Individual Income Tax for Expats in China

By Dezan Shira & Associates

Editor: Jake Liddle

China’s Individual Income Tax (IIT) Law stipulates that all individuals working and deriving income from within the territory of China are subject to IIT.

While Chinese nationals are taxed on all income sourced both domestically and overseas, non-Chinese nationals are only taxed on income deriving from within China.

An individual’s salary is taxed according to progressive rates, while other types of income are taxed at variable rates depending on their nature.

Though IIT is usually filed by employers’ HR and payroll teams on behalf of employees, both parties should be aware of tax thresholds, and implement sufficient salary planning to reduce tax liability. Furthermore, individuals are required to make annual declarations before the end of the financial year.

In this article, we give a general overview of how IIT works for foreign nationals working China.

Taxable income for expatriates

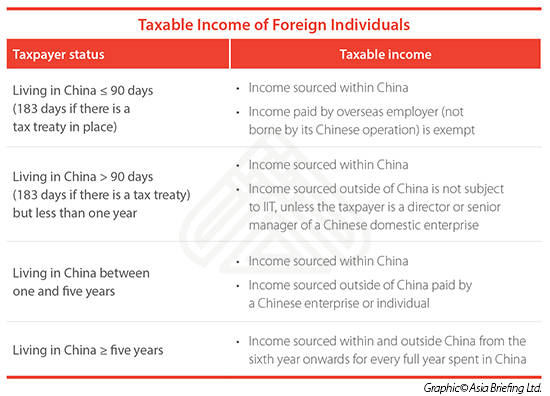

The calculation for IIT liability is dependent on the source of income, how long one has worked in China, and whether or not income is sourced within or outside of China.

Whether or not income is sourced inside or outside of China is determined by how long an individual has actually worked in China. The following income types are deemed China-sourced income regardless of where the payment is made:

- Income from providing services in China;

- Income from leasing property to a lessee for use in China;

- Income from transferring property located in China, such as buildings and land-use rights;

- Income from licensing the use of proprietary rights in China; and,

- Interest, dividend, and bonus income derived from companies, enterprises, and other organizations or individuals in China.

Employers and expatriates that would like to see more in depth information on tax liability, including scenarios that assess ‘time in China’ calculations, should review this article.

![]() RELATED: Tax, Accounting and Audit in China 2017

RELATED: Tax, Accounting and Audit in China 2017

IIT on income and deductions

Salary

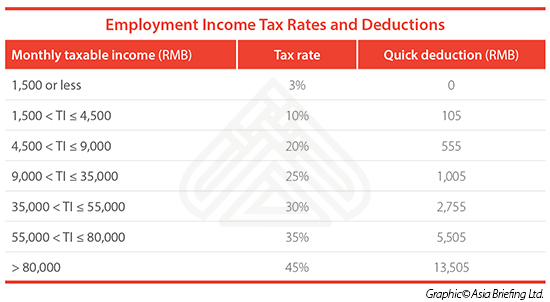

IIT on salary, which is any income received from employment including bonuses and stock options, is set at progressive rates from three to 45 percent. It is usually withheld from wages by employers and paid to the tax authorities on a monthly basis.

The basic formula for calculating monthly IIT is as follows:

Monthly taxable income x applicable tax rate – quick deduction = monthly tax payable

Monthly taxable income is calculated after a standard reduction of RMB 4,800 for foreign nationals, including residents of Hong Kong, Macau, and Taiwan.

Contributions to Chinese social insurance as well as other employment benefits can also be added to pre-tax deduction, as long as relevant requirements are met and relevant fapiao are provided. Employment benefits include:

- Allowances for housing, meals, relocation, and laundry expenses;

- Relocation expenses upon commencement or cessation of employment in China;

- Reasonable business travel expenses and two personal trips to the individual’s country of origin; and,

- Reasonable allowances for language training and children’s education.

Such allowances are not obligatory for an employer to provide, and should be discussed with employees. As benefits paid in cash may be subject to IIT, reimbursement is an effective alternative for reducing IIT.

