Letters from America: Selling U.S. Exports to Asia’s Middle Class Consumers

Chinese consumers – the Americans are coming

This is Part IV of our ongoing Letters from America to Asia Series, featuring opinions and observations on America’s trade relations with China and emerging Asia from Chris Devonshire-Ellis.

Oct. 22 – One of the main issues I’ve been discussing in the United States this past week with law and tax practices, universities, chambers of commerce and potential clients in Columbia, Charlotte, and San Francisco, is the growing trend of American exports to China. The demographics already tell us that a major wave of U.S. investment and exports to China is underway. What is little recognized, however, is how large that trend is becoming – and it’s my bet that we’ll see even more significant increases in U.S. sales to China in the near future. Just last year, American exports to the PRC surpassed US$100 billion for the first time ever – an astonishing increase of some 542 percent in the past decade.

Oct. 22 – One of the main issues I’ve been discussing in the United States this past week with law and tax practices, universities, chambers of commerce and potential clients in Columbia, Charlotte, and San Francisco, is the growing trend of American exports to China. The demographics already tell us that a major wave of U.S. investment and exports to China is underway. What is little recognized, however, is how large that trend is becoming – and it’s my bet that we’ll see even more significant increases in U.S. sales to China in the near future. Just last year, American exports to the PRC surpassed US$100 billion for the first time ever – an astonishing increase of some 542 percent in the past decade.

In fact, much of the past two decades has seen the pan-China building of a massive American sales platform right across the country. Brands such as KFC, McDonald’s and Starbucks have all introduced the concept of the American quality and lifestyle experience that the bulk of Chinese consumers want to attain. It’s a little known phenomenon, maybe caused by the fact that these brands are not considered high-end in the United States, but in China they are a big deal. For example, taking your date to Starbucks for a cappuccino is a romantic notion for many young couples, as they experience their first move up the global consumer supply chain and away from traditional China. The environment these outlets provide for the Chinese consumer is one of a lifestyle upgrade in exoticism, good value, quality and fun. It is of significance that these are perceived as being representative of American values and are recognized as being U.S. lifestyle products. This has only enhanced the concepts of viability and trustworthiness of American products in China.

Let’s take a look at the consumer base these companies have already built and are continuing to develop on a national basis across China.

- Starbucks – Targeting to open 1,500 stores in 70 cities across China by end 2015.

- McDonald’s – 1,600 stores by the end of 2012, 2,000 by 2013 spread across 150 cities.

- KFC – Currently have 4,000 outlets across more than 650 cities in China. Are opening one new outlet a day.

With a development platform like that to base the acceptance of American products and quality on, I predict a huge surge over the next decade for U.S. exports to China. The development of these consumer outlets represent a great opportunity for other American manufacturers to build on what has been achieved here and start to sell to a Chinese consumer market already familiar with the American concepts of value, quality and consistency – issues that China’s domestic brands have largely failed to emulate.

However, recent reports in the media have portrayed a slowdown in China’s economy, and some predictions of doom and gloom over the meaning of this. Is the Chinese economy contracting? Are those consumers really there? In fact, the actual volume of American exports to China has been increasing at rates that indicate there is little to no actual correlation between these two issues.

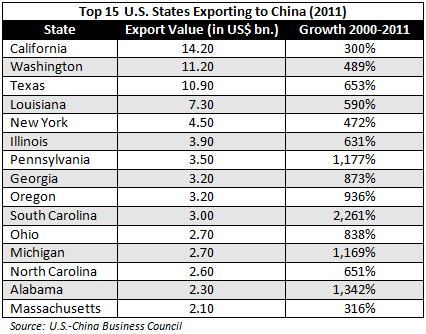

These are impressive statistics, and demonstrate that the new dynamic of American exports to China is well underway. In fact, 48 of America’s 50 states have recorded triple-digit growth in exports to China since 2000. I expect this trend to continue and to grow.

One of the central reasons for this is the fact that China is developing into a more consumer-based economy. I realize the recent headlines concerning GDP growth have screamed “slowdown,” but Q3 still showed real growth to be 7.4 percent. I’m not an economist, but growth rates at that level in what is the world’s second-largest economy do not seem unimpressive. Plus, in any event, China is a huge country and GDP growth rates there have never been uniform on a national basis. Growth may be sluggish in first-tier cities such as Shanghai and Beijing (which collectively have four international airports, over 200 five-star hotels, and state of the art infrastructure), but this is representative of a greater evolutionary process. Such cities are built-out and the main growth driver – infrastructure development – is now being replaced with sustainable commerce. It is inevitable that once massive infrastructure projects cease, because these cities are essentially completed, that the GDP growth rates drop.

