What are the Guidelines for Simplified Enterprise Deregistration in China?

By Fanny Zhang, Business Advisory Services, Dezan Shira & Associates’ Beijing Office

In order to further improve the efficiency of social resources utilization, reduce the exit cost of market entities, optimize the business environment, and continue to stimulate market vitality, China has continuously promoted reforms to its system of enterprise deregistration.

As the COVID-19 pandemic broke out in early 2020, many entities had to undergo self-liquidation, compulsory liquidation, or bankruptcy liquidation due to the deterioration of the market environment and difficulties in carrying on their business operations.

For China investors and/or shareholders, the application of online deregistration (or e-deregistration) can speed up the exit of enterprises and reduce exit costs, which is the best choice. But, it is important to understand the practical differences between e-deregistration and the general deregistration system and their respective liability.

Investors who intend to use the e-deregistration model should pay attention to the relevant legal issues to avoid unnecessary legal risks due to a hurried exit.

In this article, we briefly introduce the scope of application, process of, and legal risks associated with enterprise e-deregistration.

Simplified enterprises deregistration application

Scope of application

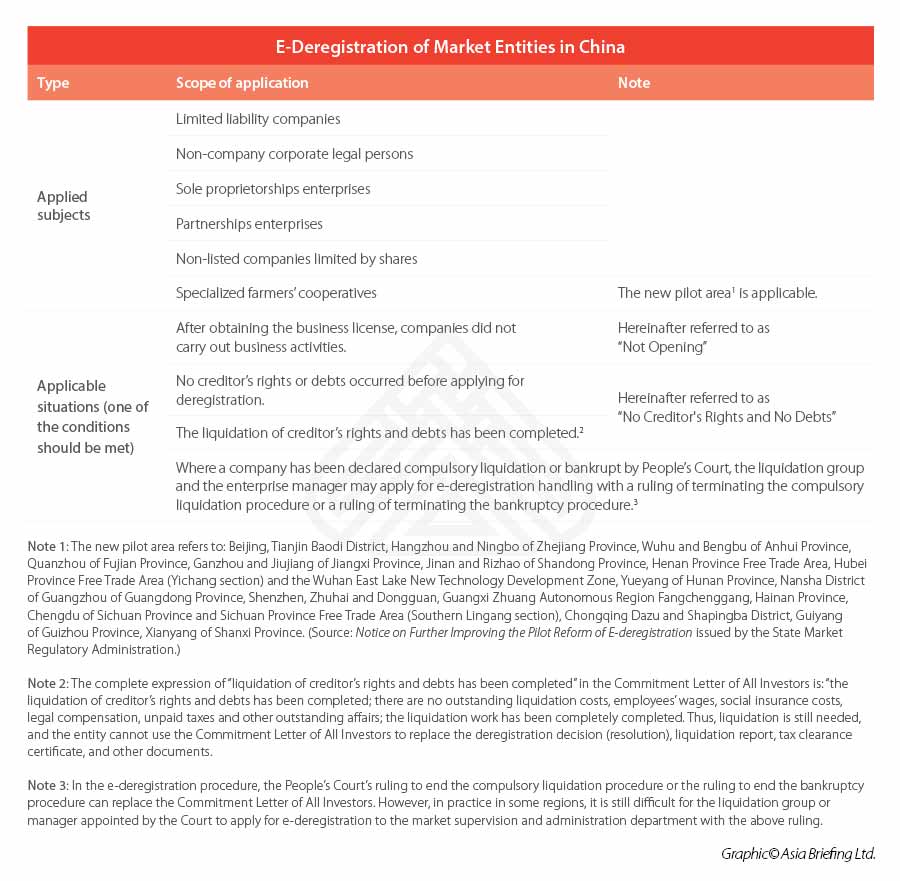

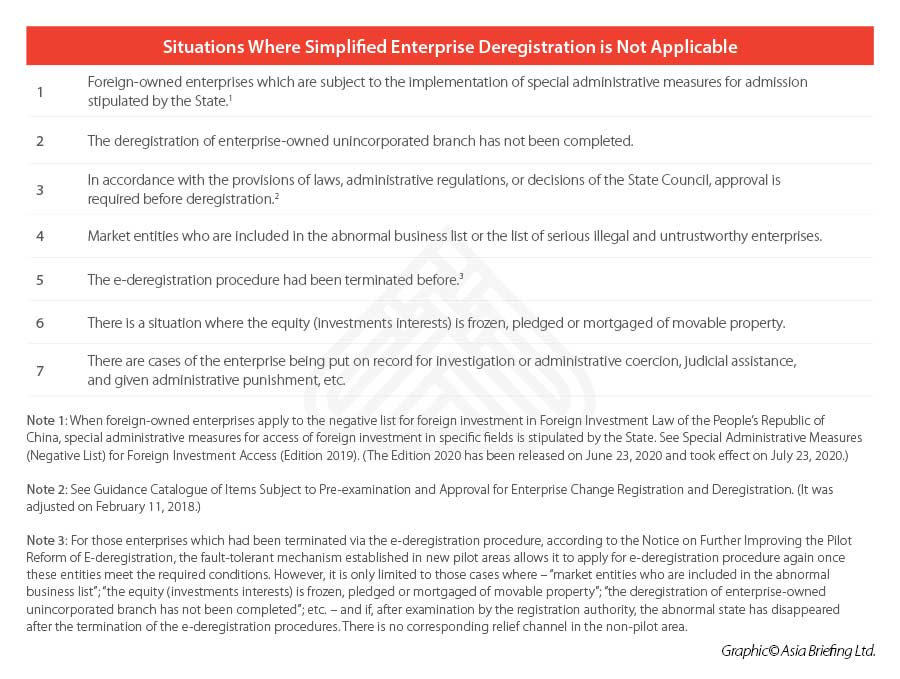

According to the Guidance for Comprehensively Promoting the Registration Reform of Enterprise E-deregistration issued by the State Administration for Industry and Commerce and Guidance for Comprehensively Promoting the Registration Reform of Enterprise E-deregistration issued by the State Market Regulatory Administration, the scope of market entities applicable to e-deregistration model is as shown in the table below:

