The Automation of China’s Labor Force

By Kelsey Ryan

By Kelsey Ryan

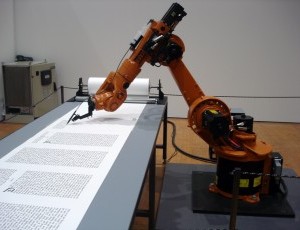

The robotics industry is on the cusp of revolutionizing the way business is conducted in China; and the world. With China expected to have the most industrial robots operating in production plants worldwide by 2017, foreign investors should take note. China currently holds the title of the world’s largest market in the sale of industrial robotics, but lacks robotic density.

With only 30 robots per 10,000 employees (in manufacturing industries), China is a step behind Japan, Germany and North America. Four out of five industrial robots in China have been made by foreign manufacturers and foreign investors have flocked to China to create their own production lines, including four of the largest foreign robot manufacturers: ABB, Kuka, Yaskawa, and Funac. Not only is the industry ripe for growth, but the Chinese government is providing incentives such as subsidies and is pushing for a shift from the manufacture of manually assembled low-quality products towards higher-value products that require the precision of automation. Beijing specifically targeted robotics as one of the main sectors for development, hoping to create four to five domestic robotics firms to meet an annual production target of 13,000 robots in China’s five-year economic plan for 2011- 2015.

The Chinese government is pushing forward with robotic research, and leading foreign robot manufacturers are their main focus. With demand rising, Chinese manufacturers will be looking to acquire foreign companies to speed up development through the use of imported technological knowledge and materials – something that China is currently lacking. This type of deal can be mutually beneficial for foreign investors as the cost is 30 percent lower in China.

![]() RELATED: China’s Rising Manufacturing Costs: Challenges and Opportunities

RELATED: China’s Rising Manufacturing Costs: Challenges and Opportunities

Currently, the automotive industry is the most prominent industry for robotics in China, claiming 40% of robots in operation. The next big industry to follow will be electronics, but the adoption of robotics is constantly increasing and has expanded into the aerospace, healthcare, railway, energy, consumer durables, apparel and jewelry industries. The automation of China’s production plants is still in the beginning stages, but is expected to double within the next three years (from 200,000 units today to more than 400,000 units) – surpassing Europe and North America.

Labor Dynamics

Over the past five years, companies in China have adopted the use of robots to combat worker shortages, rising wages, increase efficiency and to cut production costs. The ratio of industrial robots to workers in China is still relatively low, but that is swiftly changing. China has been long known as a source of low-cost manual labor, but as the cost of automation drops and wages increase, industrial automation is looking increasingly attractive. Wages have been increasing at a rate of 10% annually over the past decade while the cost of robot production has been decreasing by 5% year on year over the same period.

Guangdong has announced that it will spend RMB 943 billion on replacing human labour with robots within the next three years, and plans to have 80% of its factories automated by 2020. Guangzhou, Dongguan, Foshan and Shenzhen have begun implementing robotics on production lines, and are hoping this move towards automation will lead to an increase of innovation and local governments are providing annual subsidies in return. But it is not only South China that is looking to robotics. Qingdao has been experiencing rapid growth in the robotics industry in its High-Tech Zone, due to the support of the universities, enterprises and institutions and its strong research strength.

Most people will be concerned about the potential loss of jobs, but the reality is that China will have a labor shortage. Demographics are not in favor of China’s traditional labor-driven factories as the work force is aging and the attitudes of the younger population are changing. Young workers have historically been the foundation of China’s assembly-line workforce, but now the younger generation born between 1990 – 1999 is disinterested in manufacturing jobs and is favoring alternative pursuits. The working-age population of people aged between 16 – 59 is slowly decreasing. The population declined by 371,000 in 2013 to 915 million last year. Urbanization, cultural shifts, and population control policies have all decreased the average birth rate in comparison to more developed nations. However, as one robot from South China’s Foshan LXD Robots Co. Ltd. can replace up to 6 humans, robots could be the solution China needs.

“In recent years, China’s ageing population coupled with its rise in minimum wage has contributed to an increasing exodus of companies to regions such as Vietnam and India. Having robotics as an option for manufacturers could ease the burden that China will face in the coming decades when China’s elderly population is set to hit 330 million by 2050,” adds Stephen O’Regan, Associate at Dezan Shira & Associates in Guangzhou.

![]() RELATED: South China’s Balancing Act Between Raising Wages & Keeping Investors

RELATED: South China’s Balancing Act Between Raising Wages & Keeping Investors

Together with urban affluence, the rising wages are causing the government and factory owners to favor automation. The question remains, though, as to what will happen to the workers. Some manufacturing companies, such as Foxconn, have stated that they will move the workers out of lower skilled jobs and move them into more value-adding positions like R&D. China is hoping that a move towards automation will lead to an increase of skilled workers. It can also be argued that the robotics industry itself will provide many employment opportunities in robot manufacturing. The Chinese government has committed to expanding vocational education to ensure that low-skilled workers will not be ‘left behind’ in an automated economy.

Conclusion

Robotization in China has just begun, and can help investors to retain a long term competitive advantage. However, the timing of investment is important. Government subsidies will not last forever, and investors could face the challenge of retaining a competitive advantage when more and more suppliers flood the market. A company that can sustain profits without subsidies and position themselves for the long term could present a potential new sector for foreign investment in the automation industry in China.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Human Resources and Payroll in China 2015

Human Resources and Payroll in China 2015

This edition of Human Resources and Payroll in China, updated for 2015, provides a firm understanding of China’s laws and regulations related to human resources and payroll management – essential information for foreign investors looking to establish or already running a foreign-invested entity in China, local managers, and HR professionals needing to explain complex points of China’s labor policies.

China Investment Roadmap: The Medical Device Industry

China Investment Roadmap: The Medical Device Industry

In this issue of China Briefing, we present a roadmap for investing in China’s medical device industry, from initial market research, to establishing a manufacturing or trading company in China, to obtaining the licenses needed to make or distribute your products. With our specialized knowledge and experience in the medical industry, Dezan Shira & Associates can help you to newly establish or grow your operations in China and beyond.

Employing Foreign Nationals in China

Employing Foreign Nationals in China

In this issue of China Briefing, we have set out to produce a guide to employing foreign nationals in China, from the initial step of applying for work visas, to more advanced subjects such as determining IIT liability and optimizing employee income packages for tax efficiency. Lastly, recognizing that few foreigners immigrate to China on a permanent basis, we provide an overview of methods for remitting RMB abroad.

- Previous Article Les Nouvelles Tendances du Marché du Café en Chine

- Next Article Le Marché du Divertissement en Chine