The Annual Audit Compliance Process for FIEs in China

By Dezan Shira & Associates

Editor: Qian Zhou

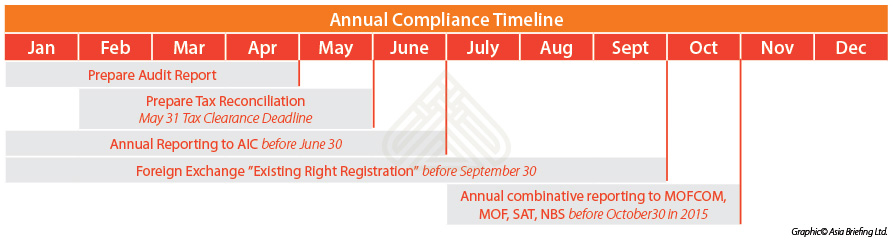

China has various nuanced annual audit procedures that FIEs will have to follow in order to achieve full compliance. Here, we provide a step by step guide to these procedures, including general requirements, key considerations, and materials to be prepared, with notes on regional differences and tips from experienced accountants and auditors.

Annual audit work for JVs, WFOEs and FICEs

For WFOEs, JVs, and FICEs, achieving annual compliance can be a long and complicated process. The work primarily involves producing a statutory annual audit report, a corporate income tax (CIT) reconciliation report, making “existing right registration” for foreign currency reconciliation, and reporting to relevant government bureaus. However, there may also be additional region-specific requirements for a foreign company to fulfill. Firms should either contact a service provider or the local government to ensure that they’re aware of these.

Step 1

Prepare a statutory annual audit report

General requirements

The statutory annual audit report consists of a balance sheet, an income statement and a cash flow statement. To ensure that foreign invested companies meet Chinese financial and accounting standards, including proper use of China GAAP, the annual audit report must be conducted by external licensed accounting firms and signed by a Certified Public Accountant (CPA) registered in China for compliance purposes.

The requirements for the audit report vary by region. For instance, in Shanghai, companies must include a taxable income adjustment sheet in the audit report, which is not a necessary supplement in Hangzhou, Beijing or Shenzhen.

The audit procedure takes about two months, and the audit report should be completed before the end of April in order to meet the May 31 tax reconciliation deadline.

Materials to be prepared

Materials to be prepared for the annual audit may vary by region. Nevertheless, it can be categorized into two groups – the accounting related materials and the administration related materials – as follows:

Accounting related materials:

- Financial statement and notes

- All accounting books, including foreign currency accounting books

- All accounting vouchers

- Account balance sheet—total accounts from level 1 to detailed opening balance, end balance and accumulated movements

- Bank statement and reconciliation sheet

- Real estate, vehicle ownership certificate

- Fixed assets sheet

- Tax returns and payments by month or quarter

Administration related materials:

- Business license

- Tax certificate

- Enterprise code

- Tax authentication

- Article of association

- Capital verification report

- Previous years’ audit report

- Accounting and financial management procedure and internal control procedure

- Organizational chart

- Board meetings minutes

- Lease

RELATED: Tax and Compliance Services from Dezan Shira & Associates

RELATED: Tax and Compliance Services from Dezan Shira & Associates

Step 2

Prepare corporate income tax (CIT) reconciliation report

In China, CIT is paid on a monthly or quarterly basis in accordance with the figures shown in the accounting books of the company; companies are required to file CIT returns within 15 days from the end of the month or quarter. However, due to discrepancies between China’s accounting standards and tax laws, the actual CIT taxable income is usually different from the total profits shown in the accounting books. As such, the State Administration of Taxation (SAT) requires companies to submit an Annual CIT Reconciliation Report within five months from the previous year’s year-end to determine if all tax liabilities have been met, and whether the company needs to pay supplementary tax or apply for a tax reimbursement. Generally, the Annual CIT Reconciliation Report must include adjustment sheets to bridge the discrepancies between tax laws and accounting standards.

Every year around March, depending on the area, the local Tax Bureau will issue annual guidance on CIT reconciliation. The Annual CIT Reconciliation Report is examined by the Tax Bureau to see if all tax liabilities have been fulfilled under tax law. Adjustments in financial statements caused by discrepancies between Tax Law and accounting standards are also required to be included in the Annual CIT Reconciliation Report.

FIEs that conduct frequent transactions with related parties should also prepare an Annual Affiliated Transaction Report on transfer pricing issues as a supplementary document to the Annual CIT Reconciliation Report.

Moreover, FIEs in certain regions need to engage a Certified Tax Agent firm in China to prepare another separate CIT audit report. In Beijing, this requirement applies to firms that meet the following conditions:

- Yearly sales revenue exceeds RMB 30 million;

- Carrying over last year’s losses to deduct this year’s income; or

- Yearly losses exceed RMB 100,000.

In Shanghai, the CIT audit report is needed when:

- Tax payers who have made a loss (current year loss) of more than RMB five million;

- Tax payers who have offset losses carried forward from previous years.

The deadline for submitting the CIT Reconciliation Report to the Tax Bureau is May 31 every year, but the investigation of the tax compliance could last to the end of the year, and companies should be prepared to provide supporting documents upon demand from the Tax Bureau.

