The 2014 China Stir-Fried Prawn Index

Op-Ed Commentary: Chris Devonshire-Ellis

Jan. 22 – One of the methods in which the comparative costs – and spending power – can be measured across a nation is by taking a relatively simple, and well used commodity – and examining its differing price points across various cities. The Mars Bar Index is of course very famous for this, measuring the cost of the product in different cities around the world. These comparisons – although fun – also have some value because they shed light on other aspects of getting product to consumers – such as logistics and other related transportation and warehousing expenses.

Jan. 22 – One of the methods in which the comparative costs – and spending power – can be measured across a nation is by taking a relatively simple, and well used commodity – and examining its differing price points across various cities. The Mars Bar Index is of course very famous for this, measuring the cost of the product in different cities around the world. These comparisons – although fun – also have some value because they shed light on other aspects of getting product to consumers – such as logistics and other related transportation and warehousing expenses.

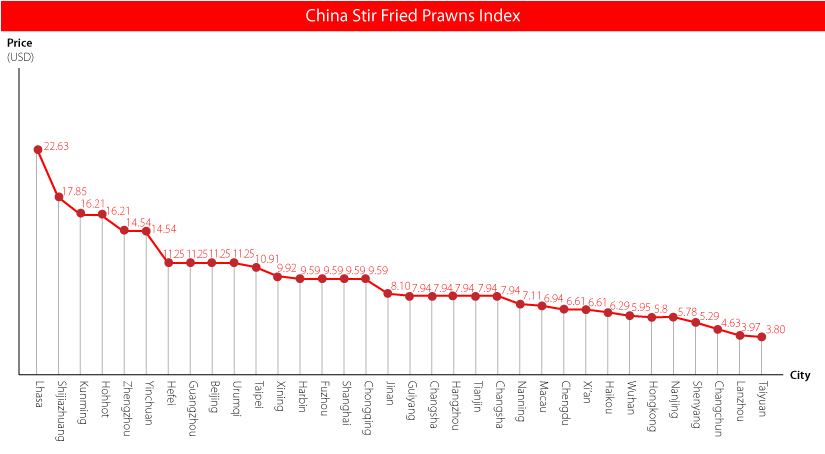

To that end, and to try and measure the comparative cost of a simple, yet nationally consumed product across China, we have chosen a simple dish of stir-fried prawns and examined the costs of purchasing this across each of China’s Provincial capitals – to see what would happen. Prawns are an interesting commodity to examine in this manner, firstly because the product is always the same, and secondly because as a perishable item it needs attention in handling and storing. This means the product carriers indicators as to China’s logistics costs in cold storage and transportation.

In terms of prawns sold in China, these are nearly always the Giant River Prawn (Macrobrachium rosenbergii). China produces 90 percent of the world’s demand of fresh water prawn, meaning that the cost data is consistent when the product being compared only comes in limited varieties. Elsewhere, Thailand is the world’s largest exporter of marine prawns, with the global market consuming only two varieties of prawn – Litopenaeus vannamei (pacific white shrimp) and Penaeus monodon (giant tiger prawn) – which account for roughly 80 percent of all farmed marine prawn.

In China, however, fancy restaurants aside, it is the Giant River Prawn that is sold as a relatively cheap consumer dish. Another cost variable could of course be in how the dish is prepared – however in our research we have kept to a simple dish of “stir-fried prawns” when examining, online, the variety of Chinese restaurant menus that we surveyed. All were large, popular restaurants to again try and inject some sort of legitimate comparison between them. No small restaurants, luxury menus or 4 or 5 star hotel restaurants were selected. Just the typically large one floor Chinese restaurant serving a whole variety of foods – your normal afternoon or evening dining experience in fact.

Prices were translated into US$ to make it easier for international readers to follow. The cost results were surprising.

Lhasa has China’s most expensive prawns, at a whopping US$23 per serving. We didn’t see that coming, however it makes sense. The city is a long way from the coast, and the transportation and refrigeration costs high. Urumqi on the other hand, arguably China’s most inland city, can afford to put on a plate at less than 50 percent of the prices in Lhasa – suggesting that cold storage and transportation links through to Xinjiang are far superior – which we can believe is certainly true.

