China Releases 2025 Edition of Encouraged Catalogue for Foreign Investment

China’s National Development and Reform Commission (NDRC) and the Ministry of Commerce (MOFCOM) have officially released the Catalogue of Encouraged Industries for Foreign Investment (2025 Edition) (hereafter the “2025 FI Encouraged Catalogue” or the “2025 Catalogue”). Taking effect on February 1, 2026, the updated Catalogue replaces the 2022 version and represents a renewed commitment to attracting global investment across advanced manufacturing, modern services, green development, and regional development priorities.

As one of China’s core policy tools for guiding foreign direct investment (FDI), the Catalogue outlines industries that benefit from preferential tax, land, and customs policies. The latest update is both broader in scope and more targeted in direction, signaling China’s firm intention to integrate foreign capital into its next phase of industrial upgrading and regional revitalization.

Key changes in the 2025 FI Encouraged Catalogue: Broader scope, clearer signals, and stronger commitment

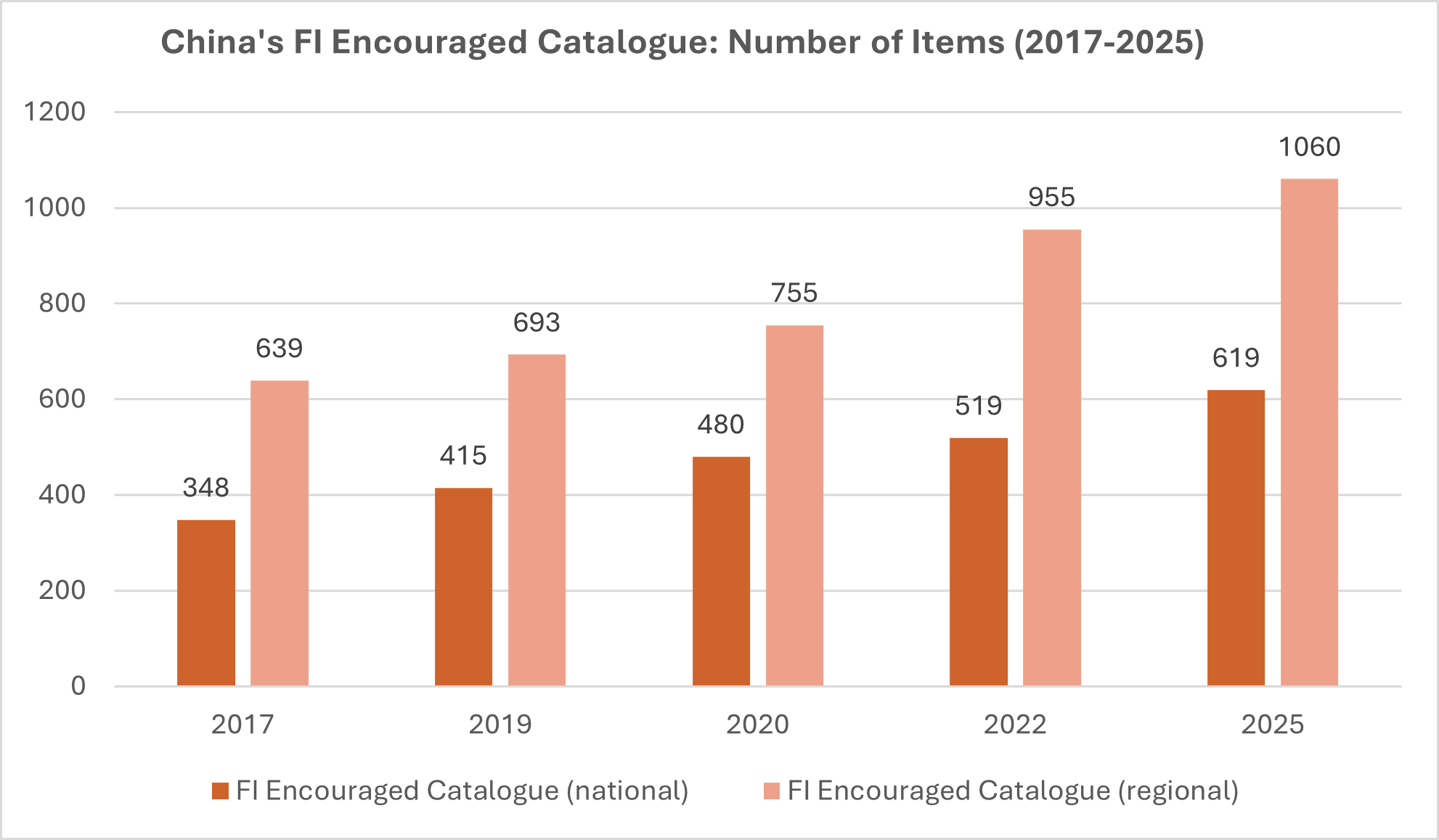

The 2025 Catalogue contains 1,679 entries, including:

- 619 in the National Catalogue

- 1,060 in the Regional Catalogue for central, western, northeastern China, and Hainan

Compared with the 2022 edition, this reflects:

- 205 net new entries

- 303 revisions

The expansion is the result of wide consultation with foreign-invested enterprises (FIEs), business associations, sector experts, and local governments, ensuring the Catalogue aligns closely with global investor expectations and China’s industrial priorities.

