14 Years Later – China Fully Lifts Video Game Console Ban

By Omar Khan

International Business Advisory

Dezan Shira & Associates

Notwithstanding a few caveats, China has lifted its 14 year ban on the manufacturing and retailing of video game consoles. On July 31st, the Chinese Ministry of Culture released a statement pertaining to the new policy. Alongside the announcement comes a series of requirements and procedures that will be imposed on foreign companies engaging in the video game console business.

One of the procedural formalities will be the application timeline for commencing business operations. Firms wishing to be granted approval will be required to undergo a 20-day application process with their local culture department. Springboarding off of last year’s easening of the law in the Shanghai Free Trade Zone (FTZ), foreign businesses will be attentive to how the market pans out on a national scale in the wake of the new policy.

The Gamer/Consumer & The Market

Global market research firm Newzoo has branded China as world No.1 in terms of spending and revenue on video games, with 2015 already generating US$22.2 billion. Moreover, the Chinese gaming consumer is recorded at 446 million users – with 35 percent of those spending an average of US$141.38 per year on games and related purchases.

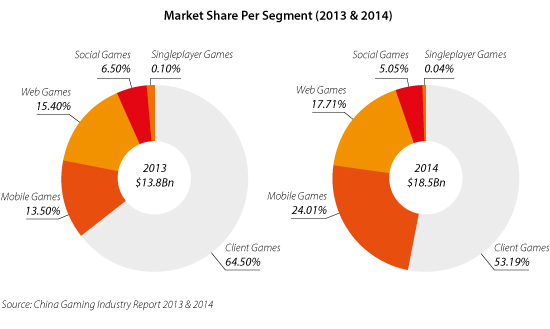

The market, however, is primarily dominated by the online and mobile gaming industries. In 2014, the mobile gaming market reached US$4.4 billion in total gaming revenues, putting it second behind client based games. Findings from the Publications Committee of the Game Publishers Association China illustrate the stranglehold that mobile and client based games have on the market:

Tracing the mobile gamer/consumer is also paramount to market entrants. Market analyst iResearch have projected an increase from 300 million online mobile gamers in 2014 to 510 million online mobile gamers by 2017. What this will mean for console-based businesses is without question precarious, as they will go head-to-head with an already cemented gaming population.

Compounded with this obstacle, console game developers will have to keep in mind the genres and types of games the Chinese consumer enjoys most. Traditionally, console games and mobile games differ in variety. A quick breakdown of preferred genres may be a useful insight for console based developers:

Console Entry & Survival

Last year in Shanghai it was Microsoft and Sony making moves into the market, signing agreements with local firms. Though these agreements were previously locked solely to the Shanghai FTZ, they are now permitted to operate across China. Well into their partnerships, however, corporate reports have yet to surface regarding their progress and if they have been able to secure a portion of the market with their products.

Microsoft reported that 100,000 Xbox One units were sold on launch day last year in the Shanghai FTZ but with unit console prices marked at RMB 3,699, sales soonafter declined. Furthermore, the pricing of consoles is problematic as the majority – 70 percent – of Chinese gamers simply cannot afford the pricetag. CLSA, a Hong Kong brokerage, found that this population of gamers earn less than RMB 4,000 a month. Reinforcing this problem is the fact that sales have indeed been disappointing for both Microsoft and Sony. With the mobile and online games industry having enjoyed market freedom and no imposed bans, this aspect can potentially serve as linking the causality to why console sales may well not have soared as expected.

Niko Partners, an Asian games market research firm, attributes China’s blackmarket console availability, limited game selection and the high-pricing of legal consoles as the factors responsible for poor sales. For the year 2015, only a combined 550,000 units of Microsoft’s Xbox One and Playstation’s PS4 are expected to be sold.

![]() RELATED: Trends in China’s Online Mobile Gaming Market

RELATED: Trends in China’s Online Mobile Gaming Market

Lifted Ban & New Regulations

Gaining approval from the relevant authorities is just one of the guidelines presiding over the operations of foreign businesses wishing to set up shop. The following covers some Articles found in the new policy:

- Firms engaged in the production and sale of game products shall submit an application to the provincial censorship and cultural administrative departments. Within 20 days of the application, the Provincial Cultural Administrative Department shall review the application and decide if it qualifies for the gaming entertainment device content approval list.

