5 Big Changes to China’s VAT in 2019

Following the announcements made in the annual Work Report delivered at the Two Sessions, the Ministry of Finance, State Taxation Administration, and General Administration of Customs have jointly issued a series of new policies on value-added tax (VAT).

The new polices, which took effect on April 1, 2019, aim to enhance economic activity in certain sectors by lowering VAT rates and increasing VAT credits.

The latest changes mark the final stages of China’s overhaul of its VAT system, and come as part of a larger RMB 2 trillion (US$298.3 billion) cost cutting package intended to boost China’s economy

Here, we highlight five major changes to the new VAT policies.

1. Reducing VAT rates

Beginning April 1, 2019, taxpayers who were originally subject to VAT rates of 16 percent and 10 percent imports or exports of goods and services, will now be subject to an adjusted 13 percent and 9 percent, respectively.

The 10 percent deduction rate on agricultural products purchased by taxpayers will be adjusted to 9 percent. For agricultural products purchased by taxpayers for production or commissioned processing, the input VAT will be calculated at a 10 percent deduction rate; previously, it was subject to VAT at 13 percent.

Moreover, for goods purchased by overseas visitors, the departure tax refund rate has now been adjusted to 11 percent and 8 percent from 13 percent and 9 percent, respectively.

Transitional rules

The tax position during the changeover period has been further clarified to ensure a smooth transition into the new VAT rates. Generally, if the VAT invoice was generated or issued prior to April 1, 2019, the old tax rate will apply – this point is illustrated and expanded upon in the examples below.

Example 1: If a VAT invoice has been issued prior to April 1, 2019, any corresponding negative VAT invoice issued – due to sales discount, sales return, sales cancellation, or inaccuracies in the original VAT invoice – will also be subject to the old tax rate.

Example 2: In situations where a general VAT taxpayer has not issued VAT invoices for taxable income generated before April 1, 2019 but needs to issue such invoices on or after April 1, 2019 – the VAT invoicing will be done at the old tax rate.

2. Changing the redemption of input VAT credit for real estate and projects under construction

From April 1, 2019, a business registered as a general VAT taxpayer can claim the full input VAT credit all at once for purchases of real estate and construction services.

Previously, the old rule stipulated that the input VAT credits for purchases of real estate and construction services are claimed over a two-year period.

