South China’s Business Environment in 2021 Looks Bright: AMCHAM Findings

- South China’s business environment in 2021 looks bright as companies surveyed by AMCHAM South China reported higher return on investment, despite a dip due to the pandemic, when compared to their global operations.

- Most American companies surveyed indicated no intentions of leaving China, rather many have expansion plans in the pipeline.

- Guangzhou, followed by Shanghai, Shenzhen, and Beijing, are the most preferred investment destinations. Dongguan, Chengdu, and Zhuhai also feature on investor radars.

As China navigates a faster than expected rebound from the initial economic shock due to the pandemic, it becomes important to understand how developments are transpiring on the ground. China’s economy is projected to expand by 7.9 percent in 2021 after showing two percent growth last year, and despite the numbers, the country is an outlier in the world.

China’s policymakers should be credited with the efficient infection control strategies as well as the roll-out of a spate of stabilization and income support measures that made it possible for businesses to restart activity.

Moreover, the pandemic – an event the likes of which comes only every few generations – unleashed far reaching, possibly permanent changes, on how we do business, consumption priorities, and innovations in key sectors.

Digital infrastructure, education and health services, climate resilience and green technologies, are just among the many frontier industries that will see expanding investment, R&D, and market growth due to the experiences spilling over from coping under and combating COVID-19.

Thus, while there will continue to be several challenges on the road to normalization, plenty of opportunities exist for businesses in China, and elsewhere.

In its 2021 White Paper and the 2021 Special Report on the State of Business in South China, the American Chamber of Commerce in South China (“AMCHAM South China”) takes a focused look on the business environment in China, in particular, how companies were able to survive unforeseen catastrophes and emerge stronger and optimistic. The publications offer a lot of insights on local practices, provincial growth and business experience, demographic trends, revenue and profitability, as well as what to expect from political maneuvers, trade deals, and general occurrences impacting the business environment in China.

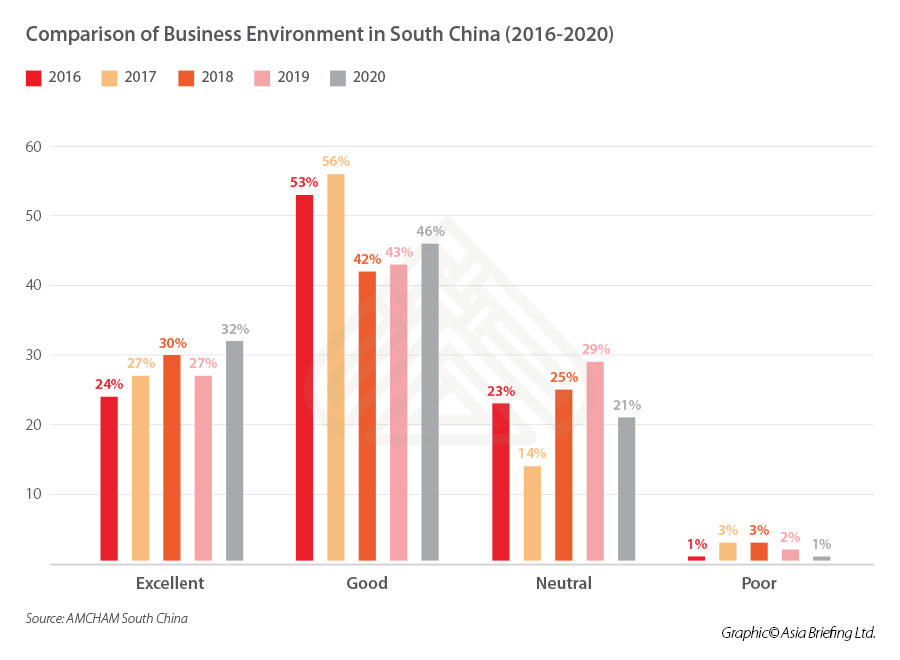

AMCHAM’s survey in South China met with mostly positive answers as most companies rated the business environment as ‘very good’ or ‘good’. Answers were more positive than the previous year, accounting for nearly 80 percent; those seeing a decline in the business environment accounted for only about 14 percent – a decrease of six percent year-on-year.

China’s business environment in 2021: Key findings

The overall message is a positive one and in the words of AMCHAM’s President: “I believe that there is much to be proud of as we enter 2021. Like a phoenix, we have risen again from what may have been certain catastrophic circumstances.”

Key findings include:

- 94 percent of American companies see a bright future in China’s market.