- The following content or depictions are prohibited to appear in any products:

- Violation of the basic principles of the Constitution

- Harm to national unity, sovereignty or territorial integrity

- Jeopardize national security, or harm national honor and interests

- Incitement of ethnic hatred, ethnic discrimination, undermining national sentiment, ethnic customs, habits and national unity

- Violation of state religious policy, propagating evil cults or superstition

- Advocating obscenity, gambling, violence and drug-related criminal activities, or abetting a crime

- Violation of public morality or fine national cultural traditions

- Insulting, slandering others, infringing upon the legitimate rights and interests of others

- Legally registered firms shall submit the following materials to the relevant authorities:

1. Gaming entertainment devices censorship application form

2. Copy of business license and documents

3. Game equipment software, video files and video presentation (demo)

4. All lyrics and electronic texts – foreign languages to be submitted in text controls

- Firms that qualify for the gaming entertainment device content approval list will have to submit new documents when system upgrades, revision upgrades and substantive changes occur in regards to their content

Of note is the gulf-like scope of these policies. A broad catching net casts a wide range on what content could possibly breach regulations. Patching software and regular updates will also go through scrutiny as any changes to products qualify for further review.

![]() RELATED: Ban on Video Game Consoles Tentatively Lifted in the Shanghai FTZ

RELATED: Ban on Video Game Consoles Tentatively Lifted in the Shanghai FTZ

Industry Perspective

To give investors a better undersatnding of how these new regulations will impact existing businesses and market entrants, we spoke to Thomas Rosenthal, the greater China manager of DigitalBros, a global Italian company that has recently expanded operations into China.

How will the lifting of the ban impact the blackmarket and illegal console business?

This comes down to the issue of pricing. Simply put, there is no need to purchase illegal products and goods when readily available, and legal, products are on the market. If the price and the console can be competitive, simultaneously localized and culturally adapted to the Chinese market, the consumer will turn their purchasing to legitimate products.

Will Microsoft, Sony and Nintendo be able to make big steps with their consoles into a market already dominated by mobile and computer based games?

Aside from Microsoft and Sony showcasing their console based products at the China Joy trade show, Microsoft made it evident that their long term strategy is to continue huge investment into hardware, intellectual property, and perhaps most importantly, alliances with local game developers and publishers. Not only will foreign titles be brought into China, but so will the injection of locally developed content be placed on the larger platform.

However, mobile games and home entertainment are two completely different markets; thus, a head-to-head comparison does not prove useful in a holistic sense. What does hold value is further examining the home entertainment market, i.e. consoles vs. set top boxes and smart TVs.

I also expect to see the rapid emergence of at least one local console manufacturer because of local manufacturing excellence. However, competition with the more established players will be mostly about contents.

Based on appeal and demand, how will the console itself survive? Are online computer games and mobile games too much to handle?

Though the current focus is on the limitations and restrictions placed upon all-things console, it is expected that new rules and regulations for mobile and computer games are on their way. This, in the short term, may cause a slowdown in regards to their growth as they adapt to the new playing field and legal environment. The console market share will grow but from a very low base. Growth will most likely be a function of hardware and software cost (hardware cost has been declining) and availability of quality games in line with Chinese consumer preferences.One important piece to note is that pricing will surely be an issue as Chinese gamers are used to playing for free.

Can we expect this law to cause or be the beginning of a new-wave of video games – or a video game revolution?

No, no grand transformation will take place. Rather, China’s gradual integration in the global videogame market, as in other industries will inevitably be a (video) game changer. This is one peculiarity of entertainment, whose products are typically harder to export overseas especially because of cultural and language differences and because of politically sensitivity. What I observe at the moment is that Western companies are struggling to enter the Chinese market while Chinese companies are trying to go-global, and aside the very big players, they still have a long way to go and to learn from each other.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

An Introduction to Doing Business in China 2015

An Introduction to Doing Business in China 2015

Doing Business in China 2015 is designed to introduce the fundamentals of investing in China. Compiled by the professionals at Dezan Shira & Associates, this comprehensive guide is ideal not only for businesses looking to enter the Chinese market, but also for companies that already have a presence here and want to keep up-to-date with the most recent and relevant policy changes.

China Investment Roadmap: The Entertainment Industry

In this special edition China Briefing Industry Report, we cast our gaze over the broad landscape of China’s entertainment industry, identifying where the greatest opportunities are to be found and why. Next, we detail some of the most important issues for foreign investors to be aware of, including legal, regulatory, and tax considerations specific to the industry. Lastly, we provide an insider analysis of the sector’s unique HR & payroll challenges.

Revisiting the Shanghai Free Trade Zone: A Year of Reforms

Revisiting the Shanghai Free Trade Zone: A Year of Reforms

In this issue of China Briefing, we revisit the Shanghai FTZ and its preferential environment for foreign investment. In the first three articles, we highlight the many changes that have been introduced in the Zone’s first year of operations, including the 2014 Revised Negative List, as well as new measures relating to alternative dispute resolution, cash pooling, and logistics. Lastly, we include a case study of a foreign company successfully utilizing the Shanghai FTZ to access the Outbound Tourism Industry.

- Previous Article Opening a Bar or Microbrewery in China

- Next Article Exploring New Opportunities in Adaptive Learning in China