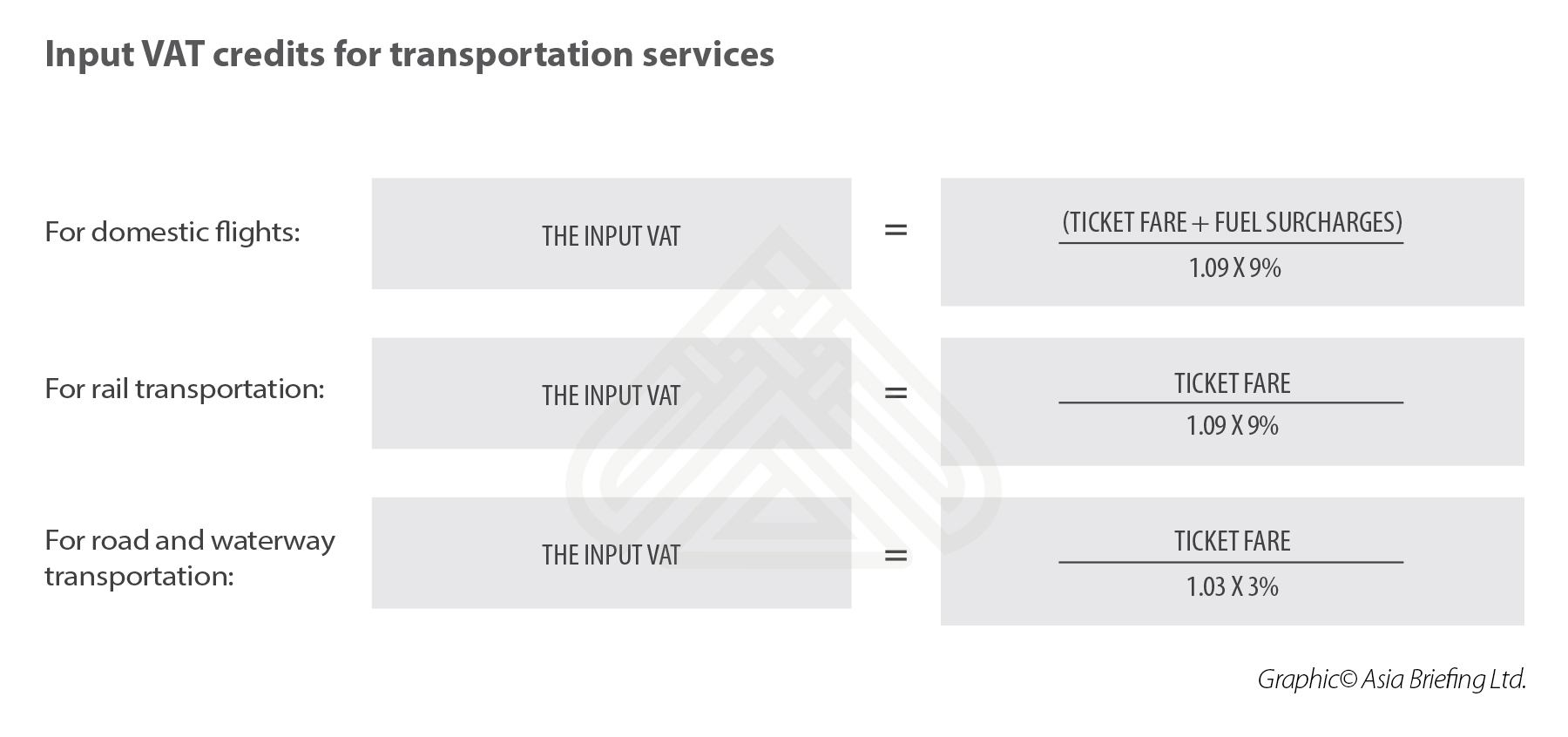

3. Allowing input VAT credits for transportation services

Businesses registered as general VAT taxpayers can now claim input VAT credits for domestic passenger transport services and credit its input tax against its output tax.

Subject to the Announcement No.31 of 2019 released by the State Administration of Taxation on September 16, this will apply to domestic transportation taken by employees who have entered into a labor contract with their employee as well as dispatched staff employed by the company.

In addition to this, the input VAT for transportation services will be calculated differently according to the documentation provided and mode of transportation taken.

For taxpayers who fail to obtain a special VAT invoice, but can obtain an electronic general VAT invoice, the input VAT credit is the amount indicated on the electronic general invoice.

Alternately, for taxpayers who can claim input VAT credits for domestic flights, rail, road, and waterway transportation services using supporting invoice or ticketing documentation and passenger ID information, the following formulas apply.

4. Allowing additional VAT deductions for certain industries

4. Allowing additional VAT deductions for certain industries

Between April 1, 2019, to December 31, 2021, taxpayers in the postal, telecommunications, modern, and life services will be eligible for a 10 percent additional VAT deduction based on deductible input VAT in the current period.

The services are defined to include the following:

- Postal services: Mail deliverance, postal remittance, confidential communication, stamp issuance, and newspaper distribution.

- Telecommunication services: Voice call services, SMS, MMS, or other services requiring transmission, receiving, or application of electronic data and information using fixed network resources.

- Modern services: Research and development, information technology services, cultural and creative services, certification and consulting services, business support services, and radio, film, and television services.

- Life services: Cultural and sports services, logistics and ancillary services, certification, consulting, and business support services, education and healthcare, and travel and entertainment services.

Starting October 1, 2019, additional deductions in the life services industry will increase from 10 percent to 15 percent, based on the current-period of deductible input VAT. This is based on the newest government document released on September 30, 2019 and will be contingent on the taxpayer’s life service sales accounting for more than 50 percent of their total sales.

Taxpayers shall set up separate accounts to track the movement of the additional deduction and its balance.

5. Allowing VAT refund for excess input VAT credits

In the past, when a company’s input VAT exceeds the output VAT, the excess VAT credits can be carried forward to offset the output VAT incurred in the next tax period.

Under the new policy, businesses are able to enjoy a refund on their excess input VAT (meaning added cash flow for the company), if they are able to meet the following criteria:

- If the incremental overpaid VAT for each of the six consecutive months (two consecutive quarters if taxed quarterly) is a positive number, and the incremental overpaid VAT in the sixth month is not less than RMB 500,000 (US$74,561);

- The taxation credit is rated as A or B;

- There has been no VAT fraud in the last 36 months prior to claim;

- There have been no penalties by tax authorities 36 months before its claim for VAT refund; and

- They have not received refunds on their levy.

Preparing for the new changes

To prepare for these reforms, businesses are advised to reflect on how the new changes affect both their internal management systems and external business operations.

In doing so, businesses should carefully review their agreements and processes to ensure this is in line with the new VAT policies.

This includes reviewing the purchase and sales contract with suppliers and customers as well as internal software – such as their VAT invoicing and ERP system.

With regards to the ERP system, businesses should review the VAT rates under the purchase and sales modules, inform key users of such changes, and perform regular checks to make sure the rates are chosen correctly.

Enterprises are also advised to check whether they are eligible for the 10 percent additional VAT deduction as well as the refund for excess input VAT credits.

Finally, enterprises are advised to share the new policy of input VAT credits for transportation services with staff to make sure they get proper support for their travel.

If the company has an established ERP system, it is necessary to update the system to allow their staff to fill in input VAT amount (or calculate the input VAT automatically by the system) when the travel expenses reimbursement applications are filled in the system.

For travel expenses – enterprises are also advised to differentiate business-related travel from travel carried out for staff welfare purposes as the latter is not allowed for input VAT deduction.

(Editor’s Note: This article was originally published on April 18, 2019. It was last updated on October 14, 2019.)

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article Starting a Business in China: When to Choose a FICE Model

- Next Article How a China Slowdown Could Affect Your Business