Tax Focus: M&As of Chinese Domestic Companies by Foreign Investors

By Eunice Ku and Shirley Zhang

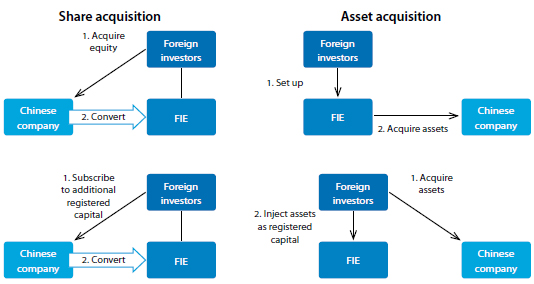

Apr. 15 – With respect to M&As involving the acquisition of Chinese domestic companies by foreign investors, in June 2009, the Ministry of Commerce promulgated the “Provisions on Foreign Investors’ Merger with and Acquisition of Domestic Enterprises (Order No. 6, ‘M&A Provisions’),” which address share and asset acquisitions of Chinese enterprises by foreign investors. The M&A Provisions cover the following types of transactions:

Share Acquisitions

- Acquisition of equity in a Chinese company and its conversion into a FIE; or

- Subscription of additional registered capital in a Chinese company and its conversion into a FIE.

Asset Acquisitions

- Establishment of a new FIE and its acquisition of the assets of a Chinese company; or

- Acquisition of assets in a Chinese company by a foreign investor and the injection of those assets as registered capital into a FIE.

In a share acquisition, the FIE established as a result inherits the rights and debts of the Chinese company. In an asset acquisition, the target company will retain its rights and liabilities.

Transaction Price of Shares/Assets

According to the M&A Provisions, when determining the transaction price of shares or assets, the parties should use evaluation results concluded by an asset evaluation agency established under Chinese law as the basis, adopting internationally accepted common evaluation methods. Shares or assets cannot be transferred at a price significantly lower than the evaluation results.

CIT Treatment on Share and Asset Transfers

Under China’s Corporate Income Tax (CIT) Law, which applies to both domestic enterprises as well as foreign and foreign-invested enterprises, income arising from the transfer of equity and assets (both fixed and intangible) is subject to CIT. The taxable income equals the gross income (i.e., transaction price) subtracted by the net value of the shares or assets:

- Taxable income = Gross income – Net value of shares or assets

For resident enterprises, a standard 25 percent CIT rate applies; for non-resident enterprises, the withholding tax rate on capital gains is 10 percent. The CIT Implementing Laws further provide that, when undergoing restructuring, gains or losses arising from the transfer of assets should be recognized at the time of the transaction, and the tax base of the assets should be re-determined based on the transaction price.

Income Derived from Share Transfers

With respect to income derived from share transfers, the “Notice on Certain Issues Concerning the Thorough Implementation of the CIT Law (guoshuihan [2010] No. 79)” promulgated in February 2010 further specifies that such income should be recognized as taxable income when the share transfer agreement comes into effect and the formalities for changing the share structure have been completed.

The taxable income equals the proceeds from the share transfer deducted by the original cost of obtaining the equity interest:

- Taxable income = Proceeds from equity transfer – Original cost of obtaining equity interest

The target company’s retained earnings (e.g. undistributed profits) cannot be deducted from the proceeds.

Losses from the Transfer of Shares/Assets

In March 2011, the SAT issued the “Measures for Corporate Income Tax (CIT) Deduction on Asset Losses of Enterprises (SAT Announcement [2011] No. 25),” which provides that actual asset losses (i.e., reasonable losses incurred in the process of actually disposing of or transferring assets, including equity investments and fixed and intangible assets) are deductible in the year in which they occur.

Value-added Tax

China’s current value-added tax (VAT) regulations stipulate that organizations and individuals engaged in the sale of goods, processing and repair services and importation of goods in China are subject to a VAT. As such, the transfer of equity is outside of the scope of VAT, but the transfer of fixed assets and inventories are subject to VAT based on their fair values.

In 2011, the SAT released Announcement [2011] No. 13 which states that the transfer of entire or partial tangible assets in all forms of asset restructurings, including mergers, are exempt from VAT if the assets are transferred along with all the relevant creditor’s rights, liabilities and manpower. Announcement [2012] No. 55 further provides that, with respect to entire asset transfers (where all assets, liabilities and manpower are transferred), the transferor’s unused input VAT credit balance can be carried forward to the transferee if they are both general VAT payers and tax de-registration procedures have been completed.

Business Tax

A 5 percent business tax will be levied on the transfer of intangible assets such as copyrights, trademarks and patents based on the fair market value. However, technology transfers may be exempt. According to SAT Announcement [2011] No. 51, the transfer of entire or partial tangible assets in all forms of asset restructurings, including mergers, are outside the scope of business tax, if the assets are transferred along with all the relevant creditor’s rights, liabilities and manpower. The transfer of immovable property and land use rights involved therein will be exempt from business tax.

Land Appreciation Tax

Gains from the transfer of state-owned land use rights, buildings and their attached facilities are subject to a land appreciation tax based on the amount of appreciation. The rates range from 30 percent to 60 percent.

Stamp Tax

A 0.03 percent to 0.05 percent stamp tax is imposed on the share or asset transfer price for both sellers and buyers.

Portions of this article came from the April 2013 issue of China Briefing Magazine titled, “M&A Regulations in China.” This issue of China Briefing Magazine focuses on the regulatory issues affecting cross-border M&As, and the key tax points foreign investors should be aware of when conducting M&As involving domestic Chinese companies. We also address the key aspects of transfer pricing, corporate restructuring exemption, and valuation as they relate to M&As.

Portions of this article came from the April 2013 issue of China Briefing Magazine titled, “M&A Regulations in China.” This issue of China Briefing Magazine focuses on the regulatory issues affecting cross-border M&As, and the key tax points foreign investors should be aware of when conducting M&As involving domestic Chinese companies. We also address the key aspects of transfer pricing, corporate restructuring exemption, and valuation as they relate to M&As.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Mergers and Acquisitions in China (Second Edition)

Mergers and Acquisitions in China (Second Edition)

This guide is a practical overview for the international business to understand the rules, regulations and management issues regarding mergers and acquisitions in China. It will help you to understand the implications of what can initially appear be a complicated and contradictory subject as well as points you at the structures you should use and some of the common pitfalls you may encounter.

Reevaluating China Joint Ventures and M&As

In this issue of China Briefing Magazine, we take a fresh look at joint ventures and M&As in China – the current market circumstances, the motivations and challenges faced – and provide a few practical insights into key issues such as forming a joint venture contract and finding an M&A partner.

Issues Affecting Cross-Border Mergers and Acquisitions in China

The Legal Fundamentals of China M&As

Co-Investing in China with Chinese Partners

China Formalizes Security Review Rules for Inward M&As

- Previous Article China Releases Interpretation on Tariff Misclassification

- Next Article China’s Grass-Root Courts to Handle Patent Dispute Cases