China Releases Announcement on Consumption Tax Policies

Dec. 4 – China’s State Administration of Taxation (SAT) released the “Announcement on Certain Issues Related to Consumption Tax Policies (Announcement [2012] No. 47, hereinafter referred to as ‘Announcement’)” on November 6, 2012.

The Announcement regulates the collection of consumption tax on products manufactured or processed with crude oil or other raw material by taxpayers. It also provides that the following acts of individuals and entities other than industrial enterprises shall be deemed as production of taxable consumer goods and such goods shall be subject to consumption tax:

- Sale of purchased non-taxable consumer goods to others as taxable consumer goods

- Sales of purchased taxable consumer goods subject to low consumption tax rates to others as taxable consumer goods subject to high consumption tax rates

The Announcement is scheduled to take effect from January 1, 2013.

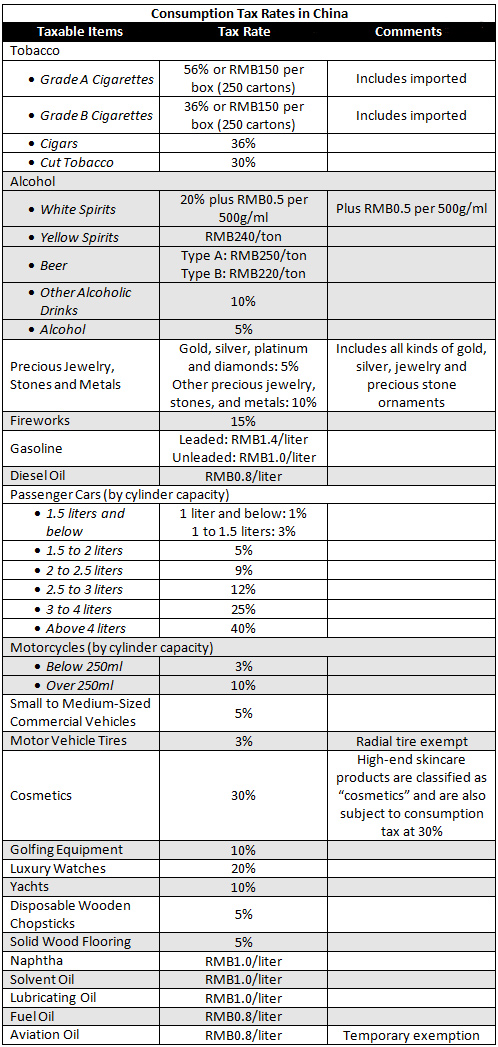

Consumption tax in China is levied on five categories of products:

- Products the over-consumption of which is harmful to health, social order and the environment (such as tobacco, alcohol, and fireworks)

- Luxury goods and non-necessities (such as precious jewelry and cosmetics)

- High-energy consumption and high-end products (such as passenger cars and motorcycles)

- Non-renewable and non-replaceable petroleum products (such as gasoline and diesel oil)

- Financially significant products (such as motor vehicle tires)

This tax applies whenever certain luxury or other goods are manufactured, processed or imported. Consumption tax is levied only once. Tax rates vary considerably with the product and the tax paid is computed directly as a cost and cannot be refunded (except in rare cases upon the receipt of a consumption tax special invoice from the domestic supplier for consumption taxes paid for export goods). In addition, consumption tax is part of the base upon which VAT is levied. Be careful if you are processing taxable goods for others, since you are liable to withhold and pay consumption tax based on the value of the raw material and your processing fee.

Consumption tax should be filed and paid monthly.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to The China Advantage, our complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

An Introduction to Doing Business in China

An Introduction to Doing Business in China

Asia Briefing, in cooperation with its parent firm Dezan Shira & Associates, has just released this 40-page report introducing everything that a foreign investor should be familiar with when establishing and operating a business in China.

China’s SAT Issues FAQs Relating to Tax Payments: Part I

China’s SAT Issues FAQs Relating to Tax Payments: Part II

China’s SAT Issues FAQs Relating to Tax Payments: Part III

China Issues FAQs Relating to Deed Tax and VAT

China Releases Circular to Crack Down on Tax Over-Collection

- Previous Article Tianjin, Zhejiang, Hubei Officially Start VAT Pilot Reform

- Next Article China Law Deskbook Legal Update – December 2012