A Period of Change: Current Import and Export Trends in China

By Dezan Shira & Associates

Editor: Kimberly Wright

China is in a period of economic transition. As global demand has cooled for Chinese exports, the country has struggled to transition from an export-based economy to one driven by domestic consumption. In order to achieve a targeted 6 percent growth in trade for this year, the government has taken steps to increase domestic consumption and the inflow of imports. This can be seen through various government initiatives, such as the lowering of duties on certain consumer goods, the opening of new Free Trade Zones in Guangzhou, Fujian and Tianjin with simplified customs procedures, and the nationwide abolishment of restrictions for foreign companies to engage in e-commerce.

RELATED: Pre-Investment and Entry Strategy Advisory

RELATED: Pre-Investment and Entry Strategy Advisory

Major Import and Export Statistics

Total Import-export Volume

In 2014, the total value of exports and imports of goods was US$4.3 trillion – an increase of 2.3 percent from 2013. Exports were valued at US$2.34 trillion, an increase of 4.9 percent from the previous year, and imports were worth US$1.96 trillion, down 0.6 percent from 2013. In comparison, the United States imported US$2.41 trillion and exported US$2.35 trillion in 2014, while Japan’s imports reached US$813 billion and exports US$691 billion.

While total trade in China rose 3.4 percent in 2014, this number was significantly below the government’s projection of 7.5 percent. Much of this can be explained by the global economic slowdown, as in the United States imports and exports only rose by 3.3 percent and 2.9 percent respectively, while Japan’s imports and exports both fell by 1.3 percent and 4.4 percent.

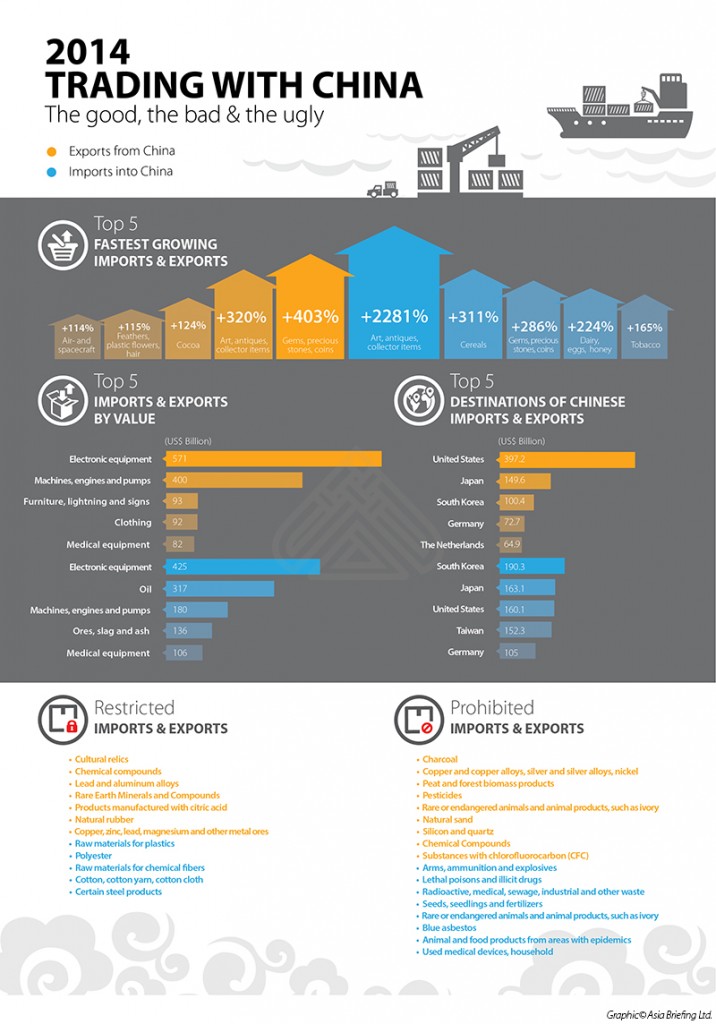

As can be seen from the fastest-growing imports and exports, China is taking steps to transform its

economy. While electronic parts and clothing still lead in terms of volume, with space- and aircraft as

one of the fastest growing exports, we can see that China’s economy is moving towards more high-value production. Much in the same way, foods and high-end consumer items such as art and precious stones signal the increasing role consumption is playing in the Chinese economy.

Import and Export Restrictions, Prohibitions and Quotas

Investors should note that certain products are prohibited or limited from import and export. A

general outline is given on the next page. For certain goods, there is a quota on how many of these may be imported or exported.

This article is an excerpt from the July issue of China Briefing Magazine, titled “Importing and Exporting in China: a Guide for Trading Companies.” In this issue of China Briefing, we discuss the latest import and export trends in China, and analyze the ways in which a foreign company in China can properly prepare for the import/export process. With import taxes and duties adding a significant cost burden, we explain how this system works in China, and highlight some of the tax incentives that the Chinese government has put in place to help stimulate trade. This article is an excerpt from the July issue of China Briefing Magazine, titled “Importing and Exporting in China: a Guide for Trading Companies.” In this issue of China Briefing, we discuss the latest import and export trends in China, and analyze the ways in which a foreign company in China can properly prepare for the import/export process. With import taxes and duties adding a significant cost burden, we explain how this system works in China, and highlight some of the tax incentives that the Chinese government has put in place to help stimulate trade. |

![]()

Using China’s Free Trade & Double Tax Agreements

In this issue of China Briefing, we examine the role of Free Trade Agreements and the various regional blocs that China is either a member of or considering becoming so, as well as how these can be of significance to your China business. We also examine the role of Double Tax Treaties, provide a list of active agreements, and explain how to obtain the tax minimization benefits on offer.

Employing Foreign Nationals in China

Employing Foreign Nationals in China

In this issue of China Briefing, we have set out to produce a guide to employing foreign nationals in China, from the initial step of applying for work visas, to more advanced subjects such as determining IIT liability and optimizing employee income packages for tax efficiency. Lastly, recognizing that few foreigners immigrate to China on a permanent basis, we provide an overview of methods for remitting RMB abroad.

Double Taxation Avoidance in China: A Business Intelligence Primer

Double Taxation Avoidance in China: A Business Intelligence Primer

In our twenty-two years of experience in facilitating foreign investment into Asia, Dezan Shira & Associates has witnessed first-hand the development of China’s double taxation avoidance mechanism and established an extensive library of resources for helping foreign investors obtain DTA benefits. In this issue of China Briefing Magazine, we are proud to present the distillation of this knowledge in the form of a business intelligence primer to DTAs in China.

- Previous Article Internet Challenges & Solutions When Doing Business in China – New Issue of China Briefing Magazine

- Next Article Is China Getting More Difficult? Common Problems that Foreign Companies will Encounter