Will Foreigners be Subject to China Social Insurance in Shanghai?

Employers should note the regulatory documents being issued pertaining to social insurance in Shanghai and whether these obligations will impact foreign employees, as is being speculated online. In this article, we explain the reasons for the online speculation, discuss what we know, and provide information on China’s social insurance schemes.

According to much speculation online, foreign employees in Shanghai could be required to contribute to China’s social insurance scheme starting from August 2021.

This news may be based on the fact that the current legal document regulating foreign employee’s participation of the social insurance scheme, the Notice of Shanghai Municipal Human Resources and Social Security Bureau on Several Issues Relating to the Contribution to Social Insurance for Urban Employees by Foreigners, Persons with Permanent (Long-term) Residence Abroad and Residents from Hong Kong, Macau and Taiwan Working in Shanghai (Hu ren she yang fa [2009] No.38, the Notice) is about to expire on August 15, 2021.

According to the Notice, foreign employees legally working in Shanghai can choose to join China’s social insurance scheme in Shanghai on a voluntary basis, which is more like a benefit than a mandatory obligation.

As a result, foreign employees in Shanghai are exempted from contributing to China’s social insurance scheme, while most other cities have been asking for foreign employee’s participation in the scheme since 2011.

So far, there is no official document or notification confirming this news. All decision-makers of companies hiring foreign employees in Shanghai are not suggested to make any radical arrangements before receiving official notice.

However, considering the substantial impact of social insurance on the labor cost, the calculation of individual income tax (IIT), as well as the compliance of human resources (HR) management, it’s necessary for potentially affected companies to have a comprehensive understanding of China’s social insurance system and make some preparations in advance.

As the Notice only discusses social insurance, and foreigner’s participation in the mandatory housing fund in Shanghai is regulated by another legal document, we will solely focus on social insurance contribution in this article.

In this article, we will walk you through China’s social insurance scheme, explain employer’s obligations with social insurance management, analyze the impacts of the suspected changes, and make some predictions based on our experiences.

China’s social insurance scheme

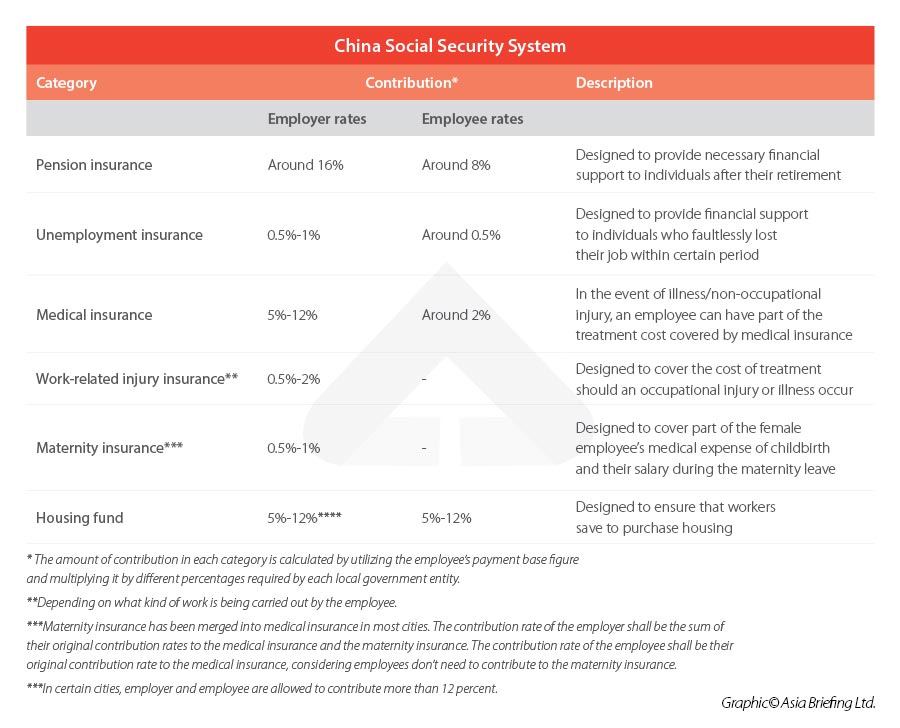

China’s social insurance system consists of five different types of insurance – pension, medical, unemployment, work-related injury, and maternity insurances. These five insurances plus a housing fund scheme form China’s social security system.

