An Introduction to Indian Trade with Eastern China

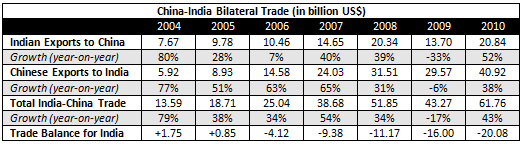

Jun. 2 – India-China bilateral trade for 2010 stood at US$61.76 billion, an increase of 42.73 percent year-on-year. Presently, China is India’s largest goods trading partner (excluding trade in services), having surpassed the United States in 2007, while India is China’s 10th largest trading partner.

In recent years, overall trade between the two countries has increased dramatically, but the trade imbalance has also increased. Indian exports to China and Chinese exports to India both increased between 2009 and 2010, with Chinese exports to India increasing 52.11 percent and India’s exports to China increasing 38.38 percent. The trade deficit for India in 2010 reached US$20.08 billion, exceeding the previous year’s trade deficit of US$15.87 billion.

Bilateral Institutional Mechanisms

There are several institutional mechanisms for India’s economic and commercial engagement with China, including:

- India-China Joint Economic Group on Economic Relations and Trade, Science and Technology, a ministerial-level dialogue mechanism established in 1988 during former Prime Minister Rajiv Gandhi’s visit to China

- A Joint Study Group to examine the potential complementary areas between the two countries in expanded trade and economic cooperation, set up after former Prime Minister Vajpayee’s visit to China in June 2003

- Joint Task Force to study the feasibility of an India-China Regional Trading Arrangement, with a report completed in October 2007

- Joint Working Groups on Trade, Agriculture and Energy

Furthermore, both India and China are members of the WTO and bilateral financial dialogues are also in progress.

Trade with eastern China

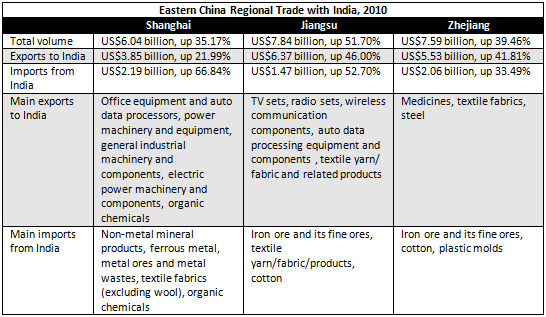

India’s trade with eastern China (defined in this article as Jiangsu Province, Zhejiang Province, and Shanghai Municipality) constituted slightly more than one-third of India’s total bilateral trade with China. Trade with the region stood at US$21.47 billion in 2010, an increase of 42 percent from 2009. In this, exports from India to the region accounted for US$5.72 billion (up 56 percent year-on-year) and imports to India from the region accounted for US$15.75 billion (up 38 percent year-on-year).

Indian exports to eastern China constituted 27 percent of total Indian exports to China (US$20.84 billion). The principal items of export from India to eastern China are metal ores and metal wastes, non-metal mineral products, textile fabrics (excluding woolen fabrics), ferrous metal, organic chemicals, steel, plastic sand products, primary plastics, chrome ore and fine ore, unforged copper and copper material, leather, soy bean powder, and cotton and synthetic yarn.

Imports from eastern China into India constituted 39 percent of total Indian imports from China (US$40.92 billion). Main items of import from eastern China to India include power machinery and equipment for power plants, office equipment and auto data processors, electrical machinery and tools and components, machinery and equipment for general industrial use, telecommunications and recording appliances, organic chemicals, textile yarn, textile fabric and products, steel, textile machinery and components, medicines, components for motor cycles, bicycles, electronic appliances, and wireless communication equipment.

Future outlook

India’s growing trade deficit is a cause of concern and, to address this, India is seeking greater market access in China for products in which India has a competitive advantage. Greater market access is being sought in pharmaceuticals, engineering goods, agriculture, and IT/ITES. There are also opportunities in jewelry, banking, auto components, and green technologies.

China’s pharmaceutical industry is poised for significant growth due to an aging population and burgeoning middle class with more money in hand. Foreign players currently account for 10 to 20 percent of overall sales in the industry, depending on the types of medicines and ventures included in the count.

The country is poised to become the world’s third-largest prescription drug market in 2011, according to a report by pharmaceutical intelligence service IMS Health, and the valueadded output of China’s pharmaceutical industry as whole increased 14.9 percent year on year in 2009, according to statistics released by the Ministry of Industry and Information Technology.