Annual bonuses

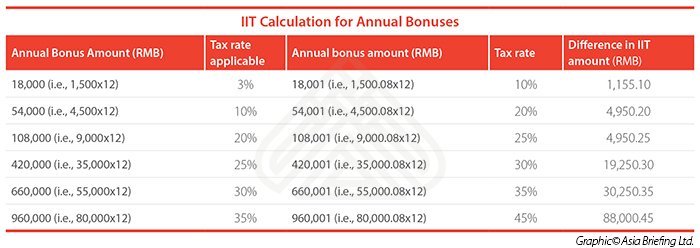

Many companies in China offer annual bonuses at the end of the year, for which IIT is calculated as follows:

IIT on lump sum – annual bonus = (lump sum annual bonus x monthly IIT rate applicable to 1/12 of lump sum annual bonus) – corresponding monthly quick deduction

To determine the applicable IIT rate on the bonus, the lump sum annual bonus should be divided by 12 to find the corresponding tax rate, shown in the table below:

Annual bonuses are often a major factor for employees to select jobs. However, the inclusion of an annual bonus in taxable income can significantly impact tax liability.

Stocks, restricted stock units and equity bonds

Stock options, restricted stock units (RSUs), or equity incentives are forms of compensation offered by an employer to an employee in the form of company stocks and shares.

They are given to employees over a set period of time according to a planned schedule, usually based on performance or time milestones.

According to relevant laws regarding stocks and bonds, IIT applies to income derived from such shares and units only upon the date they are obtained or ‘activated’, and not from the date they are granted.

Careful salary planning can allow employees to take home as much value by staying within the applicable tax rate thresholds as stipulated by China’s tax laws, as minimal salary increases may push taxable income over the thresholds and significantly affect IIT liability.

![]() RELATED: Audit and Financial Services from Dezan Shira & Associates

RELATED: Audit and Financial Services from Dezan Shira & Associates

Payment and declaration

Although IIT is usually automatically withheld from salaries by employers and paid monthly to tax authorities on a monthly basis, an annual IIT declaration should be submitted to the relevant tax authorities within three months of the end of the previous calendar year.

This should be done between January 1 and March 31 for the previous calendar year for taxpayers who meet at least one of the following five conditions:

- Have an annual income (both employment income and non-employment income) of more than RMB 120,000;

- Derive income from two or more places in China;

- Derive income from sources outside China (this applies only to a resident or non-resident individual in China who has resided in China for more than one year);

- Received taxable income for which there is no withholding agent;

- Other conditions required by the State Council.

Individuals are required to submit their annual IIT declarations regardless of whether their IIT liabilities have been fulfilled. A non-resident individual residing in China for less than one year during the tax year is exempt from this requirement.

Anti-tax evasion efforts increase importance of compliance

China’s tax authorities have been stepping up anti-tax evasion measures in recent years, having improved investigation methods aimed at foreigners. In Beijing, by screening zero tax declarations and singling out foreign enterprises with high profit margins and foreign personnel, the Chaoyang Local Taxation Bureau was able to collect over RMB 200,000 worth of IIT evaded.

Expatriates and their employers should there seek to ensure IIT is being paid in a correct and timely fashion, and to conduct annual declarations. In Beijing and Shanghai, and other major cities, individuals are able to make annual declarations online, through WeChat official accounts and on other mobile phone apps. Efforts to improve the ease of filing will go a long way to improve compliance, but expatriates and their employers will still need to put their best foot forward.

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

Payroll Processing in China: Challenges and Solutions

In this issue of China Briefing magazine, we lay out the challenges presented by China’s payroll landscape, including its peculiar Dang An and Hu Kou systems. We then explore how companies of all sizes are leveraging IT-enabled solutions to meet their HR and payroll needs, and why outsourcing payroll is the answer for certain company structures. Finally, we consider the potential for China to emerge as Asia’s premier payroll processing center.

- Previous Article China’s Labor Law on Salary Reduction

- Next Article Shanghai Revises Minimum Wage, Social Insurance Contribution Rates