This individual employment contract-based social security system emerged in the late 1990s and the 2000s through a series of specific regulations and provisions in the 1994 Labor Law and 2008 Labor Contract Law. It was not until 2011 that these separate parts were codified into a comprehensive national framework under the Social Insurance Law, in which the basic principles of China’s social security system are outlined.

Although there are national guidelines issued by the central government, local levels of government manage the specifics and administration of the system. That is to say, the contribution base, the contribution rates, the social insurance registration, as well as other compliance requirements, might be very different from one city to another.

This is part of the reason why foreign employees in Shanghai could be exempt from the social insurance contributions.

Foreigner’s participation, exemptions, and benefits

The Ministry of Human Resources and Social Security requires foreign employees working in China to participate in its social insurance scheme as detailed in the Interim Measures for the Participation in Social Insurance of Foreigners Employed in China, 2011.

Accordingly, any foreigner employed by a legally registered entity in China or any foreigner dispatched to a registered branch or representative office of a foreign company – must participate in basic pension insurance for employees, basic medical insurance for employees, work injury insurance, unemployment insurance, and maternity insurance.

In general, the employer and the employee should pay five social insurance premiums:

- Basic pension insurance for employees (pension);

- Basic medical insurance for employees;

- Work-related injury insurance;

- Unemployment insurance; and

- Maternity insurance.

Among these, the premiums for pension, medical, and unemployment insurance are jointly contributed to by the employer and employee, whereas the premiums for work-related injury and maternity insurance are solely contributed to by the employer.

However, since social insurance is managed at a regional level, a range of inconsistencies exist among cities. As a result, most major cities have implemented their respective requirements for foreign employees.

For example, in cities such as Beijing, Tianjin, Shenzhen, and Nanjing, among many others, social insurance payments are compulsory for foreign employees – who are treated in the same way as domestic workers. On the other hand, Shanghai does not currently require foreign employees to contribute towards social insurance.

Besides, even in cities where foreign employee’s social insurance participation is mandatory, foreign employees from countries that have bilateral social security agreements with China are eligible for social insurance exemptions. Again, the specific application procedure varies from city to city.

To date, China has signed social security agreements with 12 countries, but only 11 such agreements have been implemented. Currently, expatriates from Germany, South Korea, Denmark, Canada, Finland, Switzerland, the Netherlands, Spain, Luxembourg, Japan, and Serbia are eligible for social security exemptions across China.

When living in China, foreigners covered in the social insurance system are entitled to benefits of basic medical insurance, work-related injury insurance, and maternity insurance, according to the regional implementation policy. There are usually no unemployment benefits for foreign employees as a foreigner without permanent residency and not employed in China.

As for pension, same as Chinese residents, foreign employees who have contributed to the pension fund for 15 years or longer and have reached the legal retirement age in China (60 years for men and 55 years for women) can start receiving a monthly retirement income, even when living outside of China. The only difference is that if they live outside of China, they must annually submit a document of living proof issued by a Chinese embassy or consulate to the social insurance agency that pays the benefits.

What happens to social insurance accounts when leaving China?

According to the Interim Measures, for foreigners who leave China before reaching the legal retirement age in the country, the social insurance individual account will be retained and will be renewed on a cumulative basis when the person returns to work in China.

Alternately, foreigners can apply to terminate their social insurance individual account upon written application before leaving China. The amount remaining in the individual account can be paid in a lump sum to the person.

Foreigners must check out the specific implementation regulations and application processes at their local Human Resources and Social Security Bureau.

Employer’s obligations with social insurance management

Under China’s system, it is not enough that employers are simply willing to pay. Whenever hiring new staff, employers need to register them with the local Social Insurance Bureau to initiate or reactivate their corresponding accounts.

