, the measures call for:

- Supporting foreign-funded financial institutions to expand their business scope and conduct business operations, maintaining consistency between domestic and foreign investment.

- Supporting more foreign banks to apply for securities investment fund custody qualifications and obtain underwriter qualifications in the interbank bond market.

- Supporting foreign-funded institutions to apply for fund investment advisory qualifications.

- Increasing use of RMB for cross-border trade and investment.

- Support the use of RMB-denominated settlement for areas such as trade in commodities, foreign project contracting, and cross-border e-commerce, and increase the ratio of RMB receipts and payments under the current account and for direct investment.

- Facilitate current account convertibility and cross-border trade investment and financing.

- Support the development of a cross-border RMB trade financing transfer service platform.

- Under the guidance of the national financial management department, explore the implementation of capital account convertibility.

- Improve the domestic and foreign currency account system and implement a more convenient cross-border fund management system.

The 14th FYP also aims to promote the development of Shanghai’s asset management industry. One proposed method for achieving this is piloting cross-border investment of private equity funds and promoting foreign institutions to manage domestic RMB funds by participating in the Qualified Foreign Limited Partnership (QFLP) program.

What is Qualified Foreign Limited Partnership?

Qualified Foreign Limited Partnership is a system under which certain qualified foreign asset management institutions can establish renminbi funds within ‘pilot areas’ on the Chinese mainland. There are currently 10 QFLP pilot areas in China and include the cities of Shanghai, Beijing, Tianjin, Shenzhen, and Qingdao.

The new measures double down on the expansion of the QFLP program, stating that Shanghai will:

- Promote the management of domestic RMB funds by foreign institutions participating in the QFLP pilot programs.

- Encourage qualified domestic institutions to participate in QFLP pilot programs.

- Support well-known overseas asset management institutions and qualified domestic institutions to apply for Qualified Domestic Limited Partnership (QDLP) pilot qualification.

However, the 14th FYP does not provide details on how the city plans to achieve these goals.

Finally, the 14th FYP specifically proposes deepening collaboration on capital markets with the Belt & Road Initiative (BRI) countries and member countries of the Regional Cooperation Economic Partnership (RCEP). The measures include:

- Deepening equity and business cooperation with financial markets of countries and regions along the “Belt & Road”, and promoting the cross-border interconnection of financial infrastructure.

- Supporting governments, enterprises, and financial institutes of BRI countries to issue securities and other financial products in Shanghai.

- Encouraging financial institutes from BRI countries to set up legal entities or subsidiaries in Shanghai.

- Supporting the New Development Bank (NDB) to increase strategic cooperation in investment and financing with countries and regions along the Belt & Road.

- Leveraging the signing of the RCEP to optimize financial services, such as cross-border payment and settlement, supporting the cross-border use of the RMB, and strengthening financial exchanges and cooperation with RCEP members.

It bears mentioning that the 14th FYP does not offer specific measures or solutions to achieve these ambitious goals. The document, however, serves as a useful gauge for the areas the government seeks to develop or reform and acts as a guideline for formulating and implementing incentives and other policy tools in the future.

To this end, the municipal government has already released specific policies for developing Shanghai’s financial industry in various districts of the city, and we expect to see more such policy documents to be released over the next five years.

Lingang New Area as a core driver of Shanghai’s financial industry

The Lingang New Area is a section of the Shanghai Pilot FTZ in the eastern Pudong New Area of Shanghai.

Established in 2019, the Lingang New Area has become a testbed for incentive policies and tax benefits aimed at cultivating strategic high-tech and innovative industries.

Now, the local government is aiming to boost its financial capabilities, which it sees as an indispensable player in the cultivation of trade and high-tech industries in the area. The 14th FYP specifically mentioned the Lingang New Area as a region in which to develop the financial industries, proposing to:

- Innovate internationally-oriented RMB-denominated financial products, expand the scope of overseas RMB-denominated domestic investment financial products, and promote the cross-border two-way flow of RMB-denominated funds.

- Launch a pilot for the high-level opening up of foreign exchange management.

- Support financial markets and financial institutions to provide financial services for offshore economic and trade businesses, and develop offshore RMB transactions under the premise of controllable risks.

- Explore and carry out pilot projects for the safe flow of financial data based on the construction of an international data port.

Incentive policies in the Lingang measures

To cultivate more financial institutions within the area, the Lingang administrative committee released the Lingang measures on August 23, 2021. The document is a revision of a previous document released in 2019 and outlines specific policy incentives and rewards to attract and develop financial institutes in the area.

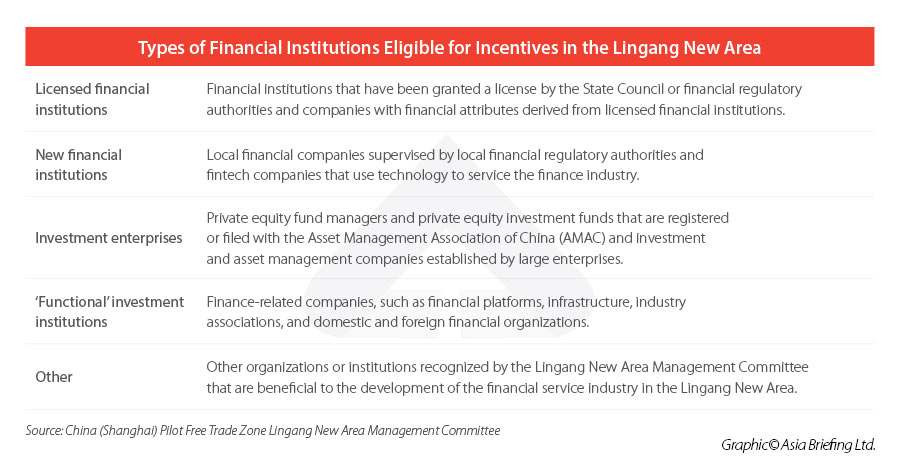

Who is eligible?