China-India trade in pharmaceutical products hit a bilateral trade volume of US$60 billion in 2010, up 2,000 percent in 10 years. Greater bilateral trade activity, particularly between API producers in India and pharmaceutical drug manufacturers in China, is expected to push the global pharmaceutical market to US$1.1 trillion by 2014. To strengthen information sharing between India and China and produce competitively priced active pharmaceutical ingredients and pharmaceutical drugs for the global market, a memorandum of understanding (MoU) was signed between the Indian Drug Manufacturers’ Association and the China Pharmaceutical Industry Association in January 2011.

Remaining challenges in the industry include intellectual property rights protection, visibility for drug approval procedures, effective governmental incentives, corporate support for drug research and equal treatment of local and foreign firms.

Total sales of gold and jewelry in 2009 amounted to more than US$12 billion, driven by increasing purchasing power of middle-class Chinese and growth in the wedding market.

Projections state that annual sales of China’s gold and jewelry will hit US$58 billion by 2020, making China the world’s biggest jewelry market. Though the global economic crisis resulted in a world-wide slow-down of diamond sales, China is the only country that witnessed a growth in diamond consumption during this period. Diamond sales increased 13 percent in 2010 compared with the same period in 2008. Experts predict that the diamond market in China will soon surpass that of the United States, and China is poised to become the next biggest diamond-consuming country.

As the world’s largest manufacturer of cut and polished diamonds, Indian diamond processors and retailers have an increasing presence in China. India was the fourth largest exporter of diamonds to China in 2010, comprising almost 8 percent of the total market share. For example, one of India’s biggest diamond and jewelry manufacturers and retailers, Gitanjali, is now running over 50 Giantti stores in China, with over 10 opening in the YRD region.

While all types of loose diamonds are sold in the Chinese market in general, the preferred product indicators are as below:

- Pointers: 30 pointers & up

- Type: VVS – SI

- Color: G-H colored diamonds

- Certificates: GIA & HRD

In addition to diamonds, India is also one of the largest centers for cutting and polishing of other precious stones like emerald, ruby, sapphire, and topaz. Surveys have, however, found that presently market demand for mid-range colored gems (RMB1,000-5,000) is low as opposed to low-end and high-end gems. The most commonly sold gem varieties were found to be ruby, followed by sapphire, crystals, garnet, alexandrite, topaz, emeralds, aquamarine, opal, and others. China’s software industry is expected to grow at a compound annual growth rate of 22 percent through 2012.

IT is particularly relevant for banking and finance, but China has been attempting to target more investment into IT in general. Growth in IT spending in a range of sectors, from manufacturing to government, will continue. The ongoing large-scale endeavors for 3G deployments are expected to fuel growth in the demand for 3G telecom software across various application platforms.

Expanding broadband infrastructure with increased Internet usage from small and medium enterprises (SMEs) will help the market to grow at a compound annual growth rate of more than 40 percent during FY2008-2012.

The lion’s share of China’s IT and ITES growth is found in the Yangtze River Delta region. Shanghai, Hangzhou, Wenzhou, Nanjing, Suzhou, and Wuxi are all important cities in the YRD for this industry sector.

The Indian IT industry has played a key role in putting India on the global map. India’s IT exports for 2011 are poised to reach US$88.1 billion; export revenue is expected to reach US$59 billion and the sector as a whole is expected to be worth US$225 billion by 2020. Cooperation in the IT sector offers huge opportunities for India and Chinese companies as China is opting for greater outsourcing.

Indian engineering goods have done well in other markets and can offer niche products to Chinese importers. The auto components industry in India in particular has been a great success story in recent years. Growing at almost 20 percent annually, it was estimated last year at US$26 billion. Approximately 60 percent of Indian auto component exports are to European and North American markets.

China offers Indian auto component manufacturers several opportunities as despite the growth of Chinese car manufacturers, Chinese firms engaged in the production of automotive components comprise a relatively small portion of their industry’s global market. In 2010, car production in China accounted for 14 percent of world output, and was second only to that in Japan. By contrast, in the same year, Chinese automotive component production (which includes the production of tires, electric displays, window parts, engine parts) only accounted for half a percentage point of global output.

This is true for two key reasons. First, many of the components Chinese firms produce are used in the aftermarket as lower-value replacement parts. Moreover, the foreign automobile firms that do enter China and partner with local Chinese companies typically bring in their own component suppliers to assure that quality control standards are met.

To reduce China’s dependence on coal (which is generally estimated to provide approximately 70 percent of the country’s energy), the 12th Five-Year Plan (2011–2015) includes a focus on increasing energy efficiency by developing renewable energy technology. Targets of the plan include increasing non-fossil fuel consumption to 11.5 percent, cutting energy consumption by 16 percent, and cutting carbon dioxide emissions per unit of GDP by 17 percent, in addition to emissions caps for several cities.

