Costs of Running a WFOE in China

Sept. 30 – WFOEs are considered resident enterprises in China and, just as other domestic companies, their profits are subject to corporate income tax (CIT), which is generally 25 percent. Businesses generally also pay either business tax (BT) or value-added tax (VAT), depending on the nature of the business. Only in special circumstances are both taxes paid. BT is imposed on the provision of taxable services and sale of immovable property and intangible assets. Meanwhile, VAT is levied on the on the sale of goods, provision of repair and replacement services, and importation of goods into China. BT ranges from 3 percent to 20 percent, while VAT ranges from 0 percent to 17 percent. For both BT and VAT, certain exemptions apply.

With the commencement of the VAT pilot reform to merge BT with VAT, which was implemented nationwide starting August 1, 2013 in various service sectors, companies that were previously subject to BT are now subject to VAT if they provide the following services:

- Transportation services;

- R&D and technology services;

- IT services;

- Cultural and creative services;

- Logistics auxiliary services;

- Tangible movable property leasing services;

- Authentication and consulting services; and

- Broadcasting, film and television services.

VAT taxpayers are categorized into general taxpayers and small-scale taxpayers. Businesses with annual sales volumes exceeding a certain threshold are required to apply for general taxpayer status. The thresholds are RMB500,000 (for manufacturing enterprises) and RMB800,000 (for trading enterprises). For taxpayers providing services that fall under the VAT pilot reform, the annual sales value threshold is RMB5 million derived from taxable services.

General and small-scale taxpayers are subject to different treatments. General taxpayers are subject to VAT ranging from 0 percent to 17 percent, and are able to credit input VAT (levied while purchasing raw materials from suppliers and fixed assets) against output VAT (levied on selling of goods). The VAT rate for small-scale taxpayers is 3 percent, with no input tax deductions allowed. Distributors or customers tend to require the issuance of special VAT invoices in order to credit their VAT, and these invoices can only be issued by general taxpayers.

Consumption tax (CT) applies to the production, import and sales of certain products (e.g., tobacco, alcohol, vehicles and cosmetics) and the tax rates vary considerably with the product. Customs duties apply to the import and export of goods. Exporting enterprises are entitled to export tax rebates which refund them the indirect taxes paid in the production and distribution process in China.

WFOEs are also subject to urban construction and maintenance taxes (UCMT), an education surcharge (ES) and a local education surcharge (LES). UCMT rates are 7 percent for urban areas, 5 percent for counties (towns), and 1 percent for other regions. The ES rate and LES rate are 3 percent and 2 percent, respectively, regardless of location.

Recruiting

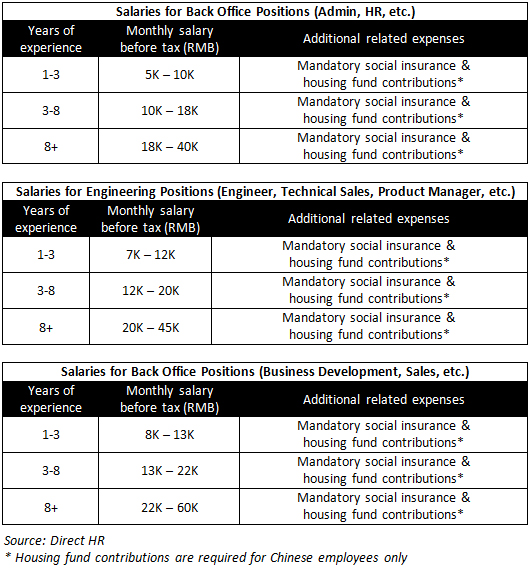

It usually takes 8 to 16 weeks to find a suitable employee. As such, it is advisable to start the recruitment process once a formal decision has been made to set up an operation in China (assuming the planned start date of operation in China is within the next six months). In terms of salary expectations, candidates in first-tier cities (such as Beijing or Shanghai) will probably have higher salary expectations than in second-tier cities (such as Harbin, Tianjin, or Dalian) or in third-tier cities (such as Xuzhou or Luoyang). Since job titles are not used consistently across companies, the actual job content and responsibilities of a position should be the basis for the salary discussion. The following three tables present information on back office, engineering and sales staff. The salaries are for Chinese nationals with working English knowledge in Beijing.

Social insurance

Social security (also called “social welfare” or “mandatory benefit”) payments are contributions to government-run funds for individuals in China. There are five such funds – pension, unemployment, medical, occupational and maternity – plus a mandatory housing fund for Chinese employees (which is considered separate, as it is not strictly considered a type of social welfare). Both employee and employer make mandatory contributions to these funds and generally the employer is responsible for withholding the contribution of the employee from gross salary each month and making their contributions together.

Exact calculations of social security payments are quite complicated (percentages are not technically based on the employee’s monthly salary, but rather of a theoretical “base” salary calculated based on a given formula) and required percentages for each fund vary by region. For an employer, social security payments typically add approximately an additional cost of between 30 percent and 45 percent of an employee’s salary for that employee each month.

Office rental

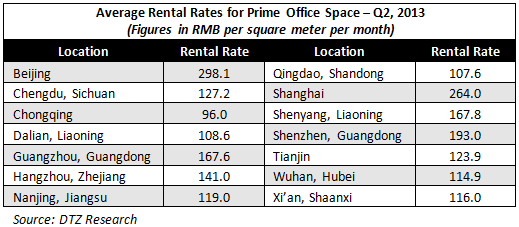

China’s first tier cities remain the most expensive markets for prime office rentals, with Beijing, Shanghai and Shenzhen topping the list, according to a survey conducted by DTZ, a global property services provider. Meanwhile, prime rental prices in China’s second and third-tier cities remain susceptible to local and national economic pressures. Average rental prices for prime office spaces during the second quarter of 2013 can be found below:

Portions of this article came from the September 2013 issue of China Briefing Magazine titled, “Using China WFOEs in the Service and Manufacturing Industries,” which is currently available as a complimentary PDF download on the Asia Briefing Bookstore until the end of this month. In this issue of China Briefing Magazine, we provide a detailed overview of the WFOE establishment procedures as well as outline the typical costs associated with running these entities in China. We hope that this information will give foreign investors contemplating entry into the Chinese market a better understanding of the time and costs involved.

Portions of this article came from the September 2013 issue of China Briefing Magazine titled, “Using China WFOEs in the Service and Manufacturing Industries,” which is currently available as a complimentary PDF download on the Asia Briefing Bookstore until the end of this month. In this issue of China Briefing Magazine, we provide a detailed overview of the WFOE establishment procedures as well as outline the typical costs associated with running these entities in China. We hope that this information will give foreign investors contemplating entry into the Chinese market a better understanding of the time and costs involved.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

This edition of the China Tax Guide, updated for 2013, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

Setting Up Wholly Foreign Owned Enterprises in China (Third Edition)

Setting Up Wholly Foreign Owned Enterprises in China (Third Edition)

This guide provides a practical overview for any business-minded individual to understand the rules, regulations and management issues regarding establishing and running a WFOE in China.

Establishing a Trading Company in China

Setting Up a Wholly Foreign-Owned Enterprise in China

- Previous Article Shanghai’s New Free Trade Zone – General Plan and Regulations

- Next Article Shanghai Releases ‘Negative List’ for Foreign Investment in Shanghai Free Trade Zone