Contemporaneous Transfer Pricing Documentation in China

By Dezan Shira & Associates and Steven Carey at Transfer Pricing Associates

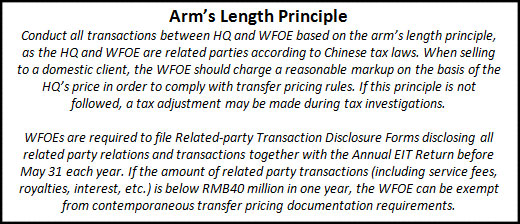

Nov. 8 – With the release of comprehensive transfer pricing regulations in early 2009, China’s tax authority – The State Administration of Taxation (SAT) – sent a very clear signal that it is serious about protecting its revenue base and actively enforcing the arm’s length principle for pricing of intragroup transactions, e.g. transactions between a headquarters overseas and its wholly foreign-owned enterprise (WFOE) in China.

Nov. 8 – With the release of comprehensive transfer pricing regulations in early 2009, China’s tax authority – The State Administration of Taxation (SAT) – sent a very clear signal that it is serious about protecting its revenue base and actively enforcing the arm’s length principle for pricing of intragroup transactions, e.g. transactions between a headquarters overseas and its wholly foreign-owned enterprise (WFOE) in China.

These regulations introduced a mandatory requirement for taxpayers to prepare, submit and retain transfer pricing documentation to support the arm’s length nature of their related party transactions.

Although these mandatory requirements apply when a RMB200 million threshold is met, there is increasing evidence that the documentation requirement is being widened and it is reported that loss-making single-function entities in China are now required to provide documentation, notwithstanding their size or the scope of their related party transactions. The Chinese tax authorities’ expanded use of the Related Party Transactions disclosure forms during the annual tax return also supports the validity of such reports.

Recent developments have further signaled that the SAT is taking such matters seriously. In 2010, Transfer Pricing Week Magazine ranked China as the third most aggressive tax authority, up five places from 2007 and behind only Japan and India.

What this all means is that no foreign company operating in China can ignore the transfer pricing provisions. Areas of increased scrutiny include the valuation of intangibles, use of appropriate functional analysis and contract manufacturing and R&D arrangements.

The SAT’s three-pronged system combining “administration, services and investigation” in relation to transfer pricing work contributed to additional tax collection of RMB10.272 billion in 2010, which divided among the three system parts as:

Administration (RMB7.168 billion)

- i.e. reviewing taxpayers’ related party transaction disclosure forms and transfer documentation and conducting follow-up efforts with previously-audited taxpayers, urging enterprises to make voluntary adjustments to transfer pricing arrangements and tax planning modes

Services (RMB796 million)

- i.e. conducting negotiations related to special arrangements with tax administrations

Investigation (RMB2.3 billion)

- i.e. strengthening, unifying and standardizing audits and investigations across regions and specific sectors

Investigations were conducted in industries including automobile, real estate, hotel chains, shipping, pharmaceuticals, computer OEM and tire manufacturing. Cross-regional investigations were conducted on certain large apparel group and chain department stores. The focus of such investigations is on large multinational companies with influence in the industry, so as to set an example for other companies.

To support this effort, the SAT is expanding. There were 228 transfer pricing specialists as of the issuance of the report in March 2010, and increasing the number of specialists is the focus of various tax bureaus in major cities such as Beijing, Shanghai, Fujian, Tianjin and Guangzhou. There are expected to be 500 transfer pricing specialists nationally by March 2012, according to an SAT indication in 2009.

Here we focus on a narrow but important aspect of compliance with transfer pricing regulations in China – the contemporaneous transfer pricing documentation requirements, including:

- Who must comply?

- How should the documentation be prepared, submitted and retained?

- What information should contemporaneous documentation consist of? (See Nov. issue of China Briefing Magazine)

- What transfer pricing methods can be applied? (See Nov. issue of China Briefing Magazine)

Who must comply?

The China Transfer Pricing Regulations provide three specific exemptions from the preparation of contemporaneous documentation:

- The annual amount of related party tangible goods transactions is below RMB200 million (US$31.25 million) and the amount of related party intangible goods transactions is below RMB40 million (US$6.25 million)

- The transactions are covered by an advanced pricing arrangement (APA)

- The foreign shareholding is below 50 percent and the enterprise only conducts transactions with domestic related parties

It should be noted that the exemption only extends to the requirement to prepare documentation and does not amount to an exemption from the transfer pricing regime, which applies to all related party transactions.