However, several other cities not that far from the coast also showed up as expensive. Shijiazhuang, the military garrison city and capital of Hebei Province close to Beijing, is the second most expensive at nearly 18 bucks a plate. That’s nearly US$6 more than in Beijing, China’s capital, possessing some of the most expensive real estate in Asia. While cases can be made for the dish to be expensive in Hohhot, Yinchuan and Harbin, other inland cities seem able to offer the dish at far more reasonable prices. Taiyuan and Lanzhou are both well inland, but able to place the dish as the best value for money in the entire country. They both share, to some extent, the same rail infrastructure as Urumqi, but can provide the commodity at nearly a quarter of the price. We wonder if the dish is perhaps being used as a loss-leader in these cities to attract people into the restaurant, and make money from alternative items on the menu.

Also relatively inexpensive, and especially so given the overall cost of living in these cities, were Hong Kong and Taipei. This we feel is due to an improved and efficient infrastructure helping to get the dish to the restaurant in a timely and inexpensive manner. A lesson learned about the impact of improved infrastructure, and especially storage and transportation facilities – when in place, consumer prices drop.

Other surprisingly expensive cities were Hefei – which has a prawn industry of its own but seems to charge locals high prices for eating them – possibly because most are marked for bulk ‘export’ to China’s other cities, and overseas. If a locally produced product is in demand elsewhere, it can make the commodity scarce in its home town. I have witnessed exactly the same in Sri Lanka, where the famous chilli crabs of Singapore come from, yet are almost impossible to find in their country of origin – and those restaurants that do charge top dollar. Hefei, it seems, suffers from the same phenomena.

Meanwhile the apparent rise of the consumer class across China would seem to be an accurate reason as to why stir-fried prawns are now more expensive in cities such as Jinan than Shanghai, the former where it is still a luxury item against the latter where it is more commonplace, and ‘normal’. The Jinan consumer is more likely to pay more for what is still considered an upmarket item than the consumer in Shanghai. Cities that fall into this category include the likes of Xining, Chongqing, Guiyang, Changsha and Nanning. Not co-incidentally, each of these cities are undergoing significant GDP growth rates. Consumers there are prepared to pay more for luxury than in Shanghai, where luxury has become the new normal, and prices have dropped as a result.

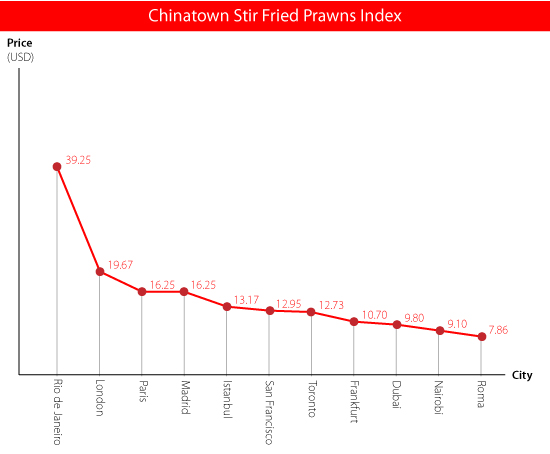

Additionally, to gauge the cost of a dish of prawns in China against other world cities, we also evaluated a handful of Chinatowns around the world.

Again, a surprise. Rio de Janerio can take the prize for the most expensive dish of stir-fried prawns in the world at close to US$40 a plate – getting close to double that of being served the same dish on the Roof of the World. Brazilian inflation, a huge jump in consumers ability to pay for luxury and possibly a warping of prices going on due to the on-going World Cup Soccer and Olympics projects being built, may be factors to consider when evaluating this very high expense. Of the rest, London and Paris would seem to be normal in terms of what could be expected as these are expensive cities. Yet Rome offers the best value – prawns of course are a staple in many Italian dishes, and San Francisco is reasonable. However it should be noted that Rome compares with China’s inland city of Changsha in consumer costs, and that many Chinese cities are now more expensive than that of Italy’s capital when it comes to buying a simple plate of food- such as prawns. This has significance when assessing both costs in China- and Chinese nationals’ increasing income levels.

Meanwhile, to see how China fared against Asia overall, and against nineteen other Asian cities, please see our Asia Stir Fried Prawn Index over on our Asia Briefing website.

We are sure some of our readers may have their own observations as to these findings. Please feel free to leave comments below.

Chris Devonshire-Ellis is the Founding Partner of Dezan Shira & Associates – a specialist foreign direct investment practice providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email asia@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

The 2014 Asian Stir-Fried Prawn Index

- Previous Article Chinese Outbound Tourist Numbers To Double By 2020

- Next Article Qianhai Receives Thirteen Administrative Approval Rights for Foreign-Invested Projects