Taking Advantage of China’s New Normal

Having suffered through the worst of the outbreak in the initial months of the year, China now offers the world a way to move forward.

China this year emerged from a public health crisis of unprecedented proportions more resilient than ever before. As businesses and factories reopened and internal movement relaxed following the successful implementation of COVID-19 control measures, China has shown a blueprint for what the new normal will look like after the pandemic.

Market trends in the country appear to be recovering although consumer behavior has permanently changed. While the rest of the world is still navigating a myriad of nervous realities every day – extended home quarantines, social distancing in public spaces, travel curbs, constant monitoring of the health of families, friends, and neighbors, and anxiety over jobs and livelihoods, China is forecast to show positive growth in 2020, albeit by two percent. The World Bank also forecasts the country to rebound to grow by 7.9 percent in 2021.

The parallel experiences of China versus much of the rest of the world has put the country at a uniquely advantageous position. And, foreign investors who had seriously considered moving out of the country are now wondering whether China’s recovery through rapid containment of the outbreak, and any new clusters that may appear, could propel it to lead the next phase of global economic growth.

Tapping into the new normal

Many foreign companies are now back to reassessing internal structuring plans – whether to shift their manufacturing base to lower tier cities to reduce costs or diversify to nearby countries while maintaining core operations in China? Foreign firms had seriously begun reconsidering their China exposure due to the US-China trade war, rising labor costs, greater compliance requirements, such as meeting environmental goals, and competition from domestic enterprises.

Yet, through the COVID-19 crisis, China has emerged as a reliable base for industries. Moreover, recent improvements in cultivating high-tech capacity in manufacturing and logistics have made it more viable for existing businesses to remain in China if they want to scale up newly developed products and service offerings in the post-pandemic economy. Investors are also well poised to roll-out new technological solutions as the expanding application of artificial intelligence (AI), cloud computing, and construction of 5G networks remain top priorities for Beijing.

From summoning key resources to survive the health crisis, enterprises in all sectors and industries in China have now moved into the next phase – strategizing how to grow their customer base, use digitized channels, and address gaps in the supply chain. Another interesting development is the focus on servicing local market demand to reduce global exposure. The world may depend on China for much of its manufacturing needs, but the country itself offers a vast market with rising purchasing power and an expanding middle class.

Moreover, over the past five years, Beijing has continuously worked to shift its economic trajectory towards being consumption and services driven. That of course has meant that any crisis impacting local consumer spending patterns would impact national growth.

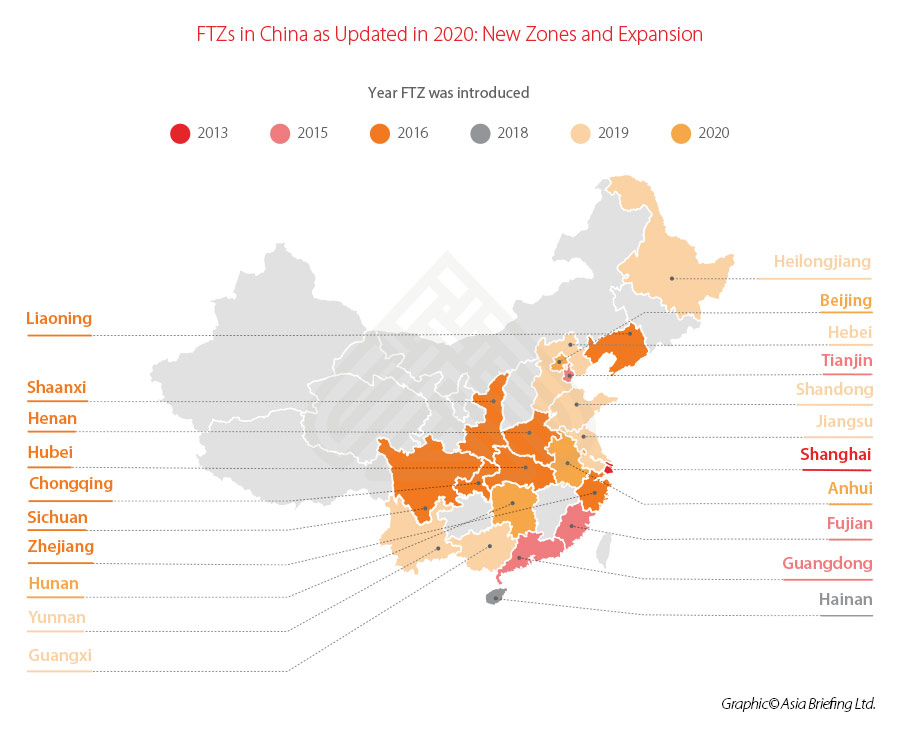

A solution to this has been the acceleration of market opening reforms to attract foreign capital, through the announcement of more free trade zones (FTZs) and cross-border e-commerce pilot zones and cities (CBECs), diversifying preferential incentives, and sector and region-based relaxation of entry norms.

