Tax Treatment in China and Hong Kong

In this article, we highlight several key tax rates in China and Hong Kong, including the corporate income tax, the withholding tax and individual income tax rate. We also outline several points of interest relating to the tax treatment of these items.

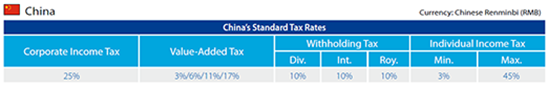

China’s Standard Tax Rates

Corporate Income Tax

- Rate: 25 percent

- Residency: Companies are legal residents if they are established under PRC law, or if a foreign company’s place of effective management is located in the country.

- Compliance: Tax returns are self-assessed and subject to audit by the tax authorities. Annual returns are due on May 31 after the end of the tax year, and quarterly (or monthly) returns are due 15 days after the end of the quarter..

- Incentives: Qualifying R&D expenses can receive a 50 percent supplementary deduction. Subject to the approval of tax authorities, companies located in the country’s central/western regions that conduct business in encouraged industries are eligible for a reduced 15 percent CIT rate. In 21 cities, recognized technologically-advanced service enterprises are also subject to this rate. Income earned from qualifying environmental protection projects, and companies using equipment that aids in environmental goals can receive tax reductions or credits.

RELATED: Calculating Taxes and Duties for Import to China

Indirect Tax

- Rate: Standard VAT of 17 percent for general taxpayers with certain products subject to 13 percent. Small-scale taxpayers face a reduced 3 percent rate.

- Other: Under the ongoing VAT reforms aimed at eliminating business tax, the transportation industry is currently subject to 11 percent and the modern services industry is taxed at 6 percent.

Individual Income Tax

- Rate: Up to 45 percent depending upon income and source of income

- Other: Employers and employees must contribute to social security insurance. Rates vary depending upon location and fund category.

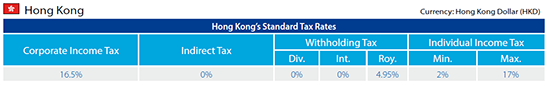

Hong Kong’s Standard Tax Rates

Corporate Income Tax

- Rate: 16.5 percent, or 15 percent for unincorporated bodies

- Residency: Tax is not levied on the basis of a company’s residence, although this concept does have some importance with transfer pricing, off-shore fund exemptions, and tax treaties.

- Compliance: Assess first, audit later approach. Tax returns are due on the following dates:

- April 30 of the following year if firm’s accounting year ends between April 1 and November 30

- August 15 of the following year if firm’s accounting year ends between December 1 and 31

- November 15 of the same year if firm’s accounting year ends between January 1 and March 31

- Incentives: Some outright deductions for certain expenditures that may include scientific research, expenditures on certain fixed assets or technical education. Incentives for capital expenditures on copyrights, registered designs, and registered trademarks in equal installments over five years.

RELATED: Individual Income Tax Comparison Across Asia

Indirect Tax

- Rate: There is no sales tax/VAT/GST in Hong Kong

Individual Income Tax

- Rate: Between 2 and 17 percent

This article is an excerpt from the November and December issue of Asia Briefing Magazine, title “The 2014 Asia Tax Comparator.” In this issue of Asia Briefing Magazine, we examine the different tax rates in 13 Asian jurisdictions – the 10 countries of ASEAN, plus China, India and Hong Kong. We examine the on-the-ground tax rates that each of these countries levy, including corporate income tax, individual income tax, indirect tax and withholding tax. We also examine residency triggers, as well as available tax incentives for the foreign investor and important compliance issues.

This article is an excerpt from the November and December issue of Asia Briefing Magazine, title “The 2014 Asia Tax Comparator.” In this issue of Asia Briefing Magazine, we examine the different tax rates in 13 Asian jurisdictions – the 10 countries of ASEAN, plus China, India and Hong Kong. We examine the on-the-ground tax rates that each of these countries levy, including corporate income tax, individual income tax, indirect tax and withholding tax. We also examine residency triggers, as well as available tax incentives for the foreign investor and important compliance issues.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email asia@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

- Previous Article China’s Relationship with the Contentious U.S. FATCA

- Next Article Understanding China’s Free Trade Agreements