Further, although both employer and employee are obligated to make contributions, it is generally the employer’s responsibility to correctly calculate and withhold the payments for both parties.

Meanwhile, employers are obliged to make timely payments for themselves and their employees. A late contribution can result in a fine, while failure to contribute may lead to onerous labor disputes.

In case of severe and multiple violations, the company might be put on an HR “name and shame” list, which can do significant reputational damage and create barriers to future recruitment.

One thing to be noted is that the employer’s obligation to make adequate and timely contributions cannot be alleviated or exempted by reaching a mutual agreement with employees.

In practice, employers and employees (especially those whose gross salary is not high) may mutually agree not to contribute to the social security schemes or to make contributions on a smaller basis, to save labor costs and maximize the employee’s take-home pay.

However, the court would consider such an agreement to be invalid in the case of a labor dispute between the employer and employee. The employer might be required to repay the social security evaded or pay an extra severance payment to its employee in case of termination.

How much social insurance premium should be contributed in Shanghai?

Social insurance contribution amount = social insurance contribution base ×contribution rates

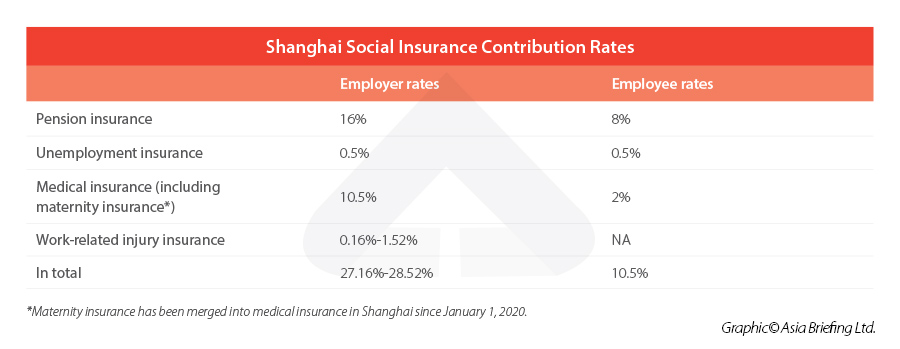

The most recent shanghai social security contribution rates are as follows:

To correctly calculate the monthly social insurance contribution amount, it is also important for employers to understand the basic rules on deciding the contribution base figure.

Firstly, rather than the actual payment that employees get for each month, the social security contribution base is a figure that is determined by the employee’s average income in the previous year (that is, January to December). The calculation method is as follows:

Social security contribution base = previous year’s total income / 12*

*For new hires, the starting salary may be used as the social security base during the first year.

Secondly, the base figures for social security contributions have floors and ceilings. Generally, the contribution base is capped at 300 percent of the average local salary. And the minimum contribution base is usually decided either by the local minimum wage or a certain percentage of the average local wage.

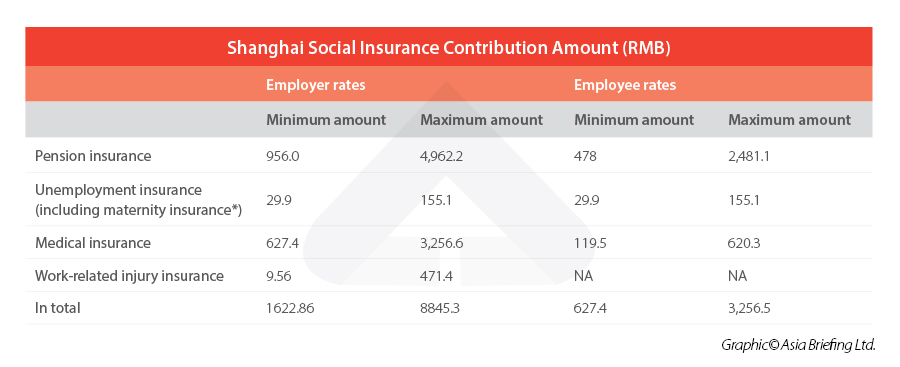

In Shanghai, starting from July 2021, the maximum social insurance contribution base was raised to RMB 31,014 (US$4,788), and the minimum contribution base was raised to RMB 5,975 (US$922). Accordingly, the maximum social insurance contribution for each insurance are as follows:

Impacts of the social insurance contribution for employers and foreign employees in Shanghai

If foreign employees are no longer exempted from social insurance contributions, the labor cost for the employer, the IIT liability, the employee’s take-home salary amount, as well as the employer’s compliance management will be impacted, respectively.