- None of the 208 companies surveyed showed willingness to leave China completely.

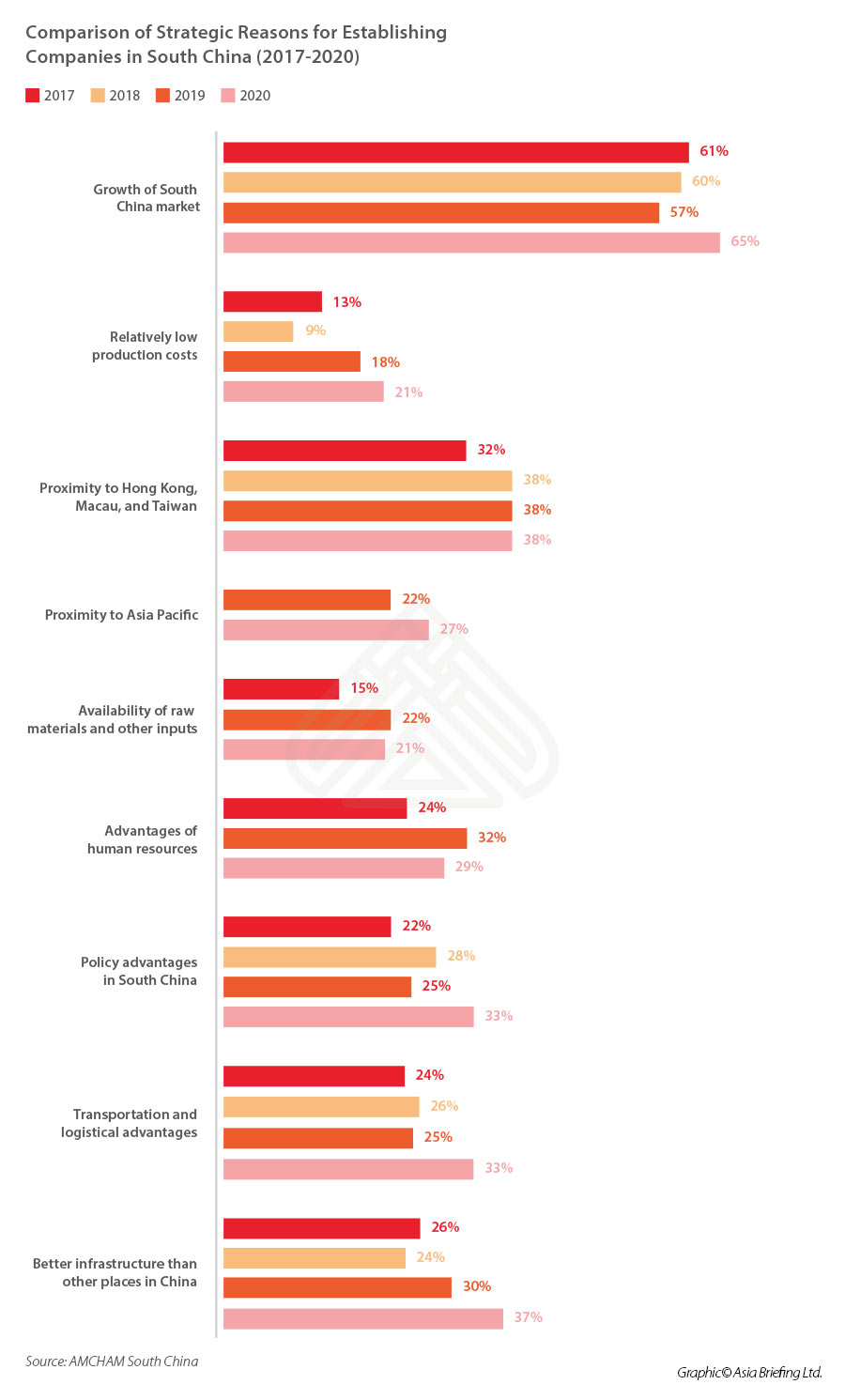

- China remains the top investment destination for more than half of the studied companies despite its decreasing traction as a manufacturing base.

- While a combination of factors, including the coronavirus pandemic, severely impacted the global economy in 2020, only a slight decrease in actual reinvestment in China was realized.

- Factors including huge market potential, preferential policies, and uncertainties in the pandemic management in other countries have whetted companies’ interest to increase reinvestment in China or shift investment to China.

