Tax Implications of a Service Permanent Establishment

By Eunice Ku and Shirley Zhang

May 20 – With an increasing number of foreign enterprises starting to conduct business in China, tax liabilities resulting from business activities within the country are fast becoming an issue of key concern. If an establishment or venue of a non-resident enterprise constitutes a service permanent establishment (PE) in China, it will be subject to 25 percent CIT on all of its China-sourced income, as well as non-China sourced income that has an actual connection to the PE. We outline what constitutes a service permanent establishment in the current issue of China Briefing Magazine “Understanding Permanent Establishments in China,” which is available as a complimentary download on the Asia Briefing Bookstore through the end of the month.

The general principles on service PE taxation are laid out in Article 7 of DTAs, which makes clear that:

- Only profits of a non-resident enterprise attributable to its PE in China are taxable in China;

- When determining the profits of a PE, transactions between the non-resident enterprise and the PE are treated as transactions between independent parties;

- Expenses incurred for the business of a PE, including general and administrative allocated from the non-resident enterprise, are deductible; and

- Amounts paid to the head office or its other offices by way of royalties or interests on money lent to the PE are not deductible.

Corporate Income Tax (CIT)

According to the “Administrative Measures for the Assessment and Collection of CIT on Non-Resident Enterprises (Guoshuifa [2010] No.19, ‘Circular 19’),” non-resident enterprises are required to keep accurate and complete accounts so that the taxable income could be based on its actual profits, reflecting actual functions and risks. The CIT payable is calculated on an actual profit basis as follows:

CIT = Actual taxable income × CIT rate

For non-resident enterprises that are not able to accurately calculate its actual taxable income because of incomplete accounting books or other reasons, tax authorities are entitled to determine their taxable income using the following methods:

Actual revenue method:

- Taxable income = Total revenue × Deemed profit rate

Applied to situations where actual revenues, but not costs, can be deduced through accounting books or other reasonable ways.

Cost-plus method:

- Taxable income = Costs / (1 – Deemed profit rate) × Deemed profit rate

Applied to situations where costs can be correctly calculated, but not revenues.

Expenditure-plus method:

- Taxable income = Expenditures / (1 – Deemed profit rate– Business tax rate) × Deemed profit rate

Applied to situations where business expenditures can be accurately computed, but not revenues and costs.

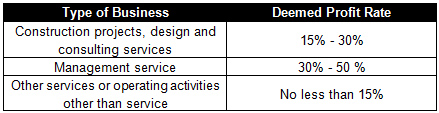

Circular 19 also provides a range of deemed profit rates that the tax authorities will apply depending on the business type of the non-resident enterprise:

In addition, if the tax authorities have evidence to believe that the actual profit rate of the non-resident enterprise significantly exceeds the prescribed ranges, they are allowed to apply a higher profit rate. No upper limit is specified. If a non-resident enterprise engages in several types of businesses, the respective taxable incomes should be calculated separately, or they will be uniformly subject to the highest profit rate applicable.

Non-resident enterprises that provide services are liable for Chinese tax to the extent of the income derived from those offered in China. Non-resident enterprises who render services both inside and outside of China should allocate profit based on the work load and cost. Chinese tax authorities may ask the non-resident enterprise to prove that the profit allocation is reasonable and genuine. If the non-resident enterprise is unable to provide the evidence, the tax authority could deem that the entire service happened in China and, therefore, the entire relevant income will be subject to Chinese tax.

For non-resident enterprises selling machinery equipment or products to Chinese enterprises and simultaneously providing services such as installation, assembling, technical training, guidance and supervision, the prices for both the equipment and the supportive services should be included in the equipment sales contracts.

If the price for the supportive services is not listed in the sales contract or if the listed price is not reasonable, the competent tax authorities could refer to the price level of identical or similar services to deem the revenues of non-resident enterprises from providing the supportive services. If no reference is available, service revenues would be deemed to be no less than 10 percent of the total amount of the sales contract. Therefore, non-resident enterprises are advised to create separate contracts for the equipment sales and supportive services. Note that even if the sales of equipment are not subject to Chinese tax because the transaction took place outside of China, the revenues from the supportive services provided in China will still be subject to China tax.

Also note that PE provisions in a DTA prevail over those on royalty service fees. In other words, royalty service fees that have substantial connections with a PE will be taxed as the profit of the PE, applying the 25 percent CIT rather than the reduced or exempted rates under the royalties provision.

Indirect Taxes

When a non-resident enterprise provides services to a Chinese company, the service fees are subject to a 5 percent business tax (BT), or value-added tax (VAT), and surcharges. The surcharges include the urban construction and maintenance tax (UCMT), education surcharge (ES) and local education surcharge (LES), which amount to an additional 12 percent on the total indirect tax liability.

A value-added tax (VAT) pilot reform to merge BT with VAT commenced in Shanghai and other provinces in 2012 and is expected to be implemented nationwide starting August 1, 2013 in various service sectors, including R&D and technology services, information technology services, cultural and creative services, logistics auxiliary services, and authentication and consulting services. In these sectors, a 6 percent VAT is imposed in lieu of BT.

Indirect taxes are withheld by the Chinese service recipient when it remits the payment to the foreign service provider and are paid to the tax authority. If the Chinese company is a general VAT taxpayer, it will be able to deduct the VAT paid against their output VAT incurred in its business operations. It is therefore advisable to stipulate clearly in the service contract that the contract amount is VAT-exclusive, so that the VAT does not become a cost for the foreign service provider while benefitting the Chinese company.

Individual Income Tax

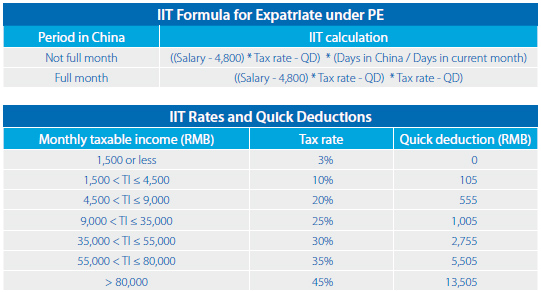

Once a PE is constituted, all expatriates working for the PE are subject to individual income tax (IIT) on their China-sourced income from the first day they arrived in China for the project, and the 183-day exemption rule under the DTAs will no longer apply. Their work will be taxed pro rata, (i.e., based on the number of days they are in China in a month). Tax filings and payments are made on a monthly basis. If it is not certain whether a project constitutes a PE, filing and payment can be postponed until the month when it is clear that the project does constitute a PE.

Portions of this article came from the May 2013 issue of China Briefing Magazine titled, “Understanding Permanent Establishments in China.” This issue of China Briefing Magazine casts some light on permanent establishment status in China by discussing the circumstances triggering a PE in China, focusing on Service PEs. We also discuss the tax implications for a non-resident enterprise where its activities in China constitute a Service PE in the country, and address the taxation of representative offices.

Portions of this article came from the May 2013 issue of China Briefing Magazine titled, “Understanding Permanent Establishments in China.” This issue of China Briefing Magazine casts some light on permanent establishment status in China by discussing the circumstances triggering a PE in China, focusing on Service PEs. We also discuss the tax implications for a non-resident enterprise where its activities in China constitute a Service PE in the country, and address the taxation of representative offices.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

This edition of the China Tax Guide, updated for 2013, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

- Previous Article India Poised to Be China’s New Engine for Growth

- Next Article China Allows Private Equity Investment in Insurance Companies