Labor cost

While an employee’s social insurance contributions are deducted from the employee’s gross salary, the employer needs to pay extra money for the social insurance contribution on top of the gross salary. Based on the calculations we explained in the previous section, the total labor cost for foreign employees will increase by around 27-28 percent.

IIT

In China, social insurance premiums contributed by the employee following the scope and standard stipulated by relevant laws and regulations are regarded as special deductions that can be deducted from the gross salary when calculating the IIT liabilities.

In this case, if foreign employees are to be included in the social insurance schemes, the contribution paid by employees themselves could be deducted from the taxable income when calculating IIT.

In the context that some tax-free fringe benefits will no longer be available to foreigners working in China starting next year under the amended IIT Law, the social insurance contribution can actually mitigate part of the IIT increase resulted from the policy change.

Take-home pay

Despite that foreign employee’s IIT liability can be alleviated due to the social insurance contribution, based on our calculations, the saved tax cannot compensate for the paid social insurance. That is to say, the employee’s take-home pay will be less.

Take a foreign employee who earns RMB 30,000 per month as an example. Suppose there are no other deductibles for IIT other than the standard deduction and the calculation is for a single month (not considering the impact of the cumulative withholding method):

Compliance burden

It can be seen that the IIT liability of the foreign employee would be reduced by RMB 630 but the employee’s take-home pay will be RMB 2,520 less than the current take-home pay.

As introduced in the employer’s obligation part, the employer will need to register their foreign employee with the social insurance bureau in charge, make accurate calculations for the contributions attributed to the employer and the employee, and withhold and pay the social insurance contributions for both parties timely on a monthly basis.

A late contribution can result in a fine, while failure to contribute may lead to onerous labor disputes.

Tips for companies with foreign employees

Keep a close eye on the policy updates

Based on the above discussion, companies and foreign employees may thoroughly understand China’s social insurance system and the potential impacts if foreign employees in Shanghai are no longer exempted from the social insurance schemes.

Nevertheless, it’s not impossible that Shanghai may extend the implementation of the said Notice that exempts foreigners from mandatory social insurance participation. If so, foreign employees can continue to enjoy the current social insurance exemptions, and the labor cost, the IIT liability, and the HR management will remain the same.

HR departments of companies are suggested to pay close attention to relevant policy updates on foreign employers’ social insurance contributions.

Explain the potential impacts to foreign employees in advance

As the potential change in social insurance policies will affect employee’s IIT liability and the amount of take-home pay, HR departments of companies are suggested to explain the potential impacts of the policy change to their foreign employees in advance.

Prepare for the labor cost increase and potential salary adjustment

As the potential change on social insurance policies will substantially increase the total labor cost for foreign employees, companies hiring a large number of foreign employees are suggested to hold internal discussions on the matter and prepare to amend their 2021 budget plan to ensure there are enough funds to pay for the increased labor cost.

Also, companies who worry about losing talents due to reduced take-home pay may need to consider increasing salaries for certain foreign employees to maintain a stable talent pool.

Collect proof of overseas social insurance payments for certain foreign employees

As explained in the previous section, foreign employees coming from countries having social insurance exemption agreements with China can be exempted from China’s social insurance schemes. HR departments of companies are thus suggested to check whether their foreign employees are from countries that have such social insurance agreements with China, study the qualification and application procedure for enjoying the social insurance exemption policies under such agreements, and collect relevant documents required from their foreign employees in advance.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China Removes Didi from App Stores: What We Learned from the Case and China’s Cybersecurity Regime

- Next Article GBA IIT Subsidy in Shenzhen: Updated Application Rules and Deadline