Opportunities for trade and investment in the renewable energy sector are particularly prominent in the YRD region. According to Shanghai’s latest 3 year environmental plan (2009-2011), US$10 billion is dedicated to controlling water/air/industrial pollution, solid waste disposal, agricultural and rural environmental improvement, and ecological protection. Furthermore, Jiangsu Province has the largest number of environmental protectionrelated firms in mainland China and excels particularly in the area of wind power. As a whole, Jiangsu province will establish 7,000 MW inter-tidal and offshore wind farms by 2020. The primary city in this development is Nantong, which has a current wind power capacity of 992 MW and a targeted wind power and installed capacity of 3,000 MW by 2015. In addition, an environmental technology base focusing on wind power development has been developed in Nanjing Economic Development Zone and the city of Huishan has a large Wind Power Science & Technology Industrial Park focused on renewable energy manufacturing and related R&D.

To sum up, Indian Ambassador to China, Dr. S. Jaishankar, commented on the opportunities and value offered by Indian companies for Chinese businesses in various sectors which will also address the issue of balance of trade at the India Business Forum held as part of “India Day” celebrations at the Shanghai World Expo in August 2010:

“We were assured that greater efforts would be made to increase imports from India. But this will not happen automatically. Indian industry must show greater commitment and marketing activity even as the Chinese one displays more openness and offers better access. Our objective should be to persuade Chinese companies that Indian IT can assist their becoming global. As China improves its health coverage, I hope that they will also see value in the competitiveness of India’s pharmaceuticals. Greater engagement between our engineering sectors will improve projects execution in India as well as enable production in China. Our long dialogue on market access to Indian agro exports should also start yielding concrete results. In areas where Indian companies have globally recognized leadership lack of success in China is difficult to justify. My plea to Chinese business is that they should be more open to opportunities and value offered by Indian companies. To Indian industry, my message is that they need to devote more attention and energy to the Chinese market. Such a large segment of global demand cannot be neglected.”

Indian companies in eastern China

There are more than 100 Indian companies in eastern China alone, which include major global players such as the TATA Group, Reliance, ESSAR Steel, Infosys, NIIT, Larsen & Toubro, and Mahindra & Mahindra. Four Indian Public Sector Undertakings namely BEML Ltd., Bharat Heavy Electricals Ltd, Engineers India Ltd. and Air India are also present in Shanghai. Air India operates four weekly flights from Shanghai to Delhi and Mumbai.

Many of these companies have a presence in not one but several of China’s provinces. TATA Consultancy Services has set up a wholly-owned subsidiary, TATA Information Technology (Shanghai) Co Ltd, and has four delivery centers located in Hangzhou, in addition to Shanghai and northern Beijing and Tianjin.

NIIT, India’s most well-known IT training institute, has been in China since 1997 and today NIIT has more than 180 cooperative education and training centers across 25 provinces in China, with NIIT curriculum embedded in 129 universities and colleges. The Chinese Society of Educational Development Strategy, under the Ministry of Education, has awarded NIIT five awards, including “Most Influential Brand in China’s IT Training Industry.”

With 5 out of 21 national “outsourcing model cities” for IT namely Shanghai, Nanjing, Suzhou, Wuxi, and Hangzhou in the Yangtze River Delta region, there are many business opportunities for Indian IT companies here.

Another key example is Larson & Toubro (L&T), a technology-driven engineering and construction company, and one of the largest Indian private sector companies, which also has major presence in east China. Besides looking at China as a sourcing base for the Indian market and a possible base for exports to third countries, L&T also has four manufacturing units in the region that have supplied critical process plant equipment like reactors and gasified coal valued at over USD150 million to major petro-chemical projects in China. L&T’s first factory producing low voltage switch gears was set up in Wuxi (Jiangsu Province), the second factory producing industrial valves in Yancheng (Jiangsu Province), a third factory manufacturing tire machinery in Shandong and a fourth factory producing medium voltage switch gears in Shanghai’s Minhang District.

Reliance Power signed a US$ 8.29 billion deal with Shanghai Electric Group in October 2010 for the supply of power equipment and related services – creating the largest deal of its kind between India and China.

Infosys Technologies (China) Co. Ltd, headquartered in Shanghai, is a fully owned subsidiary of Infosys Technologies Ltd, and provides IT and BPO services to global and Asia- Pacific clients through the Shanghai and Hangzhou centers.

