Calculating Individual Income Tax on Annual Bonus in China

Dec. 9 – As the year’s end is approaching, many companies in China are poised to give out annual bonuses. However, when contemplating the appropriate bonus amount, employers should pay close attention to the calculation of individual income tax (IIT) on bonuses. The State Administration of Taxation’s announcement No.9 issued in 2005 (guoshuifa [2005] No.9) provides for the method of calculating IIT on lump-sum annual bonuses as follows (assuming that the individual’s monthly salary is higher than the IIT exemption threshold):

- IIT on lump-sum annual bonus = (lump-sum annual bonus x monthly IIT rate applicable to 1/12 of lump-sum annual bonus) – corresponding monthly quick deduction

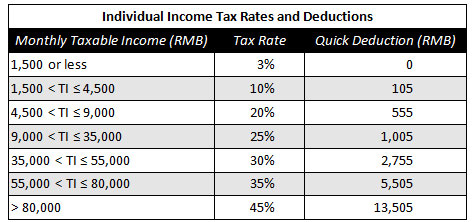

Based on the formula above, employers should divide the lump sum annual bonus amount by 12 and pay attention to numbers that hover around the threshold values at each progressive tax rate level (shown in the IIT Rates and Deductions table below). This number would be the basis for determining the applicable IIT rate payable on the bonus.

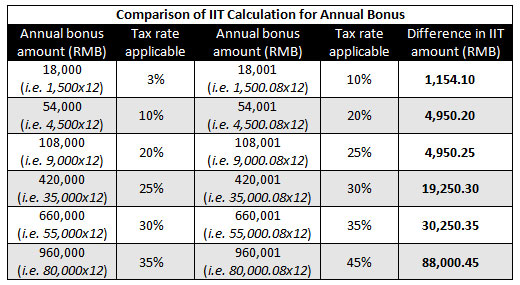

To illustrate, if a senior manager “A” receives an annual bonus of RMB420,000, and another senior manager “B” receives a total of RMB420,001, the IIT rate of 25 percent is applicable to A’s bonus (RMB35,000 x 12 months), while the IIT rate of 30 percent is applicable to B’s bonus (RMB35,000.08 x 12 months). Therefore:

- A’s IIT on the lump-sum annual bonus = RMB420,000 x 25% – RMB1,005 = RMB103,995.00

- B’s IIT on the lump sum annual bonus = RMB420,001 x 35% – RMB 2,755 = RMB123,245.30

In the example above, B’s annual bonus was only RMB1 more than A’s, but the total bonus income that ultimately goes to B’s pocket is RMB19,250.30 less than A’s. The relevant comparisons are shown in the table below:

Dezan Shira & Associates is a boutique professional services firm providing foreign direct investment business advisory, tax, accounting, payroll and due diligence services for multinational clients in China. The firm specializes in assisting foreign enterprises with their tax obligations. For further advice and specifics relating to individual income tax in China, please email china@dezshira.com, visit www.dezshira.com, or download the firm’s brochure here.

This article is also available on Dezan Shira & Associates’ online business resource library. To view the article, and other regulatory updates, please click here.

Related Reading

The China Tax Guide (Fifth Edition)

The China Tax Guide (Fifth Edition)

This popular book, fully updated with all recent tax changes and amendments, details all taxes in China affecting businesses and individuals, how to calculate the amounts due, tax registration and filing procedures, tax minimization techniques, and claiming VAT rebates. It also details good financial management techniques, handling negotiations with the tax bureau and annual audit and compliance procedures.

The Asia Tax Comparator (Complimentary Download)

The Asia Tax Comparator (Complimentary Download)

Asia Briefing devotes this issue of China Briefing to providing a practical comparison of taxation throughout Asia. In particular, this issue takes a look at the taxes most applicable to foreign businesses and individuals in Asia, i.e., corporate income tax, value-added tax, goods and service tax, standard tax on dividends and individual income tax.

Human Resources in China

Human Resources in China

Specifically designed to cover the most important issues relating to managing a Chinese workforce, this guide details the HR issues that both local managers in China and investors looking to establish a presence on the mainland should be aware about.

- Previous Article China, India and Emerging Asia Tax Rates Compared

- Next Article China to Offer Incentives to Its High-Tech, Cultural Industries