More importantly, through its handling of COVID-19, the world’s second largest economy has shown that its central and provincial governments are more than capable of managing repercussions from unforeseen events and adapting to fast-changing scenarios.

At the same time, China has not focused on microeconomic policymaking alone. It has not abandoned the cross-regional Belt and Road Initiative, for example. Further, the Greater Bay Area scheme and the new Go West plan to develop the central and western regions of China, are key priorities for the government. Altogether, they seek to build critical regional infrastructure, augment trade routes with upgraded facilities to maximize logistics efficiencies, create the high-tech manufacturing and services capacity needed to attract more international business, as well as address the uneven levels of industrial development in the country.

Overall, China’s ongoing expansion of its FTZs and other incentive hubs as well as reduction of items on the prohibitive Negative List for FDI will facilitate the increased movement of goods, people, and capital – both to its market and as a base for increased exports.

China’s support for businesses in the aftermath of COVID-19

China has extended several tax and preferential policies, unveiled last year, to the end of 2020. For example, from May 1, 2020 to December 31, 2020, small low-profit enterprises (referring to the enterprises that meet requirements set out in the State Taxation Administration’s Announcement [2019] No.2) are allowed to defer payment of corporate income tax (CIT) until the first declaration period in 2021 after they make pre-payment declarations.

Similarly, China has asked banks to allow for the extension of repayment deadlines for corporate borrowers. In addition, China’s central and local governments have been rolling out a series of supporting policies to shore up the confidence of businesses and ease some of their compliance burdens. Since February, policies have been released to enable businesses to resume production as well as access tax and fee reductions and exemptions, financial support, reduced social security compliance requirements, energy cost reductions, and incentives targeted at the medical supply chain. Further, several policies have been released to facilitate foreign trade.

Businesses in China, including foreign-invested enterprises, can leverage these special policies to overcome the short-term challenges due to the economic impact of the outbreak. Over the long-term, these will give way to a faster opening-up of multiple sectors as China seeks greater foreign investment to boost economic growth, create jobs, and move up the chain of value-added enterprise.

At this year’s Two Sessions (Lianghui), held in late May after a two-month delay, China announced it would not set a GDP growth target this year as an economic goal – the first time since 1990 – but rather implement measures to support employment. (The Two Sessions are China’s most important annual political meetings and signal major policy goals and government intentions for the year.)

Jobs growth will necessitate the faster opening-up of key sectors or relaxation of regulatory requirements that indirectly blocked market access for foreign investors.

What makes China a reliable investment destination

The coronavirus pandemic, or COVID-19, has shaken all parts of the global economy without exception. Some countries, however, have emerged more successful than others as they have adopted clear strategies, mobilized critical resources in a timely manner, and secured widespread community engagement and support. China is at the forefront of this recovery, having suffered through the worst of the crisis at the start of the year. Key lessons learnt while managing the outbreak have quickly converted into important policymaking that targets the strengthening of public health systems, financial well-being of businesses, market stabilization, and supply chain restoration, all of which have cumulatively aided China’s faster than expected economic recovery.