Step 3

Annual reporting to AIC

According to the “Interim Regulations for the Publicity of Corporate Information”, each year from January 1 to June 30 all FIEs should submit an annual report for the previous fiscal year to the relevant AIC. This should be done through the corporate credit & information publicity system.

The annual report submitted should cover the following information:

- The mailing address, post code, telephone number and email address of the enterprise;

- Information regarding the existence status of the enterprise;

- Information relating to any investment by the enterprise to establish companies or purchase equity rights;

- Information regarding the subscribed and paid-in amount, time and ways of contribution of the shareholders or promoters thereof, in the case that the enterprise is a limited liability company or a company limited by shares;

- Equity change information of the equity transfer by the shareholders of a limited liability company;

- The name and URL of the website of the enterprise and of its online shops;

- Information of the number of business practitioners, total assets, total liabilities, warranties and guarantees provided for other entities, total owner’s equity, total revenue, income from the main business, gross profit, net profit, and total tax.

Step 4

Annual foreign exchange reconciliation

All foreign exchange transactions in and out of China are strictly controlled by SAFE, the bureau under the central bank of China that drafts rules and regulations governing foreign exchange and market activities, as well as supervises and inspects foreign exchange transactions.

Previously, SAFE required that all FIEs complete a Statement of Foreign Investors’ Equity to demonstrate the legality of their foreign currency inflow and outflow, and hire an authorized Chinese CPA firm to issue a Foreign Exchange Annual Inspection Report. However, according to the “Notice on Further Simplifying and Improving the Foreign Exchange Management Policies for Direct Investment” (Hui Fa [2015] No.13) effective since June 1, 2015, the foreign exchange annual inspection for direct investment has now been canceled. In its place, relevant market players are required to make an “Existing Right Registration” before September 30 each year. Failure to comply with the registration requirements results in the foreign exchange bureaus taking control over the parties in the capital account information system. Further, banks will not carry out foreign exchange business under the capital account for offending companies.

Step 5

Annual combinative reporting to MOFCOM, MOF, SAT and NBS

FIEs in China have been required to undergo an Annual Combinative Inspection jointly conducted by several governmental departments since 1998. However, pursuant to a Notice jointly released by MOFCOM, MOF, AIC, SAT, SAFE and NBS in 2014, the annual combinative inspection has now been replaced by an annual combinative reporting system. Unlike the annual inspection, annual reporting entails that relevant government bureaus take on the role of supervisors rather than judges. They no longer have the right to disapprove reports that are submitted, even if they think the reports are unqualified – they can only suggest the FIEs make modifications. Accordingly, relevant government bureaus no longer affix any seals on a report.

The deadline for this combinative report has yet to be fixed. In 2014, it was June 30, but it has been extended to October 30 for 2015. With this new rule implemented, the annual compliance requirements for FIEs have become much more manageable. All information can be submitted online and paper materials are no longer required.

This article is an excerpt from the November issue of China Briefing Magazine, titled “Annual Audit and Compliance in China 2016.” In this issue of China Briefing, we provide a comprehensive analysis of the various annual compliance procedures that foreign invested enterprises in China will have to follow, including wholly-foreign owned enterprises, joint ventures, foreign-invested commercial enterprises, and representative offices. We include a step-by-step guide to these procedures, list out the annual compliance timeline, detail the latest changes to China’s standards, and finally explain why China’s audit should be started as early as possible. This article is an excerpt from the November issue of China Briefing Magazine, titled “Annual Audit and Compliance in China 2016.” In this issue of China Briefing, we provide a comprehensive analysis of the various annual compliance procedures that foreign invested enterprises in China will have to follow, including wholly-foreign owned enterprises, joint ventures, foreign-invested commercial enterprises, and representative offices. We include a step-by-step guide to these procedures, list out the annual compliance timeline, detail the latest changes to China’s standards, and finally explain why China’s audit should be started as early as possible. |

![]()

Transfer Pricing in China 2016

Transfer Pricing in China 2016

Transfer Pricing in China 2016, written by Sowmya Varadharajan in collaboration with Dezan Shira & Associates and Asia Briefing, explains how transfer pricing functions in China. It examines the various transfer pricing methods that are available to foreign companies operating in the country, highlights key compliance issues, and details transfer pricing problems that arise from intercompany services, intercompany royalties and intercompany financing.

Annual Audit and Compliance in China 2016

Annual Audit and Compliance in China 2016

In this issue of China Briefing, we provide a comprehensive analysis of the various annual compliance procedures that foreign invested enterprises in China will have to follow, including wholly-foreign owned enterprises, joint ventures, foreign-invested commercial enterprises, and representative offices. We include a step-by-step guide to these procedures, list out the annual compliance timeline, detail the latest changes to China’s standards, and finally explain why China’s audit should be started as early as possible.

Managing Your Accounting and Bookkeeping in China

In this issue of China Briefing, we discuss the difference between the International Financial Reporting Standards, and the accounting standards mandated by China’s Ministry of Finance. We also pay special attention to the role of foreign currency in accounting, both in remitting funds, and conversion. In an interview with Jenny Liao, Dezan Shira & Associates’ Senior Manager of Corporate Accounting Services in Shanghai, we outline some of the pros and cons of outsourcing one’s accounting function.

- Previous Article Labor Dispute Management in China – New Issue of China Briefing Magazine

- Next Article Granting Restricted Stock Units to Your Employees in China