However, this “slowing” growth does not appear to apply nationally. China’s central regions experienced collective growth of 9.2 percent last year and Tianjin, the major port city servicing Beijing and western China, posted growth rates of 16 percent in Q3 this year. Chongqing, China’s huge centrally-located metropolis of some 29 million people, grew by a similar amount. Clearly, commentary of a slowdown in China has been rather poorly defined in relation to what is going on at ground level.

Interestingly, it’s the higher inland consumption growth rates in China that are beginning to correlate to the increase in U.S. exports. That is key when one considers the true implications of the consumer platforms that the likes of KFC, McDonald’s and Starbucks have built. I previously wrote about the emergence of (and growth within) China’s 4th-6th tier cities, and the supply chain and distribution channels to access these markets are obviously already in place.

Coupled with this has been the Chinese State Policy of increasing minimum wages across China on a national basis. This has been imposed at rates averaging 22 percent annually over the past few years, and it is set to continue. While that has negative implications in terms of the increasing costs of Chinese workers, it has very positive implications for the increasing wealth and disposable income levels of everyday, ordinary Chinese. They can now afford to buy imported products and foreign brands for the first time, and this increase in purchasing power is something that the American fast-food chains I have highlighted (as one example) have been very much aware of. It also means that China is no longer an export market restricted to first-tier locations such as Beijing and Shanghai, it is one that includes 650 cities of varying sizes on a truly national basis. That, in essence, underlines the true depth of meaning behind China’s joining the WTO. Its markets are open, and its citizens increasingly wealthy. It is estimated that some 600 million Chinese nationals – nearly double the population of the United States – will have incomes applicable to middle class standards by 2020.

This statistical trend of increasing American exports to China is also being pushed along by the emergence in the United States of a younger, more internationally-educated executive making their way onto the seats of America’s boardrooms. As I suggested last week, young educated American citizens are far more likely to have completed undergraduate or MBA studies abroad, and many of those have done so in China or elsewhere in Asia. Consequently, that greater understanding of the dynamics at play in China are now being recognized at decision-making levels, and American companies, once content to collect all their profits from domestic sales, are now looking at selling overseas as part of an active growth strategy.

In this column over the coming weeks, I will be identifying – together with the help of our American partner firms – how American companies can best maximize these new China opportunities, and begin the journey from being focused largely on American domestic sales to developing an export market across China and Asia. The future growth and profit opportunities for many American businesses lie in the exportation of your products, and the demographic trends solidly predict that Chinese consumers want to acquire them in increasing numbers.

Chris Devonshire-Ellis is the founding partner and principal of Dezan Shira & Associates. The firm was established in 1992 and assists foreign companies with legal, tax and operational issues in China and Asia, and has 17 offices across the region, including 12 in China. Chris is now based in North America and assists American manufacturers with their export plans and how to develop their strategy throughout Asia. The firm also partners with U.S.-based law and tax practices to assist them in developing their international practice as concerns client development into China and Asia. If you would like to discuss any of these issues, please contact Chris at usa@dezshira.com or visit www.dezshira.com.

Dezan Shira & Associates runs an American partner firm program which provides American law and tax firms with access to our China and Asian infrastructure (17 regional offices throughout China, India, Vietnam, Hong Kong and Singapore) and to our in-house American expatriate lawyers and tax experts housed in these offices. We are also available to discuss assistance with the development of an international desk for U.S.-based firms within their own practice, and with the development of services that may be sold by their firm to local clients who wish to start exporting overseas. We are in the process of building a national American network of partner firms to jointly develop and profit from the evolution of American corporations developing export markets and business strategies overseas. To learn more about and become part of our U.S. Partner Firm program, please contact Jessica Tou at jessica.tou@dezshira.com.

Related Reading

An Introduction to Doing Business in China

An Introduction to Doing Business in China

Asia Briefing, in cooperation with its parent firm Dezan Shira & Associates, has just released this 40-page report introducing everything that a foreign investor should be familiar with when establishing and operating a business in China.

The Complete ‘Letters from America to Asia’ Series

A complete list of past articles from our ongoing ‘Letters from America to Asia Series’ featuring opinions and observations on America’s trade relations with China and emerging Asia.

Delaware and Nevada Holding Companies for Chinese Foreign-Invested Enterprises

Co-Investing in China with Chinese Partners

Double Taxation Agreements for China Investment

U.S. Exports to China by State 2000-2010

Downloadable PDF report on U.S. export trends (state-by-state) from the U.S.-China Business Council

- Previous Article Macau’s Path to Economic Diversification

- Next Article Fujian Province, Increasing Trade Ties with Taiwan