Simplified enterprise deregistration procedures

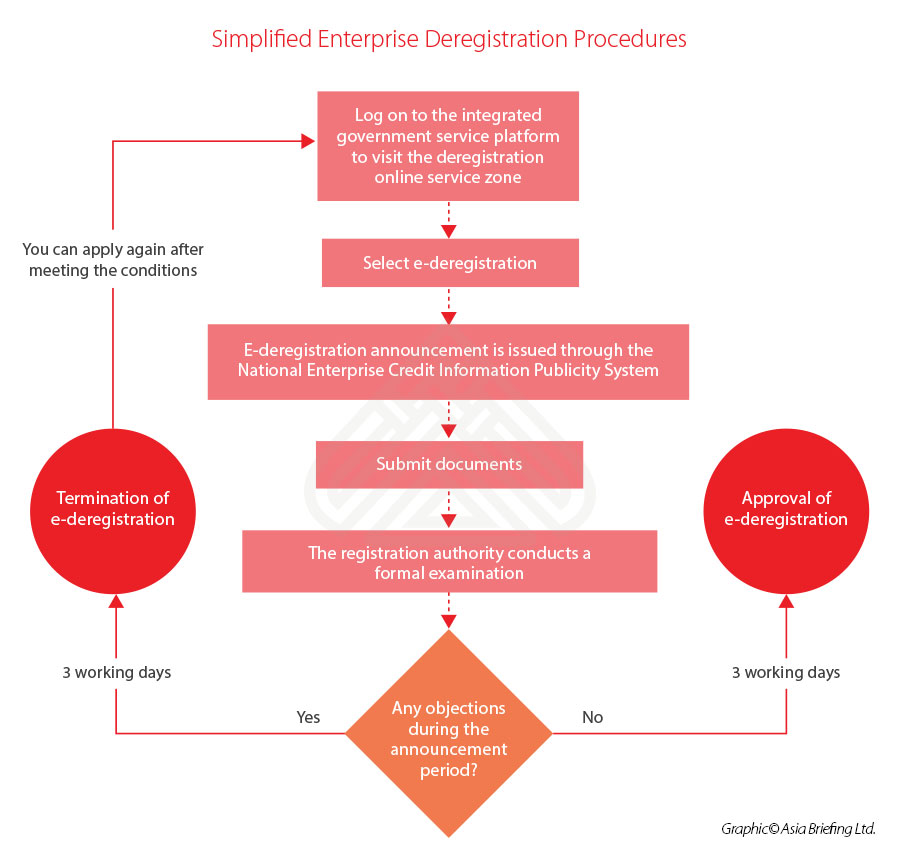

At present, all provinces and cities have basically realized the “one network” service of enterprise deregistration. According to the relevant provisions of e-deregistration, enterprises can carry out e-deregistration procedures as follows:

First, enterprises actively announce to the public that they intend to apply for e-registration through the “E-registration Announcement” column of the National Enterprise Credit Information Publicity System. The announcement period for the new pilot area of the Notice on Further Improving the Pilot Reform of E-deregistration is 20 days, and that of the non-pilot areas is 45 days.

After that, the enterprises submit the “Application”, “Power of Attorney for Designated Representative or Joint Agent”, and “Commitment Letter of All Investors” (the enterprises subject to compulsory liquidation shall submit the ruling of the People’s Court to terminate the compulsory liquidation procedure, and the enterprises that have ended bankruptcy procedures shall submit the ruling of the People’s Court to terminate the bankruptcy procedures), the original, and the copy of the business license.

After submitting the documents, the registration authority will conduct a formal review of the application materials. For applications that do not apply to the e-deregistration conditions, the registration authority will notify the applicant in writing (electronically or otherwise).

For enterprises that are objected to during the announcement period, the registration authority will make a decision not to grant e-deregistration within three working days (if an enterprise subject to the implementation of special administrative measures for admission stipulated by the State applies for e-deregistration, the regulatory authority will also raise objections within the period of announcement).