In the pharmaceuticals sector, Aurobindo Pharma has its base and one of its wholly-owned subsidiary companies, Aurobindo (Shanghai) Co. Ltd, in Shanghai.

Indian companies also have a significant presence in Jiangsu province, including pharmaceutical giant Dr. Reddy’s Laboratories’ manufacturing unit in Kunshan, Mahindra Satyam’s one of the largest software development center outside of India in Nanjing, and Mahindra & Mahindra’s joint venture tractor producing unit in Yancheng.

Finally, Indian companies with a business presence in Zhejiang are spread across industries. These companies include TCS, Sundram Fastners, Thermax, Elgi Equipments, and TATA Tea.

There are six banks namely, Axis Bank, Canara Bank, ICICI, Punjab National Bank, State Bank of India and Union Bank of India present in Shanghai. Out of these banks, State Bank of India commenced RMB operations in March, 2010, while Canara Bank does non- RMB operations. Remaining four banks are at Representative Office stage.

During Premier Wen Jiabao’s visit to India, an MOU was signed between the Reserve Bank of India (RBI) and the China Banking Regulatory Commission (CBRC). The RBI and the CBRC reached an understanding “in order to establish an arrangement for the sharing of supervisory information and the enhancing of cooperation in the area of banking supervision.”

According to the joint statement issued after Premier Wen’s visit, both countries have agreed to grant permission to the banks of the other country to open branches and representative offices.

Summary

The economy of each geographic area of the YRD – Shanghai, Zhejiang, and Jiangsu – is developing in a fashion directly related to that area’s individual circumstances: its historical industrial layout, central government attention, local government priorities, FDI incentives. The commonality among the economy of each of these areas is simple – growth and growth often at break-neck speeds.

As the region develops, so does the role of Indian companies in the region, in terms of both investment and trade. From the Indian-owned textile businesses in Shaoxing to Mahindra & Mahindra’s joint venture in Yancheng, and from the over US$5 billion traded annually with Jiangsu Province. These businesses make a clear statement about the current economic incentives of investment in the YRD region and the continued developments in these regions suggest that great potential remains.

Portions of this article were extracted from Asia Briefing’s new business guide titled “Doing Business in East China: A Guide for Indian Companies and Entrepreneurs.” To purchase the full version, priced at US$40 for immediate PDF download, please click here.

Dezan Shira & Associates is a boutique professional services firm providing foreign direct investment business advisory, tax, accounting, payroll and due diligence services for multinational clients in China, Hong Kong, Vietnam and India. Established in 1992 with nineteen offices in four jurisdictions. The firm has assisted many Indian companies establish operations in China. For more information, please contact china@dezshira.com or visit the firm’s web site at www.dezshira.com.

Related Reading

Doing Business in East China: A Guide for Indian Companies and Entrepreneurs

Doing Business in East China: A Guide for Indian Companies and Entrepreneurs

At the end of 2010, as India-China trade crossed the US$60 billion mark, one-third of this trade was conducted with the East China region. In the region, there are more than 100 Indian companies, including major global players Larsen & Toubro, Patni, Infosys, NIIT, Tata Group, Elgi, and Mahindra Satyam. This book discusses the current investment and trade opportunities in China and how to go about setting up and tackling the market.

Doing Business in China

Doing Business in China

Our 156-page definitive guide to the fastest growing economy in the world, providing a thorough and in-depth analysis of China, its history, key demographics and overviews of the major cities, provinces and autonomous regions highlighting business opportunities and infrastructure in place in each region. A comprehensive guide to investing in China is also included with information on FDI trends, business establishment procedures, economic zone information, and labor and tax considerations.

Doing Business in India

Doing Business in India

Our recently published, 156-page business introduction to India, the second fastest growing economy in the world, providing a thorough and in-depth analysis of India, its history, key demographics and overviews of the states and union territories highlighting business opportunities and infrastructure in place in each region. A comprehensive guide to investing in India is also included with information on FDI trends, business establishment procedures, economic zone information, labor and tax considerations, as well as an analysis of Indian business etiquette and culture.

India Briefing News

India Briefing News

Our magazine and regular news service about doing business in India. We cover topics relating to the Indian economy, the market in India, foreign direct investment and Indian law and tax.

![]() 2point6billion.com

2point6billion.com

Our popular emerging Asia website and commentary dealing with China, India and other regional nations multilateral development, trade, investment and politics.

- Previous Article St. Regis Opens Luxury Hotel in Lhasa

- Next Article Guangzhou Encourages Better Utilization of Foreign Capital