Stronger focus on advanced manufacturing

China continues to emphasize manufacturing as the backbone of its economy. The updated Catalogue widens the range of encouraged manufacturing activities, from core technologies to high-value components, reflecting China’s push toward innovation-driven growth and resilient supply chains.

Newly encouraged industries include:

- Development and production of nucleic acid pharmaceuticals

- R&D and manufacturing of zero‑magnetic medical devices

- Smart testing and inspection instruments

- High-speed cameras and precision imaging equipment

- Intelligent energy management systems and related monitoring devices

- Design and production of deep-sea robots and specialized marine equipment

- Key technologies for gas-fired power equipment

- R&D and production of core components for industrial robots

Collectively, these changes highlight China’s commitment to high-end, high-tech, and high-efficiency industrial development.

Expanded encouragement for modern services

A notable shift in the 2025 Catalogue is its strong emphasis on modern services, especially those that support industrial upgrading and consumption upgrading.

Production-related service sectors newly included:

- Operation of new materials R&D and service platforms

- High-end maritime and shipping services

- Operation and R&D for virtual power plants

Service consumption sectors are now encouraged:

- Pet hospitals and pet grooming

- Sports tourism

- Travel agency services

- Consulting and operation services for the camping industry

- Homestay (boutique lodging) design, branding, and operations

- Property management

- Internet-based healthcare services

This broadened scope reflects China’s growing interest in welcoming foreign investment not only into manufacturing but into lifestyle, consumer-facing, and digitalized service industries.

Greater support for central, western, northeastern regions, and Hainan

The Regional Catalogue continues to play a major role in promoting balanced regional development. The 2025 edition introduces new entries tailored to local ecosystems, aiming to direct foreign investment toward inland and northern provinces with untapped potential.

Examples of new region-specific encouraged sectors include:

- Liaoning: Cruise tourism services

- Heilongjiang: Ice-and-snow sports equipment R&D and manufacturing

- Henan: High-end intelligent lifting machinery

- Hainan: Marine environmental restoration and ecological demonstration projects

- Chongqing: Agricultural machinery suited for hilly and mountainous terrain

- Guizhou: Computing power infrastructure R&D

- Qinghai: Wind farm operation

These adjustments reflect China’s strategy of using foreign investment to empower regional strengths and bridge development gaps.

What are the favorable policies to facilitate FDI in encouraged industries?

FIEs operating in encouraged sectors may access four major preferential policies:

- Customs duty exemptions for imported self-use equipment (with certain exclusions).

- Priority access to industrial land, with reduced minimum land transfer prices (down to 70 percent of the standard) and flexible leasing models.

- Reduced corporate income tax (15 percent) for eligible projects in western China and Hainan.

- Tax credits for reinvestment when foreign investors reinvest their profits into projects listed in the National Catalogue.

These measures lower operational costs and strengthen investment certainty.

Next steps: Implementation and investor engagement

Both NDRC and MOFCOM emphasize that the release of the Catalogue marks the beginning of a new phase of policy execution.

NDRC’s planned actions include:

- Accelerating major FDI projects through dedicated work mechanisms

- Addressing project-level needs involving land, environment, and energy usage

- Enhancing communication channels with foreign businesses

- Organizing platforms for international investment cooperation

MOFCOM’s implementation agenda includes:

- Conducting outreach and policy briefings for foreign enterprises

- Ensuring local governments deliver all supportive measures

- Coordinating solutions to challenges faced during project approval and operation

These steps aim to ensure foreign investors can fully utilize the benefits of the Catalogue while enjoying a transparent, predictable, and internationalized business environment.

Conclusion: A Renewed commitment to openness

The 2025 edition of the Encouraged Catalogue for Foreign Investment signals China’s continued commitment to high-level opening and international cooperation. With expanded industry coverage, clearer regional guidance, and strengthened policy incentives, the new Catalogue provides multinational companies with a roadmap to align their China strategies with the country’s long-term development priorities.

Our Business Advisory service helps companies navigate Asia’s complex business landscape from initial market entry to ongoing expansion. We advise on corporate structuring, company setup, due diligence, legal contracts, intellectual property, and M&A transactions. Clients benefit from both standalone projects and integrated support from our in-house tax, audit, HR, and technology teams. To arrange a consultation, please contact China@dezshira.com.

About Us

China Briefing is one of five regional Asia Briefing publications. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong in China. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in Vietnam, Indonesia, Singapore, India, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to China Briefing’s content products, please click here. For support with establishing a business in China or for assistance in analyzing and entering markets, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Comprehensive Evaluation during Budget Review: A Practical Case Study

- Next Article Choosing the Right City in China for an FIE: Cost Savings vs. Hidden Risks