- Nearly half of the participating companies show confidence in employment expansion despite China’s economic growth reaching an all-time low in nearly three decades in 2020.

- Most companies still have expansion plans in China for the following three years.

- The proportion of companies expanding in China in the next three years will, however, hit a new low when compared to the past five years due to COVID-19.

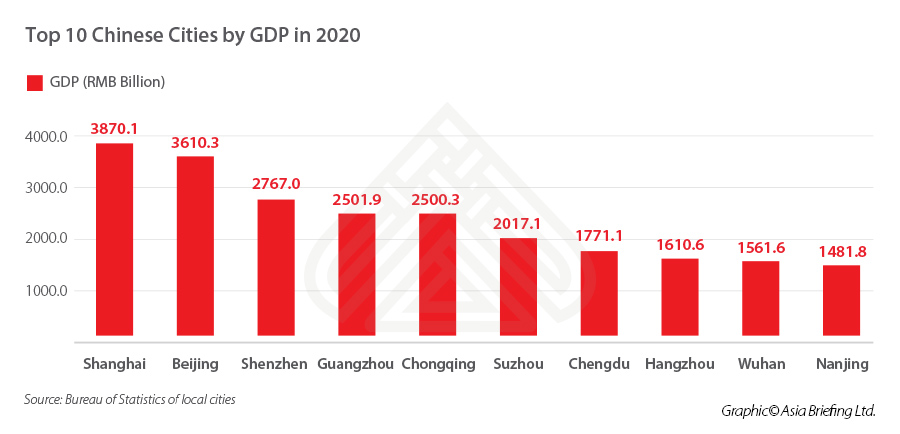

- Guangzhou is selected as the number one preferred investment destination in China, which remains unchanged for four consecutive years, followed by Shanghai, Shenzhen, and Beijing. Other cities including Dongguan, Chengdu, and Zhuhai feature prominently on investor radars.

- An overwhelming majority of companies state that visa and travel restrictions have an adverse impact on their operation. Over 50 percent of them were affected by China’s visa and travel restrictions while approximately 40 percent of them were influenced by American restrictions.

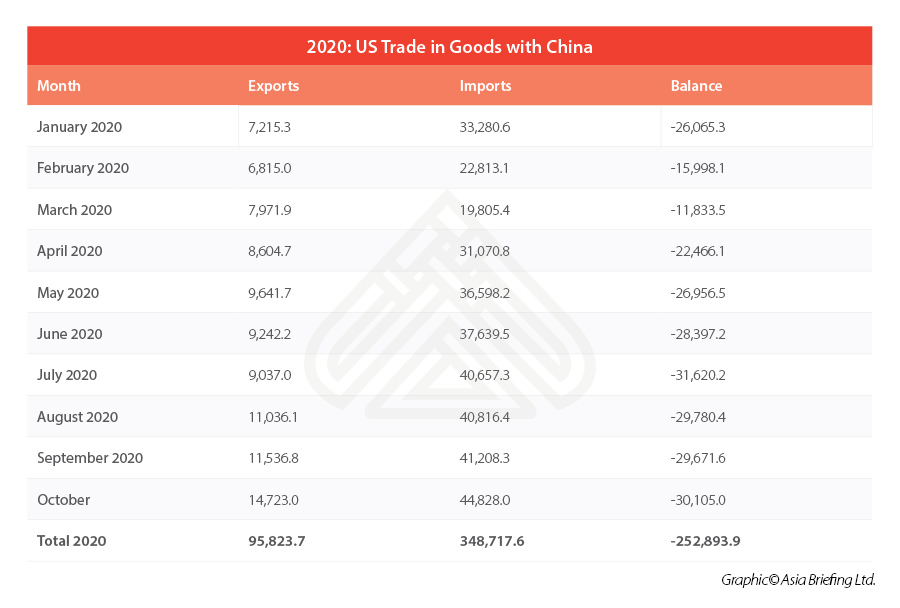

- With regards to the US-China trade war, the White Paper concludes that the objectives of the war (which were many) have not been completely fulfilled, with the trade imbalance between the US and China still a reality (with minor improvements) as you may see from the chart below.

Further, while the relationship between presidents Joe Biden and Xi Jinping appears to be less contentious, only time will tell if there will be practical differences in their bilateral engagement. This will have long-term consequences for US companies in China or trading with China and vice-versa.