The registration authority shall, within three working days, make a decision to grant e-deregistration of an enterprise that has not been objected to within the period of announcement.

The biggest difference in form – between e-deregistration and general deregistration – is that the “Commitment Letter of All Investors” in the e-deregistration replaces the liquidation report, investor resolutions, tax clearance certificates, the filing certificate of the liquidation team, and newspaper samples published in the announcement.

The e-deregistration procedure is obviously faster and more convenient.

Legal risks of simplified enterprises deregistration caused by “presumption of good faith”

Enterprises that meet the applicable conditions can freely choose to apply for e-deregistration or general deregistration. Some enterprises blindly choose e-deregistration to exit the market as soon as possible. However, the principle of “presumption of good faith” contained in e-deregistration may bring certain legal risks to applicants.

The risks brought to the enterprise

The “presumption of good faith” for e-deregistration is reflected in the “Commitment Letter of All Investors” to be submitted for e-deregistration procedure.

The Commitment Letter is signed by all investors, and it is necessary to make a commitment to the decision of enterprise deregistration, no creditor’s rights and debts, and no unsuitable applied conditions.

If it breaks the law, the registration authority can cancel the deregistration of the enterprise, according to law. While restoring the qualifications of the enterprise as a subject, the enterprise shall be included in the list of serious illegal and untrustworthy enterprises, and shall be announced through the National Enterprise Credit Information Publicity System.

This not only prolongs the exit time, but also seriously affects the enterprise’ credit record and causes obstacles to general deregistration.

The risks brought to the investors

Article 5 of the Notice on Further Improving the Pilot Reform of E-deregistration stipulates that for enterprises providing false materials to defraud the e-deregistration, relevant interested parties may follow the Provisions of the Supreme People’s Court on Several Issues Relating to Application of the Company Law of the People’s Republic of China (II) (“hereinafter referred to as “the Judicial Interpretation II of the Company Law“) and apply to the People’s Court to protect their legal rights.

Article 11, paragraph 2 of the Judicial Interpretation II of the Company Law stipulates that where the failure of the liquidation team to perform notification and public announcement obligations pursuant to the provisions of the preceding paragraph causes the creditors to be unable to declare the creditor’s rights in time and in turn to repay such creditor’s rights, and the creditors assert that the members of the liquidation team bear compensation liability for the losses incurred thereto, the People’s Court shall support the assertion pursuant to the law. We believe that given the filing materials of the liquidation team in e-deregistration procedure have been simplified to the “Commitment Letter of All Investors”, it should be possible to determine that all investors are members of the liquidation team, and in the case of false promises, all investors generally neglect to notify creditors. Therefore, the creditor can pursue all investors’ compensation liability accordingly without receiving notice.

Article 19 of the Judicial Interpretation II of the Company Law stipulates that where the malicious disposal of the company’s assets by the shareholders of a limited liability company or the directors and controlling shareholders of a company limited by shares and the actual controlling parties of a company following the dissolution of the company causes the creditors to incur losses or where the shareholders of a limited liability company or the directors and controlling shareholders of a company limited by shares and the actual controlling parties of a company use a false liquidation report to handle legal person deregistration formalities with the company registration authorities without carrying out liquidation pursuant to the law, and the creditors assert that such shareholders of the limited liability company or directors and controlling shareholders of the company limited by shares and actual controlling parties of the company bear the corresponding compensation liability for the company’s debts, the People’s Court shall support the assertion pursuant to the law. We believe that given the “Commitment Letter of All Investors” in the e-deregistration procedure replaces the liquidation report and other materials in the general deregistration procedure, if an investor makes a false written promise to defraud the deregistration, the creditor can also use this as a reason to claim investor liability.

Article 20, paragraph 2 of the Judicial Interpretation II of the Company Law stipulates that where a company has handled deregistration formalities without carrying out liquidation pursuant to the law, the shareholders or any third parties have undertaken to bear liability for the company’s debts when handling deregistration formalities with the company registration authorities and the creditors assert that such shareholders or third parties bear the corresponding civil liability for the company’s debts, the People’s Court shall support the assertion pursuant to the law. We believe that the Commitment Letter is the basis for investors to assume the responsibility of guaranteeing company’s creditors for company’s debts. All investors make a commitment to the fact that the debts have not occurred, or the creditor’s rights and debts have been paid off, which is equivalent to guaranteeing company’s debts. In the case that the enterprise still has unliquidated debts, the investor shall jointly and severally bear the responsibility for repayment.

In summary, although e-deregistration procedure simplifies the deregistration procedures and brings convenience to enterprises and investors who want to quickly exit the market, it also comes with legal risks that cannot be ignored. We hereby suggest that investors carefully evaluate and handle necessary liquidation work, and refrain from being exposed to hidden liabilities by chance.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article China Signals More Reforms, Support for Private Businesses

- Next Article China Again Suspends Entry of Foreigners, Cites COVID-19 Risk