Opportunities Abound for Dental Care in China

By Zhou Qian

In China, dental problems are traditionally considered a minor concern, and knowledge of dental care is generally lacking. According to the latest survey on oral health, a shocking 94 percent of the population has some form of dental problems, showing that there is clear demand for dental care. China’s dental care is still at an early stage, with figures like dentists per capita, dental visits per year and the presence of higher end dental treatment all relatively low.

As people’s living standards are rising and awareness of dental health issues is increasing, demand for dental care is set to grow exponentially. In addition, government policy is generally supportive of foreign participation in China’s dental care sector. This first article on dental care in China will explore the market conditions in China, the second will go into the legal requirements specific to setting up and operating a dental practice in China.

Strong Demand

According to the Third National Oral Health Epidemic Investigation Report released by the Ministry of Health in 2009, 66 percent of children aged 5 had cavities, along with 29 percent for children 12. For adults the situation was even worse. Of adults between the ages of 35 and 44, 88 percent had cavities, of which only 8 percent had seen treatment. Nearly all senior citizens had cavities, at 98.4 percent of people aged between 65 and 74.

![]() RELATED: Hospital WFOEs Permitted, Social Insurance in Jiangsu

RELATED: Hospital WFOEs Permitted, Social Insurance in Jiangsu

Periodontal disease is prevalent as well. The report states that 85 percent of the population suffers from periodontal problems. Only 14.5 percent of people in the 35-44 age bracket had healthy periodontal tissue. Dental malocclusion is another widespread problem, with estimates putting the number between 30 and 50 percent of the population.

Weak Supply

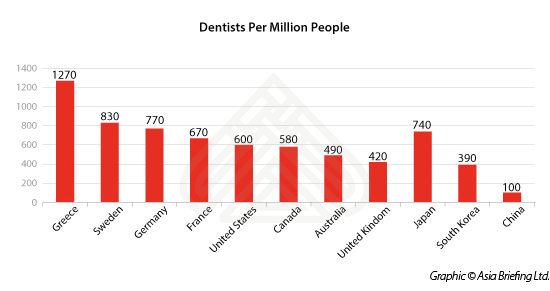

For every one million people in China, there are only 100 dentists, compared with 500—1,000 dentists in the Western countries. Currently, only half of the roughly 100 dentistry schools across the country even offer orthodontics courses. The Chinese Orthodontic Society didn’t join World Federation of Orthodontists until 2008, with only two percent of the registered dentists being members. Only about 200,000 dental implants are made in China every year, compared to nearly 1 million in South Korea, which has a population of 50 million.

High Growth Potential

Dental care in China is still in its infancy. This is expected to change in the near future, as living standards are rising and awareness of dental health issues has increased. In addition, the government is decidedly less restrictive of the dental industry, compared to other sectors of health care. These factors combined make a strong case for foreign investment and participation in China’s dental care industry.

Judging from the experience in more developed countries, there is a strong correlation between increased living standards and demand for dental care. Looking at current growth trends, the dental sector is set to grow tenfold. As China’s middle class continues to grow, so do opportunities for foreign businesses.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

China Investment Roadmap: The Medical Device Industry

China Investment Roadmap: The Medical Device Industry

In this issue of China Briefing, we present a roadmap for investing in China’s medical device industry, from initial market research, to establishing a manufacturing or trading company in China, to obtaining the licenses needed to make or distribute your products. With our specialized knowledge and experience in the medical industry, Dezan Shira & Associates can help you to newly establish or grow your operations in China and beyond.

Revisiting the Shanghai Free Trade Zone: A Year of Reforms

Revisiting the Shanghai Free Trade Zone: A Year of Reforms

In this issue of China Briefing, we revisit the Shanghai FTZ and its preferential environment for foreign investment. In the first three articles, we highlight the many changes that have been introduced in the Zone’s first year of operations, including the 2014 Revised Negative List, as well as new measures relating to alternative dispute resolution, cash pooling, and logistics. Lastly, we include a case study of a foreign company successfully utilizing the Shanghai FTZ to access the Outbound Tourism Industry.

Adapting Your China WFOE to Service China’s Consumers

Adapting Your China WFOE to Service China’s Consumers

In this issue of China Briefing Magazine, we look at the challenges posed to manufacturers amidst China’s rising labor costs and stricter environmental regulations. Manufacturing WFOEs in China should adapt by expanding their business scope to include distribution and determine suitable supply chain solutions. In this regard, we will take a look at the opportunities in China’s domestic consumer market and forecast the sectors that are set to boom in the coming years.

- Previous Article Uber in China: The Winding Road to Success

- Next Article China Outbound: Setting Up a Trading Company for China, ASEAN and India