How should documentation be prepared, submitted and retained?

- Prepare in Chinese

- Complete by May 31 of the year following the tax year, e.g. for the tax year ending December 31, 2011, the due date is May 31, 2012

- Provide within 20 days of a request

- Retain for 10 years from June 1 following the relevant tax year

All enterprises bearing limited functions and risks and that have incurred losses are required to prepare contemporaneous documentation and other relevant materials for the year(s) in which the losses are incurred, and submit them to the competent tax authority prior to June 20 of the following year.

The combined effect of the above requirements is that the documentation obligations are indeed contemporaneous. Such documentation is the only accepted method of giving the tax authorities a clear understanding of the transfer pricing model and commercial realities of the business of a taxpayer. It is not possible to provide detailed documentation within 20 days of a request if it has not already been prepared in advance, particularly given the request can go back 10 years.

It is important to emphasize that, even if taxpayers are not required to prepare transfer pricing documentation, it may still be highly recommended to do so in some circumstances, e.g. the taxpayer has characteristics that render it at high risk of transfer pricing audit and investigation, such as being a loss-making manufacturer or a distributor achieving net margins lower than the industry norm. Transfer pricing adjustments can be made, and additional tax and penalties levied, by the tax authorities, to include years when documentation may not have been strictly required. The limitation period is up to 10 years, and the interest and penalties will not be capable of correlative relief under any double tax treaties.

It should also be noted that local tax bureaus have the discretion to adjust the thresholds for needing documentation downwards for taxpayers in their jurisdiction, so it is important to monitor local tax rulings and notices for this purpose.

Content for this article was taken from the November issue of China Briefing magazine titled, “Transfer Pricing and Cross-Border Inter-Company Transactions.” In the issue, we further outline what information documentation should consist of, and what transfer pricing methods can be applied. We also look at payment arrangements among HQ, WFOE, and clients in China. A PDF copy of the magazine can be downloaded on the Asia Briefing Bookstore.

Content for this article was taken from the November issue of China Briefing magazine titled, “Transfer Pricing and Cross-Border Inter-Company Transactions.” In the issue, we further outline what information documentation should consist of, and what transfer pricing methods can be applied. We also look at payment arrangements among HQ, WFOE, and clients in China. A PDF copy of the magazine can be downloaded on the Asia Briefing Bookstore.

Dezan Shira & Associates is a boutique professional services firm providing foreign direct investment business advisory, tax, accounting, payroll and due diligence services for multinational clients in China, Hong Kong, Vietnam and India. For further information or advice on transfer pricing in China, please email info@dezshira.com.

![]()

Transfer Pricing in China 2016

Transfer Pricing in China 2016

Transfer Pricing in China 2016, written by Sowmya Varadharajan in collaboration with Dezan Shira & Associates and Asia Briefing, explains how transfer pricing functions in China. It examines the various transfer pricing methods that are available to foreign companies operating in the country, highlights key compliance issues, and details transfer pricing problems that arise from intercompany services, intercompany royalties and intercompany financing.

Annual Audit and Compliance in China 2016

Annual Audit and Compliance in China 2016

In this issue of China Briefing, we provide a comprehensive analysis of the various annual compliance procedures that foreign invested enterprises in China will have to follow, including wholly-foreign owned enterprises, joint ventures, foreign-invested commercial enterprises, and representative offices. We include a step-by-step guide to these procedures, list out the annual compliance timeline, detail the latest changes to China’s standards, and finally explain why China’s audit should be started as early as possible.

Managing Your Accounting and Bookkeeping in China

In this issue of China Briefing, we discuss the difference between the International Financial Reporting Standards, and the accounting standards mandated by China’s Ministry of Finance. We also pay special attention to the role of foreign currency in accounting, both in remitting funds, and conversion. In an interview with Jenny Liao, Dezan Shira & Associates’ Senior Manager of Corporate Accounting Services in Shanghai, we outline some of the pros and cons of outsourcing one’s accounting function.

- Previous Article Shenzhen and Xiamen Further Encourage Equity Investment

- Next Article China Regulates Cargo Owners’ Investment into Domestic Shipping Industry