Reading the findings within a larger context

Issues relating to the 14th Five Year Plan (FYP) of the Chinese government include the acknowledgement of growing inequality between rural and urban residents, environmental issues, and lack of quality innovation. The Chinese government has addressed these issues in the FYP. According to AMCHAM: “Battling the rural-urban development gap has been a goal for the CCP for decades, but very much remains a work in progress”.

On the national savings front, China’s savings rate remains at 46.2 percent, a rate much higher than the rest of the world, which has an average of 20 percent. There was a slight decline from previous years, which could be interpreted positively as consumers spent more. China has actively sought to boost consumption-led growth in its economy in recent years and develop services and high-tech manufacturing as key sectors – moving away from its legacy of low-cost export-bound manufacturing.

The Chinese government’s goals with the latest FYP include building an economic model focused on an open business environment, upgrading the country’s domestic innovation capabilities, and ensuring that growth does not come at the expense of environmental degradation. These intentions – sound like good news for foreign investors – but will need to be matched with actual progress.

The broader question that the AMCHAM White Paper answers is whether the future is promising for all who live, work, and invest in China. The conclusion is optimistic. After all, foreign direct investment (FDI) into China has been growing yearly since the country’s opening and – even in 2020, a pandemic year – this remained true.

In fact, China recently overtook the US as the number one destination for foreign investment, attracting an estimated US$163 billion in inflows, followed by the US with US$134 billion; as of 2019, according to data from the World Bank, foreign investment accounted for 1.1 percent of the Chinese GDP.

To contextualize the importance of foreign investment in the lives of ordinary Chinese citizens (which surely has an impact on the people that govern them), according to the National Statistics Bureau, in 2019, the number of workers employed as a result of foreign investment was 23.6 million, which accounts for around 5.3 percent of the urban employed population.

Thus, considerations of employment generation, cashflow, and market consumption – besides industrial capacity expansion and need for innovation – mean that China’s government has vested interests in ensuring a positive business environment in the country, that is, to attract continued foreign investment and corporate presence.

Spotlighting Guangdong: Why it is a driving force behind China’s economic growth

Guangdong remains the largest province in China by economic size, at RMB 10.77 trillion or 10.9 percent of the national total in 2019. Compared to other economic hubs in China, such as the Yangtze River Delta, Guangdong stands out for having:

- The largest external facing economy with exports accounting for 25.2 percent of the national total in 2019. Guangdong is also a major export processing base for foreign investors and the home of the Canton Fair, China’s largest export trade fair. Cities with the largest industrial production include Guangzhou, Shenzhen, Dongguan, Foshan, Huizhou, Jiangmen, and Shantou.

- The largest retail market of consumer goods at around 10.4 percent of the national total in 2019. With rising income levels and economic structural adjustments, the consumer expenditure pattern is also undergoing structural changes in favor of services, such as transportation and communications.

- Guangdong accounted for about 16.2 percent of China’s total utilized FDI and foreign investments in Guangdong are mainly engaged in tertiary sectors, including leasing and business services (27.6 percent of utilized FDI) and real estate (17.4 percent), followed by wholesale and retail trade (8.5 percent), and research and technical services (5.6 percent). The share for manufacturing, meanwhile, declined to 25.2 percent in 2019.

Guangdong Province endeavors to create a globally competitive business environment by giving play to the decisive role of the market in resource allocation, reducing administrative intervention, and strengthening comprehensive market supervision. Since 2015, Guangdong’s development has been driven by the launch of the Guangdong-Hong Kong-Macao Greater Bay Area, an innovative cluster that encourages foreign investment, strengthens conditional rewards and subsidies for enterprises, and promotes scientific research, talent, and trade cooperation with Hong Kong and Macao. In addition, it has created a free trade zone to encourage investment and trade.

Below are some findings that demonstrate Guangdong’s advantages:

Conclusion

If one were to summarize AMCHAM’s findings, the overall takeaway is that of optimism, faith, and growth, both, for foreign companies investing/based in China and the local residents who benefit from their presence (whether through employment, trade, etc.).

If the past year served a purpose, it was to make apparent that certain economies were better equipped to confront sudden adversity, manage to adapt to new realities, and rebound. China is one of those economies, and most people in the country have seen their lives return to normal.

This ability to react in a quick and decisive way, and thereby reinstate a climate of investment confidence, was the primary reason why the Chinese economy grew in 2020 and it will also be the reason why the future outlook is positive.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Incentives and Favorable Policies Available in Suzhou Industrial Park

- Next Article Is Taking More Than One Type of COVID Vaccine Safe?