The Lingang measures specify the types of financial institutions that are eligible for the incentive policies.

The incentives also clarified that rewards are given only to companies that have been established in, relocated to, or obtained business licenses in the Lingang New Area from January 1, 2021 onward.

Companies that are granted any of the rewards for new financial institutes in the Lingang New Area must promise in writing not to leave the area or reduce the amount of registered capital for 10 years, starting from the year they receive the reward. Companies that violate this promise will be required to repay the monetary rewards or support they have received.

Incentive policies for setting up in Lingang

In an effort to attract more financial institutions to the area, the Lingang New Area offers rewards of up to RMB 60 million (US$9.3 million) for financial institutions that meet the above-mentioned criteria. Rewards include:

- Up to RMB 60 million (US$9.3 million) for licensed financial institutions with a paid-in registered amount exceeding a certain scale.

- Up to RMB 50 million (US$7.8 million) for new financial institutions with a paid-in registered capital exceeding a certain amount.

- Up to RMB 20 million (US$3.1 million) for financial institutions established under a company with a paid-in registered capital exceeding a certain amount.

- Up to RMB 10 million (US$1.6 million) to the entrusted investment management enterprises registered in the Lingang New Area for financial institutions established through a partnership with actual assets under management exceeding a certain amount.

-

Up to RMB 3.5 million (US$543,968) for branches of licensed financial institutions whose taxation and finance-related matters are managed by relevant bureaus in Lingang New Area.

- A one-time settlement reward of RMB 6 million (US$932,516), RMB 4 million (US$621,677), and RMB 2 million (US$310,838) for ‘functional’ investment institutions, given in accordance with their international, national, and provincial and ministerial level.

Rewards for economic contributions

All new financial institutions that are set up in Lingang are eligible for economic contribution rewards, which are given out on a yearly basis. The reward is based on their realized added value and local economic contribution from their total profit.

- Special purpose vehicle (SPV) companies engaged in financial leasing in industries, such as aviation, shipping, and large-scale equipment, can receive economic contribution rewards based on Lingang’s relevant policies for promoting the development of financial leasing SPVs.

- New senior managers and core staff in financial companies can receive a certain reward every year based on their economic contribution formed by their wages and salaries.

- The top 100 new financial enterprises that have contributed to local annual economic development since entering the Lingang New Area that year will be given an additional one-off reward of up to RMB 1 million (US$155,419).

Assistance for ‘characteristic businesses’

New wholly-owned financial institutions or holding companies that meet the conditions outlined in the table above are also eligible for certain rewards.

Certain new asset management institutions are eligible for rewards amounting to an unspecified proportion of their scale. This reward is given on a yearly basis for four years starting from the year following their establishment in the Lingang New Area, with the total amount capped at RMB 40 million (US$6.2 million).

Eligible institutions include:

- Banks and wealth management companies

- Security asset management companies

- Insurance asset management companies

- Public funds

- QFLP and QDLP pilot institutions

Fintech companies may also be eligible for additional rewards if they make large-scale investments, introduce a large number of new talent, and are an influential driving force in the area, provided they meet the requirements for the ‘new financial institution’ designation.

Incentives for talent

Senior management in a legal financial entity set up in the Lingang New Area may be eligible for a one-time talent introduction reward of RMB 200,000 (US$31,084) per person.

New high-end overseas financial talents who are in short supply and meet certain conditions will be subsidized for the difference in personal income tax between their home country and China.

Newly introduced employees of various financial enterprises and functional institutions may also be eligible for other preferential policies and supportive services, such as support with resettlement, housing purchase and rental, medical insurance, and children’s education.

Supporting the creation of industry clusters

The Lingang measures outline a number of incentive policies geared toward encouraging the aggregation of financial businesses in the Lingang New Area. The policies include supporting financial enterprises to lease their own office buildings in Lingang’s core area and subsidies for the establishment of headquarters.

Specifically, subsidies for up to 50 percent of the annual rent over a period of three years will be provided for key projects renting office space in financial clusters, based on the actual leased area and capped at RMB 10 million (US$1.6 million).

Supporting innovation in the finance industry

In an effort to encourage innovation, the local government offers a series of rewards for accomplishments in the financial industry. The rewards include:

- The “top 10 financial innovation enterprise” reward – a reward of RMB 10 million (US$1.6 million) for 10 companies in the area that have shown exemplary financial innovation achievements.

- The “top 10 enterprises in the financial industry” reward – a reward of RMB 500,000 (US$77,710) for 10 financial institutions given in accordance with key indicators, such as asset size and profitability.

- The “outstanding financial talent” reward – a reward of RMB 500,000 (US$77,710) for talents who have made outstanding contributions to the development of the financial industry in the Lingang New Area.

A blueprint for the development of China’s financial industry

Shanghai has been the financial powerhouse of China ever since the country’s opening up. Over the past three decades, the industry has developed into one of the most mature capital markets in the world and a key driver of development in the region and beyond.

Today, the city also acts as a testbed for pilot schemes in the financial industry and is on the frontline of China’s campaign to further open its capital markets to outside investment and internationalize the RMB. In this field, it may also represent a blueprint for further opening up in other Chinese cities as successful cases in Shanghai are replicated elsewhere.

Looking ahead, it is clear the city will not be content with being the financial center of China – it is seeking to increase its influence worldwide. The measures outlined in the 14th FYP and the Lingang measures represent a continuation of Shanghai’s ambitions to become a leading financial hub on the global stage.

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Human Resources and Payroll in China 2021-2022 – New Publication from China Briefing

- Next Article EU-China Comprehensive Investment Agreement