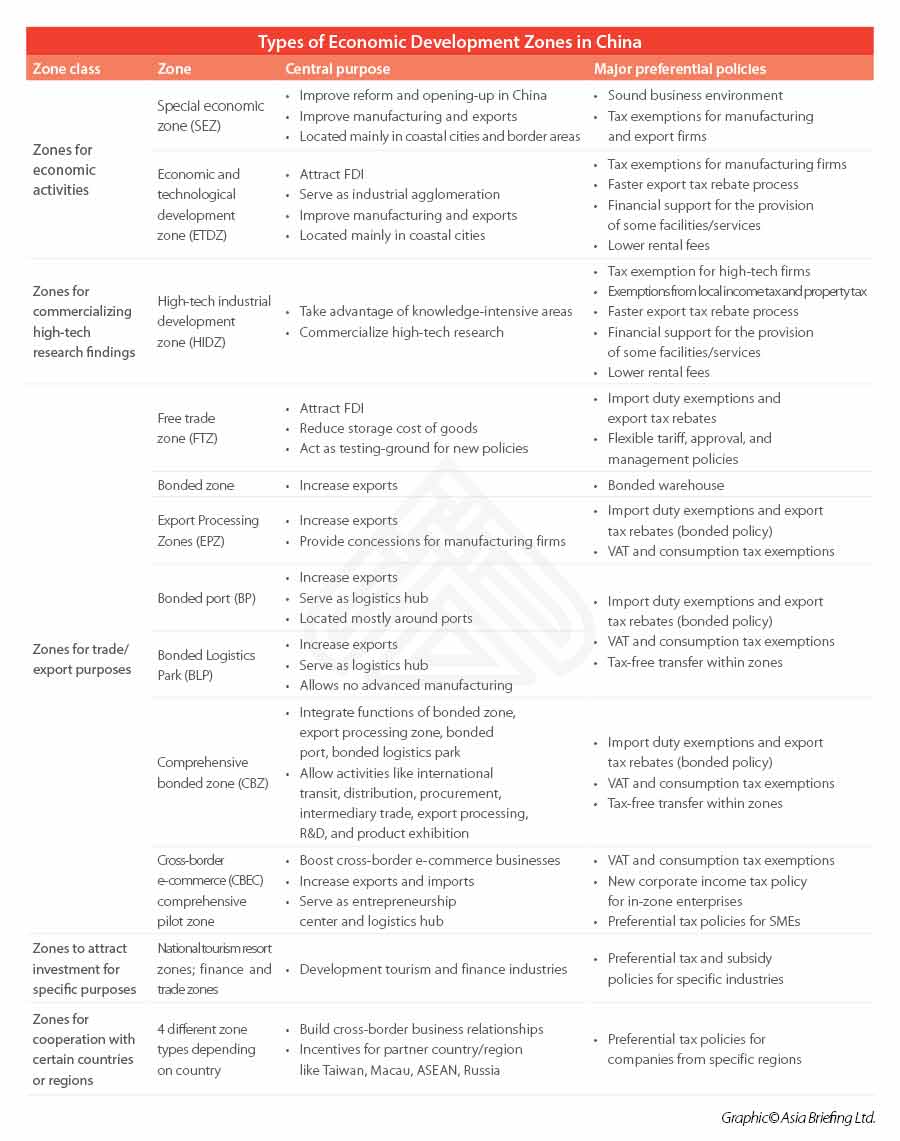

Beijing has also accelerated planned market openings in various industries as it seeks to facilitate more foreign investors. Below, we provide information on the major types of preferential zones in China where foreign firms can locate their investment and take advantage of targeted incentive schemes.

For quick reference, China has established multiple economic development zones (EDZs) since the 1970s. These are specific areas that provide preferential business policies, which differ from those governing the country as a whole. Since then China has evolved a diverse range of EDZs to attract foreign direct investment (FDI), depending on the industry and economic activity involved. Businesses operating in EDZs can expect, among other incentives, a higher level of autonomy over their operations, a variety of tax exemptions, land and building subsidies, and preferential employment and sourcing policies.

Foreign entities looking to invest in China are advised to understand and compare the incentives available in the country’s many economic development zones.

Future outlook

There is a clear trend enabling China’s economic recovery and that is the accelerated application of technology across all sectors of industry and services. Given the country’s pivot in recent years towards investing in high-tech innovation, the coronavirus outbreak has simply forwarded application timelines, as sheer urgency resulted in the almost immediate and widescale roll-out and use of tech solutions.

Whether these were software-based apps for tracking physical health and fitness parameters, surveillance of populations in lockdown, telemedicine, contactless devices, digital communication systems, e-commerce, or remote work management platforms – the speed with which new ideas, technologies, and operational changes were activated, customized, and normalized has permanently affected how companies will do business in China and with China, moving forward.

This article has been adapted from the China Briefing magazine, “Opportunities for Foreign Investors in China’s Service Industries After COVID-19”, which is available as a free download from the Asia Briefing Publication Store.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article What Do EU Investors Seek from China?

- Next Article Leading Trends in China’s Services Sector After COVID Disruption